You may fill in e-pay effectively using our PDFinity® editor. In order to make our editor better and less complicated to utilize, we constantly develop new features, bearing in mind feedback coming from our users. Here is what you will have to do to get going:

Step 1: Click the "Get Form" button in the top area of this webpage to access our PDF editor.

Step 2: When you open the PDF editor, you will find the form ready to be completed. Apart from filling in various blanks, it's also possible to do various other things with the Document, namely writing your own text, changing the initial text, adding graphics, affixing your signature to the document, and a lot more.

Completing this document requires attention to detail. Ensure all required fields are completed properly.

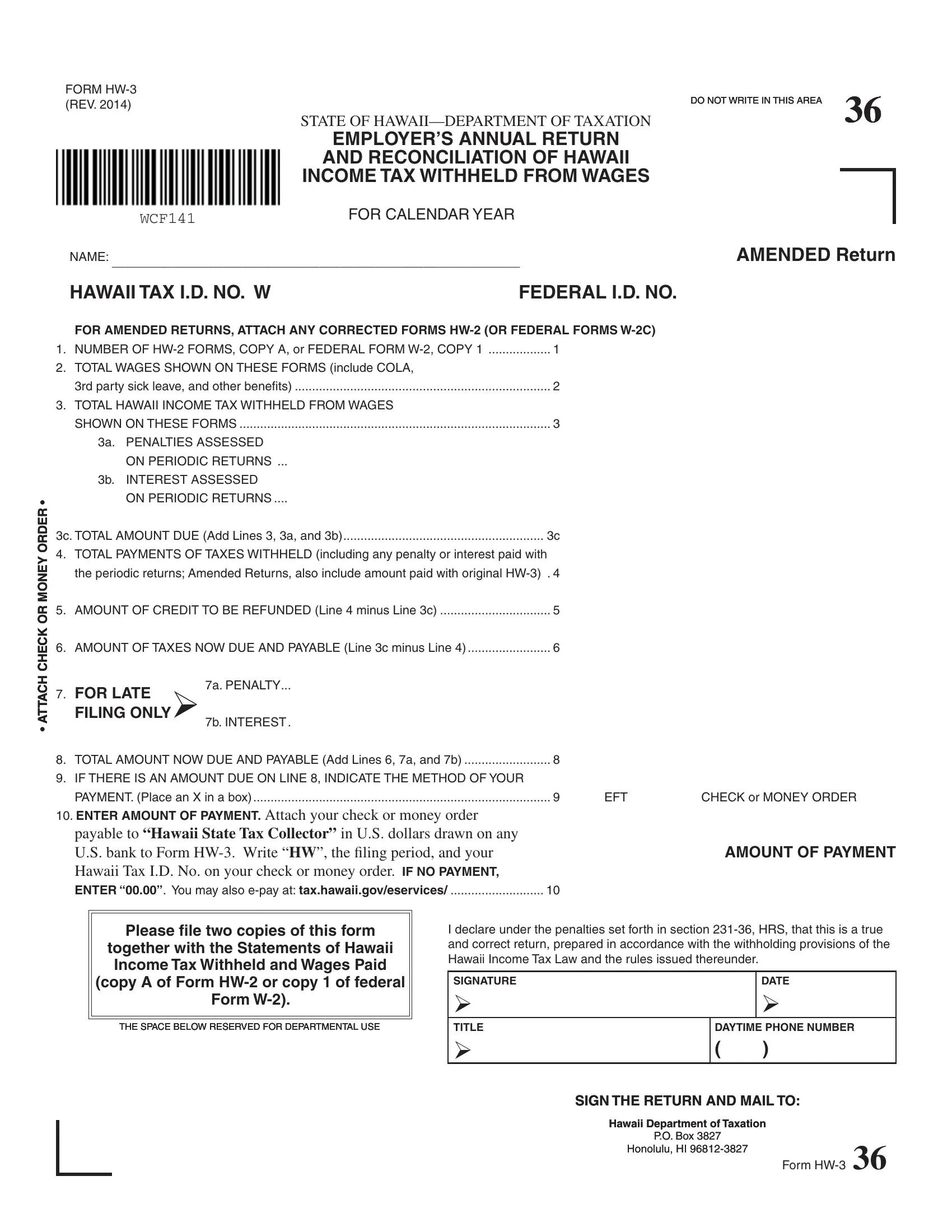

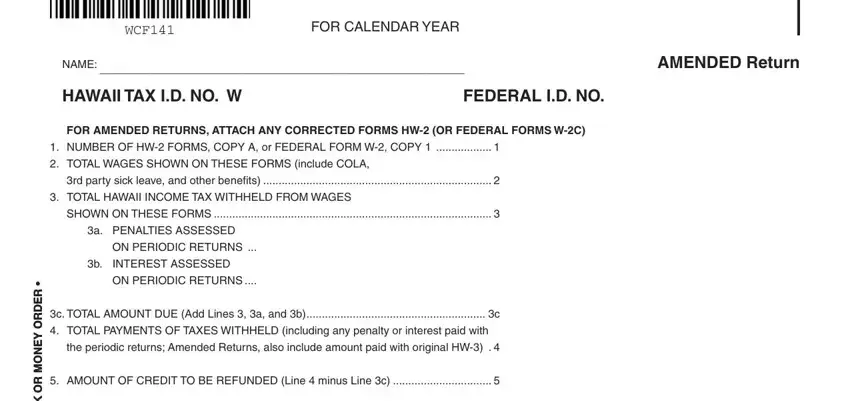

1. Start filling out your e-pay with a number of necessary fields. Gather all the information you need and make sure nothing is omitted!

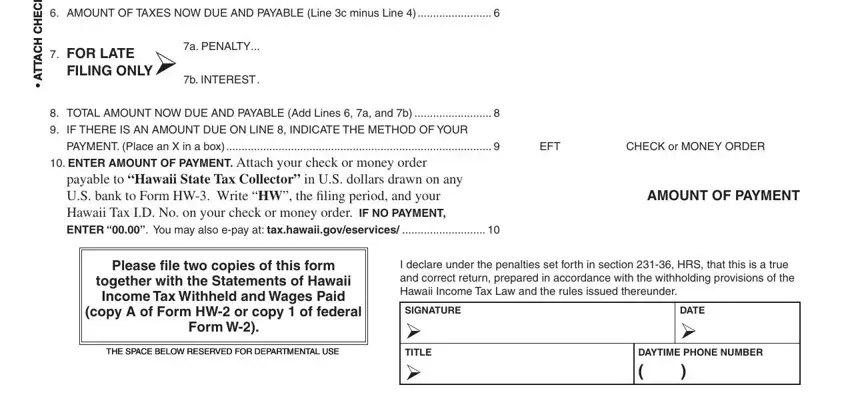

2. Just after the prior part is filled out, go on to enter the relevant information in all these: R R R E E E D D D R R R O O O Y Y, AMOUNT OF TAXES NOW DUE AND, FOR LATE, FILING ONLY b INTEREST, a PENALTY, TOTAL AMOUNT NOW DUE AND PAYABLE, IF THERE IS AN AMOUNT DUE ON LINE, PAYMENT Place an X in a box, EFT, CHECK or MONEY ORDER, ENTER AMOUNT OF PAYMENT Attach, payable to Hawaii State Tax, AMOUNT OF PAYMENT, Please fi le two copies of this form, and together with the Statements of.

A lot of people frequently make mistakes when filling out EFT in this area. Remember to re-examine everything you enter right here.

Step 3: Prior to finalizing the form, double-check that blank fields have been filled out right. As soon as you think it is all good, press “Done." Sign up with us right now and easily obtain e-pay, set for download. All adjustments you make are saved , letting you customize the pdf later on when required. Whenever you work with FormsPal, you can certainly fill out forms without needing to get worried about database breaches or records getting distributed. Our protected system helps to ensure that your private details are maintained safe.