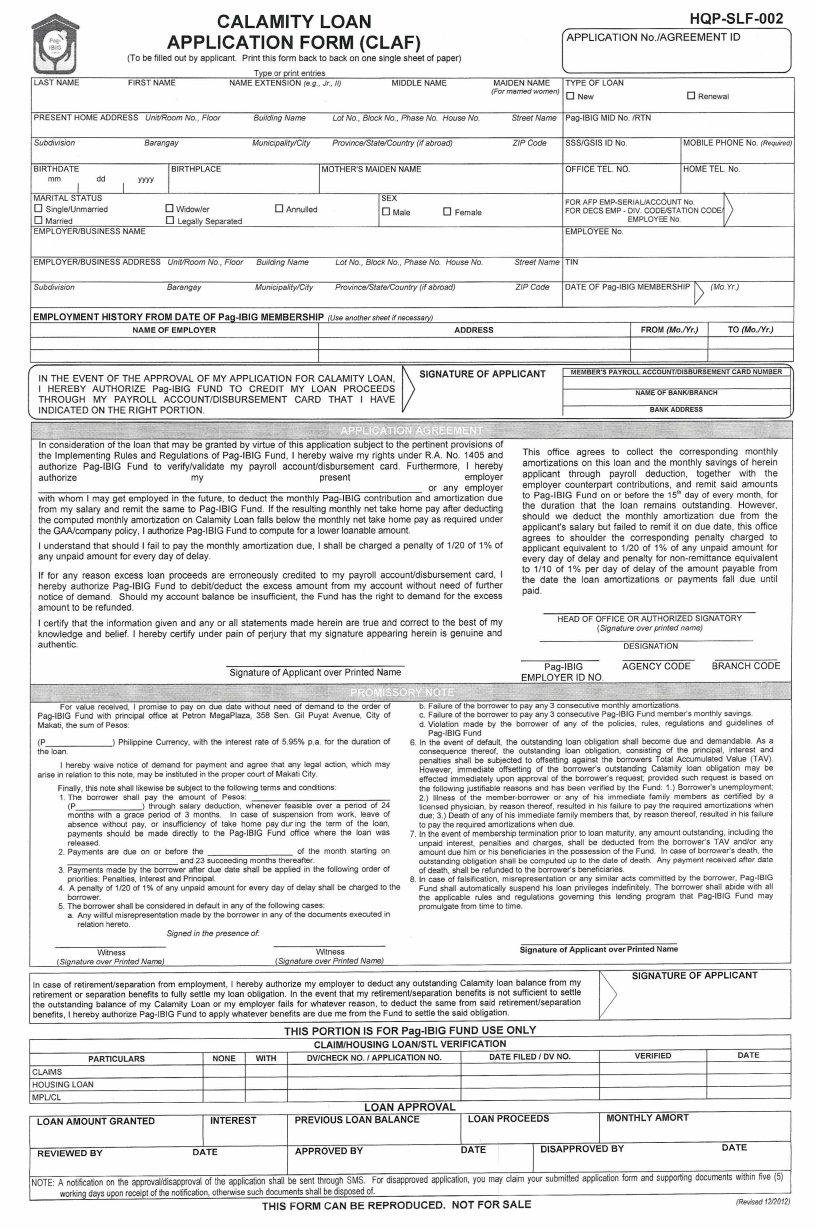

The HQP SLF 002 form, officially titled the Calamity Loan Application Form (CLAF), serves as a crucial document for individuals seeking financial assistance in the wake of a calamity. This comprehensive form, which should be printed back to back on a single sheet of paper, meticulously gathers personal and employment details from the applicant, including last name, first name, middle name, maiden name for married women, and type of loan whether new or renewal. It also collects data on the applicant's present home address, contact information, birth details, marital status, and employment specifics like employment number, employer or business name, and address. Importantly, the form is designed to facilitate the process of loan application for those affected by calamities, by outlining the conditions under which the loan proceeds will be credited by the Pag-IBIG Fund to the applicant’s designated payroll account or disbursement card. Additionally, it incorporates a declaration authorizing the Fund to verify the applicant's payroll account details and mandates the applicant's employer to deduct the loan repayments directly from their salary. The form even delineates the penalties for late repayments, the criteria for loan default, and the manner of loan settlement in various situations such as the borrower's unemployment, illness, or death. There's a section dedicated to the employer's agreement to facilitate the collection and remittance of monthly amortizations and savings through payroll deduction, and it lays down the guidelines for loan release, including the calculation of penalties for delayed payments and the employer's obligations in case of non-remittance. By signing the form, the applicant agrees to all the terms and conditions outlined, including those related to loan renewal in the event of another calamity affecting the same area.

