It is possible to prepare ia form 706 fillable instantly with the help of our online PDF editor. To make our tool better and less complicated to work with, we consistently come up with new features, with our users' feedback in mind. With some basic steps, you may begin your PDF editing:

Step 1: First, access the pdf editor by pressing the "Get Form Button" above on this webpage.

Step 2: This editor enables you to modify PDF forms in various ways. Improve it by writing any text, adjust original content, and place in a signature - all when you need it!

This document requires specific details; to guarantee accuracy, take the time to pay attention to the next suggestions:

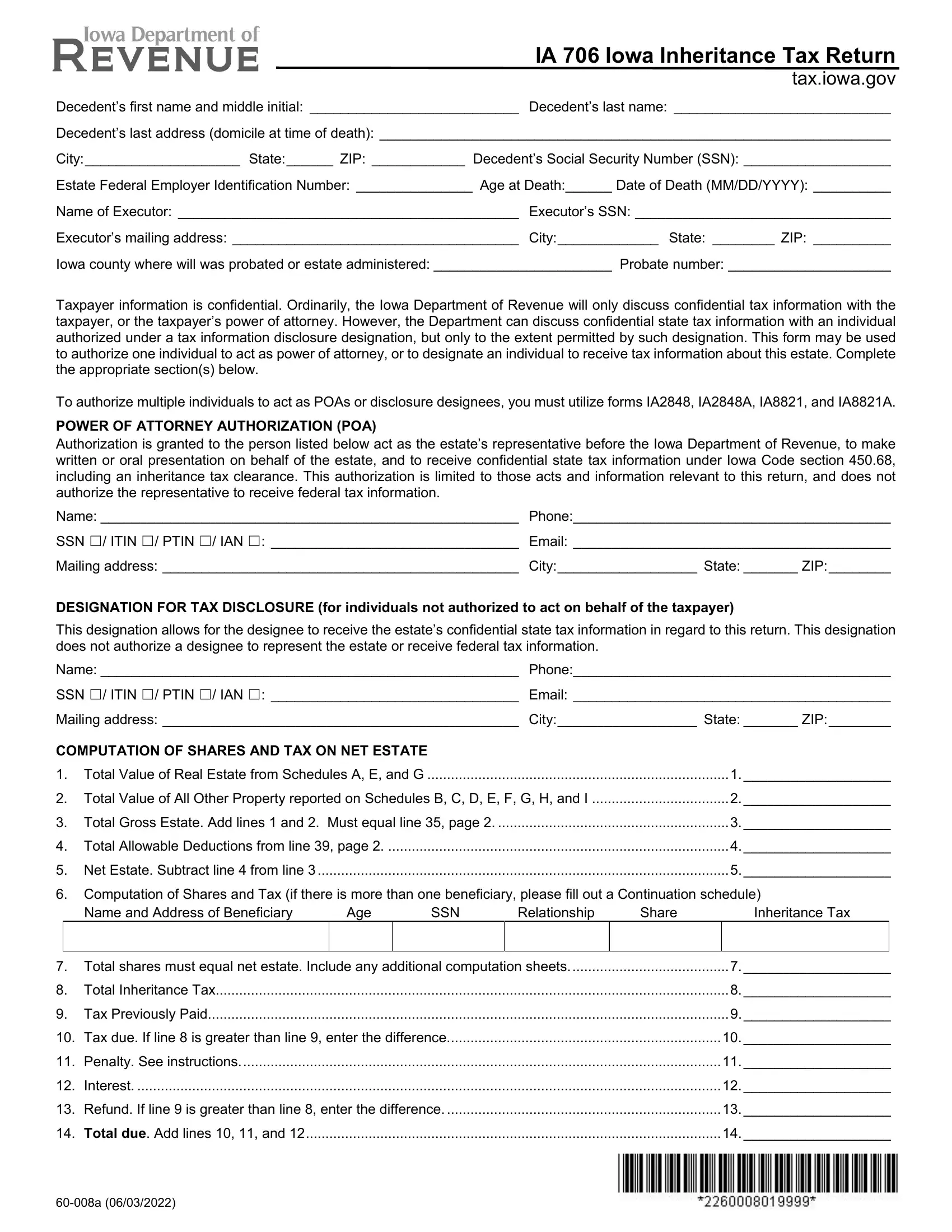

1. It's essential to complete the ia form 706 fillable properly, so be attentive when filling out the parts including all of these fields:

