Understanding the role and significance of the HA-520-U5 form within the Social Security Administration's (SSA) appeals process is crucial for individuals seeking a review of a hearing decision or order related to their Social Security benefits. As stipulated by the SSA, this form serves as an official request for the Appeals Council to reconsider a decision made by an Administrative Law Judge (ALJ) regarding one's Social Security claim. It is not used for objections to a recommended ALJ decision but rather for a comprehensive review based on the evidence on record, including any additional material that claimants may submit alongside their request. The form requires detailed information about the claimant, including their Social Security number, any differing wage earner's name, and the specific grounds upon which the review is being requested. Significantly, the form also offers the opportunity to submit further evidence, or request an extension for submitting such evidence, emphasizing the importance of a thoroughly substantiated appeal. Instructions detail where the form should be mailed or delivered, reinforcing the SSA’s commitment to accessibility and claimant representation. The acknowledgement of the Privacy Act and Paperwork Reduction Act Statements at the end of the form highlights the SSA's dedication to privacy and efficient service, underlining the form's role in a larger framework aimed at ensuring fair and accurate Social Security disability adjudication.

| Question | Answer |

|---|---|

| Form Name | Form Ha 520 U5 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ssa520, social security form ha 520, 520 form, printable form ha 520 |

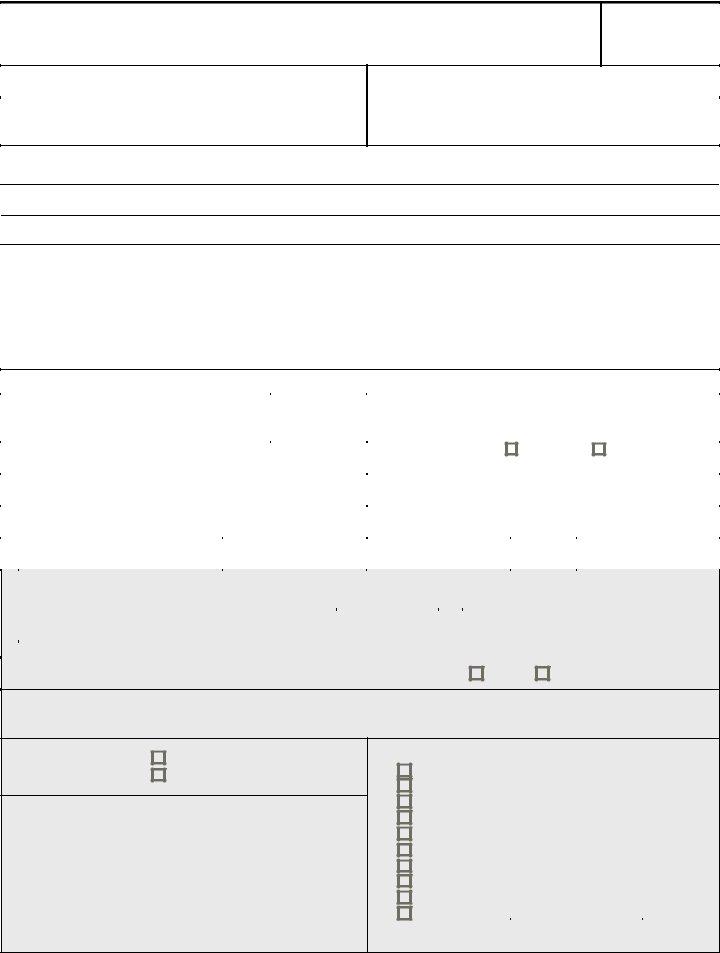

Form Approved

SOCIAL SECURITY ADMINISTRATION/OFFICE OF DISABILITY ADJUDICATION AND REVIEW |

OMB No. |

|

REQUEST FOR REVIEW OF HEARING DECISION/ORDER

(Do not use this form for objecting to a recommended ALJ decision.)

(Either mail the signed original form to the Appeals Council at the address shown below, or take or mail the signed original to your local Social Security office, the Department of Veterans Affairs Regional Office in Manila, or any U.S. Foreign Service Post and keep a copy for your records.)

See Privacy Act Notice

1. CLAIMANT NAME |

CLAIMANT SSN |

|

|

- |

- |

2. WAGE EARNER NAME, IF DIFFERENT |

3. CLAIMANT CLAIM NUMBER, IF DIFFERENT |

|

- -

4. I request that the Appeals Council review the Administrative Law Judge's action on the above claim because:

ADDITIONAL EVIDENCE

If you have additional evidence submit it with this request for review. If you need additional time to submit evidence or legal argument, you must request an extension of time in writing now. This will ensure that the Appeals Council has the opportunity to consider the additional evidence before taking its action. If you request an extension of time, you should explain the reason(s) you are unable to submit the evidence or legal argument now. If you neither submit evidence or legal argument now nor within any extension of time the Appeals Council grants, the Appeals Council will take its action based on the evidence of record.

