In an increasingly mobile and interconnected world, the necessity for reliable and comprehensive insurance coverages, especially within the transportation sector, becomes paramount. This is where the detailed intricacies of the M 4493B IL form come into the forefront, tailored specifically for the drive-away application by entities such as Columbia Insurance Company, National Fire & Marine Insurance Company, and several affiliates under the National Indemnity Company umbrella. The form elegantly lays out the requirements and queries stretching from basic identification data, business operation descriptions, to the specifics of insurance coverage desires, also delving into driver information and loss experience. As a crucial document, it encapsulates the breadth of information necessary to appraise and provide insurance, touching upon liability coverage, physical damage, personal injury protection, and more, catered to businesses operating across state lines and perhaps even those questioning their insurance status after a bankruptcy filing. Furthermore, the form meticulously gathers data regarding drive-away information, operations other than drive-away service, and even the nitty-gritty of plate usage, reflecting an encompassing approach to risk assessment and insurance provision.

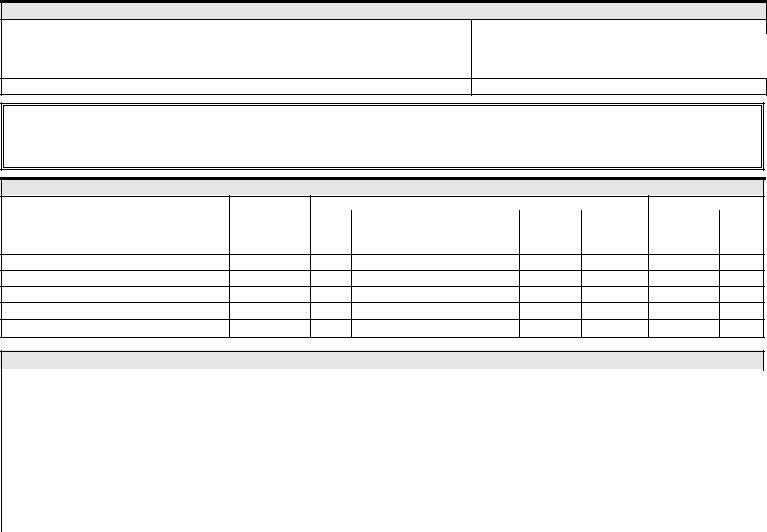

| Question | Answer |

|---|---|

| Form Name | Form M 4493B Il |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | Drive_Away national indemnity drive away program form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

COLUMBIA INSURANCE COMPANY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

NATIONAL FIRE & MARINE INSURANCE COMPANY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

NATIONAL INDEMNITY COMPANY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

NATIONAL INDEMNITY COMPANY OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

NATIONAL INDEMNITY COMPANY OF THE SOUTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

NATIONAL LIABILITY & FIRE INSURANCE COMPANY |

|

|

|

|

|

|

Policy Term From: |

|

|

|

|

To |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

1. |

Name (and "dba") |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

G Individual/Proprietorship |

G Partnership G Corporation |

G Other |

|

|

|

Business Phone Number |

|

|

|

|

|

|||||||||||||||||||||||

2. |

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

|

Zip |

|

|

||||||||||

3. |

Premises Address |

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

Zip |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

4. |

Person to contact for inspection (name and phone number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

5. |

Have you ever had insurance with one of the companies listed at the top of this page? G Yes G No |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

If yes, Policy Number(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective Date(s) |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DESCRIPTION OF OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

6. |

Describe business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Years experience |

|

|

New Venture? G Yes G No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

7. |

Is this your primary business? G Yes G No |

|

If no, explain |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

8. |

Have you ever filed for Bankruptcy? G Yes G No If yes, when |

|

Explain |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

9. |

Gross receipts last year |

|

|

|

|

Estimate for coming year |

|

|

|

|

|

|

|

|

|

Business for sale? G Yes |

G No |

||||||||||||||||||

10. |

Do you operate in more than one state? G Yes |

G No |

If yes, list states |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

11. |

Do you operate over a regular route? G Yes |

G No |

If yes, show towns operated between: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

