The Texas Health and Human Services Commission plays a crucial role in assisting families in need through various programs, one notable being the Supplemental Nutrition Assistance Program (SNAP), facilitated through the H1801 SNAP Worksheet Form. Implemented since February 2010, this form serves as a detailed worksheet to aid in the accurate evaluation of a household's eligibility for SNAP benefits. It encompasses a comprehensive scrutiny starting from the verification of the applicant's identity, income assessment, to the determination of net income, ensuring all criteria for assistance are meticulously evaluated. The form delves into specific household situations, including citizenship status, resource determination, employment services, and even arrangements for finger imaging to bolster program integrity. It mandates the provision of essential documentation such as proof of earnings or income and calculates both gross and net income to determine eligibility. With sections devoted to adjustments, management problems, and special reviews, the H1801 form is designed to streamline the eligibility assessment process, thereby facilitating a more efficient allocation of SNAP benefits to qualified applicants. Through this systematic approach, Texas aims not only to meet the immediate nutritional needs of its residents but also to uphold the integrity and effectiveness of the SNAP program.

| Question | Answer |

|---|---|

| Form Name | Form H1801 Snap |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | form h1808 snap, form h1808 snap work rules, form 1808 snap rules, form 1808 |

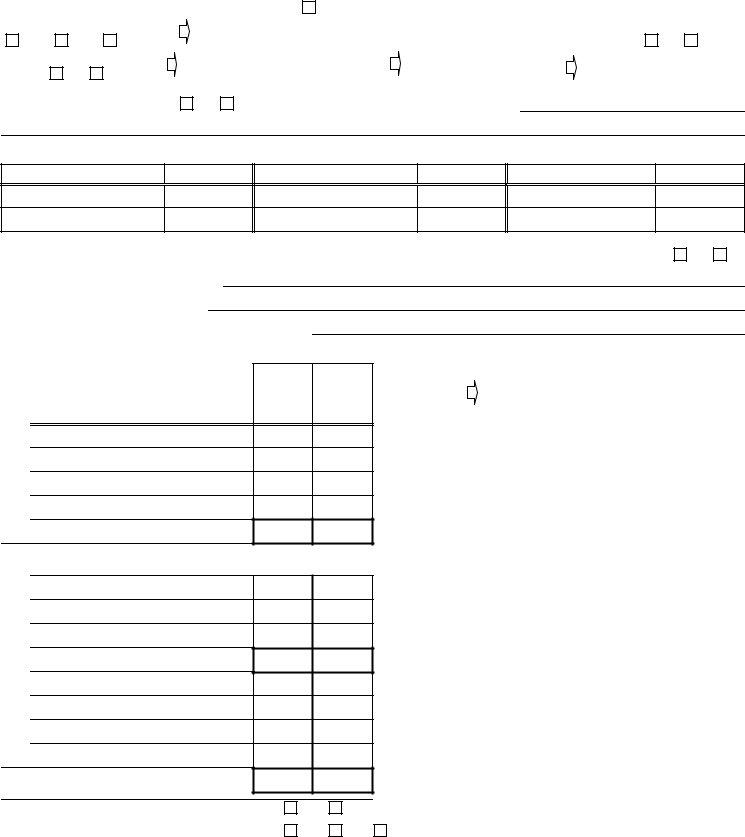

Texas Health and Human Services Commission

SNAP Worksheet

Form H1801

February 2010

Case Name (Last, First, Middle) |

|

App./Case No. |

|

ID |

|

|

Input Seq. No. |

|||

|

|

|

|

|

|

|

|

|

||

Person Interviewed |

|

|

Form |

|

|

Date Received |

||||

|

|

|

|

YES (Do not proceed further until signed and dated.) |

|

|

||||

Interview Type |

|

Date |

Name of Authorized Representative |

Are all household members U.S. citizens |

||||||

Office |

Home |

Telephone |

|

|

|

|

or eligible aliens? |

Yes |

No |

|

Is anyone applying or receiving |

If yes, who? |

|

Where? |

|

When? |

|

|

|||

TANF? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Has residence been verified?.....

