The Tennessee Department of Revenue requires the submission of the INC 250 form, an essential document for reporting individual income tax returns within the state, particularly focusing on taxable interests and dividend income. This form serves a pivotal role for residents whose taxable interest and dividend income surpasses the thresholds set for individual or joint filers. Designed to accommodate a broad spectrum of filers, from single individuals to various forms of partnerships and estates, the INC 250 form is comprehensive, addressing various facets of income reporting and tax calculation. Filing statuses, exemptions for age, income, or disability, as well as detailed instructions for calculating and reporting taxable and non-taxable interest and dividends, are integral components of the form. Notably, the form also outlines procedures for amended returns, payment extensions, and the distribution mechanism of collected taxes, ensuring local governmental entities benefit appropriately. The due date for filing aligns with federal standards, offering convenience and uniformity to taxpayers. Moreover, specific provisions cater to individuals 65 or older with limited income, as well as to those who are quadriplegic or legally blind, highlighting the form's inclusivity. The INC 250 functions not just as a tax document but as a means to establish residency and contribute to local fiscal health, demonstrating its critical role in Tennessee's tax infrastructure.

| Question | Answer |

|---|---|

| Form Name | Form Inc 250 |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | tennessee department of revenue forms, tennessee revenue tax, tennessee tax forms, tennessee form income tax |

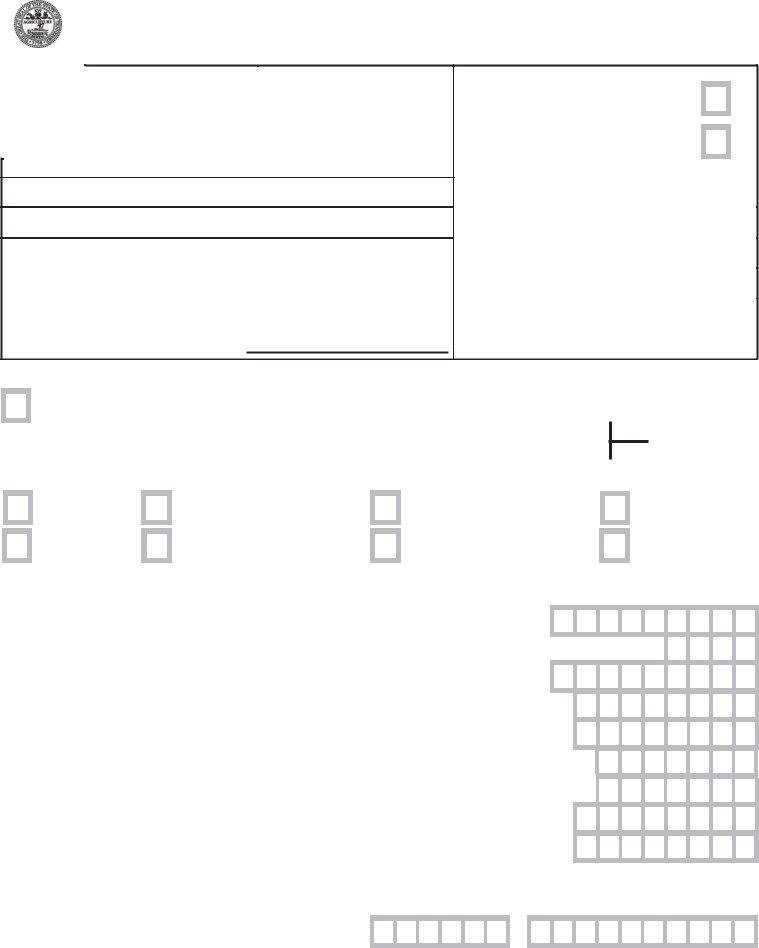

TENNESSEEDEPARTMENTOFREVENUE

2020 INDIVIDUAL INCOME TAX RETURN

INC |

Tax Year Beginning |

Account Number (if known) |

|

250 |

|

|

|

Tax Year Ending |

FEIN |

||

|

|||

|

|

|

|

|

SSN |

Spouse’s SSN |

|

|

|

|

(If filing jointly, include first names and initials of both spouses)

Name

Spouse’s Name

Legal Residence Address

City |

State |

ZIP Code |

|

|

|

Because a portion of the tax goes back to the city or county of residence, please provide the county and city (if within an incorporated municipality) of the taxpayer’s legal

residence on the lines below.

