Form It 216 can be completed effortlessly. Simply make use of FormsPal PDF tool to finish the job without delay. Our tool is consistently developing to grant the best user experience attainable, and that is because of our resolve for continuous improvement and listening closely to comments from users. Getting underway is effortless! All you have to do is take the next simple steps down below:

Step 1: Press the orange "Get Form" button above. It'll open our tool so that you can begin filling out your form.

Step 2: With our handy PDF editing tool, it is easy to do more than simply fill out forms. Edit away and make your docs appear great with custom text incorporated, or modify the file's original input to excellence - all that comes along with an ability to add your own images and sign the PDF off.

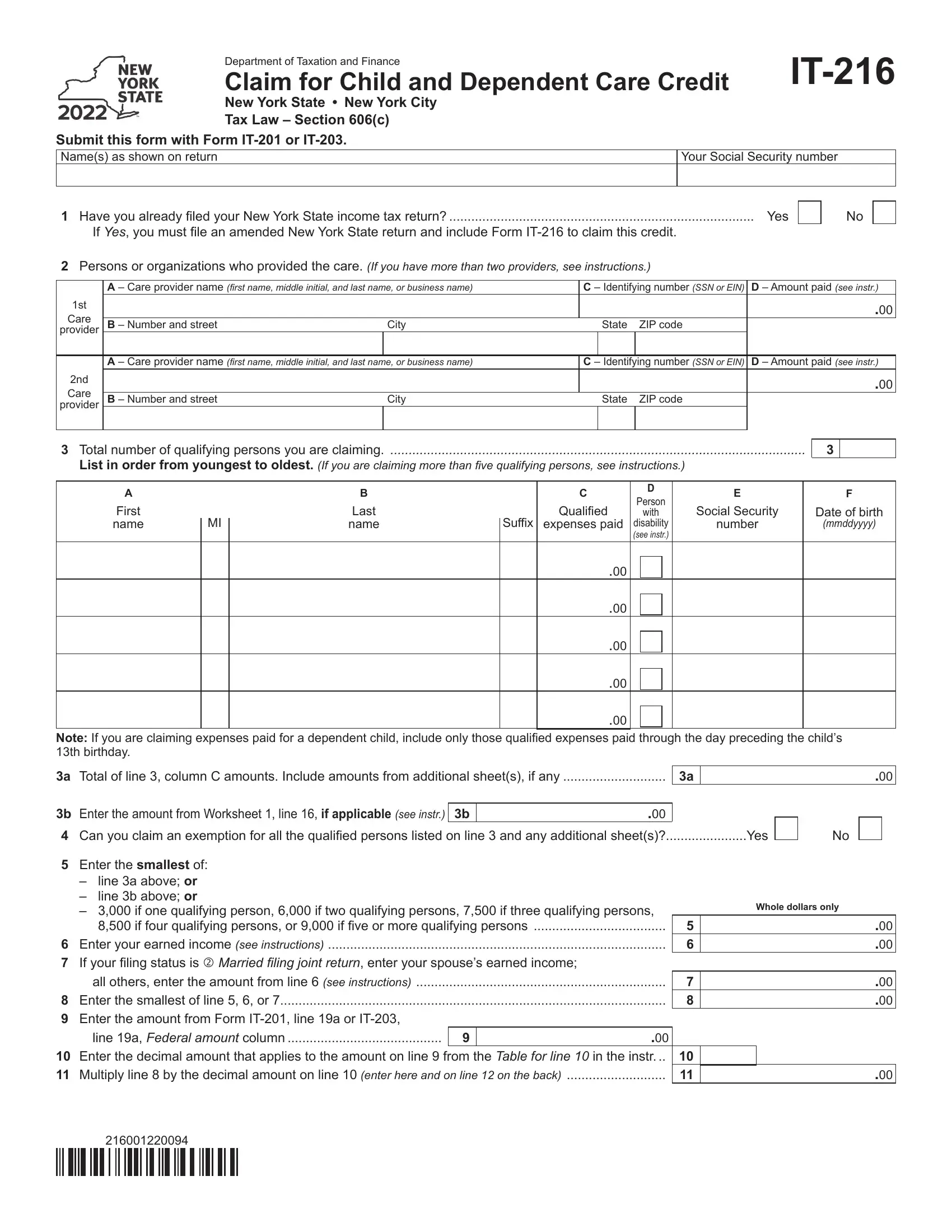

With regards to the blanks of this precise form, here is what you should know:

1. Begin completing your Form It 216 with a selection of essential fields. Note all of the important information and make sure absolutely nothing is neglected!

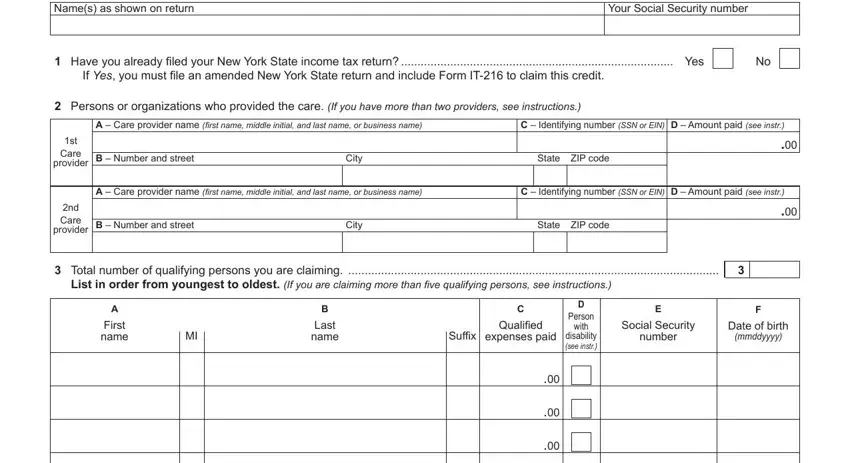

2. The subsequent stage is usually to fill in these particular blanks: Note If you are claiming expenses, b Enter the amount from Worksheet, line a above or line b above or, if one qualifying person if, Enter the smallest of if four, line a Federal amount column, and Whole dollars only.

