Navigating through the complexities of filing taxes can be daunting, but understanding specific forms like the IT-540-2D can make the process more straightforward for Louisiana residents. This form, designed for the 2012 tax year, serves multiple purposes, including accommodating name changes, filing for deceased taxpayers, and amending previous returns. It delineates taxpayer details such as Social Security numbers, dates of birth, and filing status, laying the groundwork for accurately reporting income, exemptions, deductions, and credits. Among its notable sections, it outlines federal adjusted gross income adjustments, itemized or standard deductions, and various tax credits - both nonrefundable and refundable, including those for child care and school readiness. Moreover, the form allows taxpayers to report Louisiana tax withheld, estimated payments, and overpayments, offering options for refund allocation or carrying forward to the next tax year. Additional features include provisions for underpayment penalties and donations to charitable organizations, rounding off a comprehensive tool for managing one’s tax obligations in Louisiana. Beyond its primary function, the IT-540-2D also encompasses schedules for donations, highlighting Louisiana’s encouragement for taxpayers to contribute to social and environmental causes.

| Question | Answer |

|---|---|

| Form Name | Form It 540 2D |

| Form Length | 12 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min |

| Other names | it540 2d, Louisiana, LDR, it 540 2d |

2012 Louisiana Resident - 2d

DEV ID

Name

Change

Decedent

Filing

Spouse

Decedent

Amended

Return

NOL

Carryback

Taxpayer DOB

FiLinG status: Enter the appropriate number in the iling status box. It must agree with your federal return.

Spouse DOB

6eXeMPtions:

Taxpayer SSN

Spouse SSN

Telephone

Enter a “1” in box if single.

Enter a “2” in box if married iling jointly.

Enter a “3” in box if married iling separately.

Enter a “4” in box if head of household.

If the qualifying person is not your dependent, enter name here.

Enter a “5” in box if qualifying widow(er).

6A |

X Yourself |

65 or |

|

older |

|||

6B |

Spouse |

65 or |

|

older |

|||

|

|

Blind

Blind

Qualifying

Widow(er) Total of

6A & 6B

6C dePendents – Enter dependent information below. If you have more than 6 dependents, attach a statement to your return with the

required information. Enter the total number from Federal Form 1040A, Line 6c, or Federal Form 1040, Line 6c. |

|

6C |

||||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

dependent First and Last name |

social security number |

|

Relationship to you |

Birth date (mm/dd/yyyy) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6D totaL eXeMPtions – Total of 6A, 6B, and 6C |

6d |

6360

Social Security Number

if you are not required to ile a federal return, indicate wages here.

Mark this box and enter zero “0” on Lines 7 through 16.

|

FEDERAL ADJUSTED GROSS INCOME – If your Federal Adjusted Gross |

From Louisiana |

|

7 |

Schedule E, |

||

Income is less than zero, enter “0.” |

|||

|

attached |

||

|

|

8A FEDERAL ITEMIZED DEDUCTIONS

8B FEDERAL STANDARD DEDUCTION

8C EXCESS FEDERAL ITEMIZED DEDUCTIONS – Subtract Line 8B from Line 8A.

9FEDERAL INCOME TAX – If your federal income tax has been decreased by a federal disaster credit allowed by IRS, complete Schedule H and mark box.

10YOUR LOUISIANA TAX TABLE INCOME – Subtract Lines 8C and 9 from Line 7. If less than zero, enter “0.”

11YOUR LOUISIANA INCOME TAX

7

8a

8B

8C

9

10

11

nonReFundaBLe taX CRedits

12A FEDERAL CHILD CARE CREDIT

12B 2012 LOUISIANA NONREFUNDABLE CHILD CARE CREDIT

12C AMOUNT OF LOUISIANA NONREFUNDABLE CHILD CARE CREDIT CARRIED FORWARD FROM 2008 THROUGH 2011

12D 2012 LOUISIANA NONREFUNDABLE SCHOOL READINESS CREDIT

5 |

4 |

3 |

2 |

12E AMOUNT OF LOUISIANA NONREFUNDABLE SCHOOL READINESS CREDIT CARRIED FORWARD FROM 2008 THROUGH 2011

13 EDUCATION CREDIT

14OTHER NONREFUNDABLE TAX CREDITS – From Schedule G, Line 11

15TOTAL NONREFUNDABLE TAX CREDITS – Add Lines 12B through 14.