County |

|

City |

Check all that apply:

Amended return

Taxpayer has filed for federal extension

The due date of this return is the 15th day of the fourth month following the end of your fiscal year.

Remit amount on Line 8 to:

Tennessee Department of Revenue

Andrew Jackson State Office Building

500 Deaderick Street

Nashville, TN 37242

You may file your return and payment at https://tntap . tn . gov/eservices

Should you need assistance, please contact the Taxpayer Services Division by calling:

Exemptions: (If you have checked one of the boxes in this section, please see instructions before continuing with this form.)

Age 65+ Limited Income |

|

|

Quadriplegic |

- self |

|

|

|

Legally Blind - self |

|

|

|

|

|

|

|||||

|

|

|

Quadriplegic |

- spouse |

|

|

|

|

Legally Blind - spouse |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Filing Status:

Single |

Married Filing Jointly |

Married Filing Separately |

Trust |

Enter spouse’s SSN above |

Enter spouse’s SSN above |

Estate |

Partnership |

LLC - Multi Member |

LLC - Single Member |

|

|

|

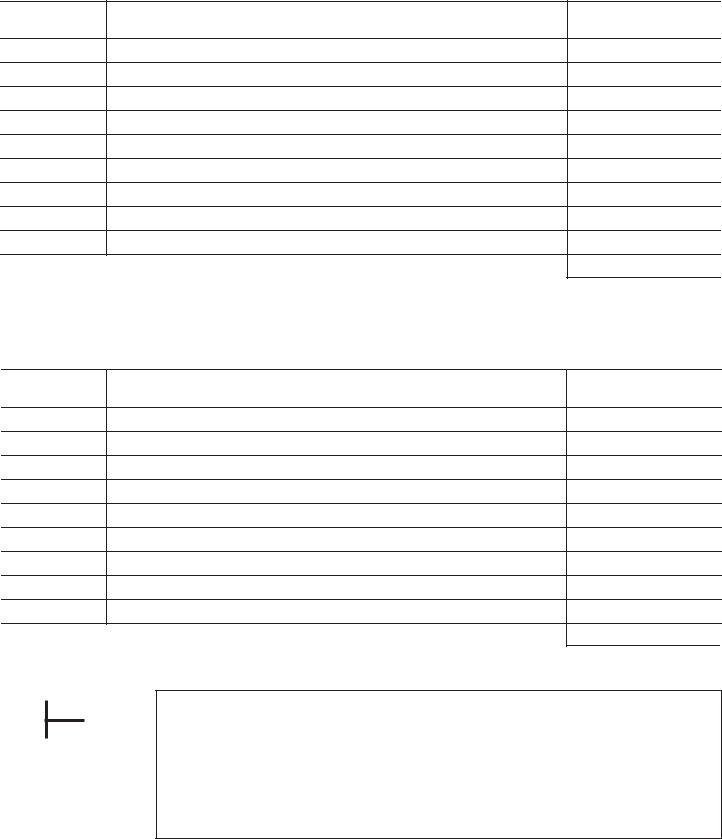

Round to the nearest dollar |

|

|

|

(Use blue or black ink) |

1. |

Gross taxable income (from Schedule A) |

(1) |

2. |

Exemption amount ($2,500 if married filing jointly, $1,250 for any other filing status) (2) |

|

3. |

Amount subject to tax (subtract Line 2 from Line 1) |

(3) |

4. |

Income tax (1% of Line 3) |

(4) |

5. |

Enter amount paid with extension request, original return, and/or prepayment(s) |

