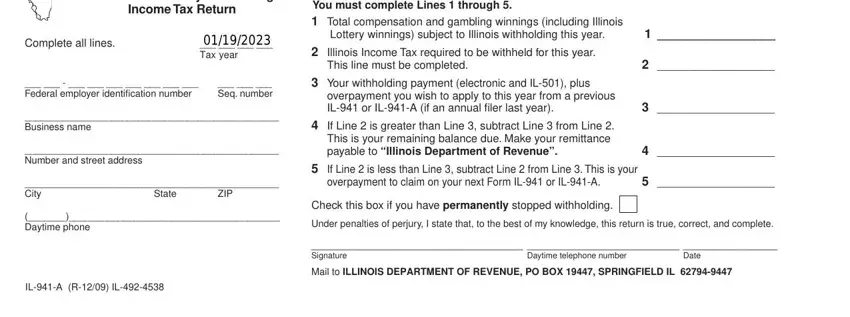

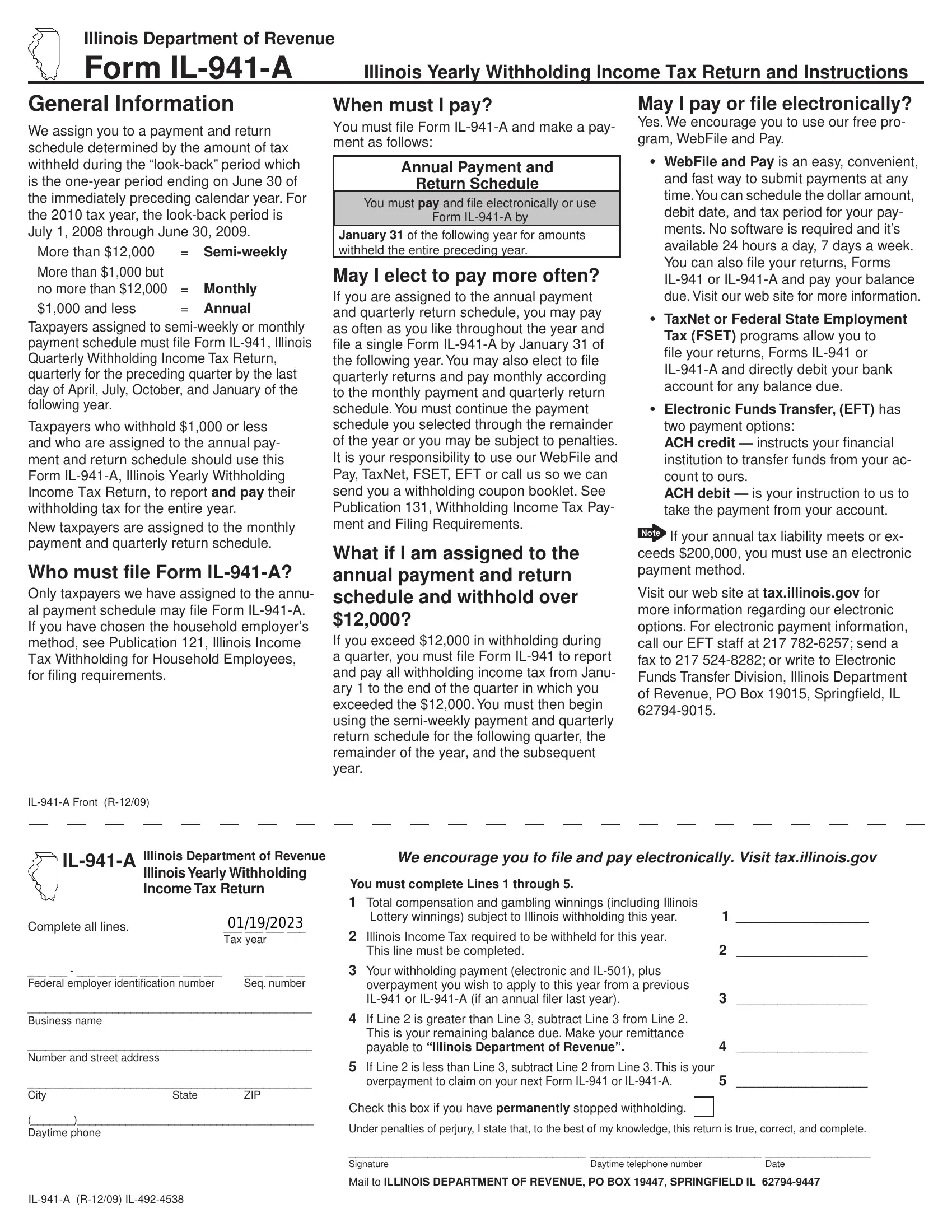

We assign you to a payment and return schedule determined by the amount of tax withheld during the “look-back” period which is the one-year period ending on June 30 of the immediately preceding calendar year. For the 2010 tax year, the look-back period is July 1, 2008 through June 30, 2009.