IMPORTANT: WRITE YOUR SOCIAL SECURITY NUMBER ON ANY LETTER OR MATERIAL YOU SEND US. IF YOU RECEIVED A BARCODE

FROM US, THE BARCODE SHOULD ACCOMPANY THIS DOCUMENT AND ANY OTHER MATERIAL YOU SUBMIT TO US. SIGNATURE BLOCKS: You should complete No. 5 and your representative (if any) should complete No. 6. If you are represented and your representative is not available to complete this form, you should also print his or her name, address, etc. in No. 6.

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge.

5. CLAIMANT'S SIGNATURE |

|

|

DATE |

|

6. REPRESENTATIVE'S SIGNATURE |

|

DATE |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

PRINT NAME |

|

|

|

|

|

|

PRINT NAME |

|

|

|

ATTORNEY |

|||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ADDRESS |

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

(CITY, STATE, ZIP CODE) |

|

|

|

|

|

(CITY, STATE, ZIP CODE) |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

TELEPHONE NUMBER |

FAX NUMBER |

|

|

|

TELEPHONE NUMBER |

|

|

|

FAX NUMBER |

|||||||||||

( |

) |

- |

( |

) |

- |

|

( |

) |

|

|

- |

|

|

( |

) |

- |

||||

|

|

|

THE SOCIAL SECURITY ADMINISTRATION STAFF WILL COMPLETE THIS PART |

|

|

|||||||||||||||

7. Request received for the Social Security Administration on |

|

|

|

by: |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

(Date) |

|

|

|

|

|

(Print Name) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Title) |

|

|

(Address) |

|

|

|

|

|

|

|

(Servicing FO Code) |

|

(PC Code) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

8. Is the request for review received within 65 days of the ALJ's Decision/Dismissal? |

|

Yes |

|

|

No |

|

|

|||||||||||||

|

|

|

|

|

||||||||||||||||

9.If "No" checked: (1) attach claimant's explanation for delay; and

(2)attach copy of appointment notice, letter or other pertinent material or information in the Social Security Office.

10. Check one: |

|

Initial Entitlement |

|

||

|

|

|

|

|

Termination or other |

|

|

APPEALS COUNCIL

OFFICE OF DISABILITY ADJUDICATION AND REVIEW, SSA

5107 Leesburg Pike

FALLS CHURCH, VA 22041 - 3255

11. Check all claim types that apply : |

|

|

|||

|

|

Retirement or survivors |

(RSI) |

||

|

|

||||

|

|

(DIWC) |

|||

|

|

||||

|

|

(DIWW) |

|||

|

|

||||

|

|

(DIWC) |

|||

|

|

||||

|

|

SSI Aged |

(SSIA) |

||

|

|

||||

|

|

SSI Blind |

(SSIB) |

||

|

|

||||

|

|

SSI Disability |

(SSID) |

||

|

|

||||

|

|

Title VIII Only |

(SVB) |

||

|

|

||||

|

|

Title VIII/Title XVI |

(SVB/SSI) |

||

|

|

||||

|

|

Other - Specify: |

|

|

|

|

|

|

|

||

Form |

TAKE OR SEND ORIGINAL TO SSA AND RETAIN A COPY FOR YOUR RECORDS |

|

|

Destroy Prior Editions |

|

Privacy Act Statement

Request for Review of Hearing Decision/Order

Sections 205(a), 702, 1631 (e)(1)(a) and (b), and 1869(b)(1) and (c) of the Social Security Act and Public Law

We rarely use the information provided on this form for any purpose other than for the reasons explained above. However, we may use it for the administration and integrity of Social Security programs. We may also disclose information to another person or to another agency in accordance with approved routine uses, which include but are not limited to the following:

1.To enable a third party or an agency to assist Social Security in establishing rights to Social Security benefits and/or coverage;

2.To comply with Federal laws requiring the release of information of Social Security records (e.g., to the Government Accountability Office, the General Services Administration, the National Archives and Records Administration, and the Department of Veterans Affairs);

3.To make determinations for eligibility in similar health and income maintenance programs at the Federal, State, and local level; and,

4.To facilitate statistical research, audit, and investigative activities necessary to ensure the integrity and improvement of Social Security Programs.

We may also use this information in computer matching programs. Computer matching programs compare our records with those of other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person's eligibility for

A complete list of routine uses for this information is available in Systems of Records Notices entitled, Administrative Law Judge Working File on Claimant Cases

Paperwork Reduction Act Statement - This information collection meets the requirements of

44 U.S. C. § 3507, as amended by section 2 of the Paperwork Reduction Act of 1995 . You do not need to answer these questions unless we display a valid Office of Management and Budget (OMB) control number. We estimate that it will take about 10 minutes to read the instructions, gather the facts, and answer the questions. You may send comments on our time estimate above to: SSA 6401 Security Blvd., Baltimore, MD

Form