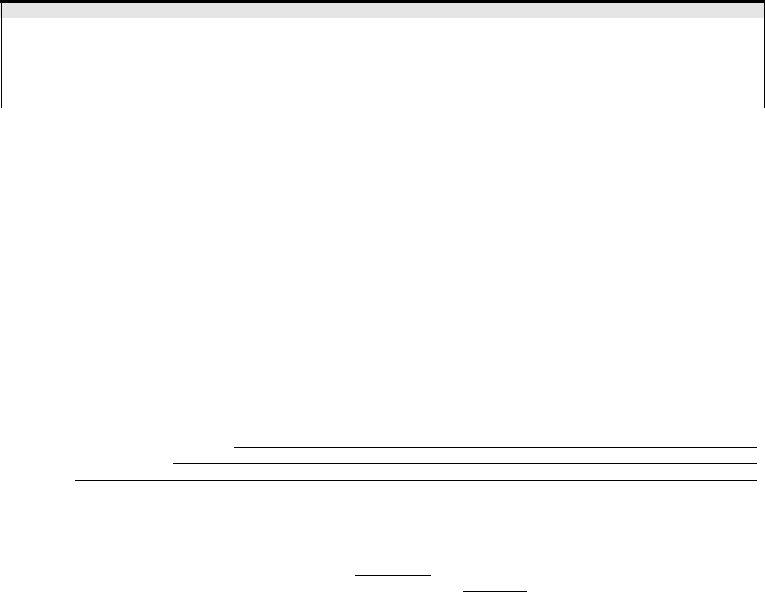

LIABILITY COVERAGE — Complete for desired coverages by indicating limits of insurance.

|

LIABILITY |

|

|

|

|

Combined Single |

|

Split Limits |

|

Medical |

|

Bodily Injury |

Property Damage |

Payments |

|||

Limit BI & PD |

|||||

|

|

|

|

||

|

Each Person |

Each Accident |

Each Accident |

|

|

|

|

|

|

|

|

Personal |

PHYSICAL DAMAGE |

|

||

Injury |

Deductibles |

|

Maximum |

|

Protection |

|

|||

G Comprehensive |

|

|

Vehicle |

|

(where |

Collision |

|

||

applicable) |

G Spec. C of Loss |

|

Value |

|

|

|

|

|

|

APPLICABLE PERSONAL INJURY PROTECTION, UNINSURED AND/OR UNDERINSURED

MOTORISTS INSURANCE SELECTION/REJECTION PAGE IS REQUIRED TO BE COMPLETED AND

SIGNED BY THE NAMED INSURED WITH THE SUBMISSION OF THIS APPLICATION.

DRIVER INFORMATION — If additional space is needed, attach separate listing.

|

|

|

Driver's Licenses |

|

|

Experience |

||

Driver's Name |

Date of Birth |

|

|

Class/Type |

Years |

Type of Unit |

|

|

State |

Number |

(Bus, Van, |

No. of |

|||||

Licensed (in |

||||||||

|

|

|||||||

|

|

|

|

(i.e. CDL) |

Class/Type) |

Truck, Tractor, |

Years |

|

|

|

|

|

|

etc.) |

|

||

|

|

|

|

|

|

|

||

1.

2.

3.

4.

5.

DRIVER INFORMATION (Continued) — If additional space is needed, attach separate listing.

No. Years |

|

|

Accidents and Minor Moving Traffic |

Major Convictions |

|

|

||||

|

|

(DWI/DUI, Hit & Run, Manslaughter, Reckless, |

Employee (E) |

|||||||

Previous |

|

|

Violations in Past 5 Years |

|

Driving While Suspended/ Revoked, Speed |

|||||

|

|

|

Ind. Cont. (IC) |

|||||||

Commercial |

Date of Hire |

|

|

|

|

|

Contest, other felony) |

|

||

|

|

|

|

|

|

Owner/Op. (O/O) |

||||

Driving |

|

|

|

|

|

|

|

|

|

|

|

No. of |

|

No. of |

|

|

|

|

|

Franchisee (F) |

|

Experience |

|

Date(s) |

|

Date(s) |

Describe Conviction |

|

Date(s) |

|||

|

Accidents |

Violations |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE ATTACH DETAILED EXPLANATION OF ACCIDENTS LISTED ABOVE.

12. |

Are drivers covered by Workers Compensation? G Yes |

G No |

If yes, name of carrier |

|

|

|

|

|||||

13. |

Minimum years driving experience required |

|

|

|

|

|

|

|

|

|

|

|

14. |

Are drivers ever allowed to take vehicles home at night? G Yes |

G No |

If yes, will family members drive? G Yes G No |

|

||||||||

15. |

Do you order MVR's on all drivers prior to hiring? G Yes |

G No |

|

Driver's maximum driving hours |

|

daily, |

weekly |

|||||

16. |

Do you agree to report all newly hired operators? G Yes |

G No |

|

|

|

|

|

|

|

|

||

17. |

What is the basis for driver(s) pay? G Hourly G Trip |

|

G Mileage |

G Other, Explain |

|

|

|

|

|

|||

LOSS EXPERIENCE — Provide prior insurance carriers information for past full three years.

