Dealing with PDF files online is definitely simple with our PDF editor. Anyone can fill in Form It 112 C here painlessly. Our tool is continually developing to present the best user experience possible, and that is because of our commitment to constant development and listening closely to customer feedback. To get the ball rolling, take these easy steps:

Step 1: Firstly, open the editor by pressing the "Get Form Button" at the top of this site.

Step 2: With our advanced PDF editing tool, you can actually do more than merely fill in blank fields. Try all the features and make your forms appear professional with custom textual content put in, or tweak the original input to excellence - all that supported by the capability to insert your personal graphics and sign it off.

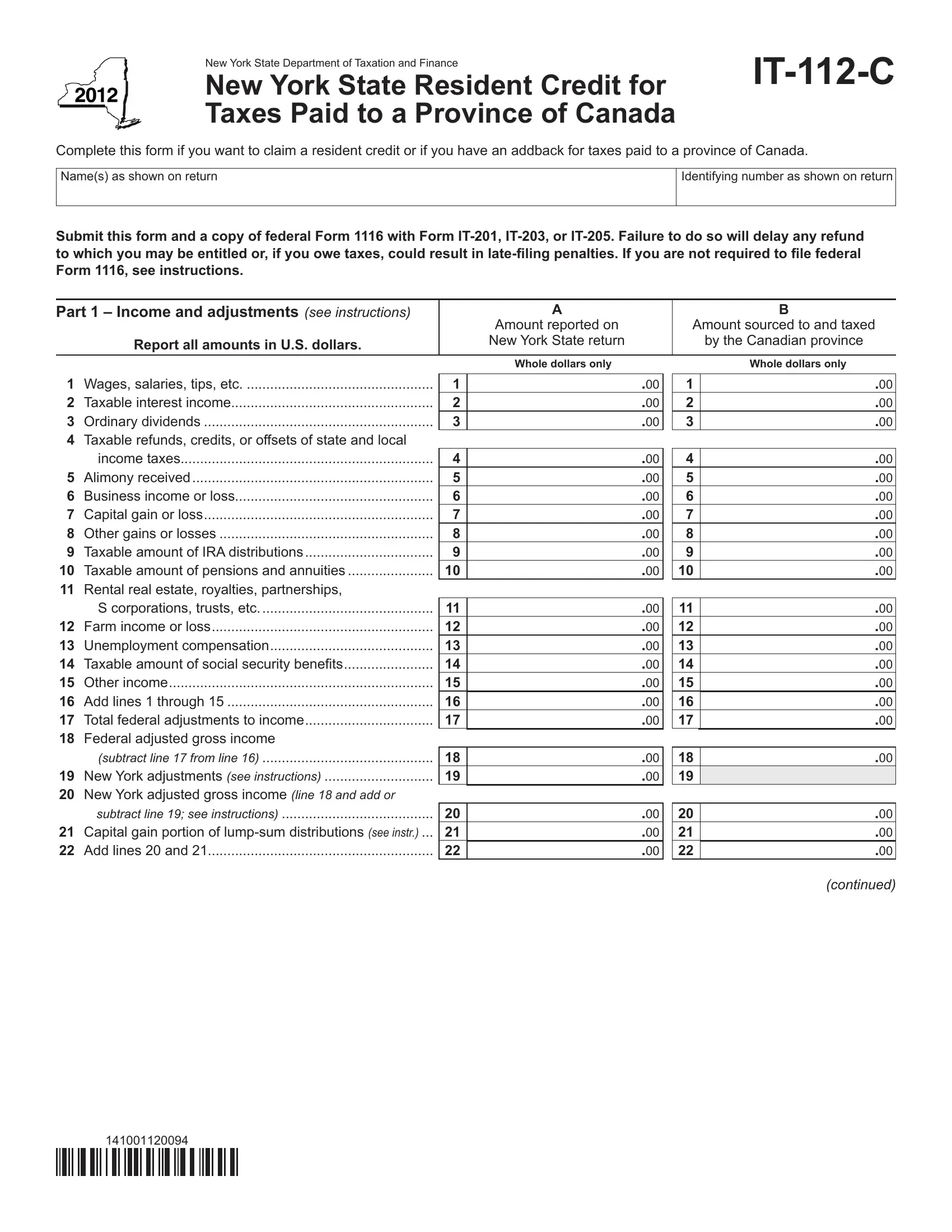

If you want to finalize this document, make sure you enter the required details in every single blank field:

