Using PDF files online can be very simple with our PDF tool. Anyone can fill in form htc 60 here effortlessly. The tool is consistently updated by our staff, getting awesome functions and growing to be greater. To begin your journey, take these basic steps:

Step 1: First of all, access the pdf tool by pressing the "Get Form Button" above on this webpage.

Step 2: After you access the online editor, you will find the document prepared to be filled in. Other than filling in various blank fields, you could also do several other things with the file, including adding your own words, modifying the initial textual content, inserting graphics, putting your signature on the document, and a lot more.

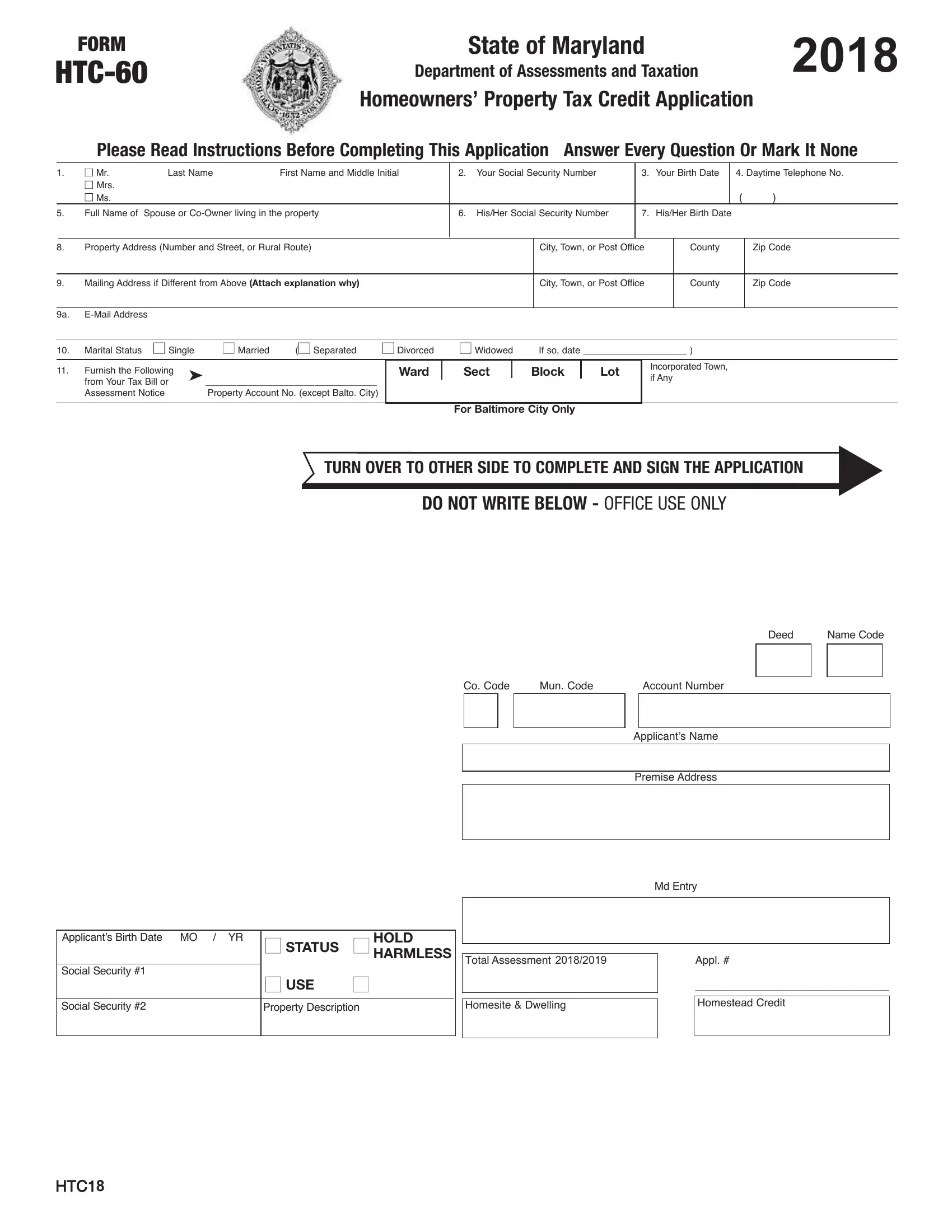

If you want to fill out this form, be certain to enter the information you need in each blank:

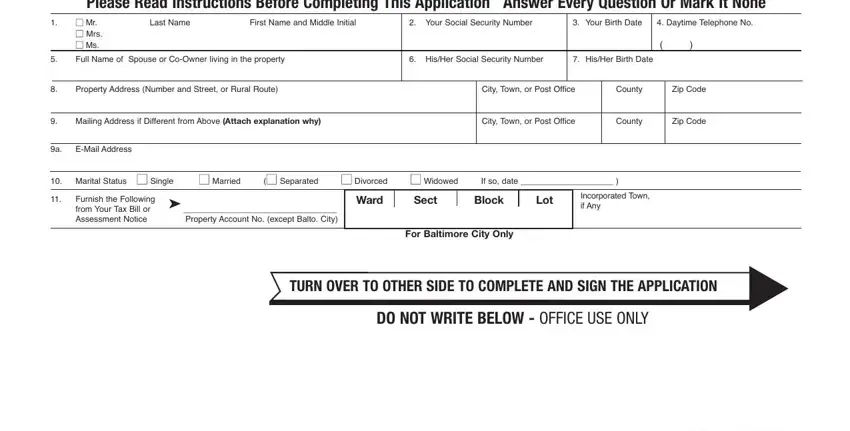

1. It is critical to fill out the form htc 60 properly, so be careful while filling in the areas comprising all these blanks:

