You are able to complete vt lc 142 easily with our online tool for PDF editing. To make our editor better and less complicated to use, we continuously come up with new features, with our users' suggestions in mind. Should you be looking to get started, here's what it's going to take:

Step 1: Firstly, open the tool by pressing the "Get Form Button" above on this webpage.

Step 2: The tool will allow you to change your PDF form in a range of ways. Change it with your own text, adjust what is originally in the file, and put in a signature - all readily available!

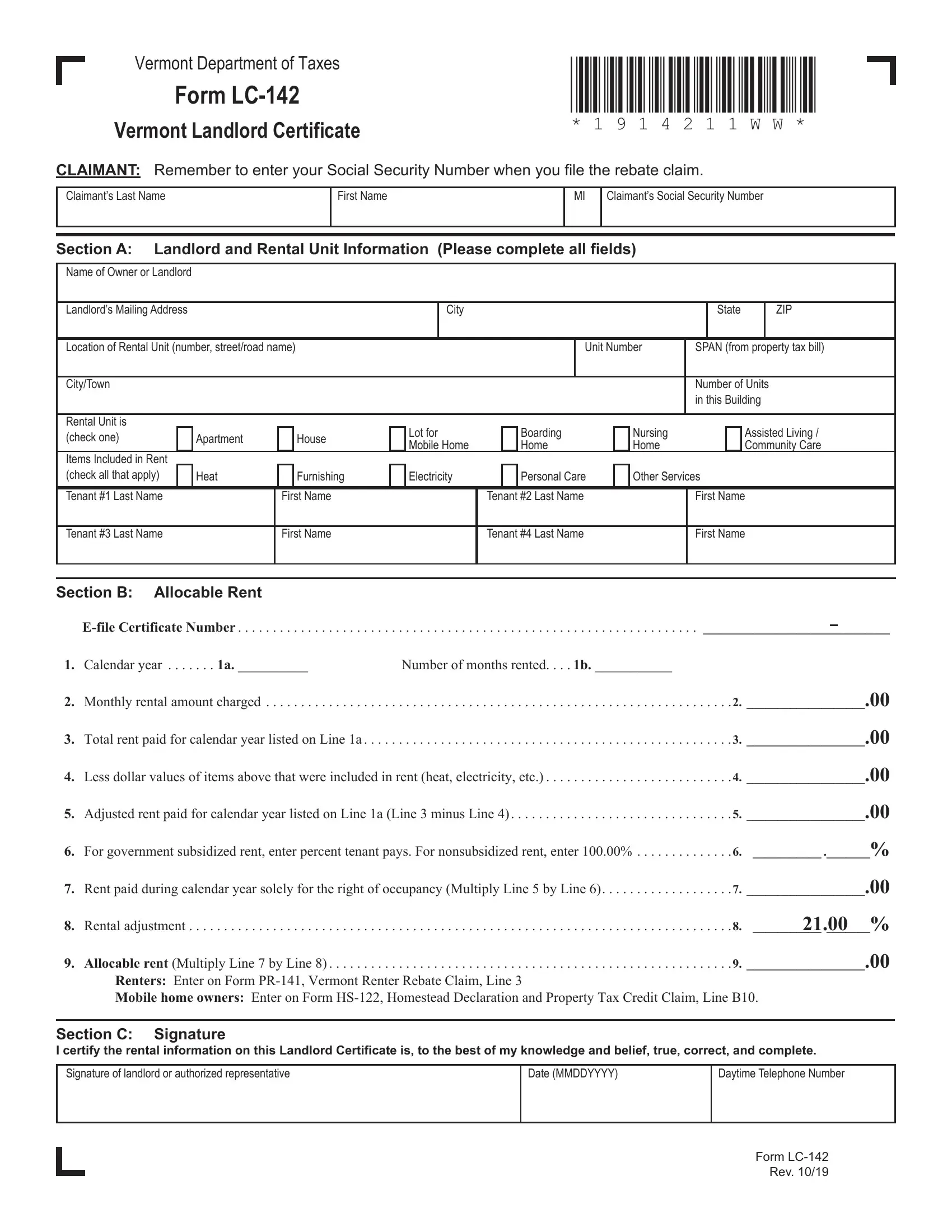

This form will require some specific information; to guarantee consistency, remember to bear in mind the guidelines down below:

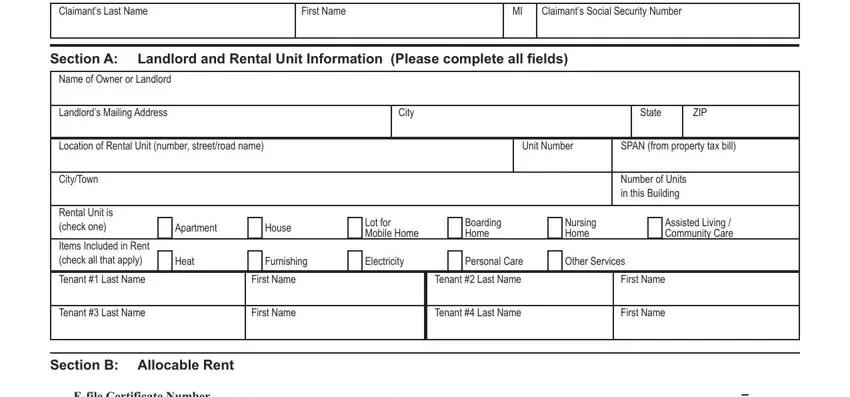

1. It is crucial to fill out the vt lc 142 accurately, so be mindful when filling in the segments containing all of these blank fields:

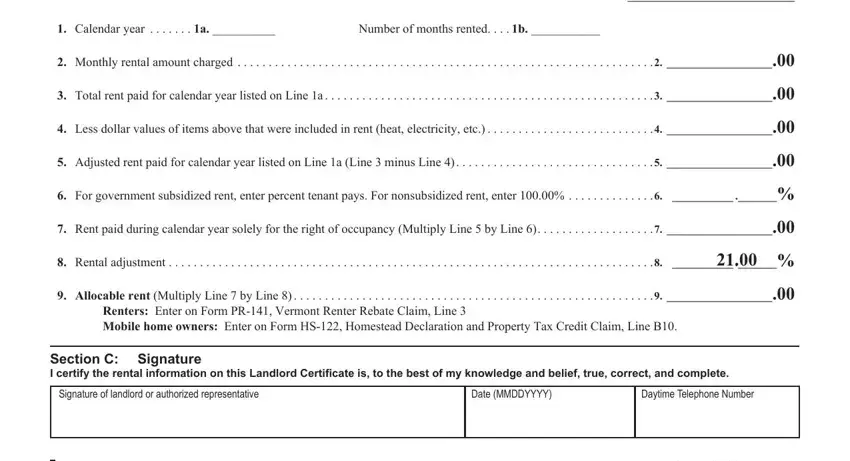

2. Right after filling out this section, go on to the subsequent step and enter the necessary details in all these blank fields - Efile Certificate Number, Calendar year a, Number of months rented b, Monthly rental amount charged, Total rent paid for calendar year, Less dollar values of items above, Adjusted rent paid for calendar, For government subsidized rent, Rent paid during calendar year, Rental adjustment, Allocable rent Multiply Line by, Renters Enter on Form PR Vermont, Section C Signature I certify the, Signature of landlord or, and Date MMDDYYYY.

Always be extremely mindful while completing Less dollar values of items above and Monthly rental amount charged, because this is where a lot of people make some mistakes.

Step 3: Always make sure that the information is correct and press "Done" to conclude the task. Make a free trial account with us and get immediate access to vt lc 142 - download, email, or change from your personal account page. We don't share any details that you enter while working with forms at our site.