(5) |

6. |

Penalty |

(6) |

7. |

Interest |

(7) |

8. |

Total amount due (add Lines 4, 6, and 7; subtract Line 5) |

(8) |

9. |

Refund (if Line 5 exceeds total of Lines 4, 6, and 7, enter overpayment here) |

(9) |

FOR OFFICE USE ONLY

If taxpayer is |

Enter taxpayer's phone number in the boxes below |

|||||||||||||||||||||||||||

deceased, enter date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of death in the boxes at |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

right. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

If taxpayer’s spouse is |

|

|

|

|

|

|

|

Taxpayer’s Email Address: |

||||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||

deceased, enter date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of death in the boxes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule A - Taxable Dividends and Interest

List taxable dividends from all sources, including holding companies and mutual funds. Also, include capital gain and nondividend distributions. List all bonds, notes, mortgages, and other taxable interest. (See instructions.)

Income Type Enter I for interest or D for dividends.

Description

Amount

Round to the nearest dollar.

Total taxable dividends and interest. Enter on Line 1 ...................................................................................

Schedule B -

List dividends from national and Tennessee chartered bank stock, credit unions, building or savings and loan companies, and Tennessee licensed insurance companies. List interest on bonds of the U.S. government and its agencies, Tennessee bonds, interest from credit unions, certificates of deposit, accounts not represented by a written instrument, passbook accounts, savings accounts, bank money market accounts, "NOW” accounts, and commercial paper maturing in six months or less. (See instructions.)

Income Type Enter I for interest or D for dividends.

Description

Amount

Round to the nearest dollar.

Total

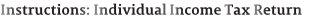

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is true, correct, and complete.

Taxpayer's Signature |

|

Spouse’s Signature |

|

|

|

|

|

|

|

|

|

Date |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Preparer's Signature |

|

|

Preparer's PTIN |

|

Date |

|

|

|

Telephone |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer's Address |

|

|

|

|

City |

|

|

|

|

State |

ZIP Code |

|

||||||

Preparer's Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Information

Who should file

The following people are required to file an Individual Income Tax Return (also see Schedule A):

•A person whose legal domicile* is in Tennessee and whose taxable interest and dividend income exceeded $1,250 ($2,500 if married, filing jointly) during the tax year.

•A person who moved into or out of Tennessee during the year and whose taxable interest and dividend income during the period of Tennessee residency exceeded $1,250 ($2,500 if married, filing jointly).

•A person whose legal domicile* is in another state, but who maintained a residence in Tennessee for more than six months of the year and whose taxable interest and dividend income exceeded $1,250 ($2,500 if married, filing jointly). Military personnel and

•A person, bank, etc. acting as a Tennessee fiduciary (e.g., administrator, executor, guardian, trustee, or other acting in a similar capacity) who received $1,250 or more in taxable interest and dividend income for the benefit of Tennessee residents. However, if a grantor trust does not obtain an FEIN, the trustee, instead of filing a return, must report the total amount of income received by the trustee to the grantor, who is liable for the tax. Also, the trustee of a charitable remainder trust is not responsible for payment of tax. The trustee must report to each resident beneficiary the amount of taxable income distributed to him, and the beneficiary is liable for the tax.

Trustees who receive taxable income on behalf of nonresident beneficiaries are NOT required to file a return. However, when taxable income is received on behalf of both resident and nonresident beneficiaries, only the taxable income of any resident beneficiary is required to be reported on Schedule A and on Line 1of the return. Nonresident income may be reported on Schedule B. An executor or administrator of a Tennessee estate must pay tax on income received by the estate, until stocks and bonds have been transferred to the beneficiaries, even if the beneficiaries are nonresidents. A trust or estate is entitled to only one exemption of $1,250 regardless of the number of beneficiaries.