| Question | Answer |

|---|---|

| Form Name | Form Hqp Slf 002 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | pag ibig calamity loan form, hdmf calamity loan application v05 2020, pagibig calamity form, declaration of being affected by calamity |

CALAMITY LOAN

APPLICATION FORM (CLAF)

APPLICATION No.lAGREEMENT ID

(To be filled out by applicant. Print this form back to back on one single sheet of paper)

|

|

|

|

|

|

|

|

Tvpe or orint entries |

|

|

|

|

|

|

|

|

|

||

LAST NAME |

|

|

FIRST NAME |

|

NAME EXTENSION (e.g., Jr., II) |

MIDDLE NAME |

|

MAIDEN NAME |

TYPE OF LOAN |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(For married |

women) |

D New |

o Renewal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PRESENT HOME ADDRESS UnitIRoom No., |

Floor |

|

Building |

Name |

Lot No., |

Block No., |

Phase No. House |

No. |

Street |

Name |

|

|

|||||||

Subdivision |

|

|

|

Barangay |

|

|

Municipality/City |

Province/State/Country |

|

(if abroad) |

|

ZIP Code |

SSS/GSIS ID No. |

MOBILE PHONE No. (Required) |

|||||

BIRTHDATE |

|

|

|

BIRTHPLACE |

|

|

|

MOTHER'S MAIDEN NAME |

|

|

|

OFFICE TEL. NO. |

HOME TEL. No. |

||||||

mm |

I |

dd |

I |

yyyy |

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

D~j) |

MARITAL STATUS |

|

|

|

|

|

|

|

|

I;:ale |

|

|

|

|

|

FORAFP |

||||

o SinglelUnmarried |

|

|

DWidow/er |

|

o Annulled |

|

|

o Female |

|

|

|||||||||

|

|

|

|

|

|

|

FORDECSEMP- DIV.CODEISTATIONCOD |

||||||||||||

o Married |

|

|

|

|

o Legally Separated |

|

|

|

|

|

|

|

|

|

EMPLOYEENo. |

|

|||

EMPLOYERIBUSINESS NAME |

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE No. |

|

|

||||

EMPLOYERIBUSINESS ADDRESS UnitIRoom |

No., |

Floor |

Building |

Name |

Lot No., |

Block No., |

Phase No. House |

No. |

Street |

Name |

TIN |

|

|

||||||

Subdivision |

|

|

|

|

Barangay |

|

|

Municipality/City |

Province/State/Country |

(if abroad) |

|

ZIP Code |

DATE OF |

||||||

EMPLOYMENT HISTORY FROM DATE OF |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

NAME OF EMPLOYER |

|

|

|

|

|

|

ADDRESS |

|

FROM (Mo./Yr.) |

TO (Mo./Yr.) |

|||||

IN THE |

EVENT OF THE APPROVAL OF MY APPLICATION |

FOR CALAMITY |

LOAN, |

~ |

SIGNATURE |

OF APPLICANT |

MEMBER'S PAYROLL ACCOUNT/DISBURSEMENT |

CARD NUMBER |

|||||||||||

|

|

|

|||||||||||||||||

I HEREBY AUTHORIZE |

|

|

|

|

|

NAME Of |

BANK/BRANCH |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

THROUGH |

MY |

PAYROLL |

ACCOUNT/DISBURSEMENT |

CARD THAT I HAVE |

|

|

|

|

|

|

|

|

|||||||

INDICATED |

ON THE RIGHT |

PORTION. |

|

|

|

|

|

|

|

|

|

|

|

BANK |

ADDRESS |

|

|||

,,11/71:1£%/" |

3khh."Cy"y!"l5::: |

J.iI |

» » |

'jDg" |

In consideration of the loan that may be granted by virtue of this application subject to the pertinent provisions of the Implementing Rules and Regulations of

authorizemypresentemployer or any employer with whom I may get employed in the future, to deduct the monthly

from my salary and remit the same to

I understand that should I fail to pay the monthly amortization due, I shall be charged a penalty of 1/20 of 1% of any unpaid amount for every day of delay.

