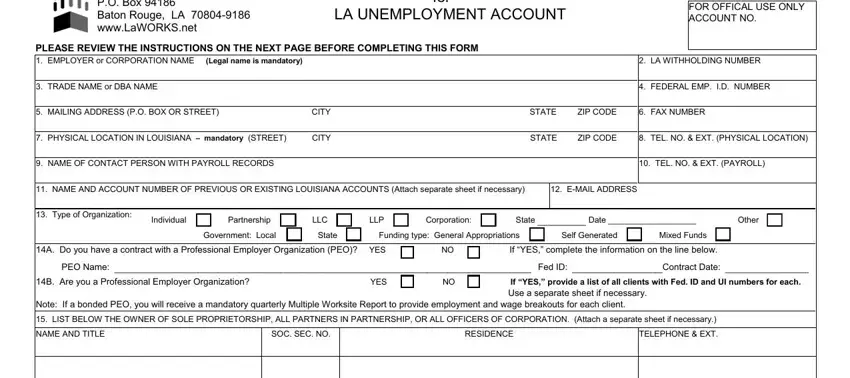

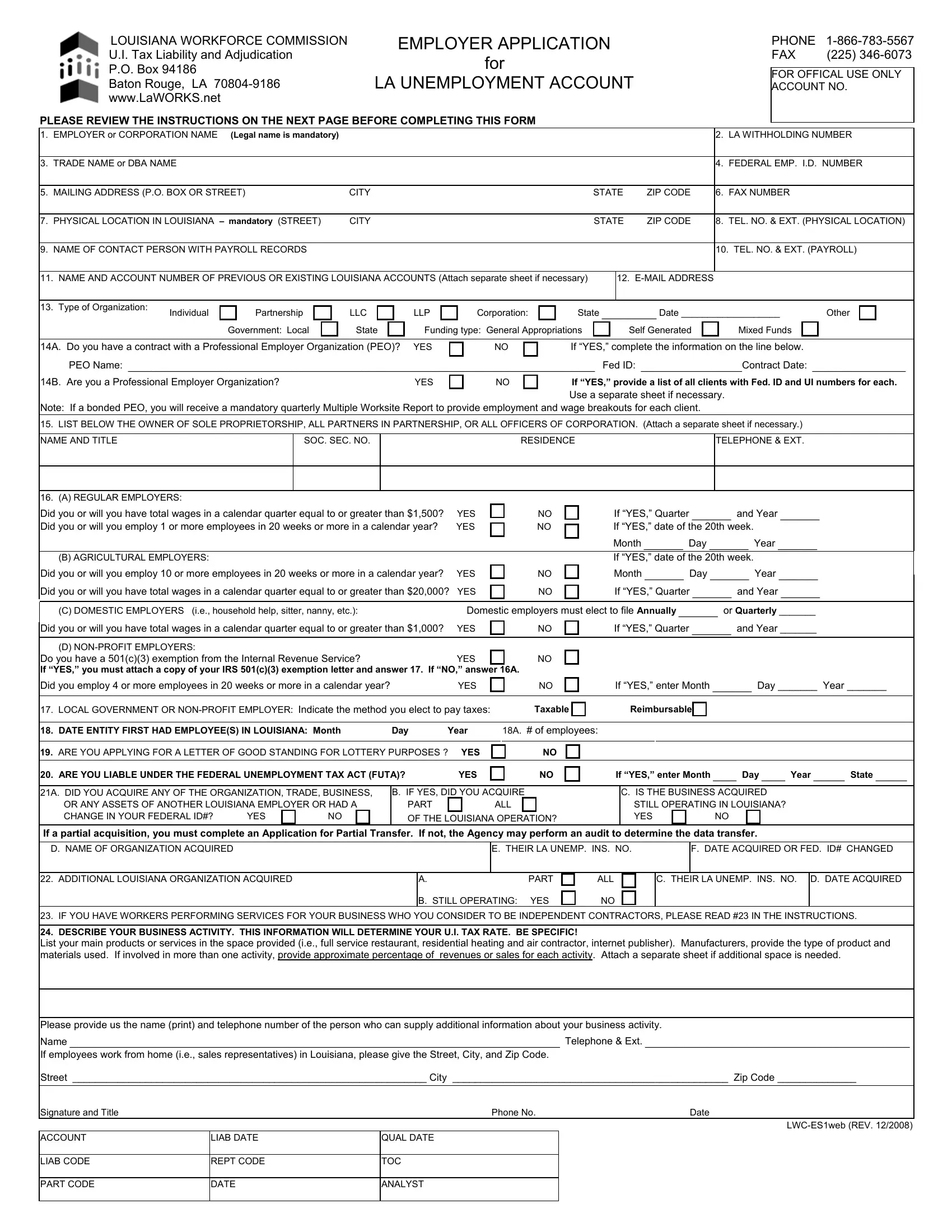

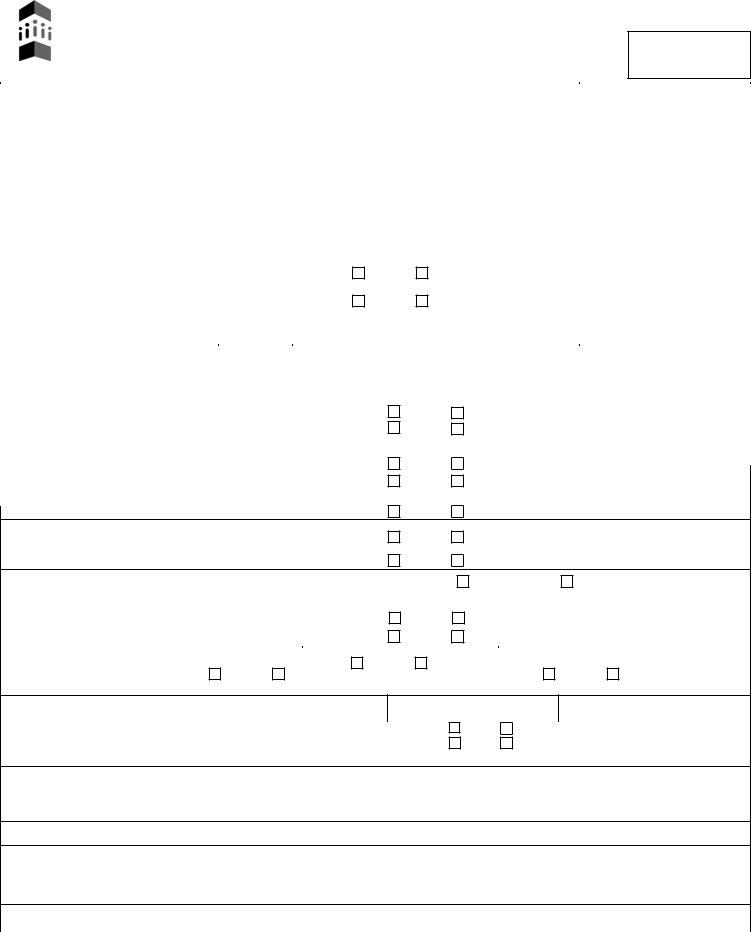

INSTRUCTIONS FOR EMPLOYER ACCOUNT APPLICATION

Do not submit this form until you can satisfy one of these requirements:

•You meet one of the requirements in #16;

•OR you answer “Yes” to #20 and have employees in Louisiana;

•OR you answer “Yes” to Number #21A;

•OR you are a local or state government employer.

1.Enter the legal employer name or full corporation name as it appears on your corporate seal. Do not use abbreviations unless the legal name uses the same abbreviations.

2.Enter your Louisiana Withholding Number (Louisiana Revenue Number).

3.Enter the name by which the business is known or the “Doing Business As” (DBA) name.

4.Enter your Federal Employer’s Identification Number (FEIN/FUTA). A change in Federal ID Number alone requires completion of a new Employer Account Application.

5.Enter the mailing address to which reports, notices, and correspondence should be mailed by this Agency.

6.Enter your fax number if available.

7.Enter the actual location of your business in Louisiana. This must be a Louisiana address. For employees who work out of their homes, this is needed for coding purposes only; nothing is mailed to this address.

8.Enter the telephone number and extension of your physical location.

9.Enter the name of the person or company that prepares your payroll records or has knowledge of such records.

10.Enter the telephone number and extension of the person or company listed in #9.

11.Enter all LA Unemployment Insurance (UI) account numbers and names if you previously filed or currently file reports to LA.

12.Enter an e-mail address if available.

13.Check the box to the right of the word that describes the type of ownership. Louisiana will treat LLCs as a partnership unless IRS Form 8832 is attached for election of treatment. Enter the state of incorporation and date of incorporation. If government, list whether local or state. If state government, check whether funding is entirely from General Appropriations, Self-generated, or a mixture of General Appropriations and Self- generated.

14A. If you are an employer who has a contract with a Professional Employer Organization (PEO), provide the PEO’s name, PEO’s Federal ID#, and the date of your PEO contract. Note: Employers may be liable for unpaid taxes of the PEO.