•A Tennessee partnership whose taxable interest and dividend income exceeded $1,250. The partnership is liable for the tax, if any.

* When determining your legal domicile, you should consider where you are registered to vote, where you

maintain your driver’s license, and where you maintain your permanent or principal residence (as opposed to a

Filing and making payments

Most taxpayers file on a calendar year basis, meaning their tax year begins on January 1 and ends on December

31.A taxpayer filing on a calendar year basis must file a return by April 15 of the following year. If a taxpayer’s tax year is something other than the calendar year, the taxpayer must include its fiscal year beginning and end dates. For a taxpayer on a fiscal year filing, the return is due by the 15th day of the fourth month following the end of the fiscal year.

Taxpayers may file and make their tax payments online by visiting the Department’s website at www.tn.gov/revenue. Alternatively, taxpayers may mail their returns and payments to the Department at the address listed on the front of the return. Make checks or postal money orders payable to Tennessee Department of Revenue. Tax may be paid in cash at the Nashville office or the regional offices (Chattanooga, Jackson, Johnson City, Knoxville, and Memphis).

Taxpayers may request an extension to file their returns by completing the Application for Extension of Filing Time. The extension request must be made on or before the due date of return. The request should be mailed to the Department at the address listed on the front of the return.

Distribution of income taxes collected

for the taxes to be properly distributed, please provide the name of the county and city (if the taxpayer resides within an incorporated municipality) of the taxpayer’s legal residence in the appropriate space on the return.

Exemptions

For tax years beginning January 1, 2015, any person 65 years of age or older having a total annual income derived from any and all sources of $37,000 or less, or $68,000 or less for joint filers are completely exempt from the tax.

If a person is certified by a medical doctor as a quadriplegic, the taxable income that is derived from circumstances resulting in the individual becoming a quadriplegic is exempt. However, when taxable interest and dividend income is received jointly by a quadriplegic and a spouse who is not a quadriplegic, or who is quadriplegic but the taxable income was not derived from circumstances resulting in such spouse becoming quadriplegic, only

A person who is legally blind is exempt from the tax. Legal blindness means that vision does not exceed 20/200 in the better eye with correcting lenses or that the widest diameter of the visual field subtends an angle no greater than 20 degrees.

To receive the exemption, single filers must send a written statement from their physician, certifying their blindness to the Department of Revenue. Single filers who are blind are not required to file a return. For joint filers, when taxable income is received by a blind person and a sighted spouse, only the taxable income of the sighted person is required to be reported in Schedule A and on Line 1 of the return. The income of the blind person is exempted and may be reported on Schedule B. If the taxable dividend/interest income is received jointly by a blind person and a

sighted spouse, only

return.

Instructions

Line 1: Enter the total taxable dividends and interest from Schedule A.

Line 2: Enter the annual exemption amount that is allowed against total taxable interest and dividend income. The

exemption amount is $2,500 for married persons filing jointly and $1,250 for any other filing status. Line 3: Subtract Line 2 from Line 1.

Line 4: Multiply the income tax rate of 1% by Line 3.

Line 5: Enter any amount previously paid with an extension request or an original return or any prepayment.

Line 6: Penalty is calculated at a rate of 5% for each

Line 7: Interest is due on any amount of tax that is paid after the statutory due date of the return. The interest rate is determined in accordance with Tenn. Code Ann. §

Line 8: Add Lines 4, 6, and 7, and subtract Line 5.

Line 9: If Line 5 is more than the total of Lines 4, 6, and 7, enter the amount here. This is the amount requested to be refunded. If you are filing an amended return and the amount is $200 or more, a Report of Debts form must be completed and filed with the return.

Schedule A – Taxable Dividends and Interest

The following are types of income subject to the Hall income tax. Include any of these types of income on Schedule A. Indicate whether the income is interest or dividends, include a brief description of the income, and include the amount. Enter the total amount of taxable income on Line 1 of the return.