If for any reason excess loan proceeds are erroneously credited to my payroll account/disbursement card, I hereby authorize

I certify that the information given and any or all statements made herein are true and correct to the best of my knowledge and belief. I hereby certify under pain of perjury that my signature appearing herein is genuine and authentic.

"';;"it'.ill .!5IF ;:;'.;,! ~;;.

This office agrees to collect the corresponding monthly amortizations on this loan and the monthly savings of herein applicant through payroll deduction, together with the employer counterpart contributions, and remit said amounts to

HEAD OF OFFICE OR AUTHORIZED SIGNATORY

(Signature over printed name)

DESIGNATION

|

|

Signature |

of Applicant |

over Printed Name |

|

AGENCY |

CODE |

BRANCH CODE |

||

|

|

|

|

tI~~~~~~~=~ |

EMPLOYER |

ID NO. |

||||

,..•• HE |

..;,;I |

;b? ..., ·····?"Ti,,+iiiIIJlli~!;,,! |

Ir]llll!Eb;~"n~'~W!i!~!%b~.jj~ ;F?~j9~.:.!""="~fW,¥";J!j'§·r!==~:·B~;lfLi>~2¥"==;_==i;";i'i2,II[=='t 3" |

|||||||

For value received, I promise |

|

|||||||||

Sen. Gil Puyat Avenue, City of |

c. Failure ot the borrower to pay any 3 consecutive |

|||||||||

Makati, |

the sum of Pesos: |

|

|

|

d. Violation made by the borrower of any |

of the |

policies, rules, |

regulations |

and guidelines of |

|

I hereby waive notice of demand for payment and agree that any legal action, which may

arise in relation to this note, may be instituted in the proper court of Makati City.

Finally, this note shall likewise be subject to the following terms and conditions:

1. The borrower |

shall |

pay the |

amount |

of Pesos: |

__ |

||

(P |

) |

through |

salary |

deduction, |

whenever feasible |

over |

a period of 24 |

months with a grace period of 3 months. In case of suspension from work, leave of absence without pay, or insufficiency of take home pay dur ing the term of the loan, payments should be made directly to the

released. |

|

|

2. Payments are due on or before the |

of the month starting on |

|

and 23 succeeding |

months thereafter. |

|

3.Payments made by the borrower after due date shall be applied in the following order of priorities: Penalties, Interest and Principal.

4.A penalty of 1/20 of 1% of any unpaid amount for every day of delay shall be charged to the borrower.

5.The borrower shall be considered in default in any of the following cases:

a. Any willful misrepresentation made by the borrower in any of the documents executed in

relation hereto.

Signed in the presence of:

6.In the event of default, the outstanding loan obligation shall become due and demandable. As a consequence thereof, the outstanding loan obligation, consisting of the principal, interest and penalties shall be subjected to offsetting against the borrowers Total Accumulated Value (TAV). However, immediate offsetting of the borrower's outstanding Calamity loan obligation may be effected immediately upon approval of the borrower's request; provided such request is based on the following justifiable reasons and has been verified by the Fund: 1.) Borrower's unemployment;

2.) Illness of the

7.In the event of membership termination prior to loan maturity, any amount outstanding, including the unpaid interest, penalties and charges, shall be deducted from the borrower's TAV andlor any amount due him or his beneficiaries in the possession of the Fund. In case of borrower's death, the outstanding obligation shall be computed up to the date of death. Any payment received after date of death, shall be refunded to the borrower's beneficiaries.

8.In case of falsification, misrepresentation or any similar acts committed by the borrower,

Fund shall automatically suspend his loan privileges indefinitely. The borrower shall abide with all the applicable rules and regUlations goveming this lending program that

Witness |

VVtness |

Signature of Applicant over Printed Name |

|

||

(Sianature over Printed Name) |

TSIANETURE over Printed Name) |

|

|

|

SIGNATURE OF APPLICANT |

In case of retirement/separation from employment, I hereby authorize my employer to deduct any outstanding Calamity loan balance from my |

||

retirement or separation benefits to fully settle my loan Obligation. In the event that my retirement/separation benefits is not sufficient to settle the outstanding balance of my Calamity Loan or my employer fails for whatever reason, to deduct the same from said retirement/separation benefits, I hereby authorize

