designations can be filled in without any problem. Just open FormsPal PDF editor to accomplish the job promptly. To retain our editor on the forefront of convenience, we strive to put into operation user-oriented features and improvements regularly. We are always looking for feedback - join us in revolutionizing how you work with PDF forms. By taking several basic steps, you may start your PDF journey:

Step 1: Access the form in our editor by hitting the "Get Form Button" at the top of this page.

Step 2: Once you launch the online editor, you'll notice the document made ready to be filled in. Aside from filling in various fields, you might also perform other sorts of actions with the file, particularly writing custom text, changing the initial text, adding images, affixing your signature to the form, and a lot more.

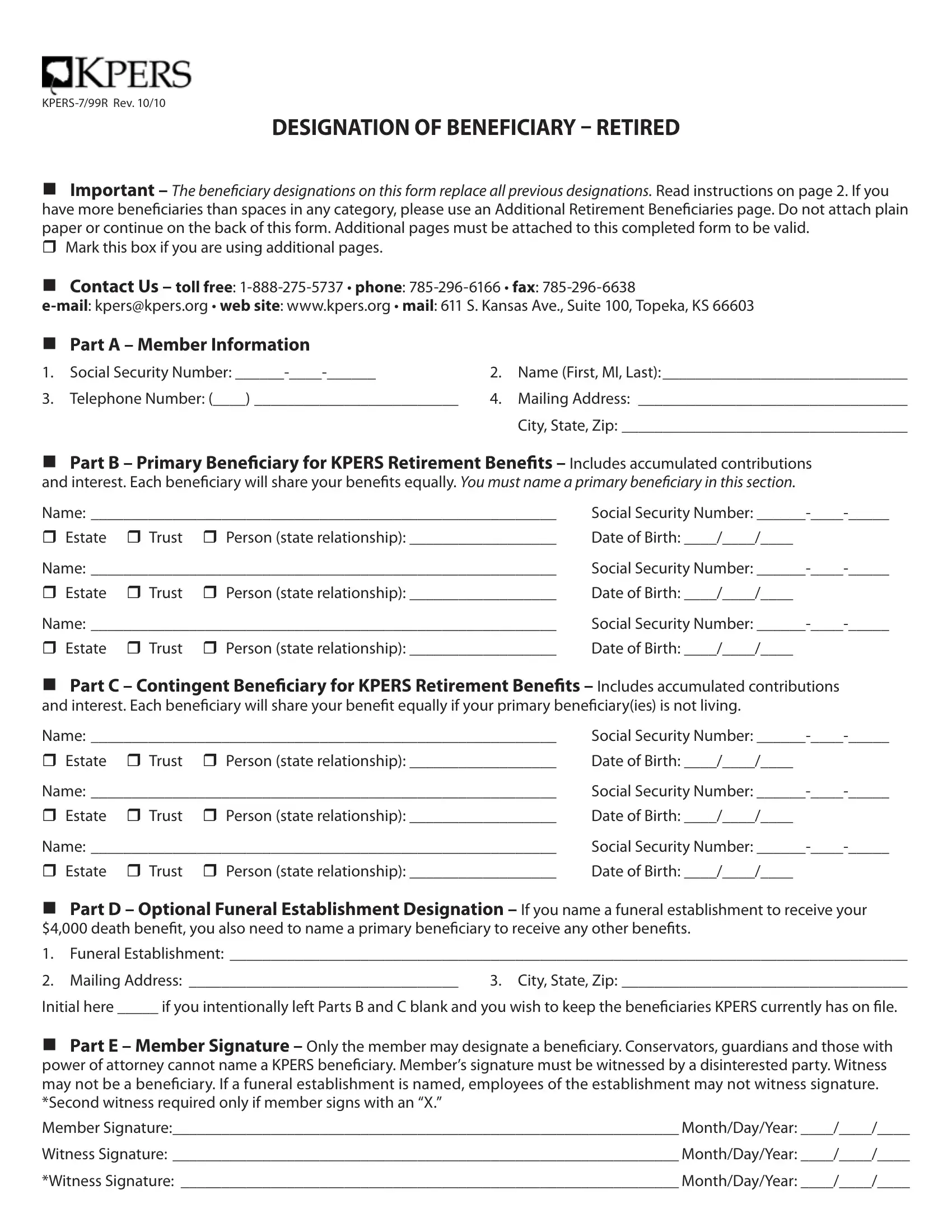

This document requires some specific information; in order to guarantee accuracy and reliability, be sure to take note of the guidelines below:

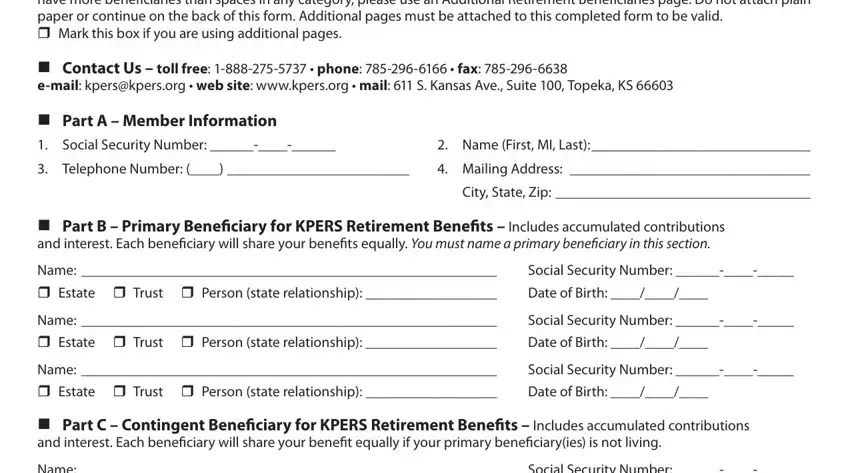

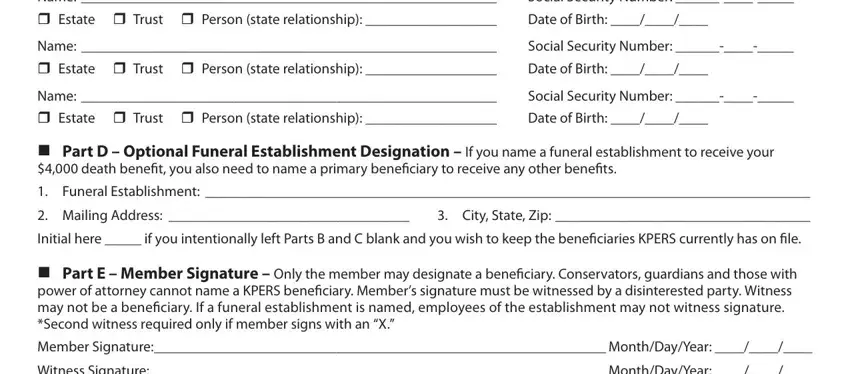

1. The designations usually requires particular information to be inserted. Make certain the following blanks are finalized:

2. The next step is usually to complete these particular blanks: Name, Estate, Name, Estate, Name, Estate, Social Security Number, Trust, Person state relationship, Date of Birth, Social Security Number, Trust, Person state relationship, Date of Birth, and Social Security Number.

Always be really careful while filling out Estate and Social Security Number, because this is where many people make mistakes.

Step 3: Revise the information you've entered into the blank fields and click on the "Done" button. After registering afree trial account with us, it will be possible to download designations or email it immediately. The form will also be readily accessible in your personal account page with your each and every edit. Here at FormsPal.com, we do everything we can to make sure that all your details are maintained secure.