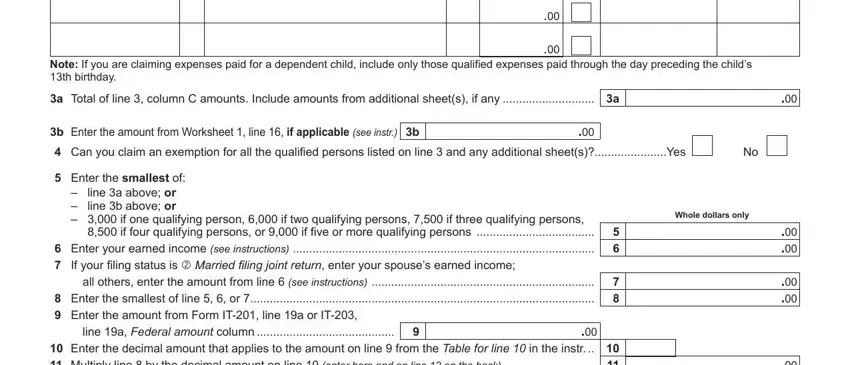

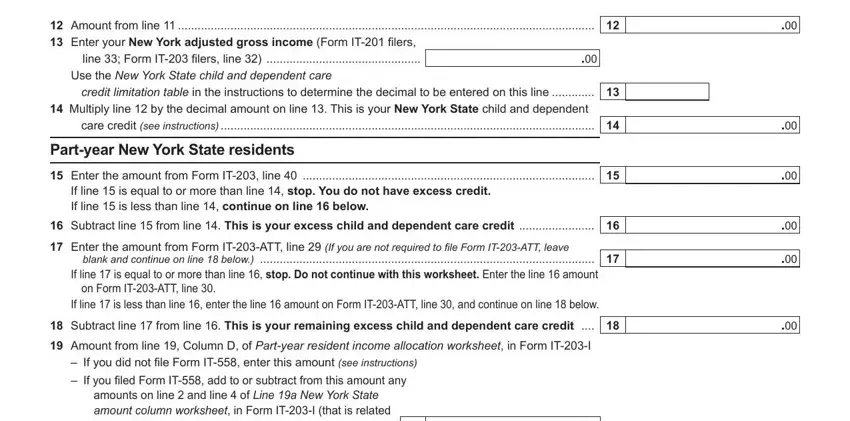

3. Your next stage is generally straightforward - fill in all the empty fields in Amount from line Enter your, Partyear New York State residents, If line is equal to or more than, blank and continue on line below, Enter the amount from Form IT, amounts on line and line of Line, and to your NYS resident period and to complete this process.

It is possible to make errors while filling out your Amount from line Enter your, so be sure you go through it again prior to deciding to submit it.

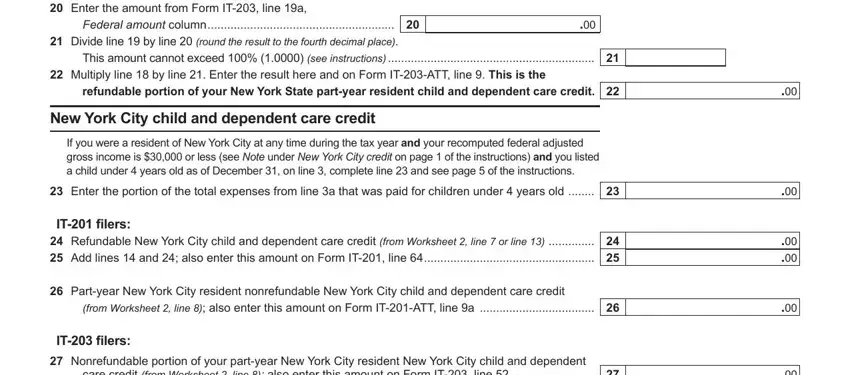

4. To move onward, the next stage requires filling out a couple of blanks. Included in these are Enter the amount from Form IT, amounts on line and line of Line, This amount cannot exceed see, refundable portion of your New, Federal amount column, to your NYS resident period and, New York City child and dependent, If you were a resident of New York, Enter the portion of the total, IT filers Refundable New York, Partyear New York City resident, from Worksheet line also enter, care credit from Worksheet line, and IT filers Nonrefundable portion, which you'll find vital to carrying on with this document.

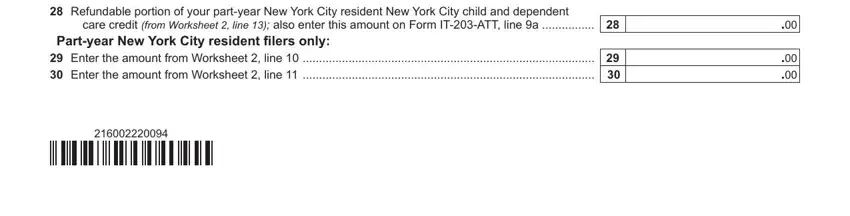

5. Because you near the completion of your form, there are actually just a few extra requirements that must be met. Mainly, care credit from Worksheet line, IT filers Nonrefundable portion, and care credit from Worksheet line should all be done.

Step 3: Before submitting your file, make sure that all form fields are filled out properly. When you confirm that it is good, click “Done." Create a free trial plan with us and gain immediate access to Form It 216 - downloadable, emailable, and editable inside your FormsPal account. We do not share or sell any details you enter when filling out documents at our site.