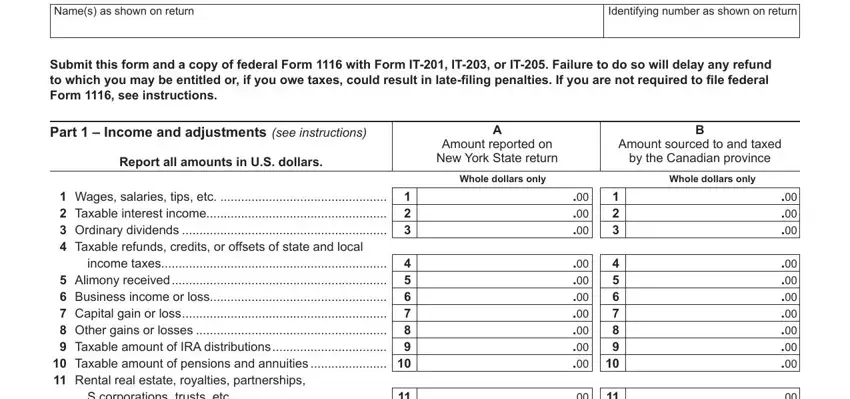

1. Firstly, while filling out the Form It 112 C, start with the section with the subsequent blanks:

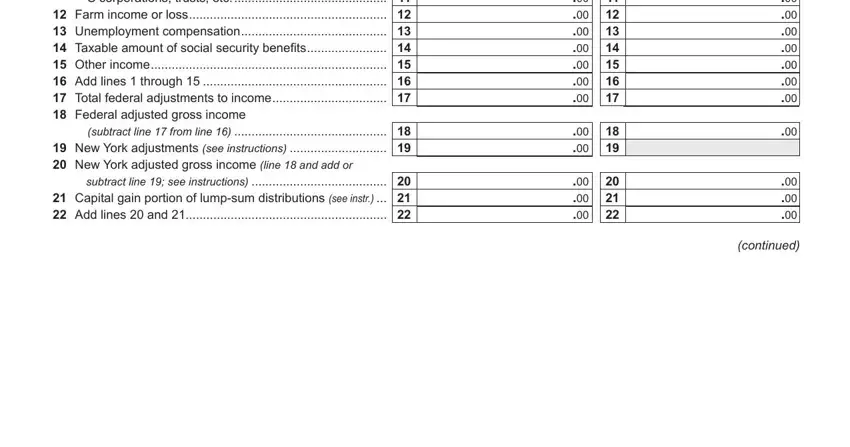

2. After filling in this step, go to the next step and enter all required particulars in all these fields - continued, Wages salaries tips etc, and subtract line see instructions.

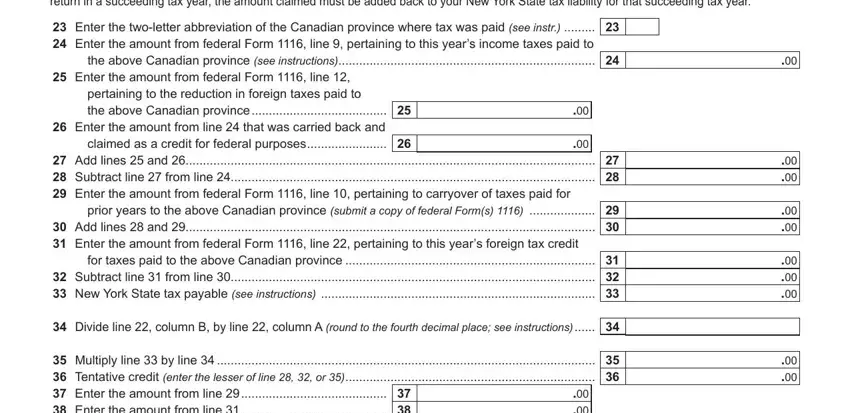

3. In this step, look at Part Computing your resident, the above Canadian province, claimed as a credit for federal, the above Canadian province see, pertaining to the reduction in, Enter the twoletter abbreviation, Divide line column B by line, and Multiply line by line. Every one of these must be filled out with highest awareness of detail.

