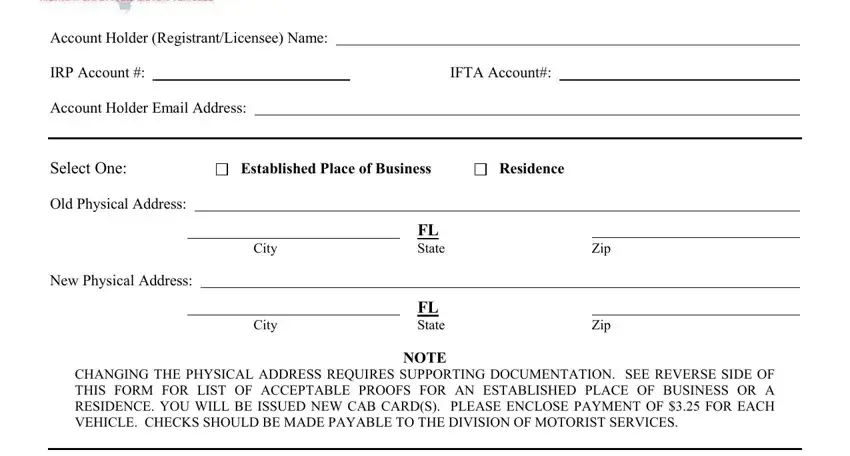

IRP/IFTA ADDRESS CHANGE FORM Established Place of Business, Residence, or Mailing Address

Account Holder (Registrant/Licensee) Name:

IRP Account #:IFTA Account#:

Account Holder Email Address:

Select One:

Old Physical Address:

New Physical Address:

Established Place of Business |

Residence |

FL

FL

NOTE

CHANGING THE PHYSICAL ADDRESS REQUIRES SUPPORTING DOCUMENTATION. SEE REVERSE SIDE OF THIS FORM FOR LIST OF ACCEPTABLE PROOFS FOR AN ESTABLISHED PLACE OF BUSINESS OR A RESIDENCE. YOU WILL BE ISSUED NEW CAB CARD(S). PLEASE ENCLOSE PAYMENT OF $3.25 FOR EACH VEHICLE. CHECKS SHOULD BE MADE PAYABLE TO THE DIVISION OF MOTORIST SERVICES.

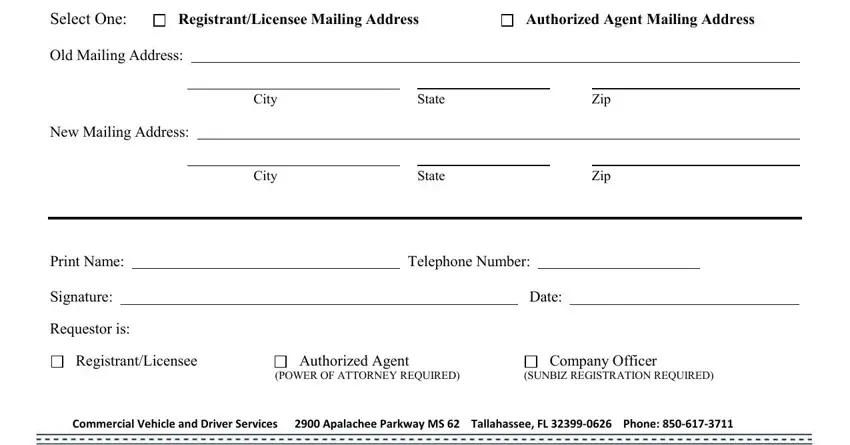

Registrant/Licensee Mailing Address

Authorized Agent Mailing Address

Old Mailing Address:

New Mailing Address:

Print Name:Telephone Number:

Signature: ____________________________________________________ Date: ______________________________

Requestor is:

Registrant/Licensee |

Authorized Agent |

Company Officer |

(POWER OF ATTORNEY REQUIRED) |

(SUNBIZ REGISTRATION REQUIRED) |

Commercial Vehicle and Driver Services |

2900 Apalachee Parkway MS 62 |

Tallahassee, FL 32399-0626 Phone: 850-617-3711 |

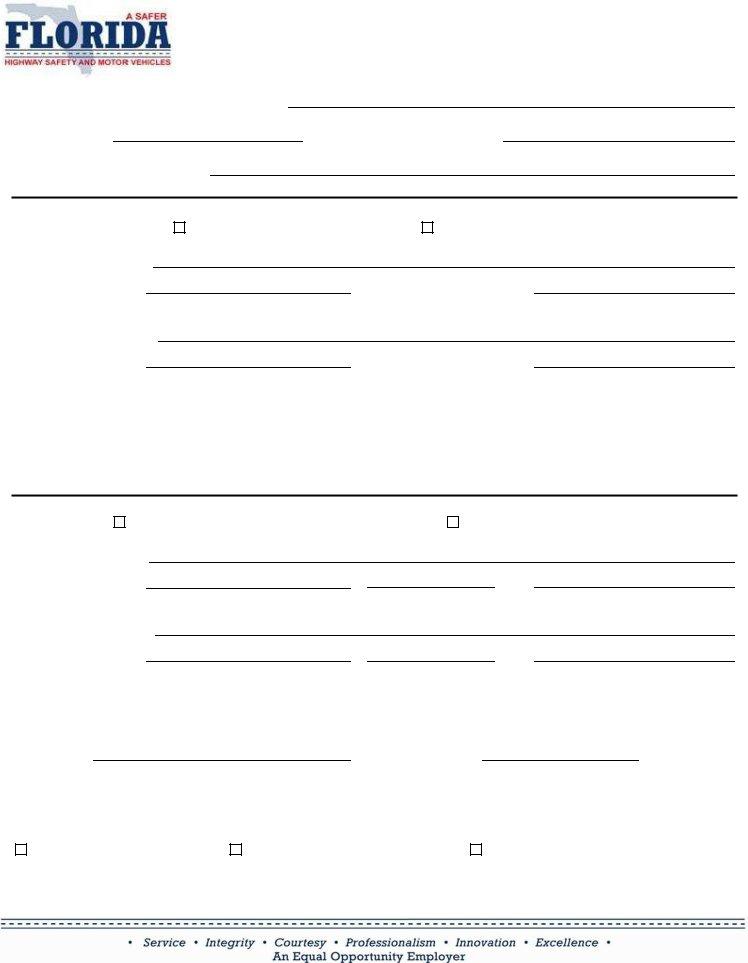

INSTRUCTIONS FOR UPDATING THE PHYSICAL ADDRESS CURRENTLY ON FILE

Complete and sign Form 85041 (reverse side); make payment for each vehicle requiring a new cab card; and submit three proofs of the new physical address from the applicable list below.

Each document must display registrant’s name (the individual or the business, if applicable) and the new physical address. All three documents must be from the same list. Legible copies are accepted.

Note: If the registrant is a business, the Florida business address will be used for registration purposes only if it meets all the requirements of an “established place of business” as defined by the International Registration Plan (Article II, Definitions). Otherwise, the Florida residential address of the principal business owner must be verified and will be used as the physical address for registration purposes.

Established Place of Business in Florida

1.Required: Copy of a current document showing the business employs at least one individual. For example, a payroll tax withholding account statement (issued by bank within last 90 days); an employee pay stub (issued within last 90 days); or the W-2 form the business sent to the IRS for the last tax year. Document must also include the business FEIN. In addition, any two of the following:

2.Copy of a document issued by the Florida Department of State/Division of Corporations, showing registrant’s business is an active Florida corporation, limited liability company, etc.; registrant is principal owner of an active Florida corporation, limited liability company, etc.; or registrant’s carrier company is currently registered to conduct business as a foreign corporation in Florida.

3.Receipt issued by FL Department of Revenue for filing/paying corporate taxes in most current tax year.

4.Active business or occupational license issued by a Florida municipality or county.

5.Property tax assessment issued to the business for the most current tax quarter or year.

6.Utility bill issued to the business within the last 90 days.

7.Bank statement issued to the business within the last 90 days.

If registrant does not have or is not an Established Place of Business in Florida (as defined by IRP), the registrant (individual or principal owner of the business) must demonstrate Florida residency:

Residence in Florida

1.The registrant’s Florida driver’s license (unexpired).

2.Receipt issued by the IRS for filing/paying federal income taxes in the most current tax year.

3.Bank statement issued to the registrant within last 90 days.

4.Utility bill issued to the registrant within the last 90 days.

5.Real estate or property tax bill issued to the registrant in the most current tax year.

6.The registrant’s Florida vehicle title or Florida vehicle registration for a vehicle currently titled in Florida.

Commercial Vehicle and Driver Services 2900 Apalachee Parkway MS 62 Tallahassee, FL 32399-0626 Phone: 850-617-3711

HSMV 85041 Rev. 12/2017