Secretary of State

Business Programs Division

Business Entities, 1500 11th Street, Sacramento, CA 95814

Limited Partnerships

California Tax Information

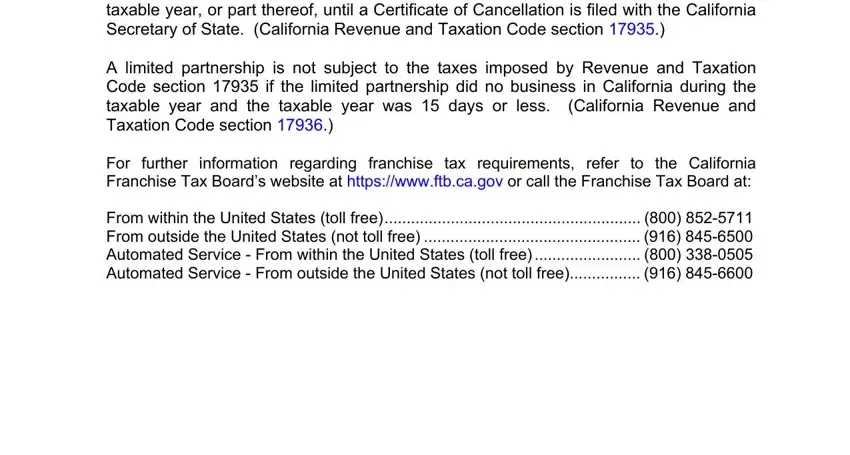

Registration of a limited partnership with the California Secretary of State will obligate a limited partnership to pay to the California Franchise Tax Board an annual minimum tax of $800.00. The tax is required to be paid for the taxable year of registration and each taxable year, or part thereof, until a Certificate of Cancellation is filed with the California Secretary of State. (California Revenue and Taxation Code section 17935.)

A limited partnership is not subject to the taxes imposed by Revenue and Taxation Code section 17935 if the limited partnership did no business in California during the taxable year and the taxable year was 15 days or less. (California Revenue and Taxation Code section 17936.)

For further information regarding franchise tax requirements, refer to the California Franchise Tax Board’s website at https://www.ftb.ca.gov or call the Franchise Tax Board at:

From within the United States (toll free) |

(800) 852-5711 |

From outside the United States (not toll free) |

(916) 845-6500 |

Automated Service - From within the United States (toll free) |

(800) 338-0505 |

Automated Service - From outside the United States (not toll free) |

(916) 845-6600 |

LP Tax Info (Rev. 01/2013) |

California Secretary of State |

|

www.sos.ca.gov/business/be |

|

(916) 657-5448 |

LP-5 File #

State of California

Secretary of State

Foreign Limited Partnership

Application for Registration

A $70.00 filing fee AND a certificate of good standing by an authorized public official of the jurisdiction of formation must accompany this form.

IMPORTANT – Read instructions before completing this form. |

This Space For Filing Use Only |

Entity Name (See instructions for name requirements in the State of California.)

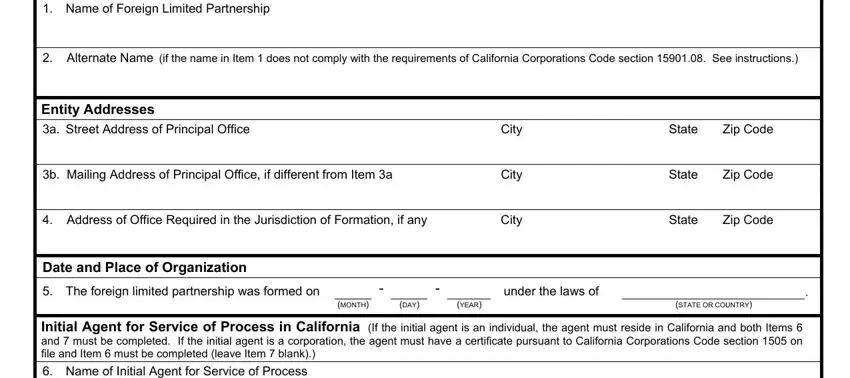

1.Name of Foreign Limited Partnership

2.Alternate Name (if the name in Item 1 does not comply with the requirements of California Corporations Code section 15901.08. See instructions.)