|

Policy Term |

|

|

No. of Motor |

No. of |

Premium |

Total Amount Claims Paid & Reserves |

|||||

|

|

|

|

Insurance Company Name |

Powered |

|

|

|

|

|

|

|

From |

To |

|

Accidents |

Liab |

Phys Dam |

BI |

PD |

Comp/Coll |

Other |

|||

|

|

Vehicles |

||||||||||

|

|

|

||||||||||

/ |

/ |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

/ |

/ |

|

|

|

|

|

|

|

|

|

18. Is any applicant aware of any facts or past incidents, circumstances or situations which could give rise to a claim under the insurance coverage

|

sought in this application? G Yes G No |

|

|

If yes, provide complete details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

19. |

Have you ever been declined, cancelled or nonrenewed for this kind of insurance? G Yes |

G No If yes, date and why |

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

20 |

Types of units driven away and percentages of each |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

21. |

Percentage of the time you drive away new units: |

|

|

% |

|

|

used units: |

|

|

% |

|

|

|

|

|

|

|

|||||||||||||||||

22. |

If physical damage coverage is desired, what is the average value per unit? |

|

|

|

|

|

|

|

|

What is the maximum value per unit? |

||||||||||||||||||||||||

23. |

How are you paid: G By Miles |

|

G By Trip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

24. |

Average rate you are paid per mile |

|

|

|

|

|

|

|

|

|

|

|

per trip |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

25. |

Total number of |

|

|

|

|

|

Total number of |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

26. |

Do you require insurance filings? |

G State |

G FHWA |

If FHWA filing, please provide MC number |

|

|

|

|

||||||||||||||||||||||||||

27. |

How is return trip handled? _ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

28. |

Is delivery made with one unit towing another unit? G Yes |

G No |

|

Do you permit drivers to tow their own vehicles? G Yes |

G No |

|||||||||||||||||||||||||||||

|

Do you haul away vehicles? G Yes G No |

|

Do you use any of the following: G Fifth wheel G Tow bars G Reese hitches |

|

G Ball hitches |

|||||||||||||||||||||||||||||

29. |

If towing a vehicle for return transportation, how often is this done? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

30. |

Maximum radius |

|

|

|

|

|

Average radius |

|

|

|

|

|

|

|

|

|

Estimated total annual mileage |

|

|

|

|

|

||||||||||||

31. |

Average total number of trips per week |

|

|

|

|

|

Do you deliver vehicles both ways? |

G Yes G No |

|

|

|

|

||||||||||||||||||||||

32.Cities and states where units are picked up _

33.List city and state destinations _

34.List clients

35. |

Any operations other than |

If yes, explain |

|

|

||||

Plate Information |

|

|

|

|

|

|

|

|

36. |

Are you required to use plates? |

G Yes G No |

Do you use your own plates exclusively? G Yes G No |

Total number of plates |

||||

|

What type of plates do you use? |

G Transporter |

G IRP G Other |

|

|

|

||

37.How many plates are required to be attached to each unit drive away?

On average, how many of your plates are attached to

38. |

How are plates returned to you? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average number of days before plates are returned? |

|

|

||||||||||||||||

39. |

List identification number for each plage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

40. |

Are all plates owned to be insured this policy? |

G Yes |

G No |

|

If no, explain |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Also, if no, number of operators used? |

|

|

Do operators have written contracts with you? G Yes G No |

ATTACHED COPY OF CONTRACT. |

||||||||||||||||||||||||||||||||||

Private Passenger |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

41. |

Do you drive away sports cars or luxury type units? G Yes |

G No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

If yes, list unit model(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42. |

Do you tow a second |

G Yes |

G No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Bus |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

43. |

Percentage of time units with the following seating capacities are driven away: under 20 |

% |

21 and over |

% |

|

|

|

||||||||||||||||||||||||||||||||

Truck/Tractor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

44. |

Percentage of time each unit type is driven away: trucks |

|

|

% |

|

tractors |

|

|

|

|

% tractors and trailers |

|

|

% |

|

|

|

||||||||||||||||||||||

45. |

If trucks, percentage of each GVW driven away: |

|

|

|

|

|

% |

|

|

% 45,001+ lbs |

|

|

% |

|

|||||||||||||||||||||||||

46. |

Do you piggyback?G Yes G No |

What percentage of time do you piggyback? |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

47. |

What percentage of your piggyback operation is 1 up? |

|

|

|

% |

|

2 up? |

|

|

% 3 up? |

% |

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

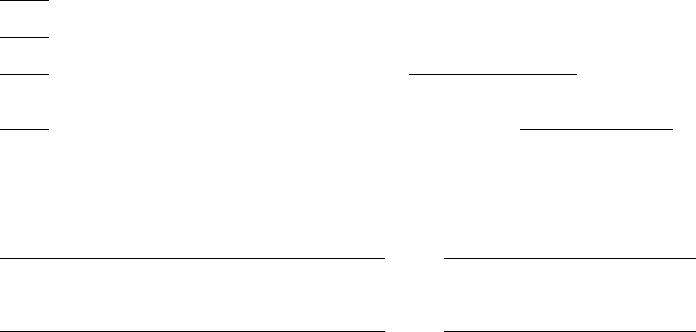

ILLINOIS

UNINSURED MOTORIST & UNDERINSURED MOTORIST

ELECTION FORM

Uninsured Motorists Coverage provides you protection when you are legally entitled to recover damages for bodily injury or death, caused by the owner of an uninsured auto.

