Working with PDF forms online is simple with our PDF editor. You can fill out form hs 122 here effortlessly. To keep our tool on the leading edge of efficiency, we strive to put into operation user-driven capabilities and improvements regularly. We're routinely grateful for any suggestions - join us in revampimg how you work with PDF docs. It merely requires several easy steps:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" above on this webpage.

Step 2: With our state-of-the-art PDF editor, it's possible to accomplish more than merely fill in forms. Try each of the functions and make your forms appear faultless with custom text added in, or fine-tune the original input to excellence - all accompanied by the capability to incorporate any kind of images and sign the PDF off.

With regards to the blanks of this particular form, here is what you need to know:

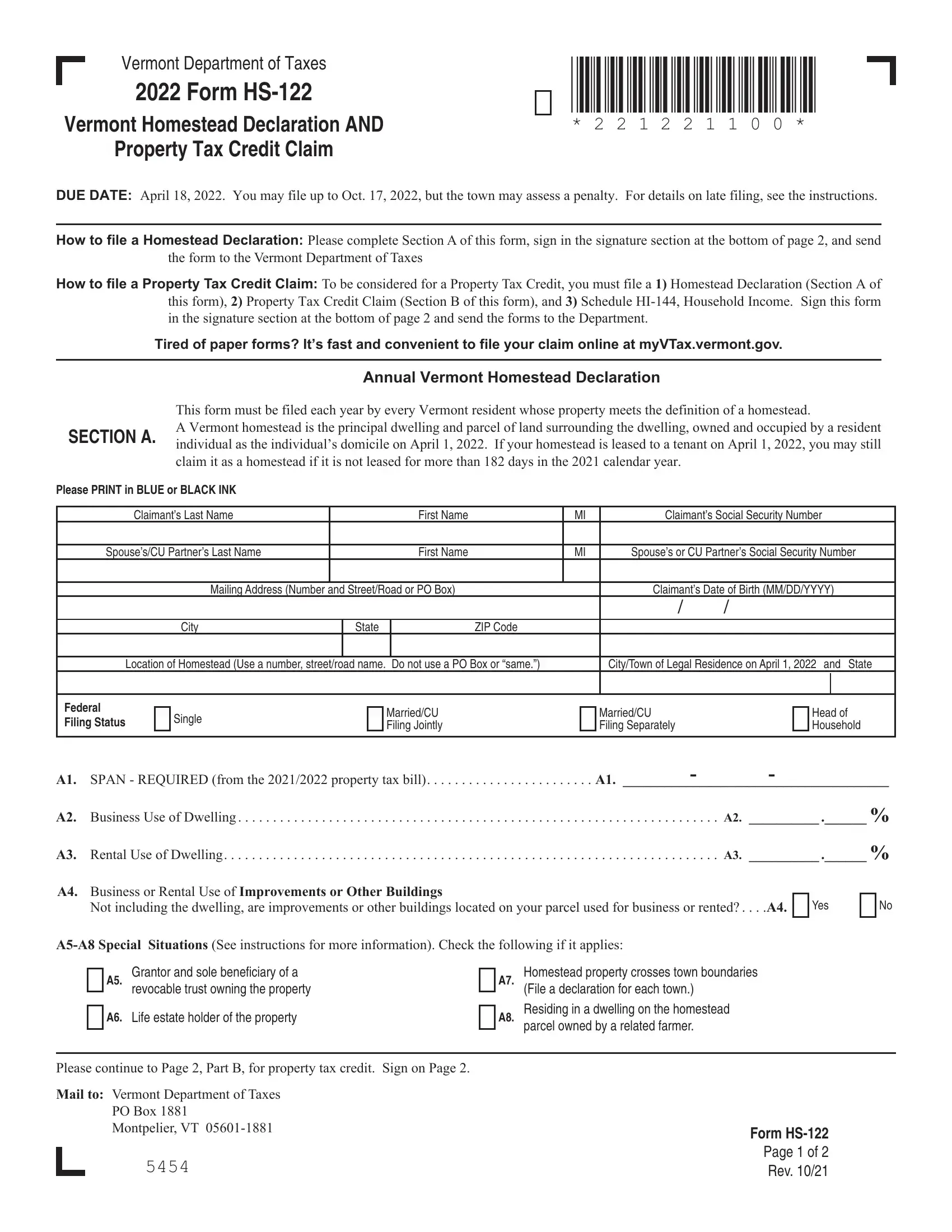

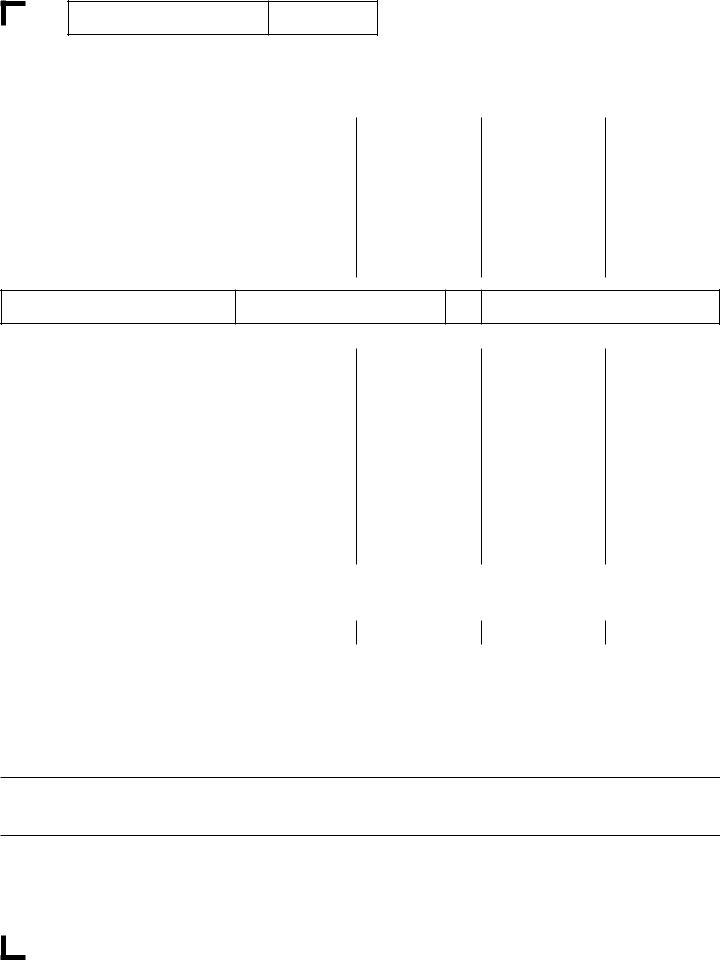

1. For starters, while completing the form hs 122, start out with the page containing subsequent fields:

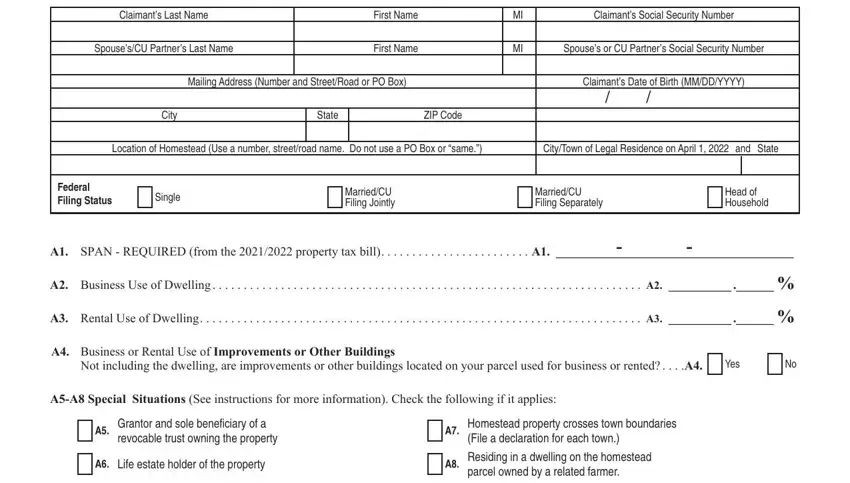

2. After the last section is done, it is time to include the required details in Claimants Last Name, Social Security Number, DUE DATE April Claims accepted, SECTION B, For Household Income up to, PROPERTY TAX CREDIT CLAIM, To qualify you must meet the, B Were you domiciled in Vermont, Yes Go to Line B, No STOP, B Were you claimed as a dependent, Yes STOP, No Go to Line B, B Do you anticipate selling this, and before April allowing you to go further.

