You may complete new jersey 5 litter effectively by using our PDFinity® PDF editor. To retain our editor on the leading edge of efficiency, we work to put into operation user-oriented features and enhancements on a regular basis. We're at all times thankful for any feedback - play a vital part in reshaping the way you work with PDF forms. Getting underway is easy! All you should do is take the next basic steps directly below:

Step 1: Just press the "Get Form Button" at the top of this webpage to see our form editing tool. Here you'll find everything that is needed to work with your document.

Step 2: The editor offers the ability to change your PDF in a range of ways. Modify it by including any text, correct what's already in the PDF, and place in a signature - all within a few clicks!

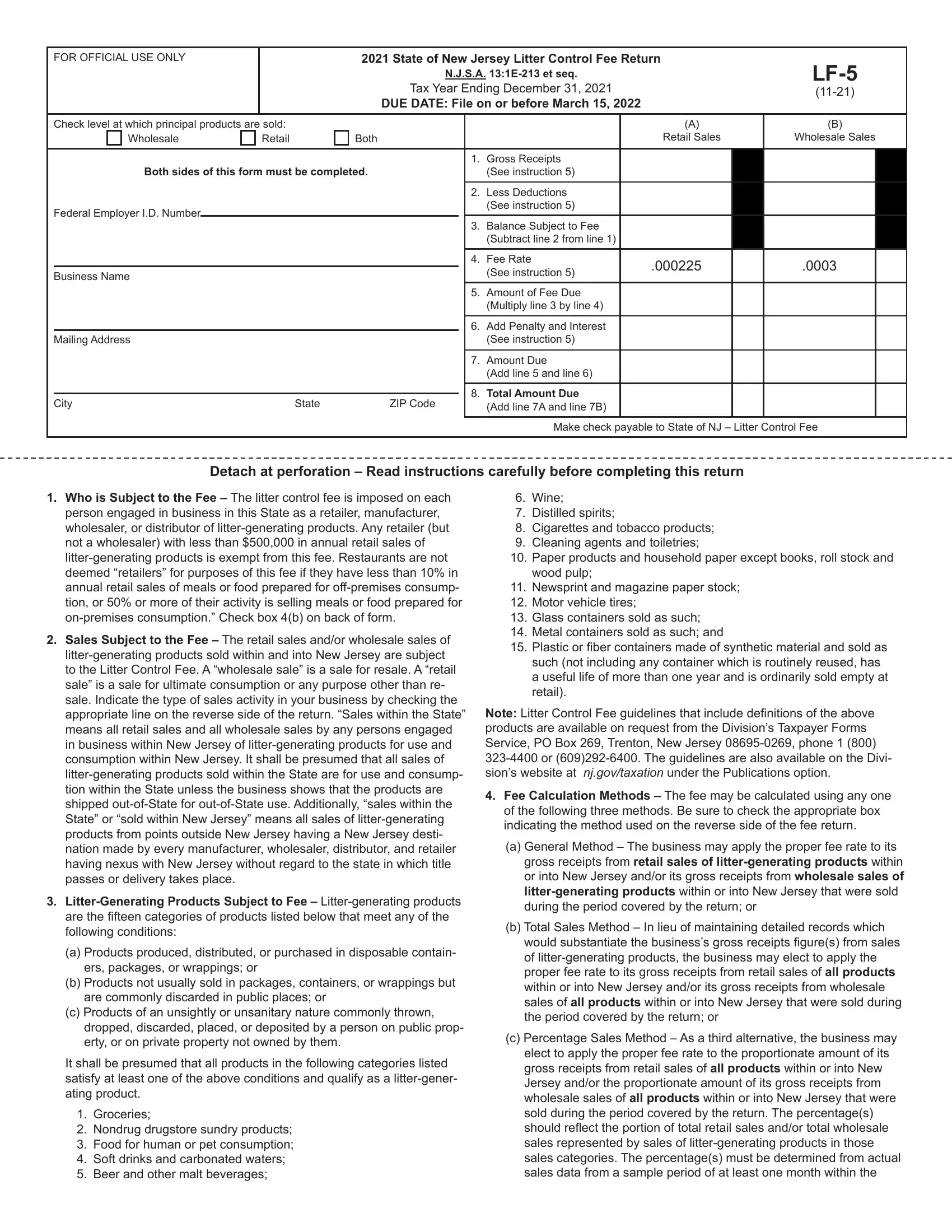

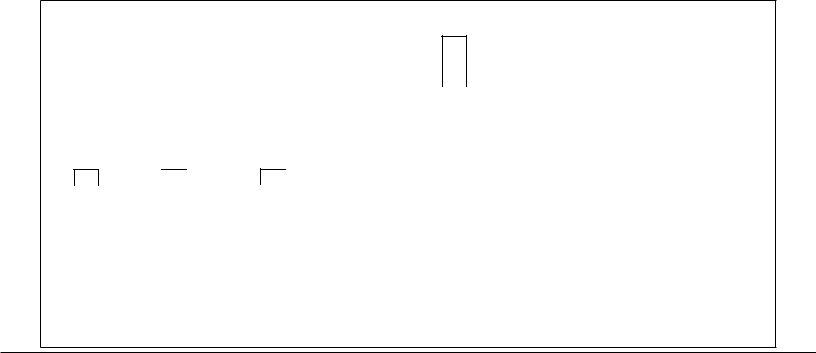

In an effort to fill out this PDF form, be certain to provide the information you need in each area:

1. Whenever filling out the new jersey 5 litter, be certain to incorporate all of the needed blanks in their associated area. It will help to hasten the process, allowing for your information to be handled quickly and appropriately.