Yes

No If yes, how? (Also document

STEP 1 – Resource Determination

TYPE

VALUE

TYPE

VALUE

TYPE

VALUE

Countable Value of Resources $ |

Is household eligible based on resources? |

Yes |

No |

|

|

|

|

|

|

Brief Description of Household Situation:

List disqualified members and reason:

Document if a disqualified member has regained eligibility:

STEP 2 – Gross Income Determination

1.Gross Earned Income (include net earned self-

BUDGET |

BUDGET |

|

documents.) |

No. 1 |

No. 2 |

NAME |

Amount |

Amount |

a.

b.

c.

d.

e. Total gross earned income (add lines a thru d)

2.Unearned Income

a.Worker's Compensation

b.TANF Grants

c.Other (include net unearned

d.Subtotal (a thru d) (Form

e.RSDI/RR

f.VA/unemployment compensation/pension

g.SSI

h.Total (add d, e, f, g)

3.Total Gross Income Subtotal (add 1.e. and 2.h.)

4. |

Is household subject to gross income test? |

Yes |

No |

5. |

Is household eligible based on total gross income? |

Yes |

No |

VERIFICATION DOCUMENTATION

FOR INCOME |

1. Date of Check |

3. Source |

5. Frequency |

INCLUDE |

|

|

|

|

2. Date Received |

4. Gross Pay |

6. Calculations |

NA

Form H1801, Page

|

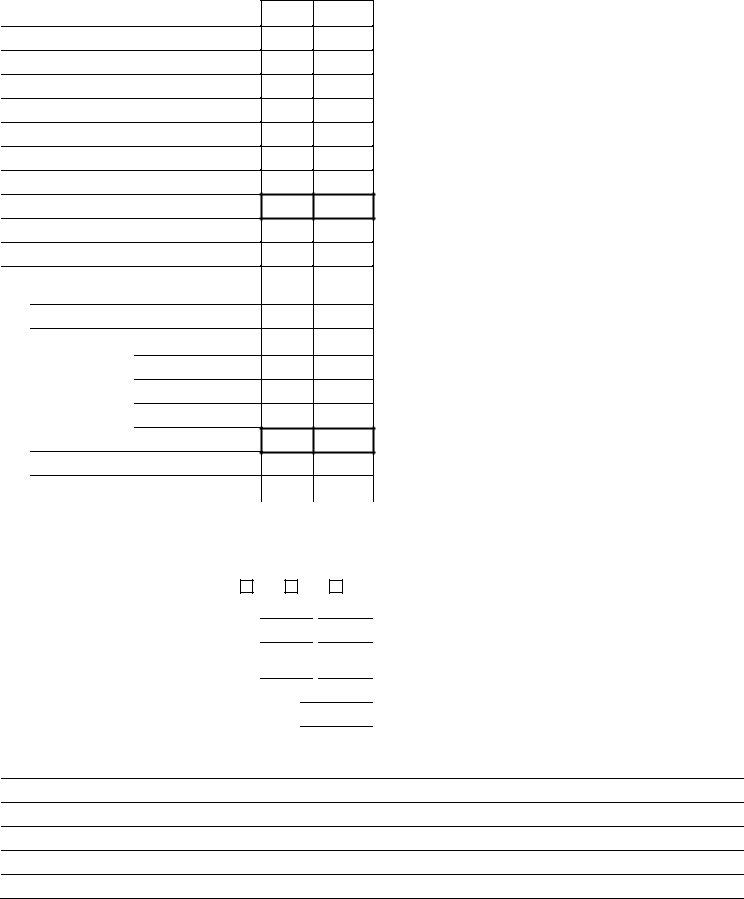

BUDGET |

BUDGET |

STEP 3 – Net Income Determination |

No. 1 |

No. 2 |

1.Total Gross Inc. (from STEP 2, Item 3)

2.Earned Inc. Ded. (20% of STEP 2, 1.e.)

3.Remaining Farm Loss (if NA, enter 0)

4.Standard Deduction

5.Allowable Medical Costs (Actual or Standard)

6.Homeless Shelter Standard

7.Monthly Dependent Care Costs

8. Child Support Paid to/for

9.Total Deductions (add 2,3,4,5,6,7 and 8)

10.Adjusted Gross Income (Item 1 minus 9)

11.Shelter Expenses:

a.Housing

b.Utility or Telephone Standard

c.Expedited Only -

Actual Utilities (1) Gas

(2)Electric

(3)Water/Sewage

(4)Other (explain):

d. Total Shelter Costs

e.Subtract 50% Adjusted Gross Income

f.Total Excess Shelter Costs

12. |

Maximum Excess Shelter (if applicable) |

|

|

|

|

13. |

Net Income (Item 10 minus 11.f. or 12) |

|

|

|

|

14. |

Rounded Net Income |

|

|

|

|

15. |

Is household eligible based on net income? |

Yes |

No |

NA |

|

16.Number of Certified Members ............................... ….

