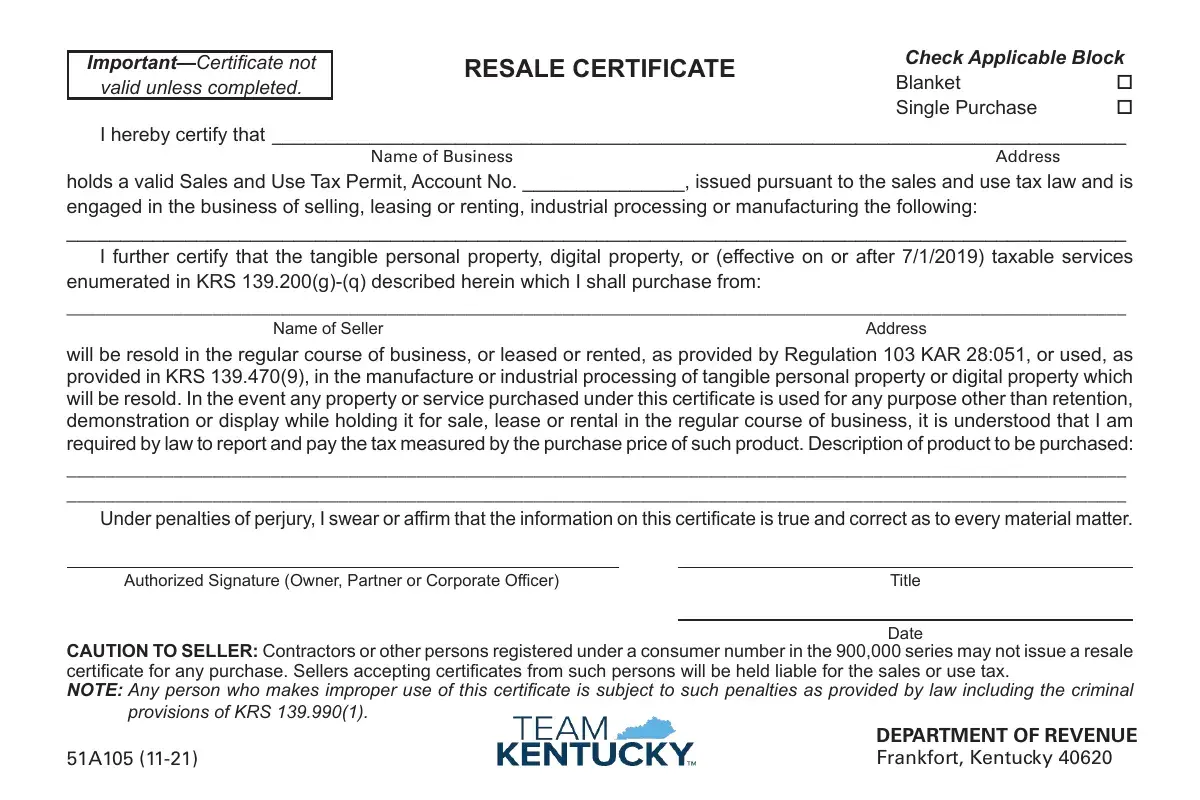

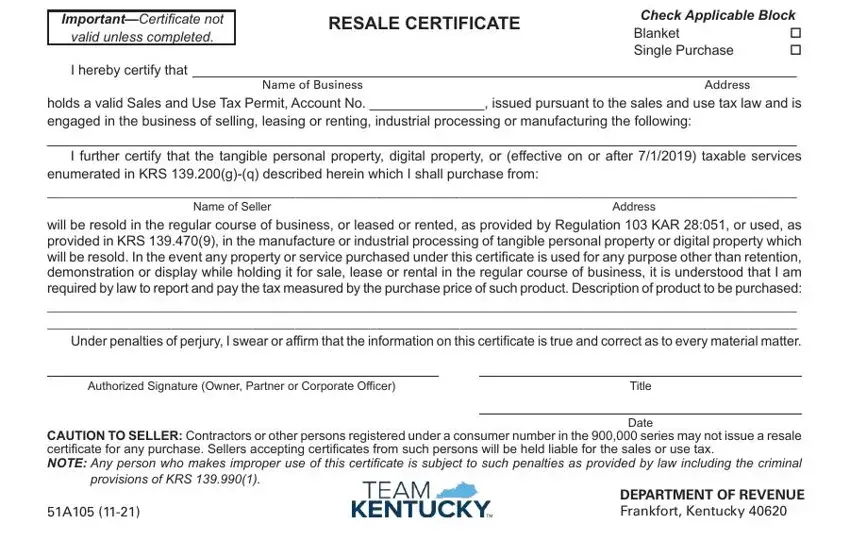

Using PDF forms online is definitely a breeze with our PDF editor. Anyone can fill out resale ky how here in a matter of minutes. In order to make our editor better and less complicated to utilize, we consistently develop new features, with our users' feedback in mind. With a few easy steps, it is possible to begin your PDF journey:

Step 1: Access the PDF doc inside our editor by clicking on the "Get Form Button" at the top of this webpage.

Step 2: With this advanced PDF editing tool, you can do more than just fill in forms. Edit away and make your forms look perfect with customized textual content incorporated, or modify the file's original input to excellence - all that comes with an ability to insert any graphics and sign the PDF off.

It's straightforward to complete the form adhering to this practical guide! This is what you must do:

1. To start with, when filling out the resale ky how, start in the section that includes the next blanks:

Step 3: Check everything you've typed into the blank fields and press the "Done" button. Right after getting afree trial account at FormsPal, you will be able to download resale ky how or email it at once. The file will also be at your disposal through your personal account page with all of your edits. We do not share or sell the details that you use whenever filling out documents at FormsPal.