THIS PORTION IS FOR

|

|

|

CLAIM/HOUSING |

LOANISTL VERIFICATION |

|

|

|

|||

PARTICULARS |

NONE |

WITH |

DViCHECK NO.1 |

APPLICATION NO, |

DATE FILED I DV NO, |

VERIFIED |

DATE |

|||

|

||||||||||

CLAIMS |

|

|

|

|

|

|

|

|

|

|

HOUSING LOAN |

|

|

|

|

|

|

|

|

|

|

MPUCL |

|

|

|

|

|

|

|

|

|

|

|

I INTEREST |

|

|

LOAN |

APPROVAL |

I LOAN |

|

I MONTHLY AMORT |

|

|

LOAN AMOUNT GRANTED |

|

PREVIOUS |

LOAN |

BALANCE |

PROCEEDS |

|

||||

REVIEWED BY |

DATE |

|

APPROVED |

BY |

|

|

DATE |

I DISAPPROVED |

BY |

DATE |

|

|

|

|

|||||||

NOTE: A notification on the approval/disapprovalof the application shall be sent through SMS. For disapproved application, you may claim your submitted applicalion form and supporting documents within five (5) workinc days upon receiptof the notification,otherwisesuch documentsshall be disposedof.

THIS FORM CAN |

BE REPRODUCED. NOT FOR SALE |

(ReVIsed1212012) |

|

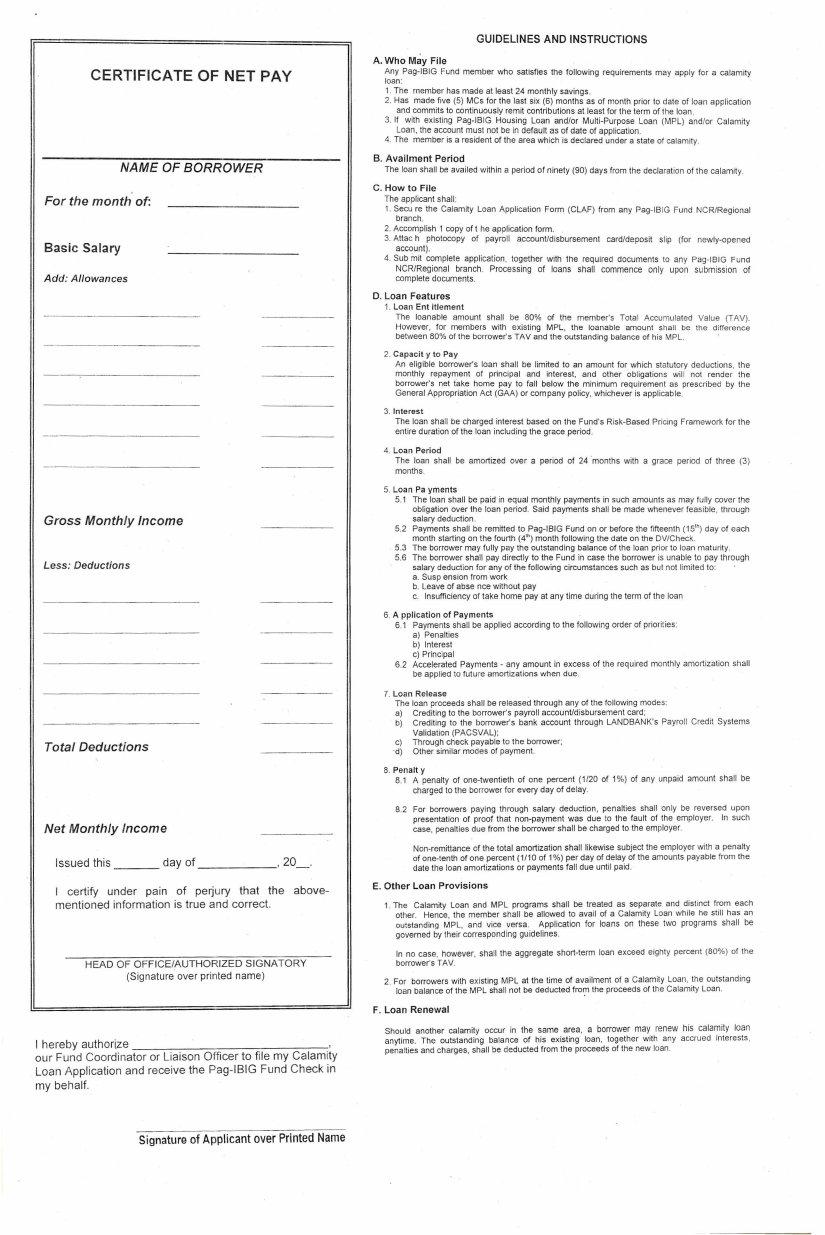

CERTIFICATE OF NET PAY

NAME OF BORROWER

For the month of:

Basic Salary

ADD: ALLOWANCES

Gross Monthly Income

LESS: DEDUCTIONS

Total Deductions

Net Monthly Income

Issued this |

day of |

, 20_. |

I certify under pain of perjury that the above- mentioned information is true and correct.

HEAD OF OFFICE/AUTHORIZED SIGNATORY

(Signature over printed name)

I here by auth 0 rize __

our Fund Coordinator or Liaison Officer to file my Calamity Loan Application and receive the

GUIDELINES AND INSTRUCTIONS

A. Who May File

Any

1.The member has made at least 24 monthly savings.

2.Has made five (5) MCs for the last six (6) months as of month prior to date of loan application and commits to continuously remit contributions at least for the term of the loan.

3.If with existing

4.The member is a resident of the area which is declared under a state of calamity.

B.Availment Period

The loan shall be availed within a period of ninety (90) days from the declaration of the calamity.

C.How to File

The applicant shall:

1.Secu re the Calamity Loan Application Form (CLAF) from any

2.Accomplish 1 copy of t he application form.

3.Attac h photocopy of payroll accounUdisbursement card/deposit slip (for

4.Sub rnit complete application. together with the required documents to any

D.Loan Features

1.Loan Ent itlement

The loanable amount shall be 80% of the member's Total Accumulated Value (TAV).

However, for members with existing MPL, the loanable amount shall be the difference

between 80% of the borrower's TAV and the outstanding balance of his MPL.

2. Capacil y 10 Pay

An eligible borrower's loan shall be limited to an amount for which statutory deductions. the monthly repayment of principal and interest, and other Obligations will not render the borrower's net take home pay to fall below the minimum requirement as prescribed by the General Appropriation Act (GAA) or company policy, whichever is applicable.

3. Interest

The loan shall be charged interest based on the Fund's

4. Loan Period

The loan shall be amortized over a period of 24 'months with a grace period of three (3) months.

5.Loan Pa yments

5.1The loan shall be paid in equal monthly payments in such amounts as may fully cover the obligation over the loan period. Said payments shall be made whenever feasible. through salary deduction.

5.2Payments shall be remitted to

5.3The borrower may fully pay the outstanding balance of the loan prior to loan maturity.

5.6The borrower shall pay directly to the Fund in case the borrower is unable to pay through salary deduction for any of the following circumstances such as but not limited to:

a.Susp ens ion from work

b.Leave of abse nce without pay

c.Insufficiency of take home pay at any time during the term of the loan

6.A pplication of Payments

6.1Payments shall be applied according to the following order of priorities:

a)Penalties

b)Interest

c)Principal

6.2Accelerated Payments - any amount in excess of the required monthly amortization shall be applied to future amortizations when due.

7.Loan Release

The loan proceeds shall be released through any of the following modes:

a)Crediting to the borrower's payroll accounUdisbursement card:

b)Crediting to the borrower's bank account through LANDBANK's Payroll Credit Systems Validation (PACSVAL);

c)Through check payable to the borrower;

'd) Other similar modes of payment.

8.Penalt y

8.1A penalty of

8.2For borrowers paying through salary deduction, penalties shall only be reversed upon presentation of proof that

E.Other Loan Provisions

The Calamity Loan and MPL programs shall be treated as separate and distinct from each other. Hence, the member shall be allowed to avail of a Calamity Loan while he still has an outstanding MPL, and vice versa. Application for loans on these two programs shall be governed by their corresponding guidelines.

In no case. however. shall the aggregate

2.For borrowers with existing MPL at the time of availment of a Calamity Loan. the outstanding loan balance of the MPL shall not be deducted fro,!, the proceeds of the Calamity Loan.

F.Loan Renewal

Should another calamity occur in the same area. a borrower may renew his calamity loan anytime. The outstanding balance of his existing loan, together with any accrued interests. penalties and charges, shall be deducted from the proceeds of the new loan.

Signature of Applicant over Printed Name