Entity Addresses

3a. |

Street Address of Principal Office |

City |

State |

Zip Code |

|

|

|

|

|

3b. |

Mailing Address of Principal Office, if different from Item 3a |

City |

State |

Zip Code |

|

|

|

|

|

4. |

Address of Office Required in the Jurisdiction of Formation, if any |

City |

State |

Zip Code |

Date and Place of Organization

5. The foreign limited partnership was formed on |

|

- |

|

- |

|

under the laws of |

|

. |

|

(MONTH) |

|

(DAY) |

(YEAR) |

(STATE OR COUNTRY) |

Initial Agent for Service of Process in California (If the initial agent is an individual, the agent must reside in California and both Items 6 and 7 must be completed. If the initial agent is a corporation, the agent must have a certificate pursuant to California Corporations Code section 1505 on file and Item 6 must be completed (leave Item 7 blank).)

6.Name of Initial Agent for Service of Process

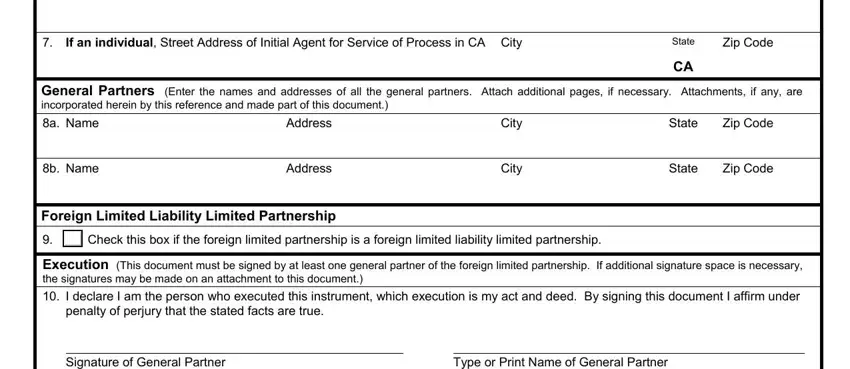

7. If an individual, Street Address of Initial Agent for Service of Process in CA City |

State |

Zip Code |

|

CA |

|

General Partners (Enter the names and addresses of all the general partners. Attach additional pages, if necessary. Attachments, if any, are incorporated herein by this reference and made part of this document.)

8a. |

Name |

Address |

City |

State |

Zip Code |

|

|

|

|

|

|

8b. |

Name |

Address |

City |

State |

Zip Code |

Foreign Limited Liability Limited Partnership

9. Check this box if the foreign limited partnership is a foreign limited liability limited partnership.

Execution (This document must be signed by at least one general partner of the foreign limited partnership. If additional signature space is necessary, the signatures may be made on an attachment to this document.)

10.I declare I am the person who executed this instrument, which execution is my act and deed. By signing this document I affirm under penalty of perjury that the stated facts are true.

Signature of General Partner |

Type or Print Name of General Partner |

|

|

|

|

LP-5 (REV 01/2013) |

APPROVED BY SECRETARY OF STATE |

|

|

Instructions for Completing the

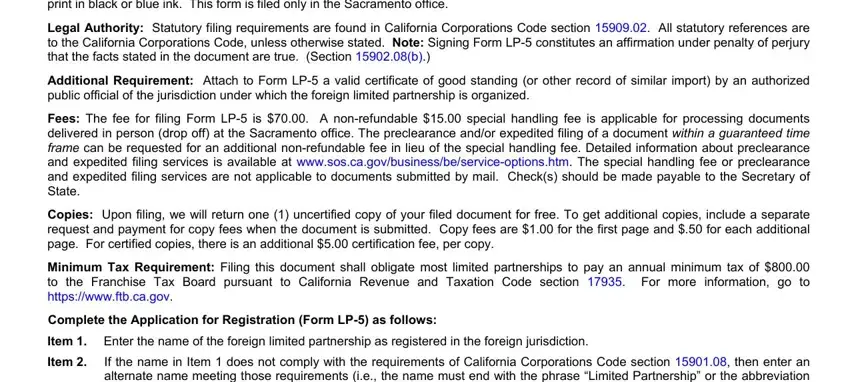

Application for Registration (Form LP-5)

Where to File: For easier completion, this form is available on the Secretary of State's website at www.sos.ca.gov/business/be/forms.htm and can be viewed, filled in and printed from your computer. The completed form along with the applicable fees can be mailed to Secretary of State, Document Filing Support Unit, P.O. Box 944225, Sacramento, CA 94244-2250 or delivered in person (drop off) to the Sacramento office, 1500 11th Street, 3rd Floor, Sacramento, CA 95814. If you are not completing this form online, please type or legibly print in black or blue ink. This form is filed only in the Sacramento office.

Legal Authority: Statutory filing requirements are found in California Corporations Code section 15909.02. All statutory references are

to the California Corporations Code, unless otherwise stated. Note: Signing Form LP-5 constitutes an affirmation under penalty of perjury that the facts stated in the document are true. (Section 15902.08(b).)