•Dividends from stock in: O all corporations

O insurance companies not licensed to do business in Tennessee

O all holding companies, including those formed by banks, savings and loan associations, and insurance companies

O

•Income from investment trusts and mutual funds, including capital gain distributions, whether in cash or additional stock (Note, the portion of income derived from bonds of the U.S. government and its agencies or bonds of the state of Tennessee and its counties and municipalities is exempt.)

•Any distribution which does not qualify as a return of capital and is otherwise taxable. In order to qualify as a return of capital, it must be shown that part of the shareholder's investment is being returned to the shareholder and that, as a result, the capital of the company is actually reduced or the number of shares decreases. The status or classification of the transaction for federal income tax purposes is not controlling.

•Market value of stock in a corporation given by another corporation as a dividend in the regular course of business

•Distributions based on stock ownership to shareholders of an S corporation

•Interest from the following, if the instrument matures in more than six months from the date of issuance (except certificates of deposit):

O bonds of states, counties, and municipalities outside Tennessee O bonds of foreign governments

O church bonds

O bonds, mortgages, deeds of trust, personal notes, promissory notes, installment notes, commercial paper, or other written instruments, issued by any person, firm, corporation,

•Interest and dividends you received as a beneficiary of a trust or estate located outside Tennessee, unless derived from a nontaxable source

•Dividends or interest from money market funds which are not bank money market accounts

•Dividends or interest from the Federal National Mortgage Association, the Government National Mortgage Association, and the Federal Home Loan Mortgage Corporation (Note, these are not agencies of the U.S. government.)

•Income credited to a limited partner’s capital account, if the partner has a certificate evidencing transferable interest in the partnership (usually a

Income is considered taxable when it is:

1.received in cash;

2.paid by check or other negotiable instrument or equivalent that is mailed to taxpayer, regardless of date received;

3.credited on books of a bank, banking institution, broker or any agent of taxpayer; or

4.received in merchandise or other commodities of intrinsic value.

Schedule B –

The following are types of income that are not subject to the Hall income tax. Include any of these types of income on Schedule B. Indicate whether the income is interest or dividends, include a brief description of the income, and include the amount.

•Dividends from stock in:

Onational banks (except holding companies)

O

Ofederal savings and loan associations and/or savings and loans in Tennessee (except holding companies)

Oinsurance companies licensed to do business in Tennessee (except holding companies)

Omutual funds and investment trusts to the extent the fund or trust invests in U.S. bonds or Tennessee municipal bonds

•Dividends on insurance policies

•Interest from the following, if the instrument matures in six months or less from the date of issuance:

Obonds, mortgages, deeds of trust, personal notes, promissory notes, commercial paper, or other written instrument, issued by any person, firm, corporation,

•Interest from the following regardless of the date of maturity:

Obonds of the state of Tennessee and its counties and municipalities

Obonds of the U.S. government and its agencies

Ocertificates of deposit issued by any bank, savings and loan association or credit union

Orepurchase agreements or similar evidences of indebtedness (A repurchase agreement is an investment instrument whereby a person buys a security, and the seller, usually a broker, agrees to repurchase the security on a certain date for a certain price.)

•Interest from insurance policies if interest is payable on demand

•Interest from savings accounts, checking accounts or money market accounts in any bank, savings and loan association or credit union (except money market funds)

•Interest or dividends from credit unions

•Income described by a partnership or S corporation as portfolio or

•Earnings or distributions from education and Roth IRAs that are not subject to federal income tax

•Distributions of income or earnings from federally recognized retirement accounts, including IRAs

•Capital gains from the sale of real estate, stock, etc. (Capital gain distributions from mutual funds are taxable.)

•Distributions paid on or after July 1, 2006, to shareholders of

•Earnings or distributions received on or after July 1, 2006, from health savings accounts (HSAs) (Earnings received prior to this date are taxable to the extent they are derived from sources taxable for Tennessee income tax purposes.)