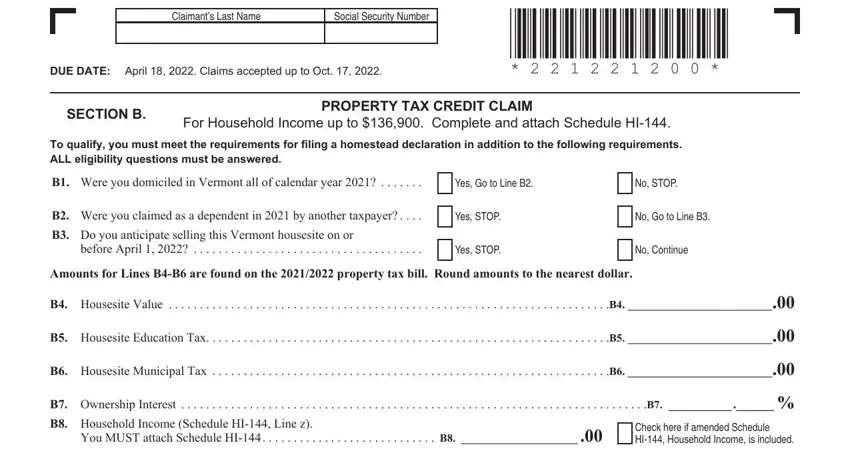

3. This next section will be about Complete the following ONLY if, B Lot Rent Allocable Rent from, Allocated Property Tax from Land, B Allocated Education Tax, B Allocated Municipal Tax, OR Property Tax from contiguous, B Contiguous property Education, B Contiguous property Municipal, Under penalties of perjury I, MAXIMUM CREDIT AMOUNT IS, Signature, Signature If a joint return BOTH, Paid Preparers Signature, Date MMDDYYYY, and Daytime Telephone Number - complete every one of these blanks.

Always be really attentive when filling out Allocated Property Tax from Land and Date MMDDYYYY, since this is the part in which most people make a few mistakes.

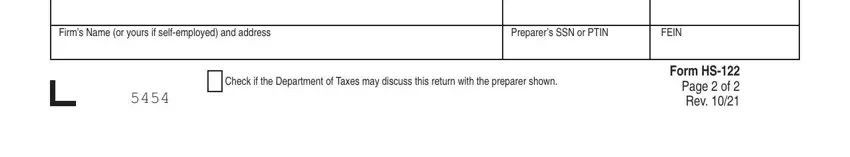

4. This next section requires some additional information. Ensure you complete all the necessary fields - Firms Name or yours if, Preparers SSN or PTIN, FEIN, Check if the Department of Taxes, and Form HS Page of Rev - to proceed further in your process!

