You'll be able to prepare iljuschin il56 instantly with our PDFinity® online tool. Our editor is constantly developing to present the very best user experience achievable, and that is because of our dedication to continual development and listening closely to feedback from users. It merely requires a few easy steps:

Step 1: Press the "Get Form" button above on this webpage to access our tool.

Step 2: As soon as you access the PDF editor, there'll be the form ready to be filled in. Besides filling in various blanks, you might also perform various other things with the PDF, that is writing custom text, changing the original text, adding illustrations or photos, signing the form, and a lot more.

It is simple to finish the form with our detailed guide! Here's what you want to do:

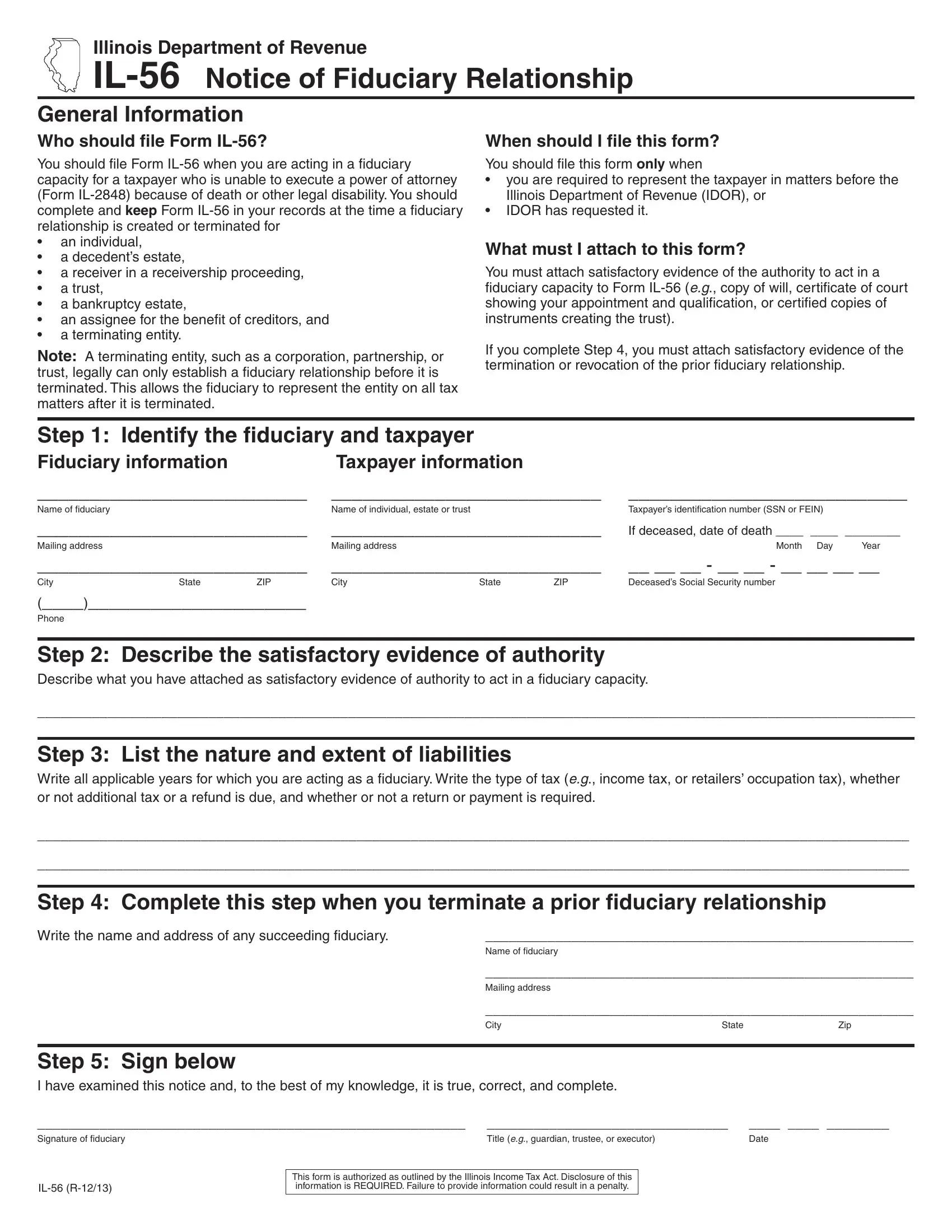

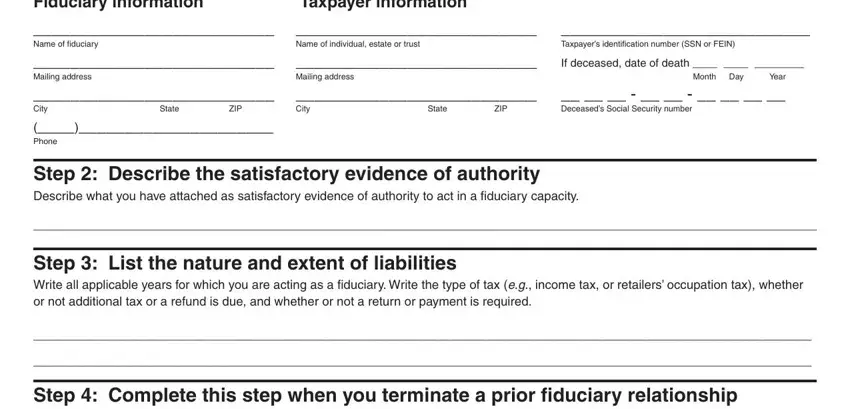

1. You'll want to fill out the iljuschin il56 correctly, thus be mindful while filling out the sections including all these blanks:

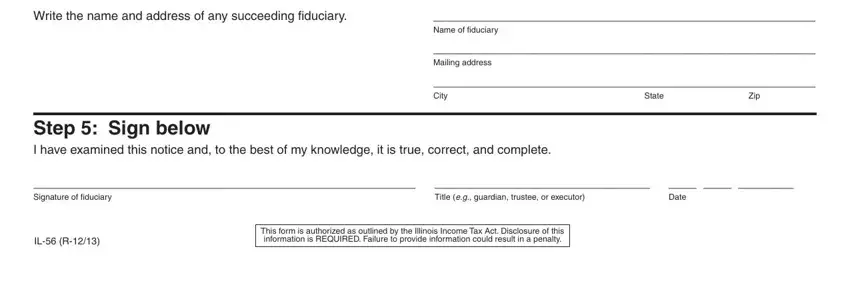

2. Once your current task is complete, take the next step – fill out all of these fields - Write the name and address of any, Name of fiduciary, Mailing address, City, State, Zip, Step Sign below I have examined, Signature of fiduciary, Title eg guardian trustee or, Date, IL R, and This form is authorized as with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be very attentive when filling out City and Zip, because this is where many people make mistakes.

Step 3: Just after looking through the completed blanks, hit "Done" and you're good to go! Sign up with us today and easily get iljuschin il56, available for downloading. All modifications you make are kept , which enables you to change the pdf at a later stage when necessary. FormsPal guarantees your information confidentiality by having a secure system that in no way records or distributes any private data involved in the process. Feel safe knowing your paperwork are kept protected whenever you work with our editor!