More than $12,000 |

= |

Semi-weekly |

More than $1,000 but |

|

|

no more than $12,000 |

= |

Monthly |

$1,000 and less |

= |

Annual |

Taxpayers assigned to semi-weekly or monthly payment schedule must file Form IL-941, Illinois Quarterly Withholding Income Tax Return, quarterly for the preceding quarter by the last day of April, July, October, and January of the following year.

Taxpayers who withhold $1,000 or less and who are assigned to the annual pay- ment and return schedule should use this Form IL-941-A, Illinois Yearly Withholding Income Tax Return, to report and pay their withholding tax for the entire year.

New taxpayers are assigned to the monthly payment and quarterly return schedule.

Who must file Form IL-941-A?

Only taxpayers we have assigned to the annu- al payment schedule may file Form IL-941-A. If you have chosen the household employer’s method, see Publication 121, Illinois Income Tax Withholding for Household Employees, for filing requirements.

You must file Form IL-941-A and make a pay- ment as follows:

Annual Payment and

Return Schedule

You must pay and file electronically or use

Form IL-941-A by

January 31 of the following year for amounts withheld the entire preceding year.

May I elect to pay more often?

If you are assigned to the annual payment and quarterly return schedule, you may pay as often as you like throughout the year and file a single Form IL-941-A by January 31 of the following year. You may also elect to file quarterly returns and pay monthly according to the monthly payment and quarterly return schedule. You must continue the payment schedule you selected through the remainder of the year or you may be subject to penalties. It is your responsibility to use our WebFile and Pay, TaxNet, FSET, EFT or call us so we can send you a withholding coupon booklet. See Publication 131, Withholding Income Tax Pay- ment and Filing Requirements.

What if I am assigned to the annual payment and return schedule and withhold over $12,000?

If you exceed $12,000 in withholding during a quarter, you must file Form IL-941 to report and pay all withholding income tax from Janu- ary 1 to the end of the quarter in which you exceeded the $12,000. You must then begin using the semi-weekly payment and quarterly return schedule for the following quarter, the remainder of the year, and the subsequent year.

Yes. We encourage you to use our free pro- gram, WebFile and Pay.

• WebFile and Pay is an easy, convenient, and fast way to submit payments at any time.You can schedule the dollar amount, debit date, and tax period for your pay- ments. No software is required and it’s available 24 hours a day, 7 days a week. You can also file your returns, Forms IL-941 or IL-941-A and pay your balance due. Visit our web site for more information.

• TaxNet or Federal State Employment Tax (FSET) programs allow you to

file your returns, Forms IL-941 or IL-941-A and directly debit your bank account for any balance due.

• Electronic Funds Transfer, (EFT) has two payment options:

ACH credit — instructs your financial institution to transfer funds from your ac- count to ours.

ACH debit — is your instruction to us to take the payment from your account.

If your annual tax liability meets or ex- ceeds $200,000, you must use an electronic payment method.

Visit our web site at tax.illinois.gov for more information regarding our electronic options. For electronic payment information, call our EFT staff at 217 782-6257; send a fax to 217 524-8282; or write to Electronic Funds Transfer Division, Illinois Department of Revenue, PO Box 19015, Springfield, IL 62794-9015.

IL-941-A Illinois Department of Revenue

Illinois Yearly Withholding

Income Tax Return

Complete all lines. |

___ ___ ___ ___ |

|

Tax year |

___ ___ - ___ ___ ___ ___ ___ ___ ___ |

___ ___ ___ |

Federal employer identification number |

Seq. number |

_______________________________________________

Business name

_______________________________________________

Number and street address

_______________________________________________

We encourage you to file and pay electronically. Visit tax.illinois.gov

You must complete Lines 1 through 5.

1Total compensation and gambling winnings (including Illinois

Lottery winnings) subject to Illinois withholding this year. |

1 _________________ |

2Illinois Income Tax required to be withheld for this year.

This line must be completed. |

2 ___________________ |

3Your withholding payment (electronic and IL-501), plus overpayment you wish to apply to this year from a previous

IL-941 or IL-941-A (if an annual filer last year). |

3 ___________________ |

4If Line 2 is greater than Line 3, subtract Line 3 from Line 2. This is your remaining balance due. Make your remittance

payable to “Illinois Department of Revenue”. |

4 ___________________ |

5If Line 2 is less than Line 3, subtract Line 2 from Line 3. This is your

overpayment to claim on your next Form IL-941 or IL-941-A. |

5 ___________________ |

Check this box if you have permanently stopped withholding.

(_______)_______________________________________

Daytime phone |

Under penalties of perjury, I state that, to the best of my knowledge, this return is true, correct, and complete. |

|

____________________________________ __________________________ ________________

Signature |

Daytime telephone number |

Date |

Mail to ILLINOIS DEPARTMENT OF REVENUE, PO BOX 19447, SPRINGFIELD IL 62794-9447

IL-941-A (R-12/09) IL-492-4538