Making use of the online PDF editor by FormsPal, it is easy to fill in or edit NewYork right here and now. To make our tool better and more convenient to use, we consistently come up with new features, with our users' suggestions in mind. This is what you'd have to do to start:

Step 1: Firstly, open the pdf tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: The editor will allow you to work with PDF forms in many different ways. Enhance it by including personalized text, correct original content, and include a signature - all within a few clicks!

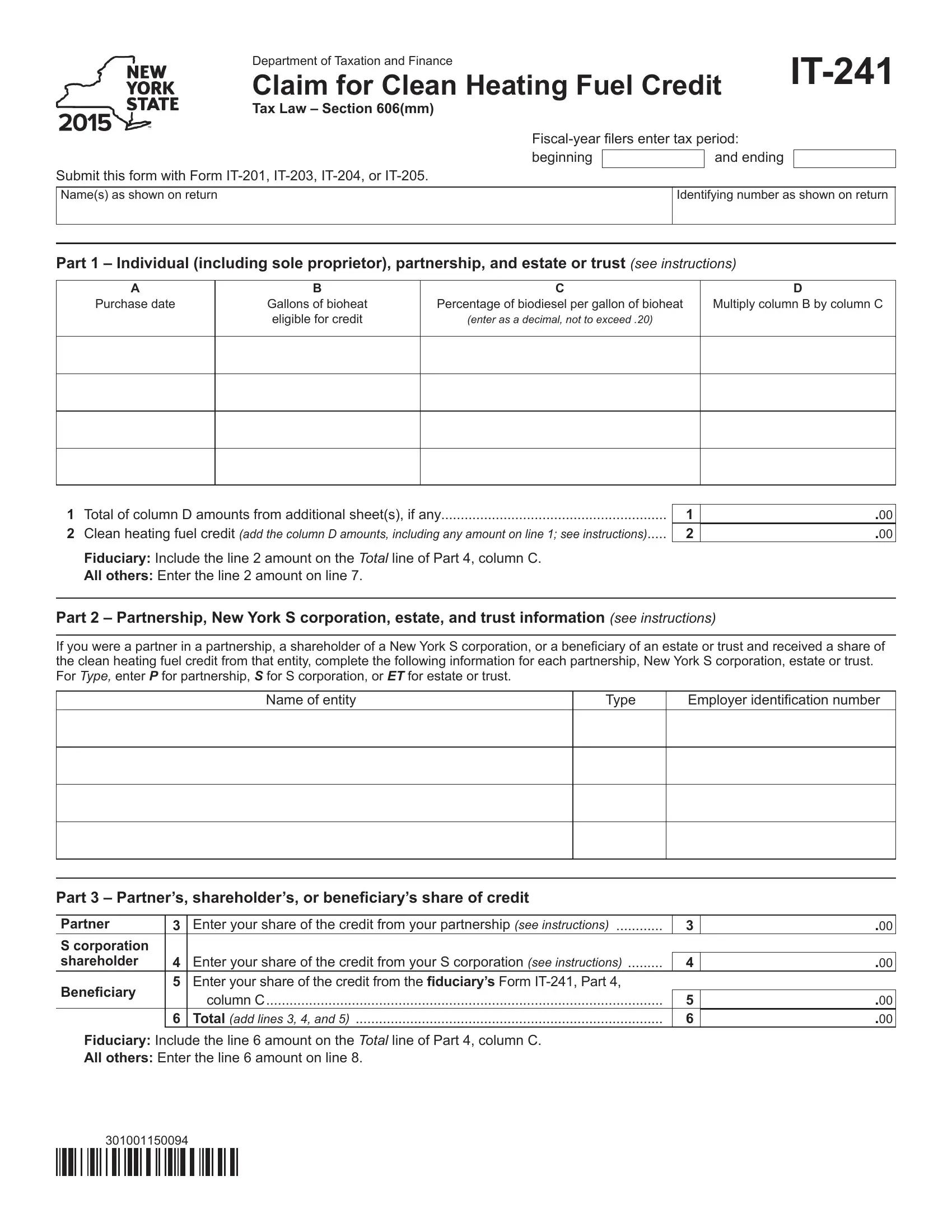

With regards to the fields of this particular document, here is what you should know:

1. The NewYork involves specific details to be typed in. Be sure that the following blank fields are complete:

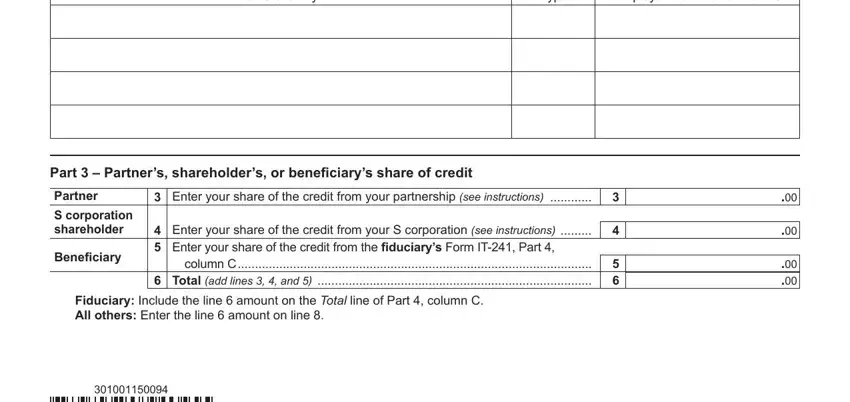

2. When the previous array of fields is done, you'll want to insert the required particulars in If you were a partner in a, Employer identiication number, Name of entity, Type, Part Partners shareholders or, Enter your share of the credit, S corporation shareholder, Beneiciary, Enter your share of the credit, and Fiduciary Include the line amount so you can progress further.

People who work with this document often make mistakes while completing Enter your share of the credit in this part. You need to revise whatever you enter right here.

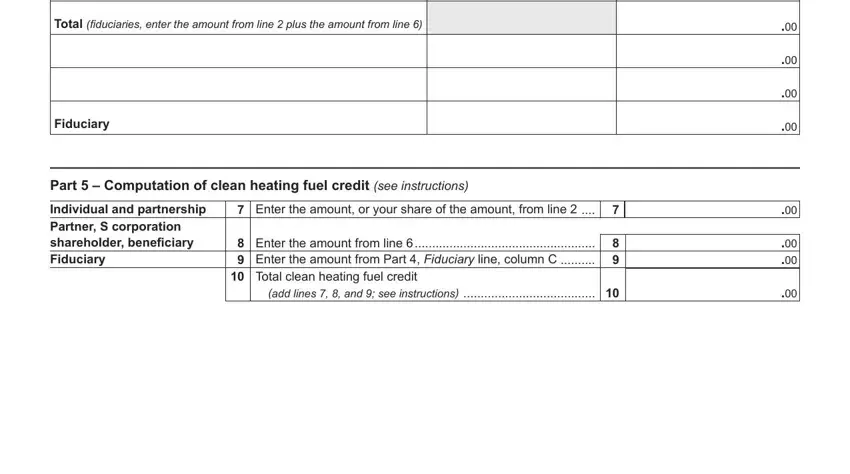

3. Through this step, review Total iduciaries enter the amount, Fiduciary, Part Computation of clean, Individual and partnership Partner, Enter the amount or your share of, Enter the amount from line, Total clean heating fuel credit, and add lines and see instructions. All these need to be taken care of with highest precision.

Step 3: Just after taking one more look at your fields you have filled in, hit "Done" and you are good to go! After setting up afree trial account with us, it will be possible to download NewYork or send it through email without delay. The PDF file will also be readily available through your personal cabinet with your edits. We don't share the information that you type in while completing documents at our website.