Additional Requirement: Attach to Form LP-5 a valid certificate of good standing (or other record of similar import) by an authorized public official of the jurisdiction under which the foreign limited partnership is organized.

Fees: The fee for filing Form LP-5 is $70.00. A non-refundable $15.00 special handling fee is applicable for processing documents delivered in person (drop off) at the Sacramento office. The preclearance and/or expedited filing of a document within a guaranteed time frame can be requested for an additional non-refundable fee in lieu of the special handling fee. Detailed information about preclearance and expedited filing services is available at www.sos.ca.gov/business/be/service-options.htm. The special handling fee or preclearance and expedited filing services are not applicable to documents submitted by mail. Check(s) should be made payable to the Secretary of State.

Copies: Upon filing, we will return one (1) uncertified copy of your filed document for free. To get additional copies, include a separate request and payment for copy fees when the document is submitted. Copy fees are $1.00 for the first page and $.50 for each additional page. For certified copies, there is an additional $5.00 certification fee, per copy.

Minimum Tax Requirement: Filing this document shall obligate most limited partnerships to pay an annual minimum tax of $800.00 to the Franchise Tax Board pursuant to California Revenue and Taxation Code section 17935. For more information, go to https://www.ftb.ca.gov.

Complete the Application for Registration (Form LP-5) as follows:

Item 1. Enter the name of the foreign limited partnership as registered in the foreign jurisdiction.

Item 2. If the name in Item 1 does not comply with the requirements of California Corporations Code section 15901.08, then enter an alternate name meeting those requirements (i.e., the name must end with the phrase “Limited Partnership” or the abbreviation “LP” or “L.P.” and may not contain the words “bank,” “insurance,” “trust,” “trustee,” “incorporated,” “inc.,” “corporation,” or “corp.” Note: If the foreign limited partnership is a foreign limited liability limited partnership, the name must contain the phrase “limited liability limited partnership,” or the abbreviation “LLLP” or “L.L.L.P.” and may not contain the abbreviation “LP” or “L.P.”).

Item 3a. Enter the street address of the principal office. (Section 15901.02.) Do not use a P.O. Box address or abbreviate the name of the city.

Item 3b. Enter the mailing address of the principal office, if different from the street address in Item 3a. Do not abbreviate the name of the city.

Item 4. Enter the address of the office required to be maintained by the foreign limited partnership under the laws of the foreign jurisdiction, if any. Do not abbreviate the name of the city.

Item 5. Enter the date of formation and the state (or other jurisdiction) under which the foreign limited partnership is organized.

Items Enter the name of the initial agent for service of process in California. An agent is an individual, whether or not affiliated with the 6 & 7. limited partnership, who resides in California or a corporation designated to accept service of process if the limited partnership is sued. The agent should agree to accept service of process on behalf of the limited partnership prior to designation. If a corporation is designated as agent, that corporation must have previously filed with the Secretary of State, a certificate pursuant to Corporations Code section 1505. Note: A limited partnership cannot act as its own agent and no domestic or foreign corporation may file pursuant to Section 1505 unless the corporation is currently authorized to engage in business in California

and is in good standing on the records of the Secretary of State.

If an individual is designated as the initial agent, complete Items 6 and 7. If a corporation is designated as the initial agent, complete only Item 6 and proceed to Item 8 (do not complete Item 7).

Items Enter the name and address of each general partner. Do not abbreviate the name of the city. If there are more than two 8a - 8b. general partners, state the name and address of each additional general partner in an attachment to Form LP-5.

Item 9. Check the box if the foreign limited partnership is a foreign limited liability limited partnership.

Item 10. Form LP-5 must be signed by at least one general partner of the foreign limited partnership. (Section 15902.04)

If Form LP-5 is signed by any person other than the general partner(s), the signature must be followed by the words “signature pursuant to Section____________________ ” identifying the appropriate statutory authority. (Section 15902.05.)

If Form LP-5 is signed by an attorney-in-fact, the signature should be followed by the words “Attorney-in-fact for (name of the partner).” (Section 15902.04)

If a trust is designated as a general partner, Form LP-5 should be signed by a trustee as follows: _____________________

trustee for ______________________ trust (including the date of the trust, if applicable). Example: Mary Todd, trustee of the Lincoln Family Trust (U/T/A 5-1-94).

If additional signature space is necessary, the signatures may be made on an attachment to Form LP-5.

Any attachments to Form LP-5 are incorporated by reference and made part of Form LP-5. All attachments should be 8 ½” x 11”, one-sided and legible.