Navigating the complexities of the biennial coin-operated device application process in South Carolina demands a thorough understanding of the L form, formally known as L-2081. This document, revised last in March 2012 and issued by the State of South Carolina Department of Revenue, serves as a critical tool for those seeking to legally operate coin-operated devices within the state. Designed for a variety of devices, from jukeboxes and billiard tables to video game machines, the form stipulates that licenses, which are non-refundable and non-transferable, must be prorated based on the month of purchase and remain valid through May 31, 2014. The process permits applications either in-person at designated South Carolina Department of Revenue offices or via mail, requiring detailed information including business and owner details, Federal ID number, and specifics about the machines to be licensed. Furthermore, the form outlines a structured tax schedule that varies by device type and application month, ensuring operators meet state financial obligations. Compliance with this process not only involves financial considerations but also a certification by owners that all operated machines comply with state legal standards. This certification is paramount, as it aligns with the state's efforts to regulate coin-operated devices, preventing unauthorized gambling and ensuring that machines are used for amusement purposes only. Knowledge of this form and adherence to its stipulations are essential for operators to navigate the regulatory landscape confidently, underscoring the importance of both understanding and fulfilling these legal requirements accurately.

| Question | Answer |

|---|---|

| Form Name | Form L 2081 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | L-2081, Howard, DLN, Southpark |

1350

2012 |

STATE OF SOUTH CAROLINA |

2014 |

DEPARTMENT OF REVENUE |

BIENNIAL

APPLICATION

(Rev. 3/20/12)

4163

Mail to: SCDOR, COD Section, Columbia, SC |

File #: |

||

Telephone: (803) |

DOR Website: www.sctax.org |

||

|

|||

IMPORTANT INFORMATION: Biennial Licenses are prorated to correspond to the month licenses are purchased (see chart below). They are

PLEASE TYPE OR PRINT:

1. |

Name |

|

|

|

|

|

Title |

|

|||||

2. |

Business Name |

|

|

|

|

|

|

|

|

|

|||

3. |

Business Address |

|

|

|

|

|

|

|

|

|

|||

|

City |

|

State |

|

|

|

Zip Code |

|

|||||

4. |

Federal ID Number |

|

|

|

Telephone Number |

|

|||||||

For Office Use Only

Type I License No

DLN

Amount $

Beg:

End:

Type II License No

DLN

Amount $

No. Type I Machines |

|

|

License Tax |

|||

|

|

X |

$ |

|

= |

|

|

|

|

|

|

||

No. Type II Machines |

|

|

License Tax |

|||

|

|

X |

$ |

|

= |

|

|

|

|

|

|

||

No. Type III Machines |

|

|

License Tax |

|||

|

|

X |

$ |

|

= |

|

|

|

|

|

|

||

|

|

|

|

|

Total Remitted for all |

|

|

|

|

|

|

Licenses (Types) |

|

Total

$

Total

$

Total

$

$

Beg:

End:

Type IV SLED

DLN

Amount $

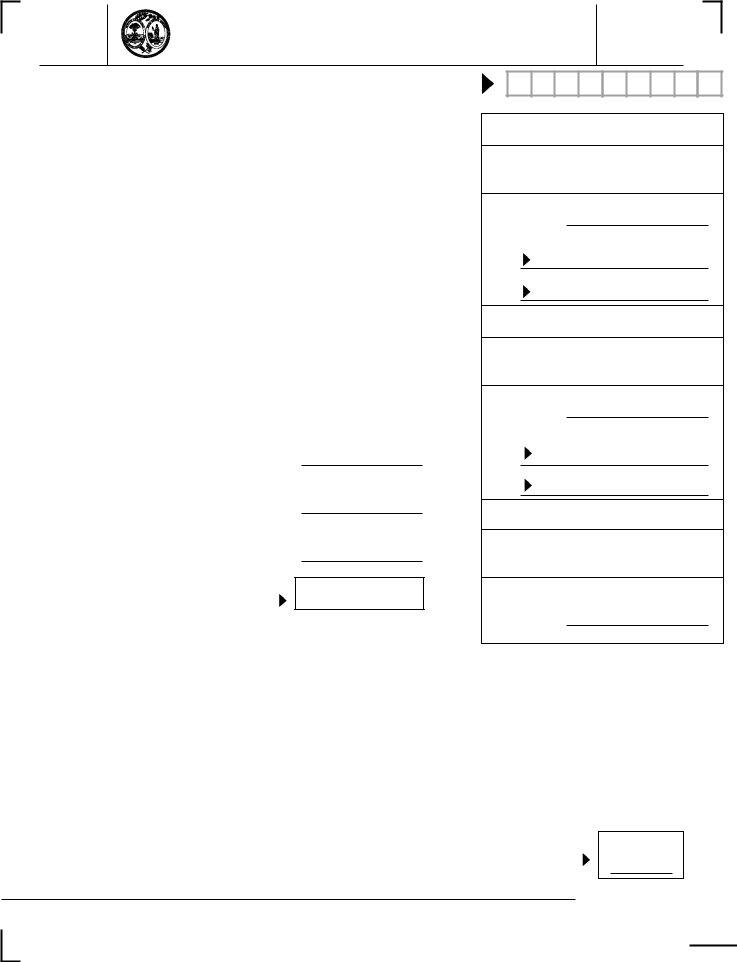

TYPE I

TYPE II

TYPE III

All licenses are

Month of |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

|

purchase |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License |

$50 |

$48 |

$46 |

$44 |

$42 |

$40 |

$38 |

$35 |

$33 |

$31 |

$29 |

$27 |

|

Tax |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License |

$250 |

$242 |

$233 |

$225 |

$217 |

$208 |

$200 |

$192 |

$183 |

$175 |

$167 |

$158 |

|

Tax |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License |

$4000 |

$3833 |

$3667 |

$3500 |

$3333 |

$3167 |

$3000 |

$2833 |

$2667 |

$2500 |

$2333 |

$2167 |

|

Tax |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Remit license tax that corresponds with the month the application is submitted. See reverse for license types.

I hereby certify that the owner/operator, whether individual, partnership, LLC, or corporation, shall own or operate only legal machines in this state, and that the information given in this application is true and correct to the best of my knowledge and belief.

Dist. Code

Signature of Owner/All Partners/ Officer |

Date |

41631029

Type I machines include the following:

1.Type I machines as defined in Section

"Any machine for the playing of music or kiddy rides operated by a slot or mechanical amusement devices and juke boxes wherein is deposited any coin or thing of value."

Billiard or pocket billiard table, footsball table,

2."Every person owning or operating any billiard or pocket billiard table, footsball table, bowling lane table, or skeeball table for profit shall apply for and procure from the Department of Revenue a license for the privilege of operating such billiard or pocket billiard table and pay for such license a biennial tax of fifty dollars for each table owned or operated."

Type II machines include the following:

1.Type II machines as defined in Section

"Any machine for the playing of amusements or video games, without free play feature or machines of the crane type operated by a slot wherein is deposited any coin or thing of value; and any machine for the playing of games or amusements, which has a free play feature, operated by a slot wherein is deposited any coin or thing of value and such machine is of the nonpayout pin table type with levers or "flippers" operated by the player by which the course of the balls can be altered or changed."

Type III machines include the following:

1.Type III machines as defined in Section

A machine of the nonpayout type or

IMPORTANT

License cannot be transferred.

County or city may require a license.

All applications must reflect your account number and your FEI Number and/or Social Security Number.

It will be the operator's responsibility to affix the decal licenses to the machines so that no one can remove them.

Any machine on location without a proper or current license and owner identification affixed to the machine will be in violation. The responsible person will be charged a penalty per violation and will be required to obtain a license for that machine.

Section

Any person violating the provisions of this section is guilty of a misdemeanor and, upon conviction, must be fined not more than five hundred dollars or imprisoned for a period of not more than one year, or both.

Section

Section

Section

Section

Section

A license will not be issued to a person with any outstanding state tax liabilities. Any license tax fee paid with the application will be applied to the tax liabilities.

For more information call (803)

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation