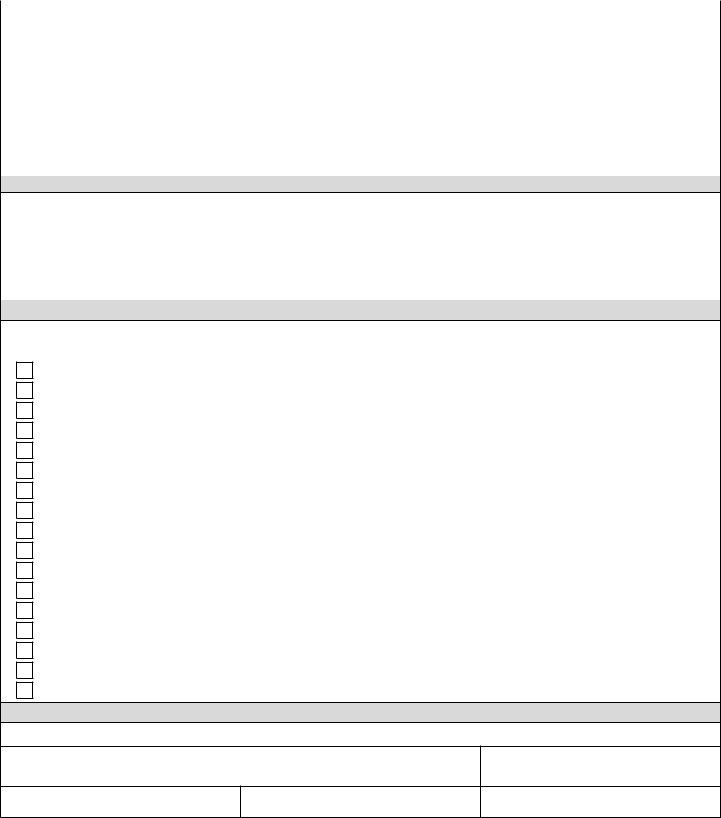

Michigan Department of Treasury |

L-4260 |

2766 (Rev. 01-15) |

|

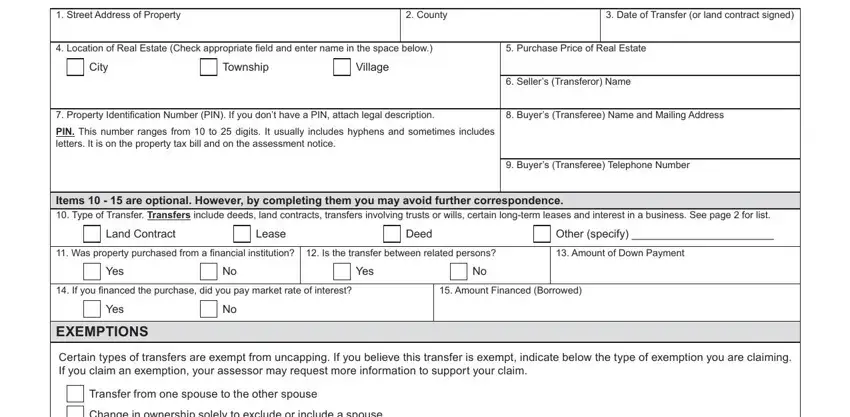

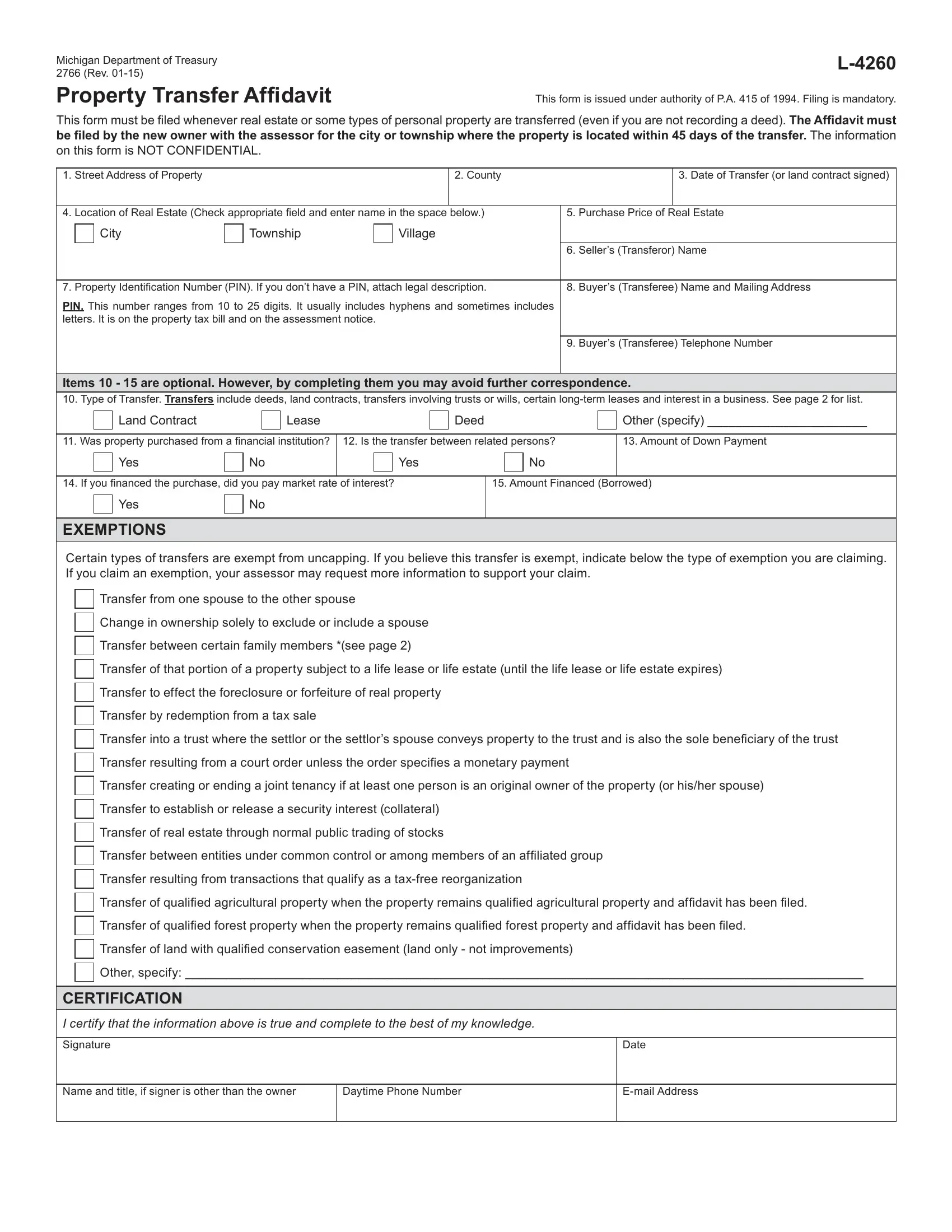

Property Transfer Afidavit

This form is issued under authority of P.A. 415 of 1994. Filing is mandatory.

This form must be iled whenever real estate or some types of personal property are transferred (even if you are not recording a deed). The Afidavit must be iled by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information

on this form is NOT CONFIDENTIAL.

1. |

Street Address of Property |

|

|

|

|

2. County |

|

|

3. Date of Transfer (or land contract signed) |

|

|

|

|

|

|

|

|

|

|

|

4. |

Location of Real Estate (Check appropriate ield and enter name in the space |

below.) |

5. |

Purchase Price of Real Estate |

|

|

City |

|

Township |

|

Village |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Seller’s (Transferor) Name |

|

|

|

|

|

|

|

|

|

|

|

7. |

Property Identiication Number (PIN). If you don’t have a PIN, attach legal description. |

8. |

Buyer’s (Transferee) Name and Mailing Address |

PIN. This number ranges from 10 to 25 digits. It usually includes hyphens and sometimes includes |

|

|

|

