You can complete OMB effortlessly by using our online PDF editor. The tool is consistently upgraded by us, receiving new awesome functions and becoming much more versatile. To get the process started, take these basic steps:

Step 1: Access the PDF doc in our editor by clicking the "Get Form Button" above on this page.

Step 2: When you start the tool, you will see the document made ready to be filled in. Besides filling out various blank fields, you may as well perform some other things with the PDF, particularly putting on custom textual content, modifying the original textual content, inserting images, putting your signature on the document, and more.

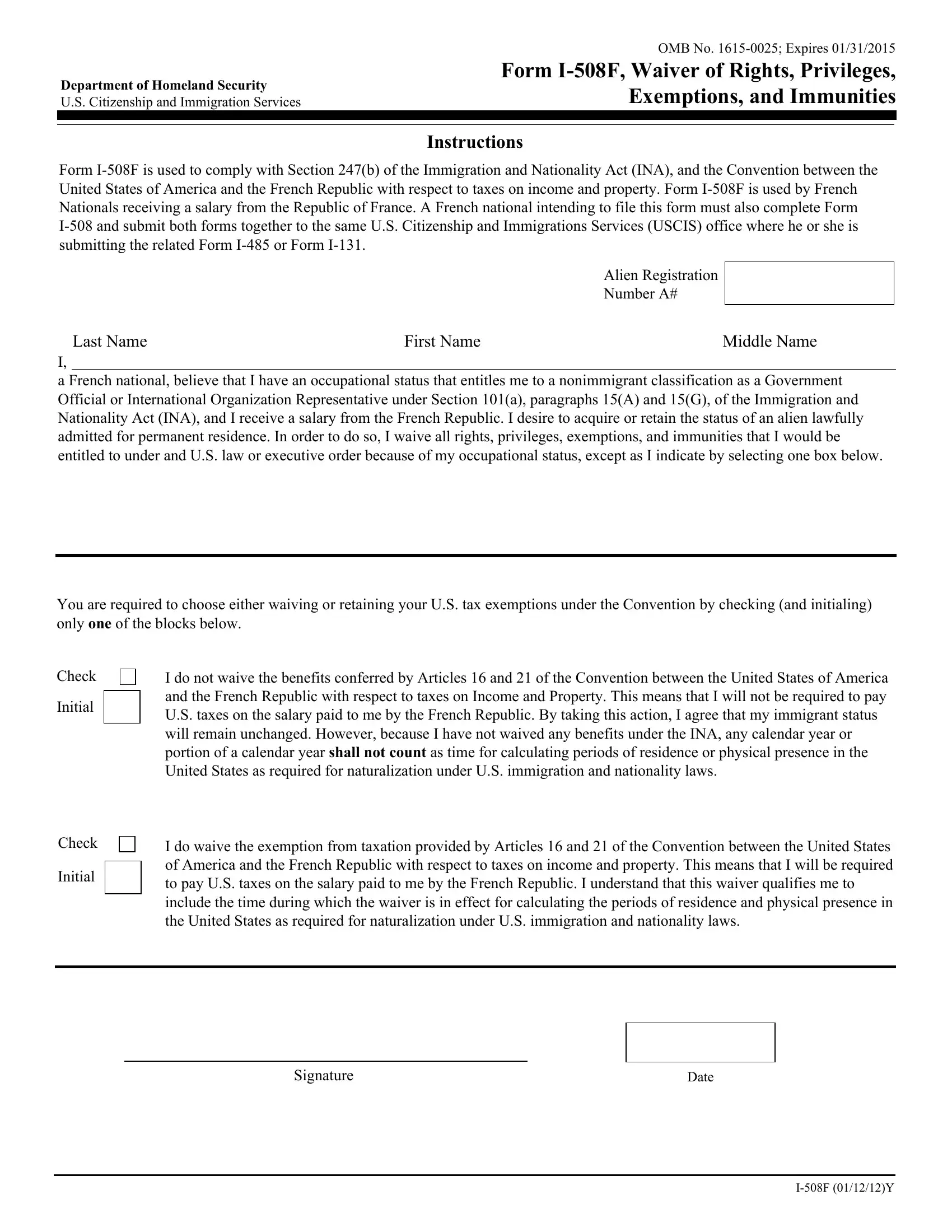

As for the fields of this specific PDF, here is what you should do:

1. It is very important complete the OMB accurately, thus be careful while working with the parts comprising all these blanks:

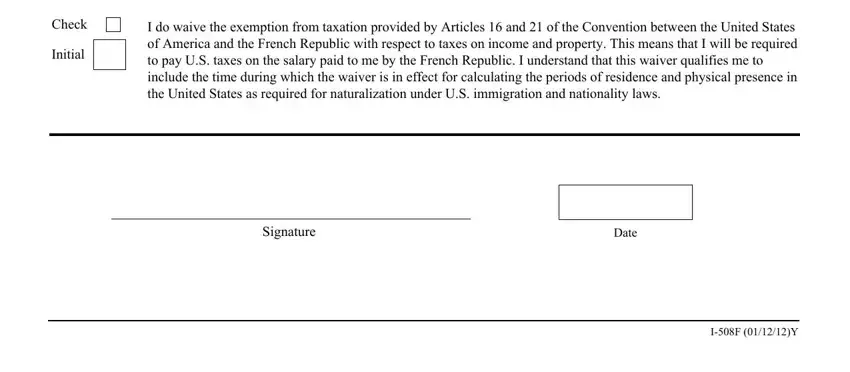

2. The subsequent part is to submit the following fields: Check, Initial, I do waive the exemption from, Signature, Date, and IF Y.

Concerning Date and Check, make sure you take another look here. These are viewed as the most important fields in this PDF.

Step 3: Go through everything you have typed into the blanks and click on the "Done" button. After getting a7-day free trial account with us, you'll be able to download OMB or send it through email at once. The file will also be available via your personal account with all your adjustments. FormsPal offers secure document tools without data record-keeping or any type of sharing. Rest assured that your information is in good hands with us!