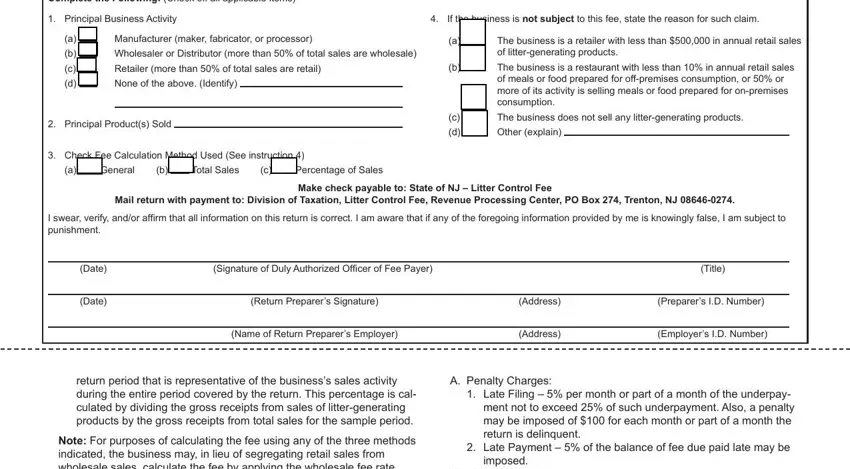

2. Once the last part is completed, you're ready to insert the needed particulars in Complete the Following Check off, Principal Business Activity, If the business is not subject to, Manufacturer maker fabricator or, Retailer more than of total sales, Principal Products Sold, The business is a retailer with, The business is a restaurant with, The business does not sell any, Other explain, Check Fee Calculation Method Used, General, Total Sales, Percentage of Sales, and Mail return with payment to so you can progress further.

Regarding Other explain and If the business is not subject to, be sure that you double-check them here. These two are viewed as the most important fields in the form.

Step 3: Before addressing the next step, check that all blanks were filled out correctly. As soon as you believe it is all fine, press “Done." Sign up with us right now and instantly gain access to new jersey 5 litter, available for downloading. All adjustments you make are kept , meaning you can change the form later if necessary. At FormsPal.com, we do everything we can to ensure that all your information is maintained secure.