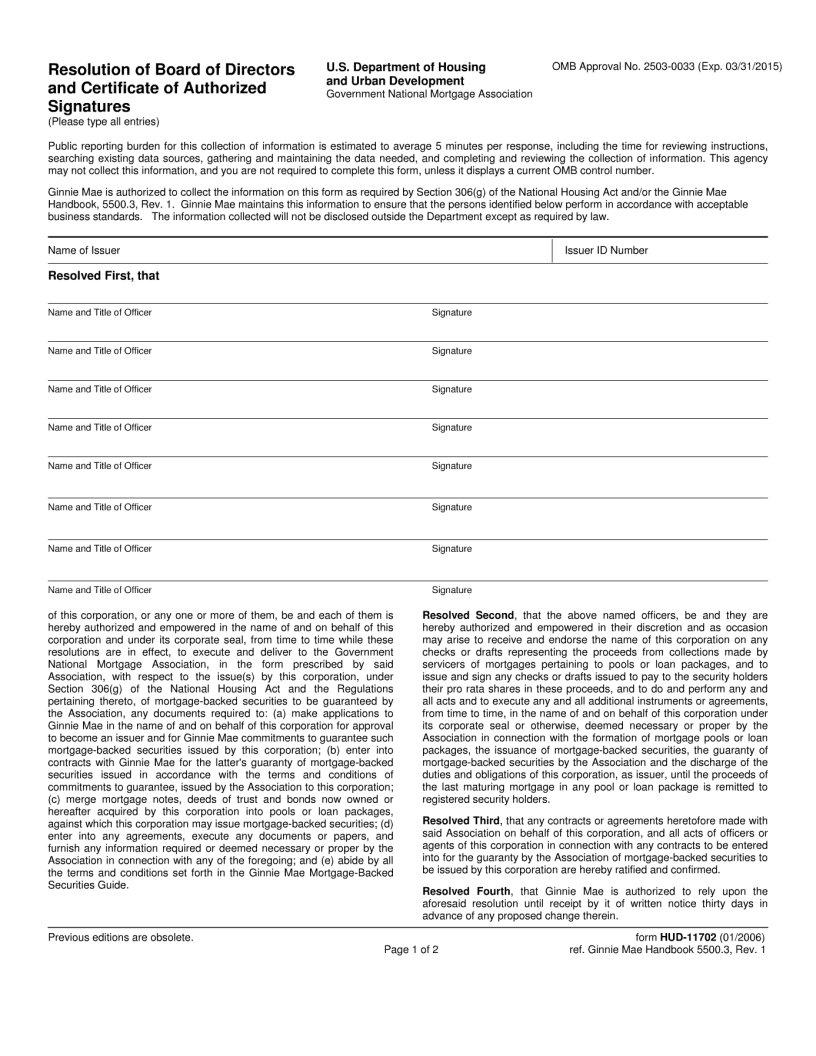

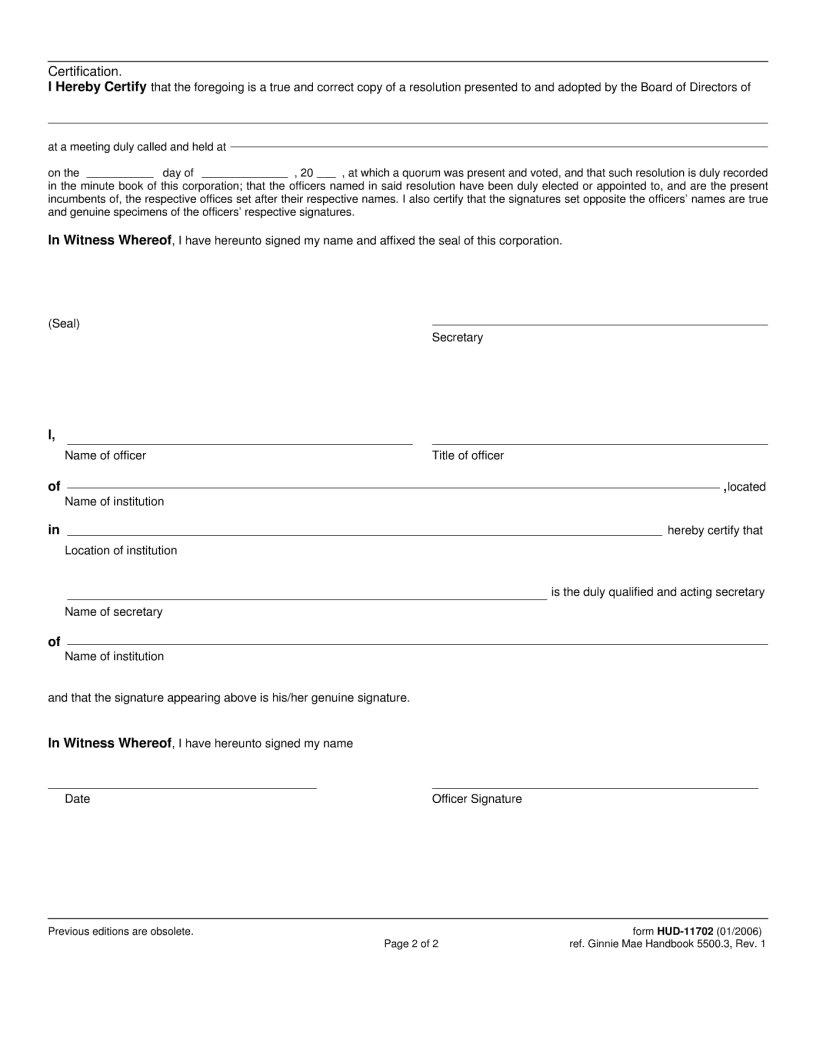

Navigating the intricacies of home ownership and property finance can be a daunting task, especially when it involves understanding and completing essential documents like the HUD 11702 form. This critical document, often encountered during the loan acquisition process for properties, plays a pivotal role in facilitating the smooth transfer of title and ensuring that all parties are adequately informed and in agreement. The HUD 11702 form is integral for buyers, sellers, and lenders alike, serving as a legal touchstone that outlines the terms of the loan, the responsibilities of the borrower, and the rights of the lender. Its presence in the property buying journey underscores the government's commitment to maintaining transparent, fair, and secure real estate transactions. By providing a structured platform for documenting the details of the loan agreement, the form not only helps in preventing misunderstandings and disputes but also promotes a level of standardization in real estate dealings across the board. Understanding the major aspects and implications of this form is crucial not just for completing the process successfully but also for ensuring one's rights and obligations are clearly defined and protected.

| Question | Answer |

|---|---|

| Form Name | Form HUD-11702 |

| Form Length | 2 pages |

| Fillable? | Yes |

| Fillable fields | 20 |

| Avg. time to fill out | 4 min 30 sec |

| Other names | 11702 hud, gnma 11702 form, hud 11702, hud 11702 pdf |