letters. It is on the property tax bill and on the assessment notice. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Buyer’s (Transferee) Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

Items 10 - 15 are optional. However, by completing them you may avoid further correspondence.

10.Type of Transfer. TRANSFERS include deeds, land contracts, transfers involving trusts or wills, certain long-term leases and interest in a business. See page 2 for list.

|

|

Land Contract |

|

|

|

Lease |

|

|

|

|

Deed |

|

Other (specify) _______________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. Was property purchased from a inancial institution? |

12. Is the transfer between related persons? |

|

13. Amount of Down Payment |

|

|

Yes |

|

No |

|

|

Yes |

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. If you inanced the purchase, did you pay market rate |

of interest? |

|

|

15. Amount Financed (Borrowed) |

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

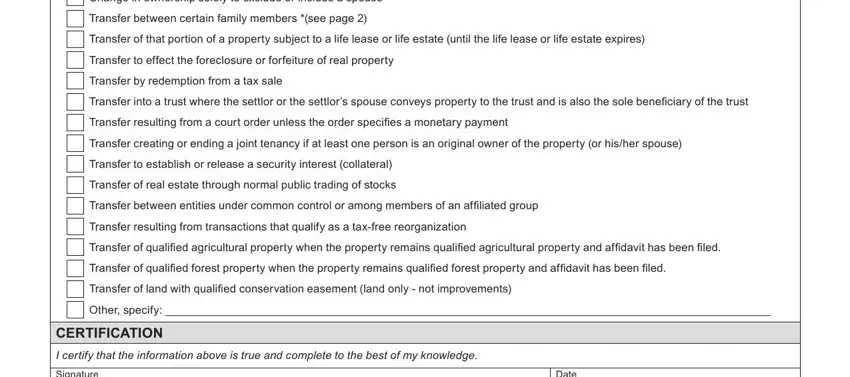

EXEMPTIONS

Certain types of transfers are exempt from uncapping. If you believe this transfer is exempt, indicate below the type of exemption you are claiming. If you claim an exemption, your assessor may request more information to support your claim.