17.Monthly Allotment (TW Handbook

18.Prorated Allotment (if applicable)

TW Handbook

19. |

Months Covered by First Budget……….. |

|

thru |

20. |

Months Covered by Second Budget…… |

|

thru |

STEP 4 – Management: Document any management problems and explain.

STEP 5 – Employment Services: List household members and their exemption or registration/education codes: |

Form H1801, Page |

MEMBER

CODE

MEMBER

CODE

MEMBER

CODE

MEMBER

CODE

Justify codes for household members coded E or H:

Does the household qualify to select the PWE? |

Yes |

No |

If yes, do all adult household members agree on the selection? |

Yes |

No |

If yes, give the name of the PWE:

STEP 6 – Finger Imaging: List household members who require imaging and their exemption code or enrollment code and VUN:

MEMBER

CODE

VUN

MEMBER

CODE

VUN

Justify all exemption codes and enrollment code Z:

STEP 7 – Basis of Certification or Denial

Certified

From:To:

Special Review Date

Reason Code

1.Special Review and Certification Period Explanation:

2.Denial Explanations:

STEP 8 – SNAP Forms and Referrals

1.Form H1009, H1017, H1019 provided? ........................................................................................................................................................................

2.Right to appeal explained? ............................................................................................................................................................................................

3.Form H1805 provided and all reminders explained? ....................................................................................................................................................

4.Form H1808 provided for each employment services registrant?.................................................................................................................................

5.Form H2067 sent to associated TANF cases? .............................................................................................................................................................

6.Has Form H1106 been returned by SSA?.....................................................................................................................................................................

Yes

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

No

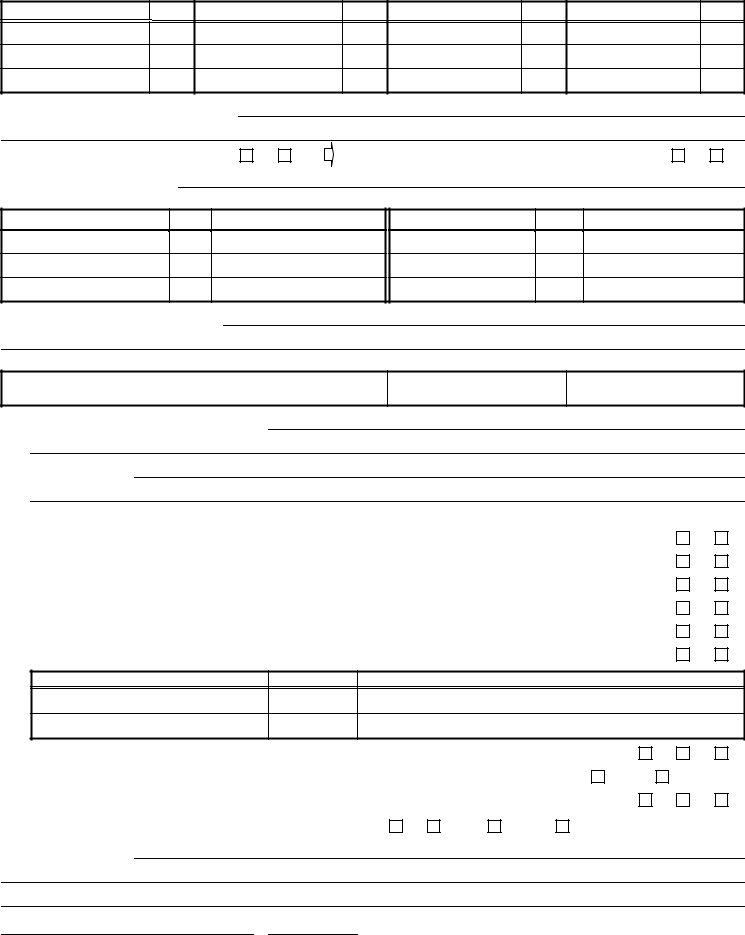

IF YES, FOR WHOM

DATE

DOCUMENT PROBLEMS/DISQUALIFICATION

7. |

|

Form H1823 completed for members age 18 - 50? |

|

|

|

NA |

Yes |

No |

|

8. |

|

Referrals to: |

|

………. |

PA SNAP |

Social Services |

|||

9. |

a. |

EBT card, PIN, and training material provided (Form H1172/H1175 sent)? |

|

|

|

NA |

Yes |

No |

|

|

b. |

Form H1803 provided if appropriate? |

NA |

Original |

Duplicate |

No |

ID No.: |

|

|

Documentation/Changes:

Signature – Worker |

Date |

Form H1801, Page

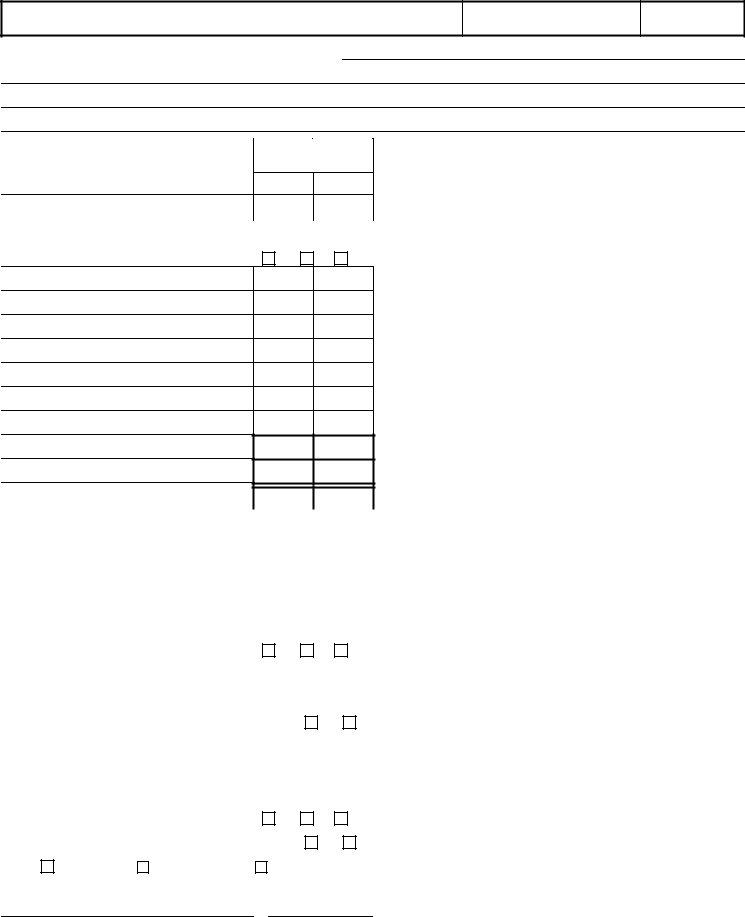

Case Name (Last, First, Middle)

Case No.

Input Seq. No.

Document Changes: Include change, date of change and date reported:

|

BUDGET |

BUDGET |

ADJUSTMENTS |

No. 1 |

No. 2 |

1.Gross Earned Income

2.Gross Unearned Income

3. |

Total Gross Income Subtotal (add Items 1 and 2) |

|

|

|

|

Is household eligible based on gross income? |

Yes |

No |

NA |

4.Earned Income Deduction (20% of Item 1)

5.Remaining Farm Loss (if NA, enter 0)

6.Standard Deduction

7.Allowable Medical Costs (Actual or Standard)

8.Homeless Shelter Standard

9.Dependent Care Expense

10.Child Support Paid to/for

11.Total Deductions (add Items 4 thru 10)

12.Adjusted Gross Income (Item 3 minus 11)

13.Total Shelter Cost

|

a. Subtract 50% of Item 12 |

|

|

|

|

|

||

|

b. Total Excess Shelter Costs |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

14. |

Maximum Excess Shelter (if applicable) |

|

|

|

|

|

||

15. |

Net Income (Item 12 minus Item 13b or 14) |

|

|

|

|

|

||

16. |

Rounded Net Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Is household eligible based on net income? |

Yes |

No |

NA |

|||||

Denied, effective |

|

|

|

|

|

|||

...................................................Effective date of change |

|

|

|

|

|

|||

Employment services registration changed? |

|

Yes |

No |

|||||

Special review (mm/yy) |

|

|

|

|

|

|||

...................................................................Reason Code |

|

|

|

|

|

|||

Household Size: |

|

Allotment: $ |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Form H1823 updated for members age 18 - 50? |

Yes |

No |

NA |

|||||

Form H2067 sent to associated TANF cases |

|

Yes |

No |

|||||

|

Form H1019 |

Form H1172/H1175 |

Form |

|

|

|

||

VERIFICATION DOCUMENTATION

FOR INCOME |

1. Date of Check |

3. Source |

5. Frequency |

INCLUDE |

2. Date Received |

4. Gross Pay |

6. Calculations |

|

|

|

|

Signature – Worker |

Date |