When using the online PDF editor by FormsPal, it is easy to complete or change forms right here and now. FormsPal team is focused on giving you the absolute best experience with our editor by consistently introducing new features and enhancements. Our editor has become much more helpful as the result of the newest updates! So now, filling out documents is simpler and faster than ever. To start your journey, consider these basic steps:

Step 1: First, access the editor by clicking the "Get Form Button" at the top of this page.

Step 2: With this handy PDF editor, it is possible to do more than merely fill out forms. Express yourself and make your docs appear great with customized text put in, or tweak the file's original content to excellence - all that accompanied by the capability to insert stunning images and sign the document off.

Completing this PDF demands attentiveness. Make sure that each and every blank is done properly.

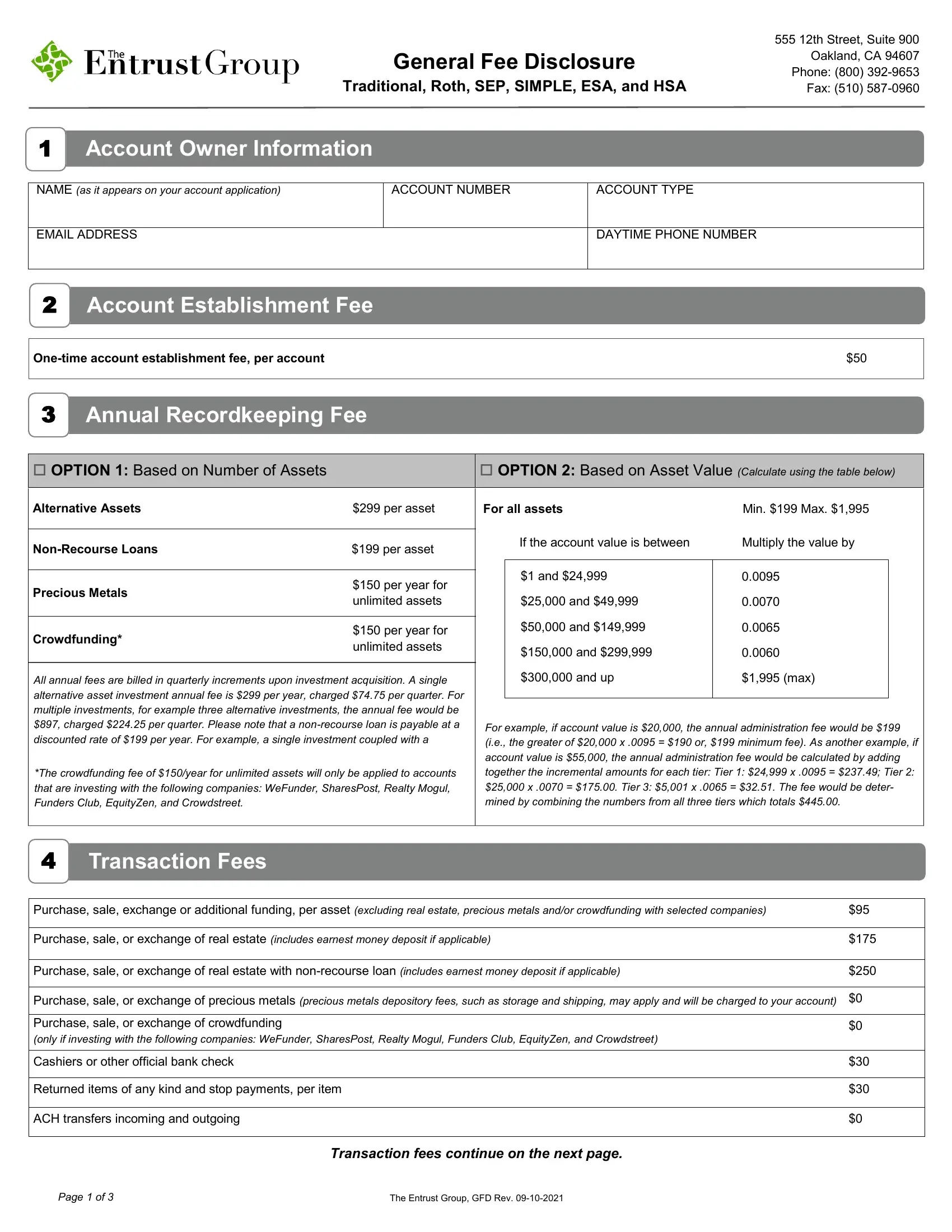

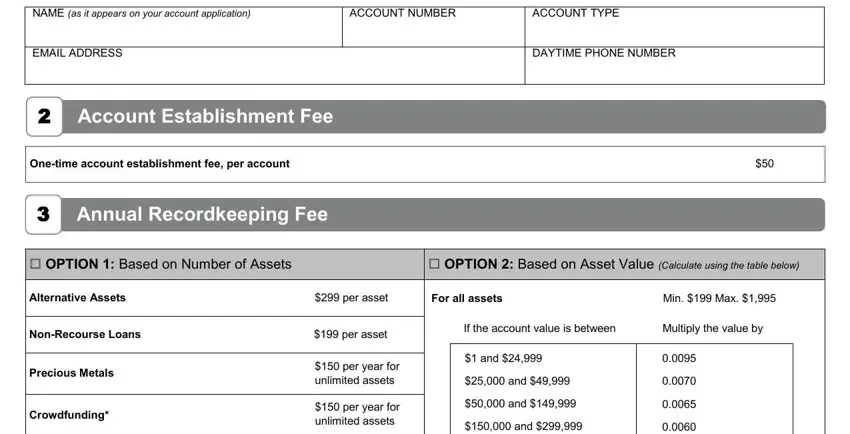

1. It's essential to complete the forms properly, hence be attentive when working with the areas including these fields:

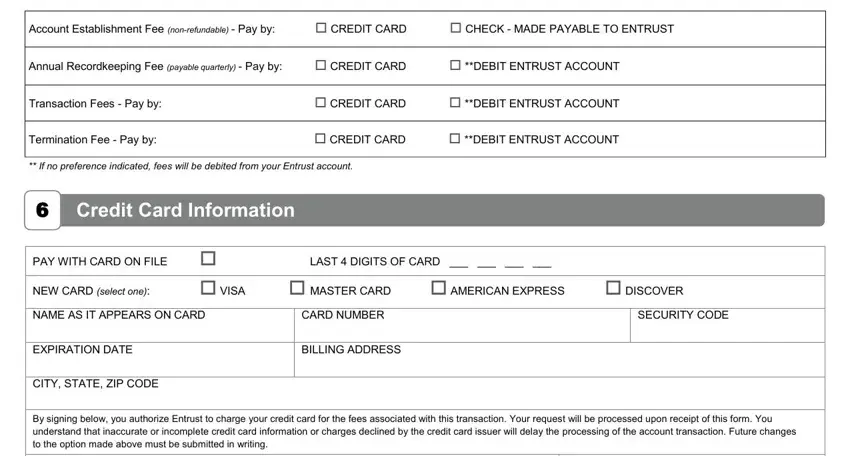

2. Once the last part is completed, you need to insert the necessary details in Account Establishment Fee, CREDIT CARD, CHECK MADE PAYABLE TO ENTRUST, Annual Recordkeeping Fee payable, CREDIT CARD, DEBIT ENTRUST ACCOUNT, Transaction Fees Pay by, CREDIT CARD, DEBIT ENTRUST ACCOUNT, Termination Fee Pay by, CREDIT CARD, DEBIT ENTRUST ACCOUNT, If no preference indicated fees, Credit Card Information, and PAY WITH CARD ON FILE so you can move on further.

3. The following step is mostly about By signing below you authorize, DATE, Page of, and The Entrust Group GFD Rev - complete each one of these empty form fields.

4. Filling out PRINT NAME, SIGNATURE, and DATE is essential in the fourth part - make sure you take your time and take a close look at each and every empty field!

People who use this document generally make some errors while completing DATE in this section. Make sure you review everything you type in right here.

Step 3: Ensure your details are accurate and simply click "Done" to finish the process. Try a 7-day free trial option with us and gain direct access to forms - which you are able to then begin to use as you wish in your personal account page. FormsPal offers protected document completion with no data record-keeping or any sort of sharing. Be assured that your data is in good hands with us!