Underinsured Motorists Coverage provides you protection when you are legally entitled to recover damages for bodily injury or death, caused by the owner of an auto which was insured at the time of loss, but whose limits of Bodily Injury Liability Coverage are less than you are legally entitled to recover, as the injured party.

These additional Coverages are required to be part of your auto policy at limits equal to the minimum limits required by the State Financial Responsibility Law. They are, however, available to you at any limits up to the Bodily Injury Liability Coverage limits of your policy, at additional premium.

To be certain that your policy is issued correctly, please indicate your choice concerning the limit desired for this additional coverage. (“x” indicates your choice)

UNINSURED/UNDERINSURED MOTORISTS BODILY INJURY COVERAGE

Elected with 20/40 limits of liability (minimum coverage required by law)

Elected with a combined single limit of $40,000 (minimum coverage required by law)

Elected with combined single limit of liability of $ (May not exceed bodily injury limit)

Elected with split limits of liability of $ |

/ $ |

|

(May not exceed bodily injury limits) |

|

|

In the event none of these options are selected, Uninsured/Underinsured Motorists Bodily Injury coverage will be issued with the same limits of liability as Bodily Injury coverage.

Signature of Named Insured |

Date |

Signature of Named Insured |

Date |

Until you advise us otherwise in writing, your choice as indicated above, will continue regardless of any addition or change in Auto coverage on your current policy or addition of any scheduled Autos and will be carried forward on all future renewal policies without additional notice.

SIGNATURE IS ALSO REQUIRED ON LAST PAGE OF APPLICATION

MUST BE SIGNED BY THE APPLICANT PERSONALLY

No coverage is bound until the Company advises the Applicant or its representative that a policy will be issued and then only as of the policy effective date and in accordance with all policy terms. The Applicant acknowledges that the Applicant's Representative named below is acting as Applicant's agent and not on behalf of the Company. The Applicant's Representative has no authority to bind coverage, may not accept any funds for the Company, and may not modify or interpret the terms of the policy.

The Applicant agrees that the foregoing statements and answers are true and correct. The Applicant requests the Company to rely on its statements and answers in issuing any policy or subsequent renewal. The Applicant agrees that if its statements and answers are materially false, the Company may rescind any policy or subsequent renewal it may issue.

If any jurisdiction in which the Applicant intends to operate or the FHWA requires a special endorsement to be attached to the policy which increases Company's liability, the Applicant agrees to reimburse the Company in accordance with the terms of that endorsement.

The Applicant agrees that any inspection of autos, vehicles, equipment, premises, operations, or inspection of any other matter relating to insurance that may be provided by the Company, is made for the use and benefit of the Company only, and is not to be relied upon by the Applicant or any other party in any respect.

The Applicant understands that an inquiry may be made into the character, finances, driving records, and other personal and business background information the Company deems necessary in determining whether to bind or maintain coverage. Upon written request, additional information will be provided to the Applicant regarding any investigation.

The Applicant represents that she/he has completed all relevant sections of this Application prior to execution and that the Applicant has personally signed below (or if Applicant is a Corporation a corporate officer has signed below).

Will premium be financed? G Yes G No If yes, with whom?

WitnessApplicant's SignatureDate

|

|

|

|

|

TO BE COMPLETED BY APPLICANT'S REPRESENTATIVE |

||||||||

|

Is this direct business to your office? |

|

If not, explain: |

|

|

|

|

|

|||||

|

Is this new business to your office? |

|

If not, how long have you had the account? |

|

|

||||||||

|

How long have you known applicant? |

|

|

|

|

|

|

|

|

||||

|

REQUEST TO COMPANY GENERAL AGENT: |

|

|

|

|

|

|

|

|||||

|

G Please quote |

G Please bind at earliest possible date and issue policy |

|

|

|

|

|||||||

|

G Please issue policy effective |

|

|

Coverage was bound by |

|

|

|||||||

|

|

|

(Time and Date Bound by General Agent) |

(Name of Person in Company General Agency's Office Binding Coverage) |

|||||||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

Applicant's Representative's Name and Address |

|

|

|

|

|

Phone No. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|