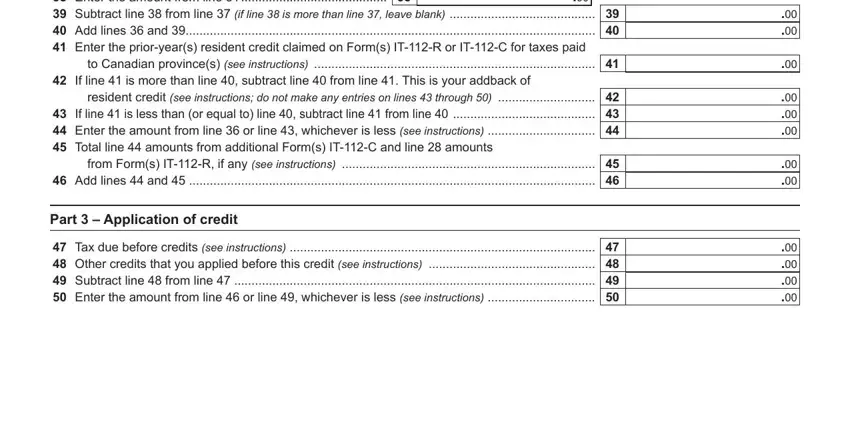

4. Filling in Multiply line by line, to Canadian provinces see, Part Application of credit, and Tax due before credits see is paramount in the next form section - make certain that you devote some time and be attentive with every single field!

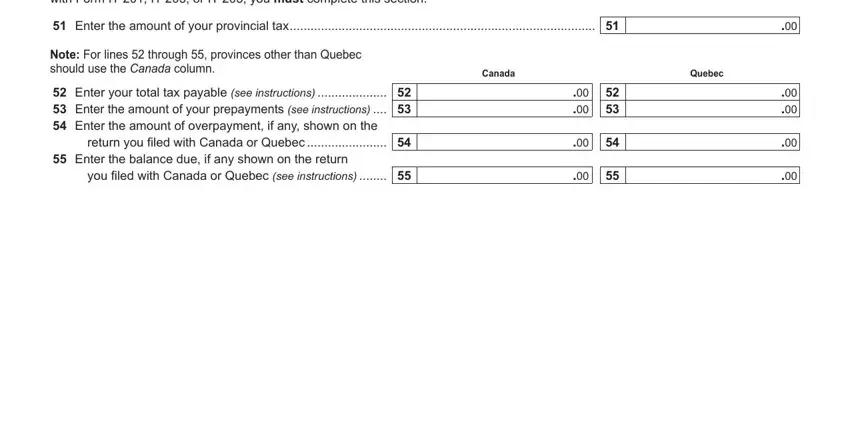

5. And finally, this last subsection is precisely what you'll want to wrap up prior to using the PDF. The blanks in question are the following: Part Information from your, Enter the amount of your, Note For lines through provinces, Canada, Quebec, Enter your total tax payable see, you filed with Canada or Quebec, and return you filed with Canada or.

Always be extremely mindful while filling out Note For lines through provinces and Quebec, because this is the part where many people make mistakes.

Step 3: Immediately after double-checking the form fields you have filled in, press "Done" and you're good to go! Go for a free trial option with us and get instant access to Form It 112 C - which you may then make use of as you would like from your FormsPal account page. FormsPal provides secure form tools without data record-keeping or distributing. Be assured that your data is safe here!