14B. If you are a PEO completing this Employer Account Application, provide a list of all your clients with the Federal ID# and State UI# of each. Use a separate sheet if necessary.

15.List the full name and title, Social Security Number, residence address, and telephone number and extension of all owners, partners, or officers of the corporation. Attach a separate sheet if necessary.

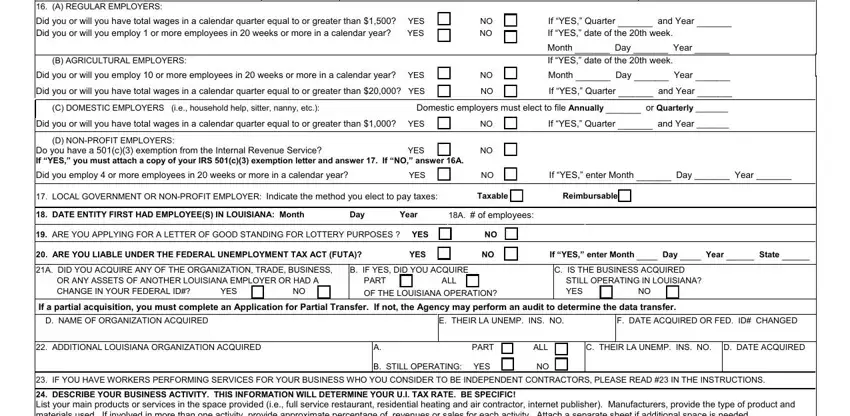

16.Check A, B, C, or D. If you are a domestic employer, you must file either quarterly or annually. If you are a non-profit employer, you must attach your 501(c)(3) exemption and answer #17. If you do not have a 501(c)(3), you will be treated as a regular employer; answer #16A. When you receive the 501(c)(3), submit it to the Agency for consideration on non-profit status. If approved, you will be granted non-profit status effective as of the IRS’s approval of such status.

17.If you are a local government or non-profit employer, indicate the method you elect to pay taxes:

Taxable: employer pays taxes on wages paid to employees at a computed tax rate.

Reimbursable: employer pays the actual cost of benefits paid to former employees.

18.Enter the month, day, and year you first had employees who were paid wages in Louisiana.

18A. Enter the number of employees employed when your entity first began in Louisiana.

19.Answer “Yes” or “No” if you are a Lottery Retailer.

20.If “Yes,” enter the date and state you first became liable to FUTA.

21A. Assets are employees, operations, property, trade name, etc. If “Yes,” you must answer B, C, D, E, and F. If you had a change in entity (eg.,

individual to corp., corp. to LLC, etc.) with a Federal ID# change, this section applies to you.

21B. If a partial acquisition, the Application and Agreement for Partial Transfer must be submitted within 180 days of the acquisition. If not, the Agency may perform an audit to determine the experience rating data to be transferred.

22.Did you acquire more than one LA operation? If “Yes,” answer A, B, C, and D. Use a separate sheet if necessary.

23.If you have workers who you consider to be self-employed or independent contractors, please review the following to be sure you are in compliance with the law. Louisiana Employment Security Law provides that services performed by an individual for wages or under any contract of hire shall be deemed to be taxable employment unless and until it is shown that: 1. Such individual has been and will continue to be free from any control or direction over the performance of such services both under his contract and in fact, and 2. Such service is either outside the usual course of the business for which such service is performed, or that such service is performed outside of all the places of business of the enterprise for which such service is performed, and 3. Such individual is customarily engaged in an independently established trade, occupation, profession, or business.

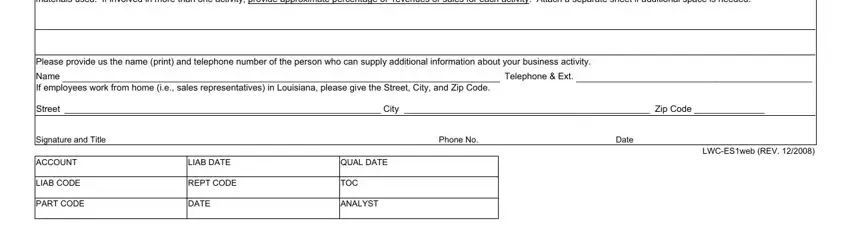

24.Be specific when describing your business; provide the name and phone number of the contact person for additional information. If your business is made up of more than one establishment in LOUISIANA, please attach a separate sheet and list the physical location and employment count of each location.

Sign your name and list title, phone number and extension, and the date.

Mail or fax this Employer Account Application form and any attachments to the address or fax number on the first page of this form.