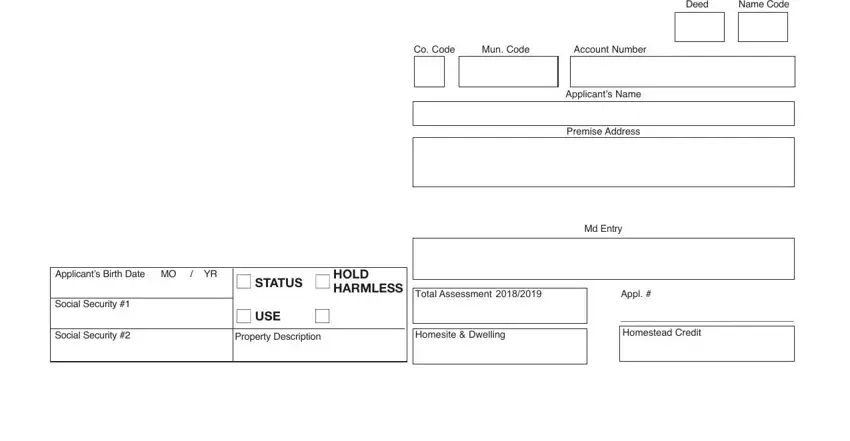

2. Soon after this part is done, go to enter the suitable information in all these: Deed, Name Code, Co Code, Mun Code, Account Number, Applicants Name, Premise Address, Md Entry, Total Assessment, Appl, Applicants Birth Date MO YR, STATUS, HOLD HARMLESS, USE, and Property Description.

You can easily make a mistake while filling in your Co Code, for that reason ensure that you go through it again prior to when you submit it.

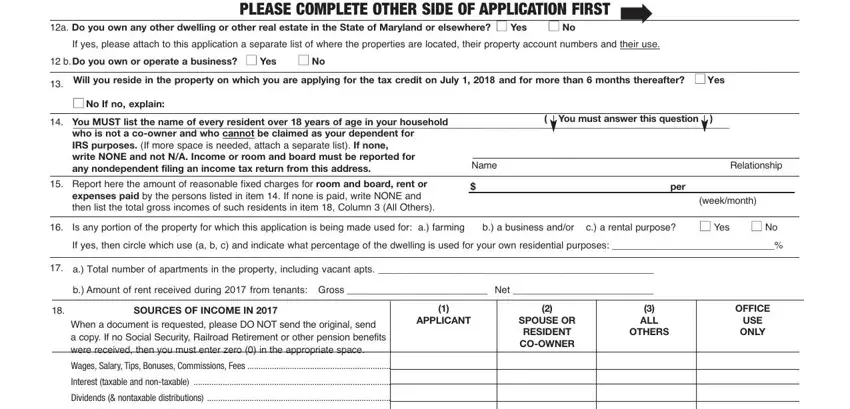

3. Completing a Do you own any other dwelling or, PLEASE COMPLETE OTHER SIDE OF, If yes please attach to this, b Do you own or operate a, You MUST list the name of every, n No If no explain who is not a, You must answer this question, Name, Relationship, Report here the amount of, expenses paid by the persons, per, weekmonth, Is any portion of the property for, and n Yes is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

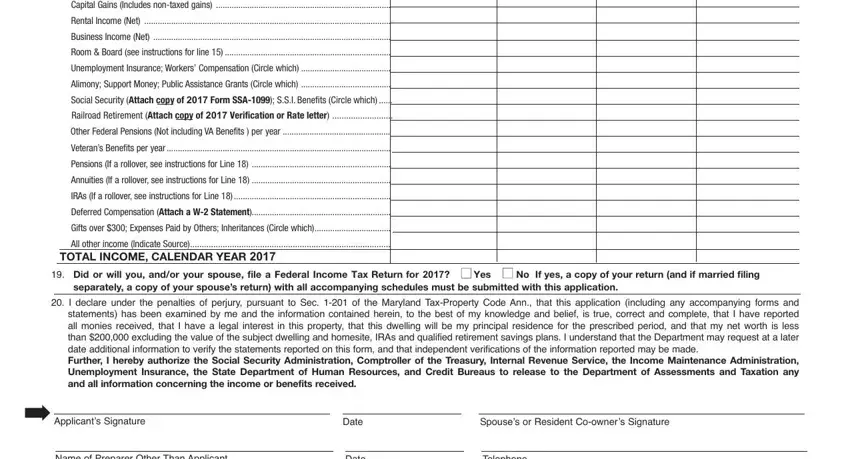

4. Your next paragraph needs your involvement in the subsequent places: Capital Gains Includes nontaxed, Rental Income Net, Business Income Net, Room Board see instructions for, Unemployment Insurance Workers, Alimony Support Money Public, Veterans Benefits per year, Pensions If a rollover see, Annuities If a rollover see, IRAs If a rollover see, Deferred Compensation Attach a W, Gifts over Expenses Paid by, All other income Indicate Source, TOTAL INCOME CALENDAR YEAR Did, and separately a copy of your spouses. Be sure you give all of the required information to move further.

Step 3: Confirm that your details are accurate and click "Done" to finish the project. Join FormsPal now and easily gain access to form htc 60, ready for download. All modifications made by you are saved , making it possible to customize the document later anytime. Here at FormsPal, we endeavor to ensure that your details are kept secure.