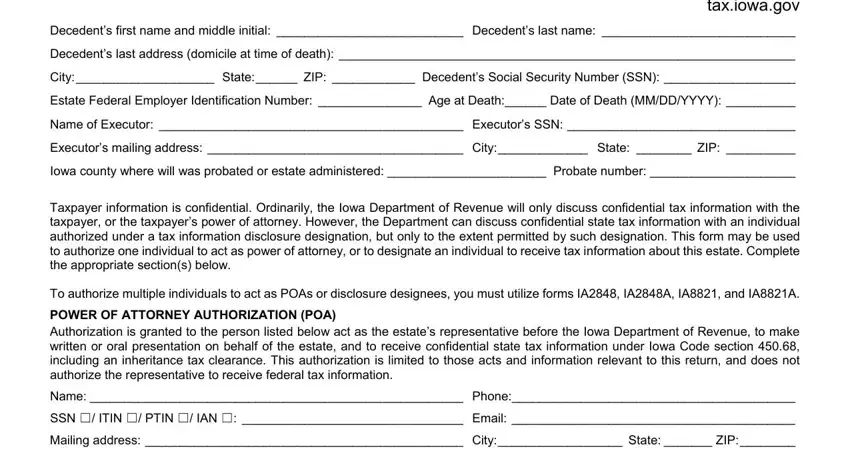

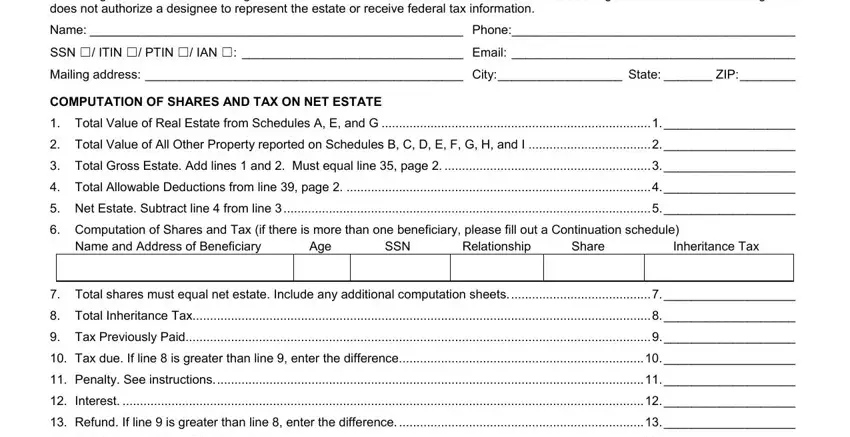

2. Soon after filling out this part, go to the subsequent stage and fill out all required particulars in these blanks - This designation allows for the, Name Phone, SSN ITIN PTIN IAN Email, Mailing address City State ZIP, COMPUTATION OF SHARES AND TAX ON, Total Value of Real Estate from, Total Value of All Other Property, Total Gross Estate Add lines and, Total Allowable Deductions from, Net Estate Subtract line from, Computation of Shares and Tax if, Name and Address of Beneficiary, Age, SSN, and Relationship.

As to SSN ITIN PTIN IAN Email and Total Value of Real Estate from, be sure you take another look in this section. Those two could be the most important fields in this form.

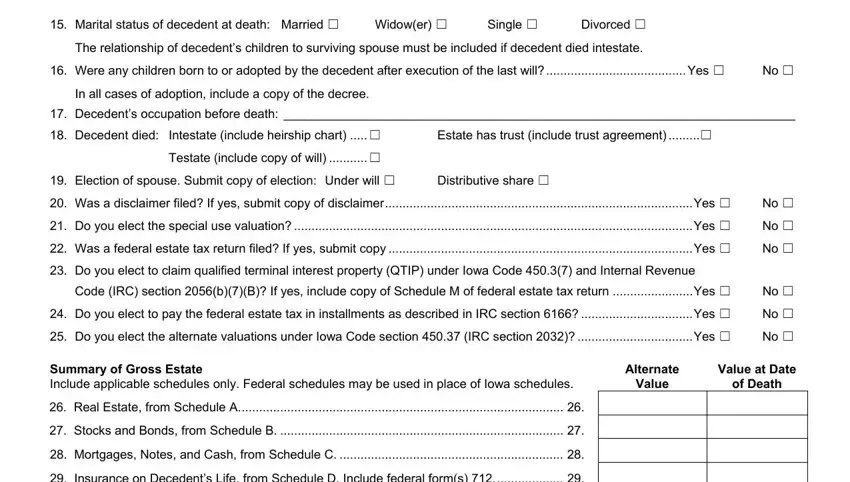

3. Your next stage is generally simple - fill in all of the form fields in Marital status of decedent at, Widower, Single, Divorced, The relationship of decedents, Were any children born to or, In all cases of adoption include a, Decedents occupation before death, Decedent died Intestate include, Estate has trust include trust, Testate include copy of will, Election of spouse Submit copy of, Distributive share, Was a disclaimer filed If yes, and Do you elect the special use in order to complete this process.

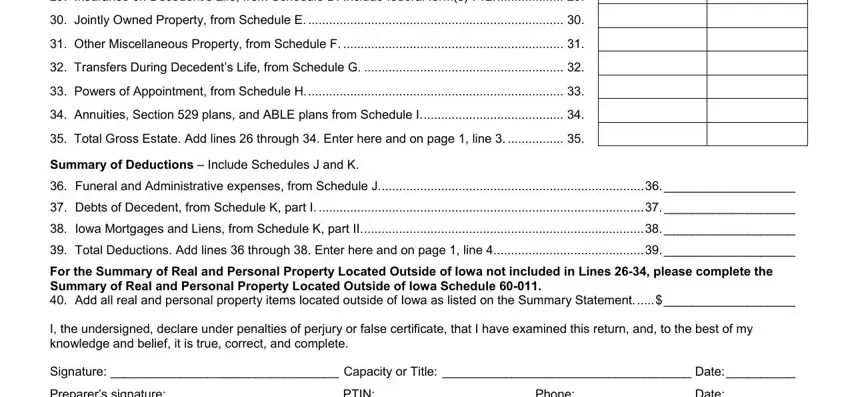

4. It is time to proceed to this fourth form section! In this case you have all of these Insurance on Decedents Life from, Jointly Owned Property from, Other Miscellaneous Property from, Transfers During Decedents Life, Powers of Appointment from, Annuities Section plans and ABLE, Total Gross Estate Add lines, Summary of Deductions Include, Funeral and Administrative, Debts of Decedent from Schedule K, Iowa Mortgages and Liens from, Total Deductions Add lines, For the Summary of Real and, I the undersigned declare under, and Signature Capacity or Title Date form blanks to fill out.

Step 3: Prior to submitting the form, make sure that all blank fields have been filled in the right way. Once you believe it's all fine, click on “Done." Acquire your ia form 706 fillable when you register here for a 7-day free trial. Conveniently use the pdf document within your personal account, together with any edits and adjustments all synced! FormsPal is dedicated to the confidentiality of our users; we ensure that all information handled by our tool stays confidential.