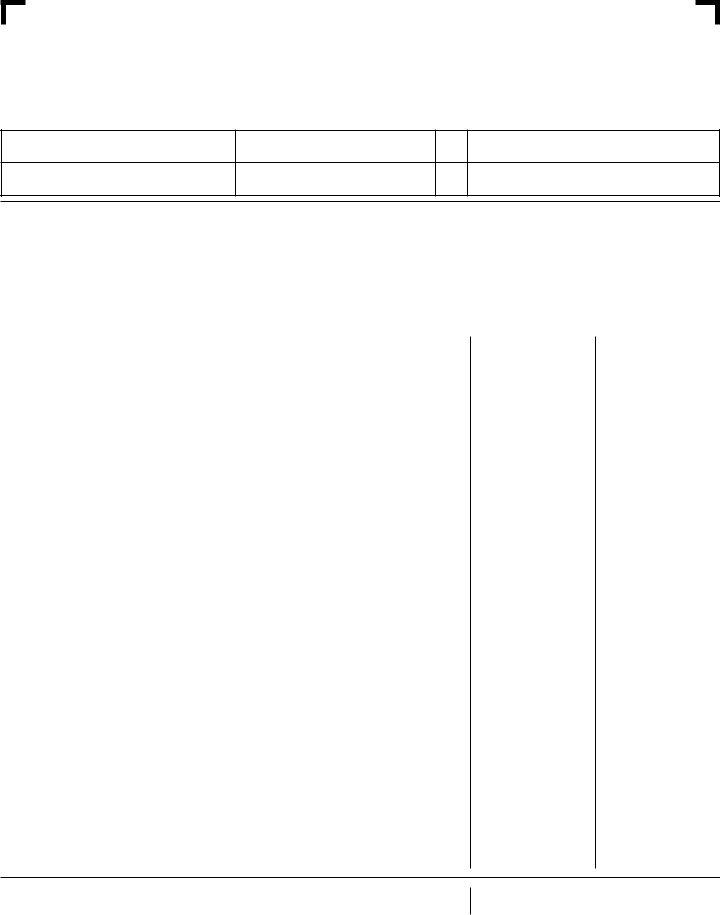

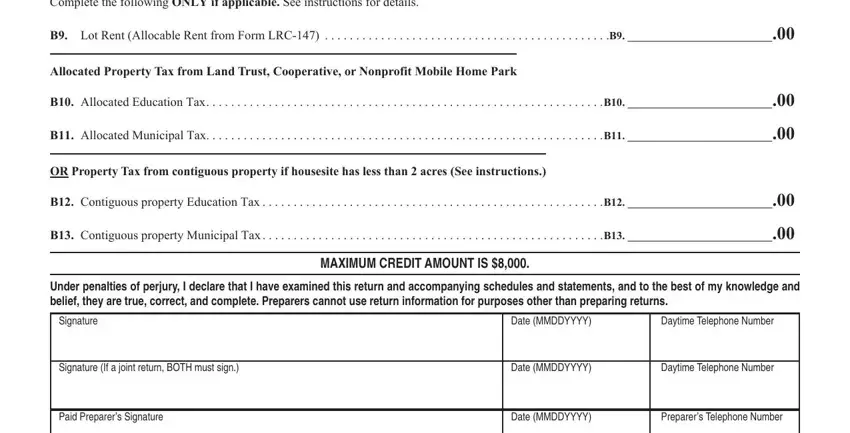

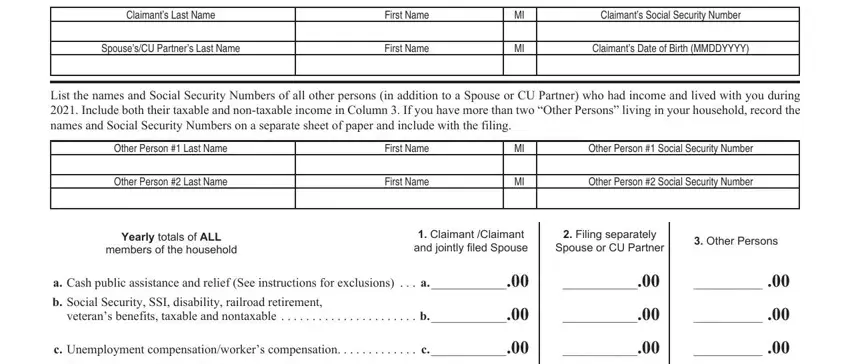

5. This form should be completed with this particular part. Further you can find a comprehensive list of form fields that require accurate information in order for your form usage to be complete: Claimants Last Name, SpousesCU Partners Last Name, First Name, First Name, Claimants Social Security Number, Claimants Date of Birth MMDDYYYY, List the names and Social Security, Other Person Last Name, Other Person Last Name, First Name, First Name, Other Person Social Security, Other Person Social Security, Yearly totals of ALL, and members of the household.

Step 3: Before finishing this form, check that all form fields were filled out the proper way. When you confirm that it is correct, click “Done." Join us now and easily get access to form hs 122, available for downloading. All modifications made by you are kept , which means you can change the form at a later point as needed. When using FormsPal, you can complete forms without stressing about database leaks or entries being shared. Our protected system makes sure that your private information is kept safely.