Handling PDF files online is definitely easy with this PDF tool. Anyone can fill in IL-492-4394 here with no trouble. The editor is continually upgraded by us, receiving new awesome features and growing to be better. For anyone who is seeking to get going, here's what it takes:

Step 1: Click the "Get Form" button above on this page to get into our PDF editor.

Step 2: With our online PDF editing tool, you'll be able to accomplish more than just fill in blanks. Edit away and make your forms seem faultless with custom text added, or tweak the file's original input to perfection - all comes along with the capability to insert any type of images and sign the file off.

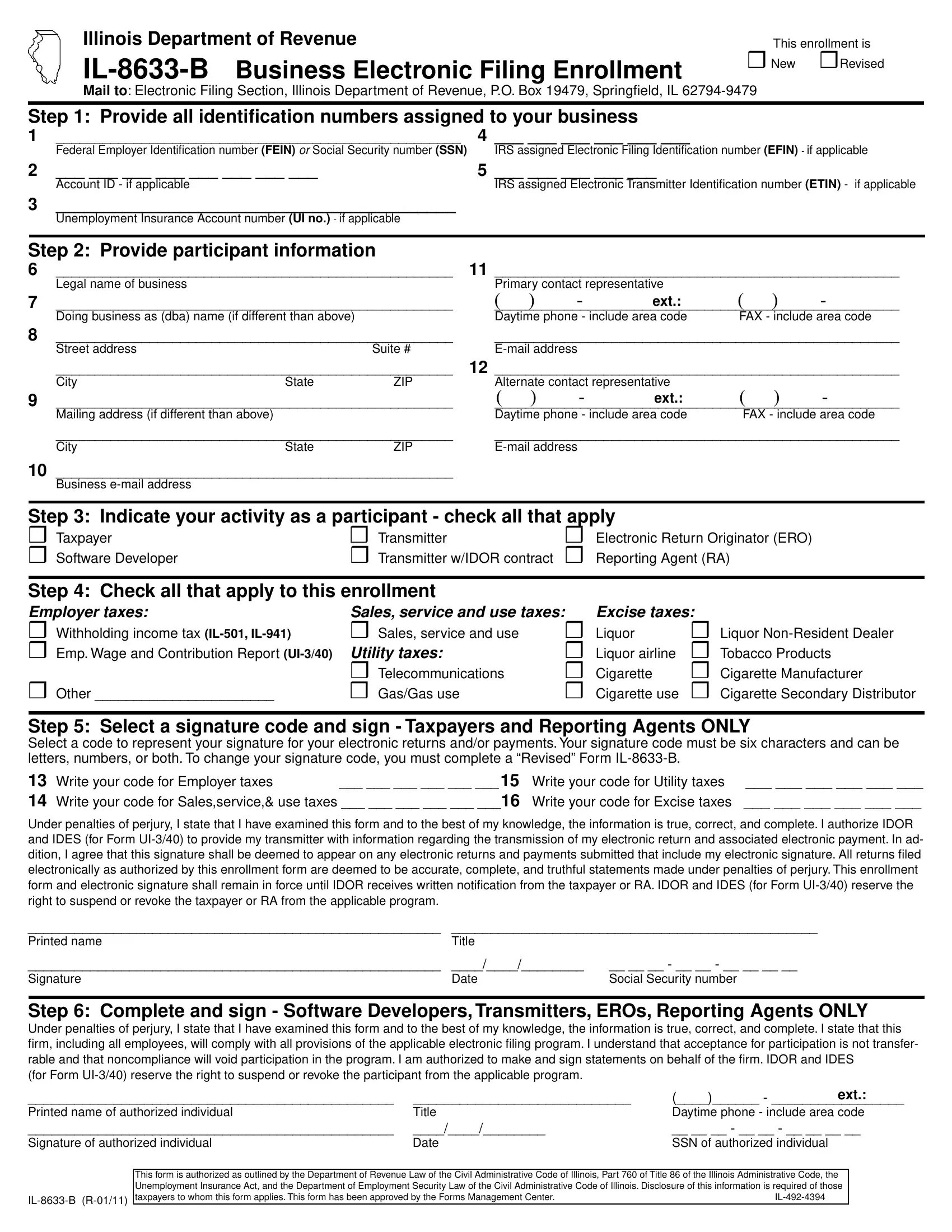

As for the blanks of this precise form, here's what you need to know:

1. To start off, when filling in the IL-492-4394, begin with the area containing subsequent blank fields:

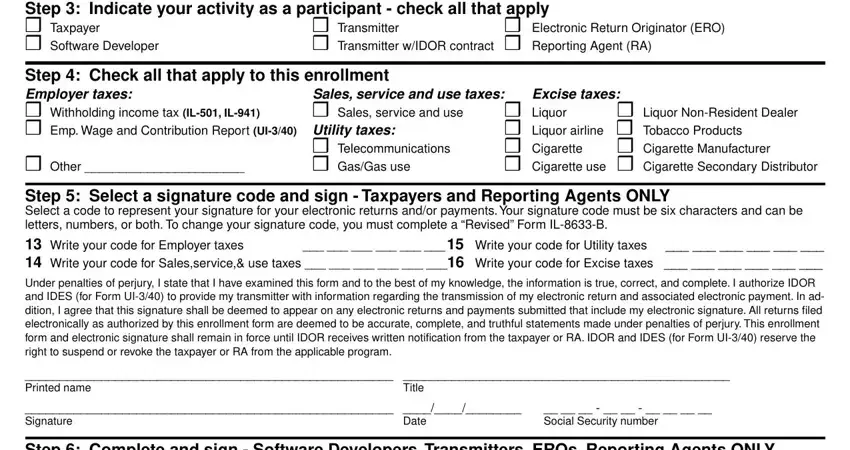

2. Now that this segment is done, you have to put in the essential specifics in Step Indicate your activity as a, Taxpayer, Software Developer, Transmitter Transmitter wIDOR, Electronic Return Originator ERO, Step Check all that apply to this, Sales service and use taxes, Excise taxes, Withholding income tax IL IL Emp, Sales service and use, Liquor, Liquor NonResident Dealer, Liquor airline, Tobacco Products, and Other allowing you to move forward further.

Lots of people often make errors when filling out Software Developer in this area. Be certain to revise everything you type in here.

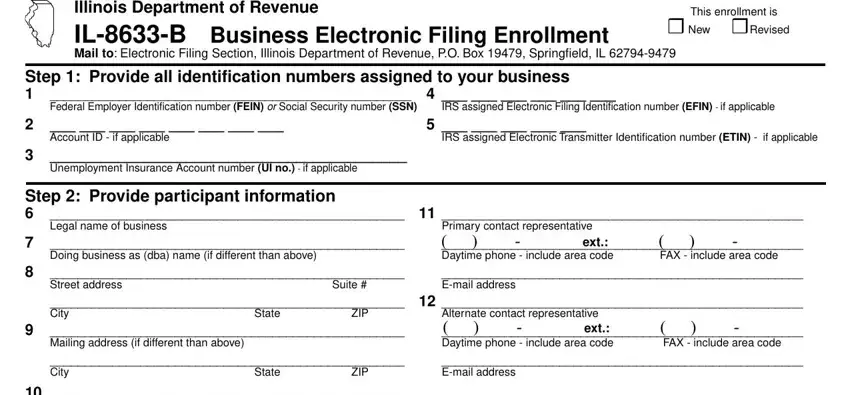

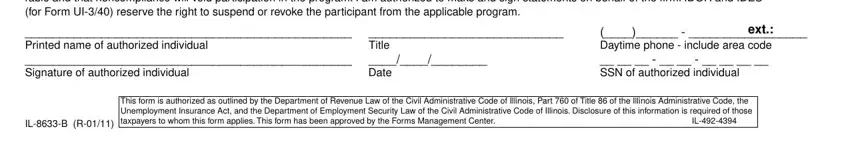

3. The following step is mostly about Step Complete and sign Software, Printed name of authorized, Title, ext Daytime phone include area, ILB R, and This form is authorized as - fill in each one of these empty form fields.

Step 3: Make sure that your details are accurate and then click "Done" to conclude the process. Join us now and immediately get access to IL-492-4394, set for download. All modifications made by you are saved , which means you can edit the form at a later stage when required. When using FormsPal, you're able to fill out documents without stressing about personal data incidents or entries being shared. Our protected software makes sure that your personal data is maintained safely.