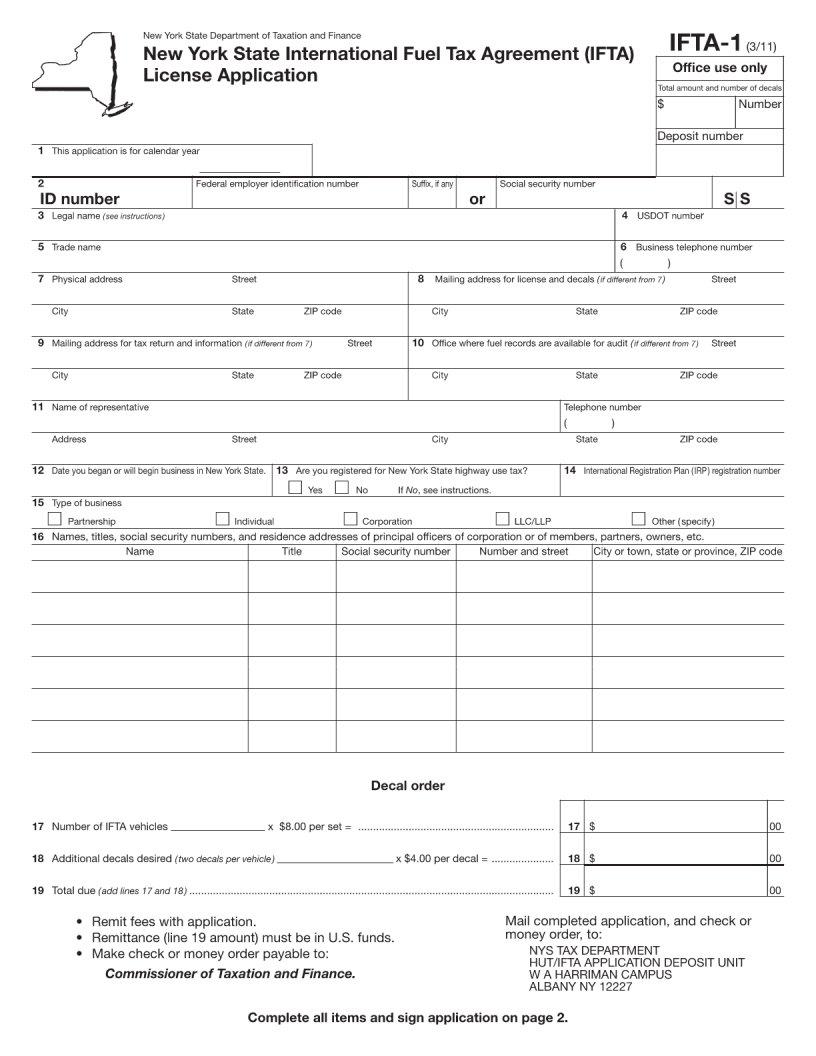

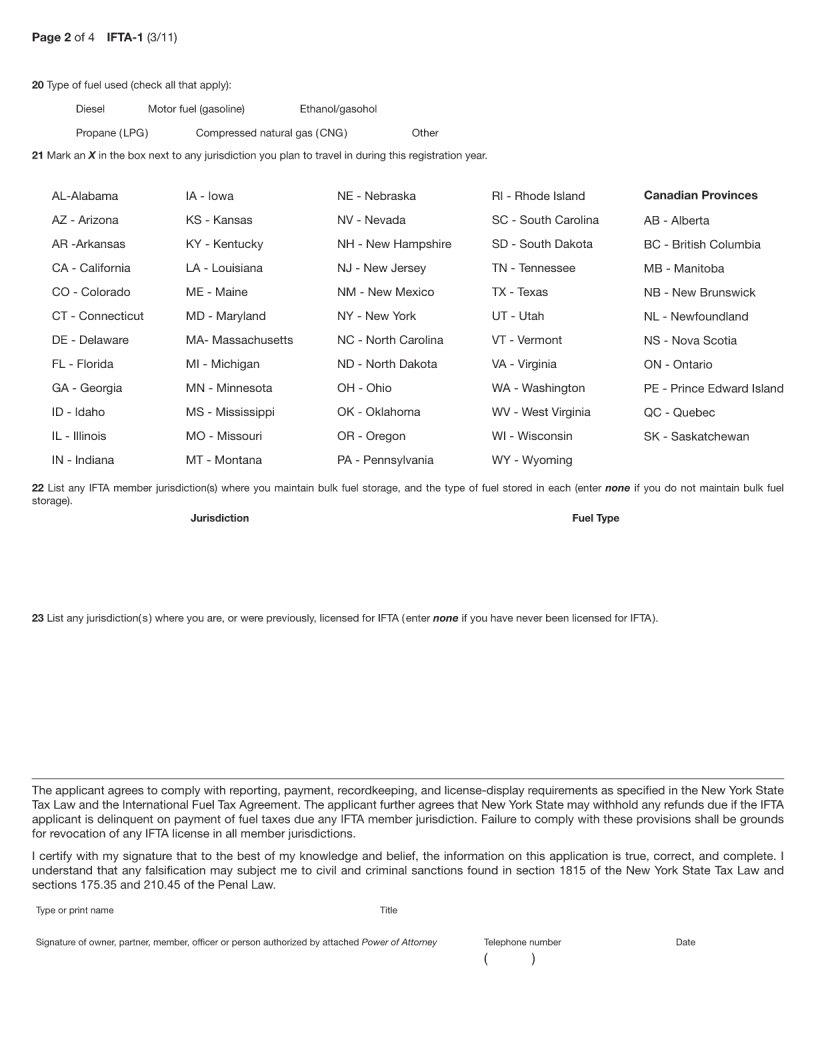

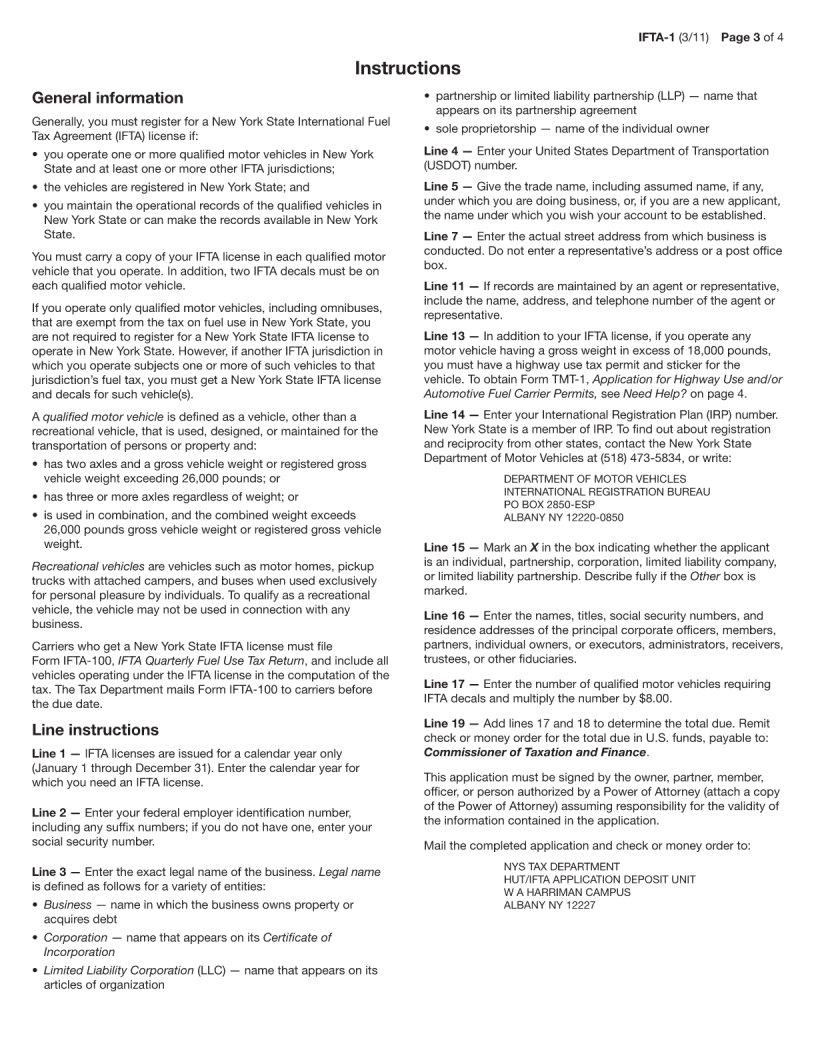

The IFTA 1 form is a critical document for many businesses operating within the transportation industry across various states. This form plays a pivotal role in the collection and reporting of fuel taxes under the International Fuel Tax Agreement (IFTA), a pact between U.S. states and Canadian provinces to simplify the reporting of fuel use by motor carriers that operate in more than one jurisdiction. Completing this form accurately is essential for businesses to ensure compliance with tax regulations, avoid potential penalties, and streamline their operations. It requires detailed information about the fuel used, miles driven, and taxes paid in each member jurisdiction. The aim of the IFTA is to facilitate the efficient and equitable distribution of fuel tax revenues among the states and provinces, taking into account the actual mileage and fuel usage of carriers. Understanding the nuances of how to properly fill out the IFTA 1 form is crucial for businesses to manage their fuel taxes effectively, making it an indispensable tool in the industry.

| Question | Answer |

|---|---|

| Form Name | Form Ifta 1 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | nys ifta, HARRIMAN, NJ, NYS |