It is possible to fill in form m 4768 effectively with the help of our online PDF editor. FormsPal team is constantly working to improve the editor and insure that it is even easier for people with its extensive features. Enjoy an ever-evolving experience now! Getting underway is simple! All you need to do is adhere to the next easy steps below:

Step 1: Click on the "Get Form" button at the top of this page to open our PDF tool.

Step 2: As you access the online editor, there'll be the form made ready to be completed. In addition to filling in different blanks, it's also possible to do various other actions with the PDF, that is writing custom words, modifying the original textual content, adding illustrations or photos, affixing your signature to the form, and much more.

Pay attention when completing this pdf. Make sure each and every blank field is done properly.

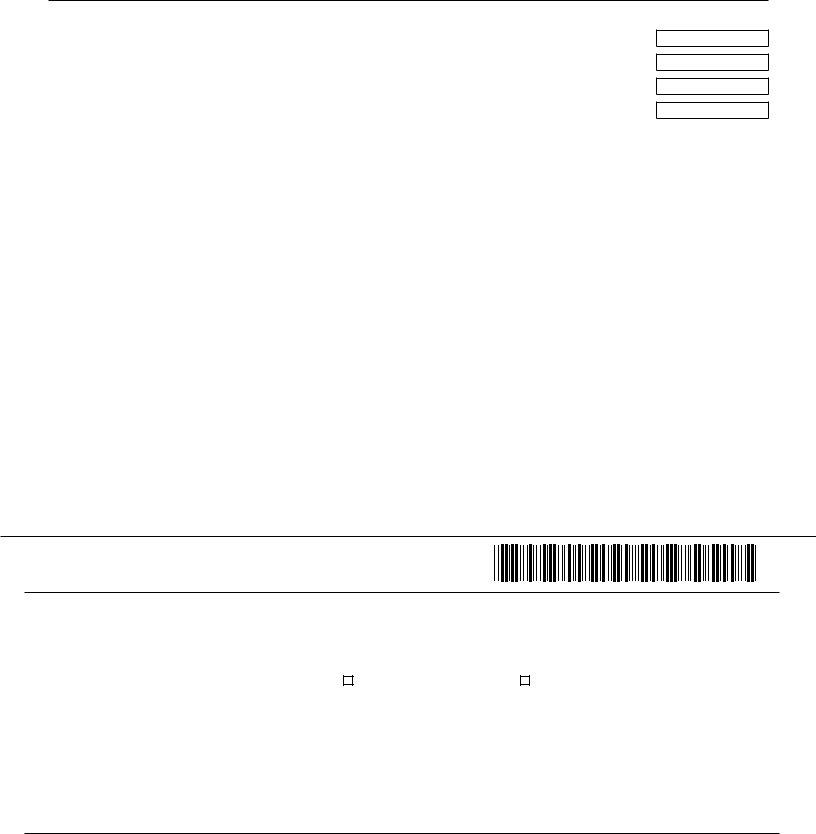

1. It is important to complete the form m 4768 correctly, hence be mindful while filling in the sections containing these specific blanks:

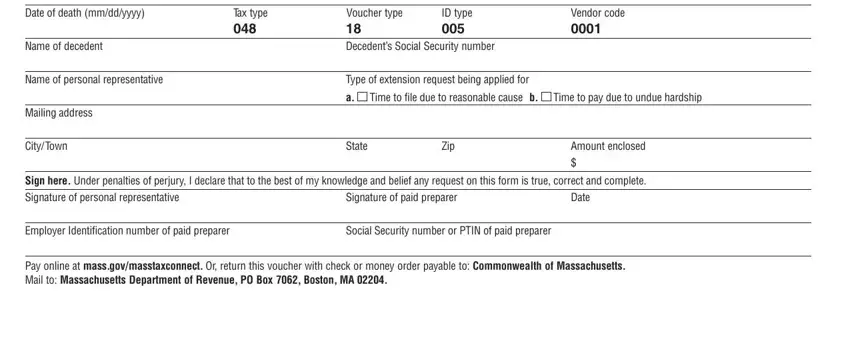

2. Once your current task is complete, take the next step – fill out all of these fields - Date of death mmddyyyy Name of, Tax type, Voucher type Decedents Social, ID type, Vendor code, Name of personal representative, CityTown, Type of extension request being, Time to file due to reasonable, Time to pay due to undue hardship, State, Zip, Amount enclosed, Sign here Under penalties of, and Signature of paid preparer with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Regarding Vendor code and State, make sure you double-check them here. Those two are viewed as the most important ones in this document.

Step 3: Before moving on, make sure that all blank fields have been filled in the right way. The moment you think it's all good, click on “Done." Download your form m 4768 once you register at FormsPal for a free trial. Quickly use the form in your FormsPal account page, with any modifications and changes automatically kept! We don't share or sell the details that you type in whenever dealing with documents at our site.