16ADJUSTED LOUISIANA INCOME TAX – Subtract Line 15 from Line 11. If the result is less than zero, or you are not required to ile a federal return, enter zero “0.”

17 CONSUMER USE TAX |

No use tax due. |

Amount from the Consumer Use |

|

Tax Worksheet, Line 2. |

|||

|

|

12a

12B

12C

12d

12e

13

14

15

16

17

18 TOTAL INCOME TAX AND CONSUMER USE TAX - Add Lines 16 and 17. |

18 |

|

6361

ReFundaBLe taX CRedits

19 2012 LOUISIANA REFUNDABLE CHILD CARE CREDIT

19A Enter the qualiied expense amount from the Refundable Child Care Credit Worksheet, Line 3.

19B Enter the amount from the Refundable Child Care Credit Worksheet, Line 6.

20 2012 LOUISIANA REFUNDABLE SCHOOL READINESS CREDIT

5 |

4 |

3 |

2 |

21 EARNED INCOME CREDIT

22 LOUISIANA CITIZENS INSURANCE CREDIT

23 OTHER REFUNDABLE TAX CREDITS – From Schedule F, Line 7

Social Security Number

19

19a

19B

20

21

22

23

PayMents

24aMount oF Louisiana taX WitHHeLd FoR 2012 – attach Forms

25AMOUNT OF CREDIT CARRIED FORWARD FROM 2011

26AMOUNT PAID ON YOUR BEHALF BY A COMPOSITE PARTNERSHIP FILING Enter name of partnership.

27AMOUNT OF ESTIMATED PAYMENTS MADE FOR 2012

28AMOUNT PAID WITH EXTENSION REQUEST

29TOTAL REFUNDABLE TAX CREDITS AND PAYMENTS – Add Lines 19 and 20 through 28. Do not include amounts on Lines 19A and 19B.

30OVERPAYMENT – If Line 29 is greater than Line 18, subtract Line 18 from Line 29. Otherwise, enter zero “0” on Lines 30 through 36 and go to Line 37.

31UNDERPAYMENT PENALTY – If you are a farmer, check the box.

adJusted oveRPayMent – If Line 30 is greater than Line 31, subtract Line 31 from Line 30 and enter the

32result here. If Line 31 is greater than Line 30, enter zero “0” on Lines 32 through 36, subtract Line 30 from Line 31, and enter the balance on Line 37.

33TOTAL DONATIONS – From Schedule D, Line 20

24

25

26

27

28

29

30

31

32

33

ReFund due

34 SUBTOTAL – Subtract Line 33 from Line 32. This amount of overpayment is available for credit or refund.

35 AMOUNT OF LINE 34 TO BE CREDITED TO 2013 INCOME TAX |

CRedit |

36AMOUNT TO BE REFUNDED – Subtract Line 35 from Line 34.

Enter a “1” in box if you want to receive your refund on a MyRefund Card.

Enter a “2” in box if you want to receive your refund by paper check. |

ReFund |

|

if you do not make a refund selection, you will receive your refund on a MyRefund Card.

34

35

36

6362

aMounts due Louisiana

37AMOUNT YOU OWE – If Line 18 is greater than Line 29, subtract Line 29 from Line 18 and enter the balance here.

38additionaL donation to tHe MiLitaRy FaMiLy assistanCe Fund

39additionaL donation to tHe CoastaL PRoteCtion and RestoRation Fund

Social Security Number

37

38

39

40

additionaL donation to Louisiana CHaPteR oF tHe nationaL MuLtiPLe sCLeRosis soCiety Fund

40

41 additionaL donation to Louisiana Food Bank assoCiation

42INTEREST

43DELINQUENT FILING PENALTY

44DELINQUENT PAYMENT PENALTY

45UNDERPAYMENT PENALTY – If you are a farmer, check the box.

46 BALANCE DUE LOUISIANA – Add Lines 37 through 45. |

Pay tHis aMount. |

41

42

43

44

45

46

do not send CasH.

Status

Contribution and Donation

I declare that I have examined this return, and to the best of my knowledge, it is true and complete. Declaration of paid preparer is based on all available information. If I made a contribution to the START Savings Program, I consent that my Social Security Number may be given to the Louisiana Office of Student Financial Assistance in order to properly identify the START Savings Program account holder. If married filing jointly, both Social Security Numbers may be submitted. I understand that by submitting this form I authorize the disbursement of individual income tax refunds through the method as described on Line 36.

Your Signature

Date

Signature of paid preparer other than taxpayer

Spouse’s Signature (If filing jointly, both must sign.)

Date

Telephone number of paid preparer

Date

Name |

Address |

|

|

||

|

|

|

|

|

Field |

|

|

|

|

|

|

individual income tax Return |

|

Flag |

|||

|

|||||

|

|

||||

Calendar year return due 5/15/2013 |

Mail to: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

FoR oFFiCe use onLy |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

Social Security Number, PTIN, or |

|

|

|

|

|

|

|

|

|

|

|

|

Department of Revenue |

FEIN of paid preparer |

||||||||||

sPeC |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

Code |

6363

Social Security Number

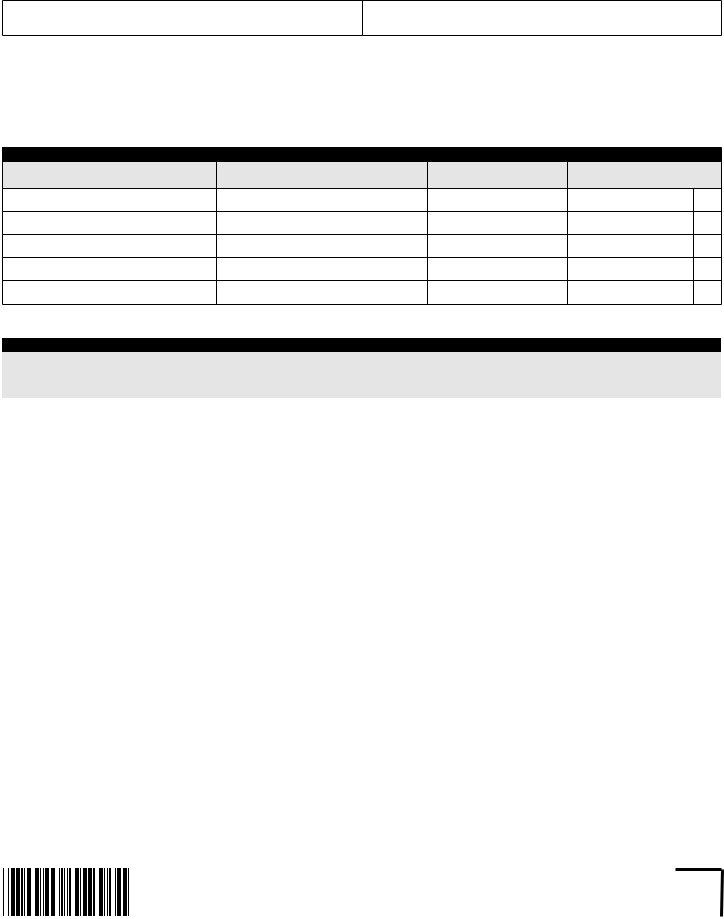

sCHeduLe d – 2012 DONATION SCHEDULE

Individuals who ile an individual income tax return and have overpaid their tax may choose to donate all or part of their overpayment shown on Line 32 of Form

1 adjusted overpayment - From |

1 |

2 |

the Military Family assistance Fund |

|

|

2 |

3 |

Coastal Protection and Restoration Fund |

3 |

||

4 |

The START Program |

4 |

||

5 |

Wildlife Habitat and Natural Heritage Trust Fund |

5 |

||

6 |

Louisiana Prostate Cancer Trust Fund |

6 |

||

7 |

Louisiana Animal Welfare Commission |

7 |

||

8 |

National Lung Cancer Partnership |

8 |

||

9 |

Louisiana Chapter of the National Multiple Sclerosis Society Fund |

9 |

||

10 |

Louisiana Food Bank Association |

10 |

||

11 |

Louisiana Bicentennial Commission and Battle of New Orleans Bicentennial Commission |

11 |

||

12 |

12 |

|||

13 |

Louisiana Association of United Ways/LA |

13 |

||

14 |

Center of Excellence for Autism Spectrum Disorder |

14 |

||

15 |

Alliance for the Advancement of End of Life Care |

15 |

||

16 |

American Red Cross |

16 |

||

17 |

New Opportunities Waiver Fund |

17 |

||

18 |

Friends of Palmetto Island State Park |

18 |

||

19 |

Dreams Come True, Inc. |

19 |

||

|

TOTAL DONATIONS – Add Lines 2 through 19. This amount cannot be more than Line 1. Also, enter this amount |

|

||

20 |

on Form |

20 |

|

||

|

|

6365

sCHeduLe e – 2012 ADJUSTMENTS TO INCOME

1FEDERAL ADJUSTED GROSS INCOME – Enter the amount from your Federal Form 1040EZ, Line 4, oR Federal Form 1040A, Line 21, oR Federal Form 1040, Line 37. Check box if amount is less than zero.

2INTEREST AND DIVIDEND INCOME FROM OTHER STATES AND THEIR POLITICAL SUBDIVISIONS

2A RECAPTURE OF START CONTRIBUTIONS

3TOTAL – Add Lines 1, 2, and 2A.

Social Security Number

1

2

2a

3

eXeMPt inCoMe – Enter on Lines 4A through 4H the amount of exempted income included in Line 1 above. Enter description and associated code, along with the dollar amount.

4A

4B

4C

4D

4E

4F

4G

4H

4I

4J

4K

5A

5B

5C

exempt income description |

Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

eXeMPt inCoMe BeFoRe aPPLiCaBLe FedeRaL taX – Add Lines 4A through 4H.

FEDERAL TAX APPLICABLE TO EXEMPT INCOME

EXEMPT INCOME – Subtract Line 4J from Line 4I.

LOUISIANA ADJUSTED GROSS INCOME BEFORE IRC 280C EXPENSE ADJUSTMENT – Subtract Line 4K from Line 3.

IRC 280C EXPENSE ADJUSTMENT

LOUISIANA ADJUSTED GROSS INCOME – Subtract Line 5B from Line 5A. Enter the result here and on Form

amount

4a

4B

4C

4d

4e

4F

4G

4H

4i

4J

4k

5a

5B

5C

description |

|

|

|

|

Code |

||||

Interest and Dividends on US Government Obligations |

01e |

||||||||

Louisiana State Employees’ Retirement Benefits (Date Retired) |

02e |

||||||||

Taxpayer |

|

|

Spouse |

|

|

|

|

||

Louisiana State Teachers’ Retirement Benefits (Date Retired) |

03e |

||||||||

Taxpayer |

|

|

Spouse |

|

|

|

|

||

Federal Retirement Benefits (Date Retired) |

04e |

||||||||

Taxpayer |

|

|

Spouse |

|

|

|

|

||

Other Retirement Benefits (Date Retired) |

05e |

||||||||

Provide name or statute: |

|

|

|

|

|

|

|

||

Taxpayer |

|

|

Spouse |

|

|

|

|

||

Annual Retirement Income Exemption for Taxpayers 65 or over |

06e |

||||||||

Provide name of pension or annuity: |

|

|

|

||||||

Taxable Amount of Social Security |

. ...................................................... |

|

|

|

07e |

||||

description |

Code |

Native American Income |

08e |

|

|

START Savings Program Contribution |

09e |

Military Pay Exclusion |

10e |

Road Home |

11e |

Recreation Volunteer |

13e |

Volunteer Firefighter |

14e |

Voluntary Retrofit Residential Structure |

16e |

Elementary and Secondary School Tuition |

17e |

Educational Expenses for |

18e |

Educational Expenses for Quality Public Education |

19e |

Capital Gain from Sale of Louisiana Business |

20e |

Other |

|

Identify: |

|

49e |

|

|

6366

Social Security Number

sCHeduLe F – 2012 REFUNDABLE TAX CREDITS

1Credit for amounts paid by certain military servicemembers for obtaining Louisiana Hunting and Fishing Licenses.

1A |

Yourself |

|

Date of Birth (MM/DD/YYYY) |

|

Driver’s License number |

|

|

|

|

|

|

|

|

|

|

|

|

|

or State Identiication |

|

1B |

Spouse |

|

Date of Birth (MM/DD/YYYY) |

|

Driver’s License number |

|

|

|

|

|

|

or State Identiication |

|

1C Dependents: List dependent names.

State of issue State of issue State of issue State of issue

Dependent name |

|

Date of Birth (MM/DD/YYYY) |

|

Dependent name |

|

Date of Birth (MM/DD/YYYY) |

|

|

|||

Dependent name |

|

Date of Birth (MM/DD/YYYY) |

|

|

|||

Dependent name |

|

Date of Birth (MM/DD/YYYY) |

|

|

|||

1D Enter the total amount of fees paid for Louisiana hunting and ishing licenses purchased for the listed individuals. |

1d |

||

additional Refundable Credits

Enter description and associated code, along with the dollar amount.

Credit description |

Code |

amount of Credit Claimed |

2

3

4

5

6

7OTHER REFUNDABLE TAX CREDITS – Add Lines 1D and 2 through 6. Enter the result here and on Form

2

3

4

5

6

7

sCHeduLe H – 2012 MODIFIED FEDERAL INCOME TAX DEDUCTION

1 |

Enter the amount of your federal income tax liability found on Federal Form 1040, Line 55. |

1 |

2 |

Enter the amount of federal disaster credits allowed by IRS. |

2 |

3 |

Add Line 1 and Line 2. Enter the result here and on Form |

3 |

6367

Social Security Number

sCHeduLe G – 2012 NONREFUNDABLE TAX CREDITS

1CREDIT FOR TAX LIABILITIES PAID TO OTHER STATES – A copy of the returns iled with the other states must be submitted with this schedule. Enter the amount of the income tax liability paid to other states. Round to the nearest dollar.

2CREDIT FOR CERTAIN DISABILITIES - Mark an “X” in the appropriate boxes. Only one credit is allowed per person.

1

Deaf |

Loss of |

Mentally |

|

Limb |

incapacitated |

||

|

2A Yourself

2B Spouse

2C Dependent *

*List dependent names here.

Blind

Enter the total number of qualifying

2D individuals. Only one credit is allowed per person.

2E Multiply Line 2D by $100.

2d

2e

3CREDIT FOR CONTRIBUTIONS TO EDUCATIONAL INSTITUTIONS

3A Enter the value of computer or other technological equipment donated. Attach Form

3a

3B Multiply Line 3A by 40 percent. Round to the nearest dollar. |

3B |

4CREDIT FOR CERTAIN FEDERAL TAX CREDITS

4A |

Enter the amount of eligible federal credits. |

4a |

4B |

Multiply Line 4A by 10 percent. Enter the result or $25, whichever is less. This credit is limited to $25. |

4B |

additional nonrefundable Credits

Enter credit description and associated code, along with the dollar amount of credit claimed.

Credit description

5

6

7

8

9

10

OTHER NONREFUNDABLE TAX CREDITS – Add Lines 1, 2E, 3B, 4B, and 5 through 10. Enter the

11 result here and on Form

Credit Code |

amount of Credit Claimed |

5

6

7

8

9

10

11

6368

CRedit Codes

do not MaiL tHis PaGe (inFoRMation onLy)

schedule F – Credit Codes

description |

Code |

Inventory Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50F

Ad Valorem Natural Gas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51F

Ad Valorem Offshore Vessels . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52F

Telephone Company Property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54F

Prison Industry Enhancement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55F

Urban Revitalization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56F

Milk Producers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58F

Technology Commercialization . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59F

Historic Residential. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60F

Angel Investor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61F

Musical and Theatrical Productions . . . . . . . . . . . . . . . . . . . . . . . . . 62F

schedule G – Credit Codes

description |

Code |

Premium Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100

Commercial Fishing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105

Family Responsibility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 110

Small Town Doctor/Dentist. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 115

Bone Marrow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120

Law Enforcement Education . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 125

First Time Drug Offenders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130

Bulletproof Vest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 135

Nonviolent Offenders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 140

Owner of Newly Constructed Accessible Home . . . . . . . . . . . . . . . 145

Qualiied Playgrounds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 150

Debt Issuance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 155

Donations of Materials, Equipment, Advisors, Instructors . . . . . . . . 175

(Reserved for future credits. Do not use unless

speciically directed to do so by LDR.) . . . . . . . . . . . . . . . . . . . . 199 Atchafalaya Trace . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 200 Organ Donation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 202

Household Expense for Physically and Mentally

Incapable Persons . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 204 Previously Unemployed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 208 Recycling Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 210 Basic Skills Training . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 212 Dedicated Research. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 220 New Jobs Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 224 Refunds by Utilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 226 Eligible

schedule F – Credit Codes

description |

Code |

Wind and Solar Energy Systems . . . . . . . . . . . . . . . . . . . . . . . . . . . 64F School Readiness Child Care Provider . . . . . . . . . . . . . . . . . . . . . . 65F School Readiness Child Care Directors and Staff . . . . . . . . . . . . . . 66F School Readiness