Transfer from one spouse to the other spouse

Change in ownership solely to exclude or include a spouse

Transfer between certain family members *(see page 2)

Transfer of that portion of a property subject to a life lease or life estate (until the life lease or life estate expires)

Transfer to effect the foreclosure or forfeiture of real property

Transfer by redemption from a tax sale

Transfer into a trust where the settlor or the settlor’s spouse conveys property to the trust and is also the sole beneiciary of the trust Transfer resulting from a court order unless the order speciies a monetary payment

Transfer creating or ending a joint tenancy if at least one person is an original owner of the property (or his/her spouse)

Transfer to establish or release a security interest (collateral)

Transfer of real estate through normal public trading of stocks

Transfer between entities under common control or among members of an afiliated group Transfer resulting from transactions that qualify as a tax-free reorganization

Transfer of qualiied agricultural property when the property remains qualiied agricultural property and afidavit has been iled. Transfer of qualiied forest property when the property remains qualiied forest property and afidavit has been iled.

Transfer of land with qualiied conservation easement (land only - not improvements)

Other, specify: __________________________________________________________________________________________________

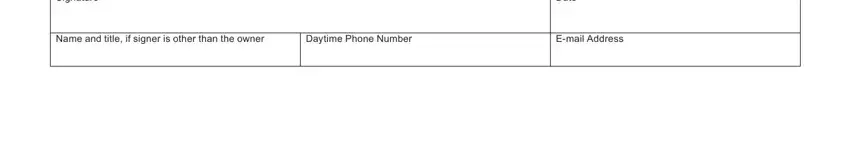

CERTIFICATION

I certify that the information above is true and complete to the best of my knowledge.

Name and title, if signer is other than the owner

2766, Page 2

Instructions:

This form must be iled when there is a transfer of real property or one of the following types of personal property:

•Buildings on leased land.

•Leasehold improvements, as deined in MCL Section 211.8(h).

•Leasehold estates, as deined in MCL Section 211.8(i) and (j).

Transfer of ownership means the conveyance of title to or a present interest in property, including the beneicial use of the property. For complete descriptions of qualifying transfers, please refer to MCL Section 211.27a(6)(a-j).

Excerpts from Michigan Compiled Laws (MCL), Chapter 211

*Section 211.27a(7)(t): Beginning December 31, 2014, a transfer of residential real property if the transferee is the transferor’s or the transferor’s spouse’s mother, father, brother, sister, son, daughter, adopted son, adopted daughter, grandson, or granddaughter and the residential real property is not used for any commercial purpose following the conveyance. Upon request by the department of treasury or the assessor, the transferee shall furnish proof within 30 days that the transferee meets the requirements of this subparagraph. If a transferee fails to comply with a request by the department of treasury or assessor under this subparagraph, that transferee is subject to a ine of $200.00.

Section 211.27a(10): “... the buyer, grantee, or other transferee of the property shall notify the appropriate assessing ofice in the local unit of government in which the property is located of the transfer of ownership of the property within 45 days of the transfer of ownership, on a form prescribed by the state tax commission that states the parties to the transfer, the date of the transfer, the actual consideration for the transfer, and the property’s parcel identiication number or legal description.”

Section 211.27(5): “Except as otherwise provided in subsection (6), the purchase price paid in a transfer of property

is not the presumptive true cash value of the property transferred. In determining the true cash value of transferred property, an assessing oficer shall assess that property using the same valuation method used to value all other property of that same classiication in the assessing jurisdiction.”

Penalties:

Section 211.27b(1): “If the buyer, grantee, or other transferee in the immediately preceding transfer of ownership of property does not notify the appropriate assessing ofice as required by section 27a(10), the property’s taxable value shall be adjusted under section 27a(3) and all of the following shall be levied:

(a)Any additional taxes that would have been levied if the transfer of ownership had been recorded as required under this act from the date of transfer.

(b)Interest and penalty from the date the tax would have been originally levied.

(c)For property classiied under section 34c as either industrial real property or commercial real property, a penalty in the following amount:

(i)Except as otherwise provided in subparagraph (ii), if the sale price of the property transferred is $100,000,000.00 or less, $20.00 per day for each separate failure beginning after the 45 days have elapsed, up to a maximum of $1,000.00.

(ii)If the sale price of the property transferred is more than $100,000,000.00, $20,000.00 after the 45 days have elapsed.

(d)For real property other than real property classiied under section 34c as industrial real property or commercial real property, a penalty of $5.00 per day for each separate failure beginning after the 45 days have elapsed, up to a maximum of $200.00.