School Readiness Fees and Grants to Resource

and Referral Agencies. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68F Sugarcane Trailer Conversion or Acquisition. . . . . . . . . . . . . . . . . . 69F Retention and Modernization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70F Conversion of Vehicle to Alternative Fuel . . . . . . . . . . . . . . . . . . . . 71F Research and Development. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72F Digital Interactive Media and Software. . . . . . . . . . . . . . . . . . . . . . . 73F

(Reserved for future credits. Do not use unless speciically

directed to do so by LDR.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80F

schedule G – Credit Codes

description |

Code |

Neighborhood Assistance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 230

Cane River Heritage. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 232

LA Community Economic Development. . . . . . . . . . . . . . . . . . . . . . 234

Apprenticeship . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 236

Ports of Louisiana Investor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 238

Ports of Louisiana Import Export Cargo. . . . . . . . . . . . . . . . . . . . . . 240

Motion Picture Investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 251

Research and Development. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 252

Historic Structures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 253

Digital Interactive Media . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 254

Motion Picture Employment of Resident . . . . . . . . . . . . . . . . . . . . . 256

Capital Company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 257

LA Community Development Financial Institution (LCDFI) . . . . . . . 258

New Markets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 259

Brownields Investor Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 260

Motion Picture Infrastructure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 261

Angel Investor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 262

(Reserved for future credits. Do not use unless

speciically directed to do so by LDR.) . . . . . . . . . . . . . . . . . . . . 299 Biomed/University Research . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 300 Tax Equalization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 305 Manufacturing Establishments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 310 Enterprise Zone . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 315

(Reserved for future credits. Do not use unless speciically

directed to do so by LDR.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 399

2012 Louisiana school expense deduction Worksheet (For use with Form

Your Name

Your Social Security Number

i.This worksheet should be used to calculate the three School Expense Deductions listed below. Refer to Revenue Information Bulletin

1.elementary and secondary school tuition – R.S. 47:297.10 provides a deduction for amounts paid during the tax year for tuition and fees required for your dependent child’s enrollment in a nonpublic elementary or secondary school that complies with the criteria set forth in Brumfield v. Dodd and Section 501(c)(3) of the Internal Revenue Code or to any public elementary or secondary laboratory school that is operated by a public college or university. The school can verify that it complies with the criteria. The deduction is equal to the actual amount of tuition and fees paid per dependent, limited to $5,000. The tuition and fees that can be deducted include amounts paid for tuition, fees, uniforms, textbooks and other supplies required by the school.

2.educational expenses for

3.educational expenses for a Quality Public education – R.S. 47:297.12 provides a deduction for the fees or other amounts paid during the tax year for a quality education of a dependent child enrolled in a public elementary or secondary school, including Louisiana Department of Education approved charter schools. The deduction is equal to 50 percent of the amounts paid per dependent, limited to $5,000. The amounts that can be deducted include amounts paid for uniforms, textbooks and other supplies required by the school.

ii.On the chart below, list the name of each qualifying dependent and the name of the school the student attends. If the student is

|

|

|

deduction as described |

||||

student |

name of Qualifying dependent |

name of school |

|

in section i |

|

||

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

|

3 |

|

|

|

|

|

|

|

|

a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iii.Using the letters that correspond to each qualifying dependent listed in Section II, list the amount paid per student for each qualifying expense. For students attending a qualifying school, the expense must be for an item required by the school. Refer to the information in Section I to determine which expenses qualify for the deduction. Retain copies of cancelled checks, receipts and other documentation in order to support the amount of qualifying expenses. if you checked column 1 in section ii, skip the 50% calculation below; however, the deduction is still limited to $5,000.

Qualifying expense |

|

List the amount paid for each student as listed in Section II. |

|

||||

|

|

|

|

|

|

||

A |

B |

C |

D |

E |

F |

||

|

|||||||

|

|

|

|

|

|

|

|

Tuition and Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

School Uniforms |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textbooks, or Other Instructional Materials |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (add amounts in each column) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If column 2 or 3 in Section II was checked, |

50% |

50% |

50% |

50% |

50% |

50% |

|

multiply by: |

|||||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

deduction per student – Enter the result |

|

|

|

|

|

|

|

or $5,000 whichever is less. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iv.Total the Deduction per Student in Section III, based on the deduction for which the students qualiied as marked in boxes 1, 2, or 3 in Section II.

Enter the elementary and secondary school tuition deduction here and on |

$ |

|

|

Enter the educational expenses for |

$ |

|

|

Enter the educational expenses for a Quality Public education deduction here and on |

$ |

|

|

6342

2012 Louisiana Refundable Child Care Credit Worksheet (For use with Form

Your Name

Social Security Number

your Federal adjusted Gross income must be $25,000 or less in order to complete this form.

1.Care Provider information schedule – Complete columns A through D for each person or organization that provided care to your child. You may use Federal Form

Care Provider information schedule

a |

B |

C |

d |

|

Care provider’s name |

Address (number, street, apartment |

Identifying number |

Amount paid |

|

number, city, state, and ZIP) |

(SSN or EIN) |

(See instructions.) |

||

|

.00

.00

.00

.00

.00

2.For each child under age 13, enter their name in column E, their Social Security Number in column F, and the amount of Qualiied Expenses you incurred and paid in 2012 in column G.

|

|

|

e |

|

F |

|

|

G |

|||

|

|

|

Qualifying person’s name |

|

Qualifying person’s |

Qualiied expenses you |

|||||

|

|

|

|

|

|

incurred and paid in 2012 for |

|||||

|

|

First |

|

|

Last |

Social Security Number |

|||||

|

|

|

|

the person listed in column (E) |

|||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Add the amounts in column G, Line 2. Do not enter more than $3,000 for one qualifying person or |

3 |

|

|

|

||||||

$6,000 for two or more persons. Enter this amount here and on Form |

|

|

.00 |

||||||||

|

|

|

|

||||||||

4 |

Enter your earned income. |

|

|

|

4 |

|

|

.00 |

|||

5 |

If married iling jointly, enter your spouse’s earned income (if your spouse was a student or was |

5 |

|

|

|

||||||

disabled, see IRS Publication 503). All other iling statuses, enter the amount from Line 4. |

|

|

.00 |

||||||||

|

|

|

|

||||||||

6 |

Enter the smallest of Lines 3, 4, or 5. Enter this amount on Form |

6 |

|

|

.00 |

||||||

7 |

Enter your Federal Adjusted Gross Income from Form |

7 |

|

|

.00 |

||||||

|

Enter on Line 8 the decimal amount shown below that applies to the amount on Line 7. |

|

|

|

|

||||||

|

|

if Line 7 is: |

over |

but not over |

decimal amount |

|

|

|

|

||

|

|

|

$0 |

|

$15,000 |

.35 |

|

|

|

|

|

8 |

|

|

$15,000 |

|

$17,000 |

.34 |

|

8 |

|

X . _______ |

|

|

|

|

$17,000 |

|

$19,000 |

.33 |

|

|

|

|

|

|

|

|

$19,000 |

|

$21,000 |

.32 |

|

|

|

|

|

|

|

|

$21,000 |

|

$23,000 |

.31 |

|

|

|

|

|

|

|

|

$23,000 |

|

$25,000 |

.30 |

|

|

|

|

|

9 |

Multiply Line 6 by the decimal amount on Line 8. |

|

|

|

9 |

|

|

.00 |

|||

10 |

Multiply Line 9 by 50 percent and enter this amount on Line 11. |

|

|

10 |

|

X .50 |

|||||

11 |

Enter this amount on Form |

|

|

|

11 |

|

|

.00 |

|||

6345

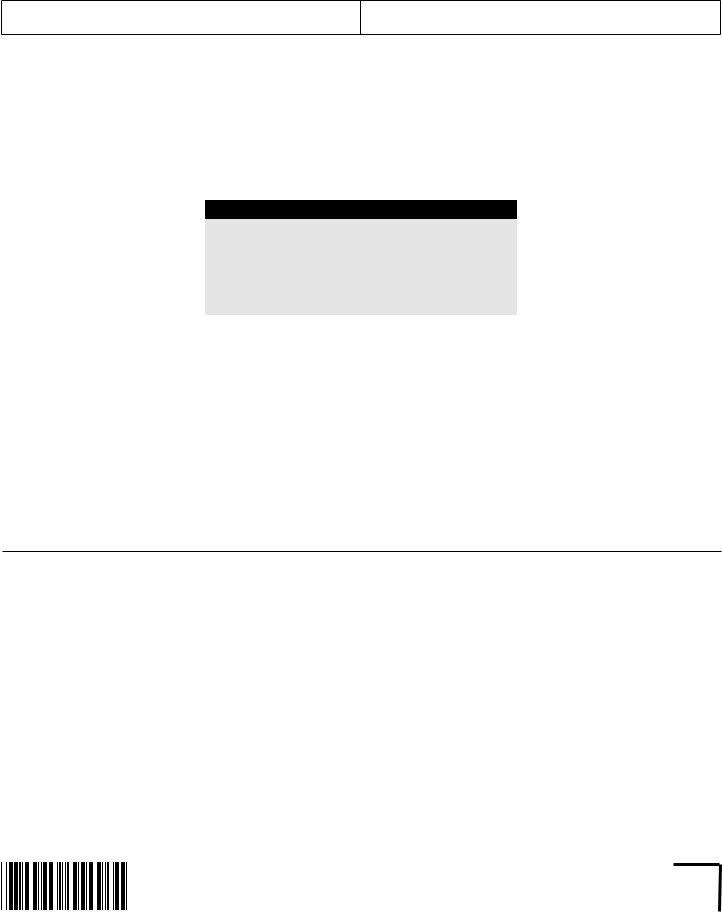

2012 Louisiana Refundable school Readiness Credit Worksheet (For use with Form

Your Name

Social Security Number

R.S. 47:6104 provides a School Readiness Credit in addition to the credit for child care expenses as provided under R.S. 47:297.4. To qualify for this credit, the taxpayer must have Federal Adjusted Gross Income of $25,000 or less and must have incurred child care expenses for a qualiied dependent under age six who attended a child care facility that is participating in the Quality Start Rating program administered by the Louisiana Department of Children and Family Services. The qualifying child care facility must have provided the taxpayer with Form

Complete this worksheet only if you claimed a Louisiana Refundable Child Care Credit on Form it

1.Enter the amount of 2012 Louisiana Refundable Child Care Credit on

the Louisiana Refundable Child Care Credit Worksheet, Line 11 |

1 |

|

. 00 |

Using the Star Rating of the child care facility that your qualiied dependent attended during 2012, shown on Form

a Quality Rating |

B Percentages for star Rating |

|

|

Five Star |

200% (2.0) |

|

|

Four Star |

150% (1.5) |

|

|

Three Star |

100% (1.0) |

|

|

Two Star |

50% (.50) |

|

|

One Star |

0% (.00) |

|

|

2.Enter the number of your qualiied dependents under age six who attended a:

|

Five Star Facility |

________ |

and multiply the number by 2.0 |

(i) __________ . ______ |

|

Four Star Facility |

________ |

and multiply the number by 1.5 |

(ii) __________ . ______ |

|

Three Star Facility |

________ |

and multiply the number by 1.0 |

(iii) __________ . ______ |

|

Two Star Facility |

________ |

and multiply the number by .50 |

(iv) __________ . ______ |

3 |

Add lines (i) through (iv) and enter the result. Be sure to include the decimal |

. . . . . . . . . . . 3 __________ . ______ |

||

4Multiply Line 1 by the total on Line 3. If the number results in a decimal, round to the nearest dollar

and enter the result here and on Form

On Form

2012 Louisiana earned income Credit Worksheet

R.S. 47:297.8 allows a refundable credit for resident individuals who claimed and received a Federal Earned Income Credit (EIC). The Federal EIC is available for certain individuals who work, have a valid Social Security Number, and have a qualifying child, or are between ages 25 and 64. These indi- viduals cannot be a qualifying child or dependent of another person.

Complete only if you claimed a Federal earned income Credit (eiC)

1Federal Earned Income Credit – Enter the amount from Federal Form 1040EZ,

|

Line 8a, OR Federal Form 1040A, Line 38a , OR Federal Form 1040, Line 64a |

1 |

|

. 00 |

2 |

Multiply Line 1 above by 3.5 percent, round to the nearest dollar, and enter the result on Line 3 |

2 |

X .035 |

|

3 |

Enter this amount on Form |

3 |

|

. 00 |

6346