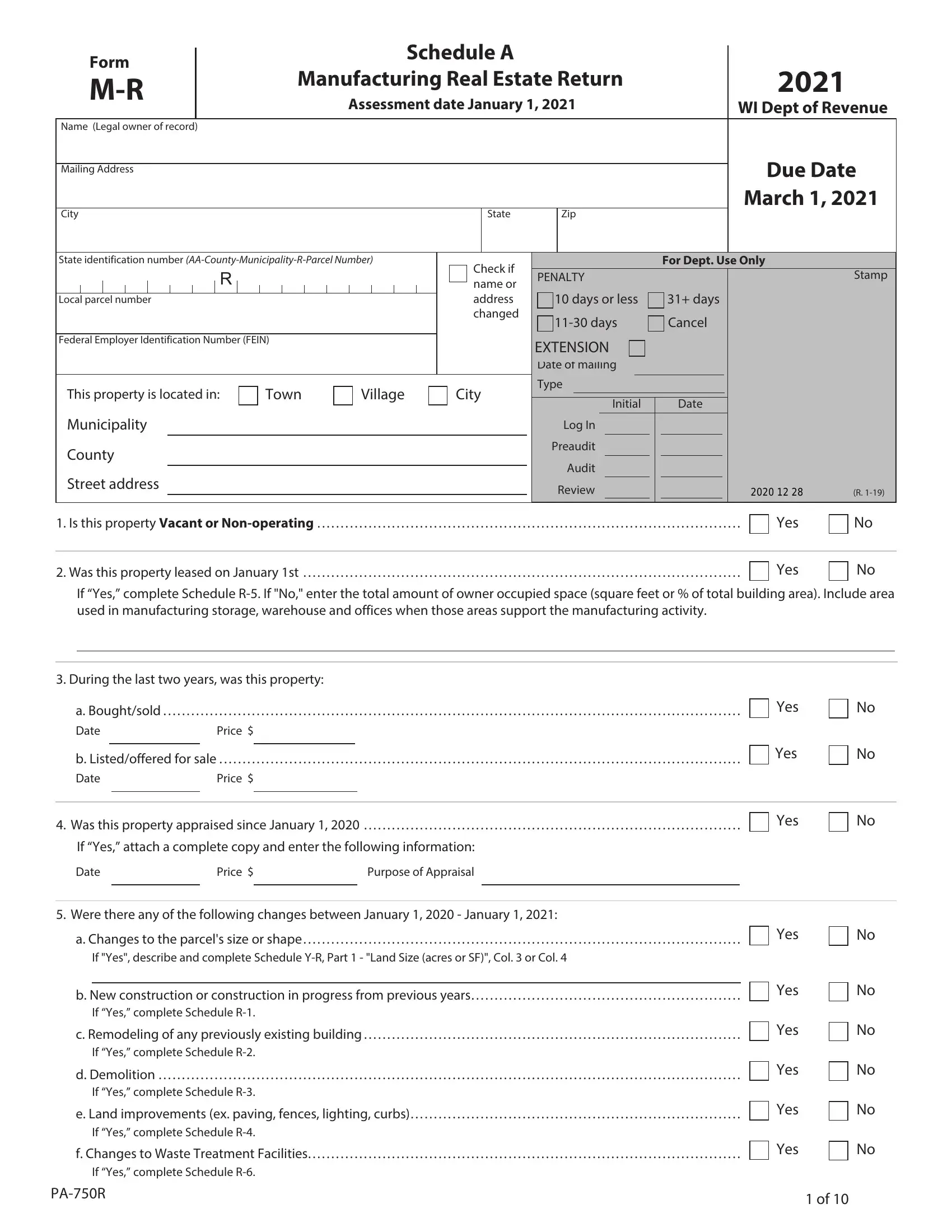

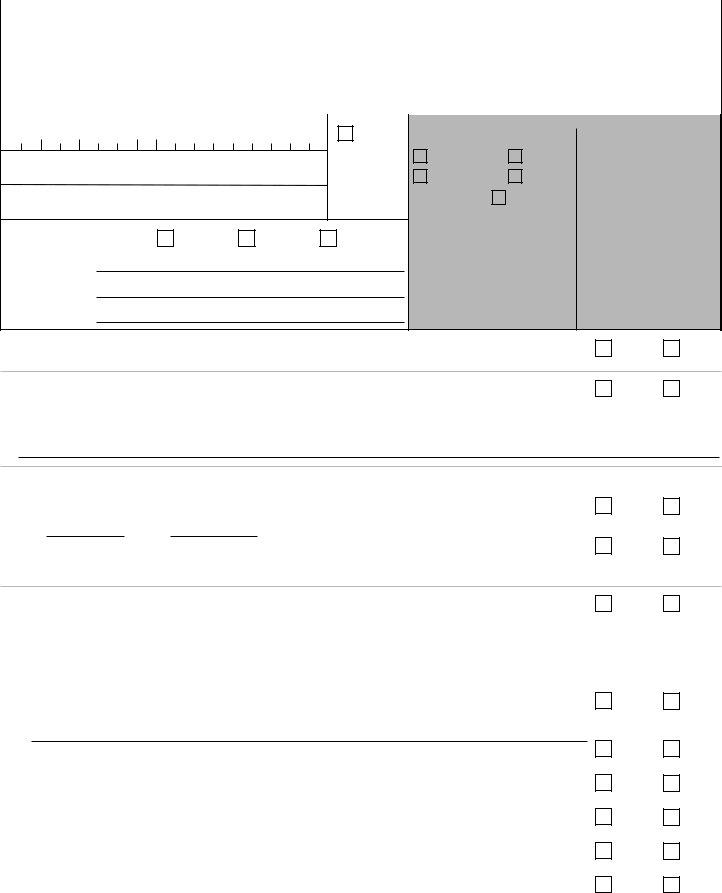

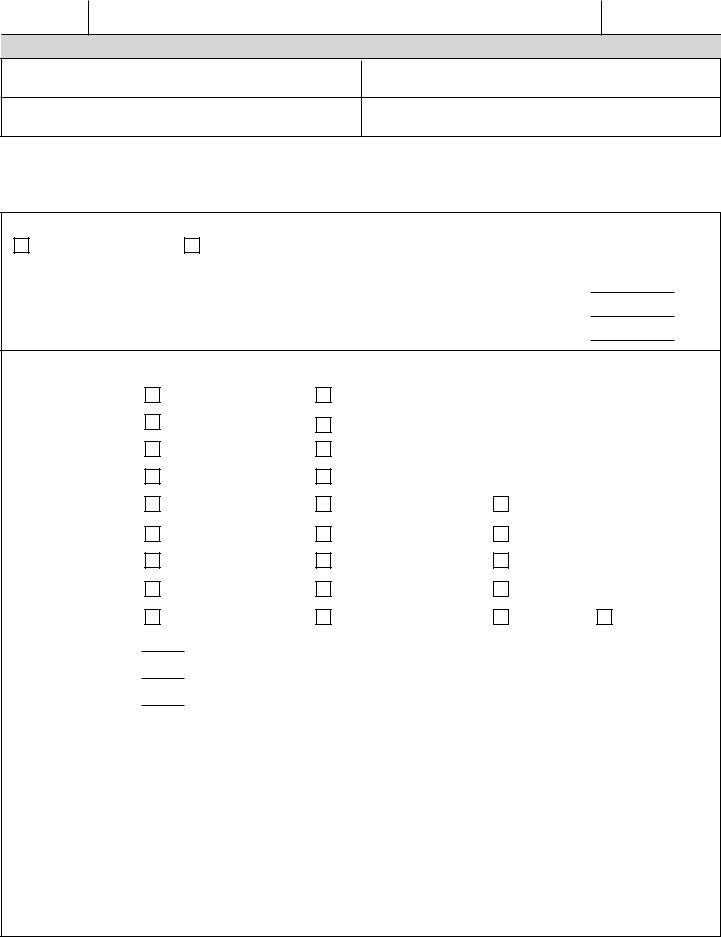

1. Site preparation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Foundation, basement and superstructure. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Electrical/lighting/power . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Plumbing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Sprinkler system . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. HVAC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Finish - partitions; interior finish on floors, walls and ceilings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Start up costs (ex: soft costs and architect fees). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Other costs (describe)

10. If costs include items you feel may qualify as exempt machinery and equipment (ex: special |

( |

) |

|

machine foundations, production power wiring or process piping), attach an explanation |

11. |

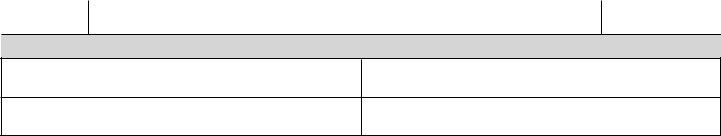

Total cost of construction upon completion |

|

|

|

|

|

|

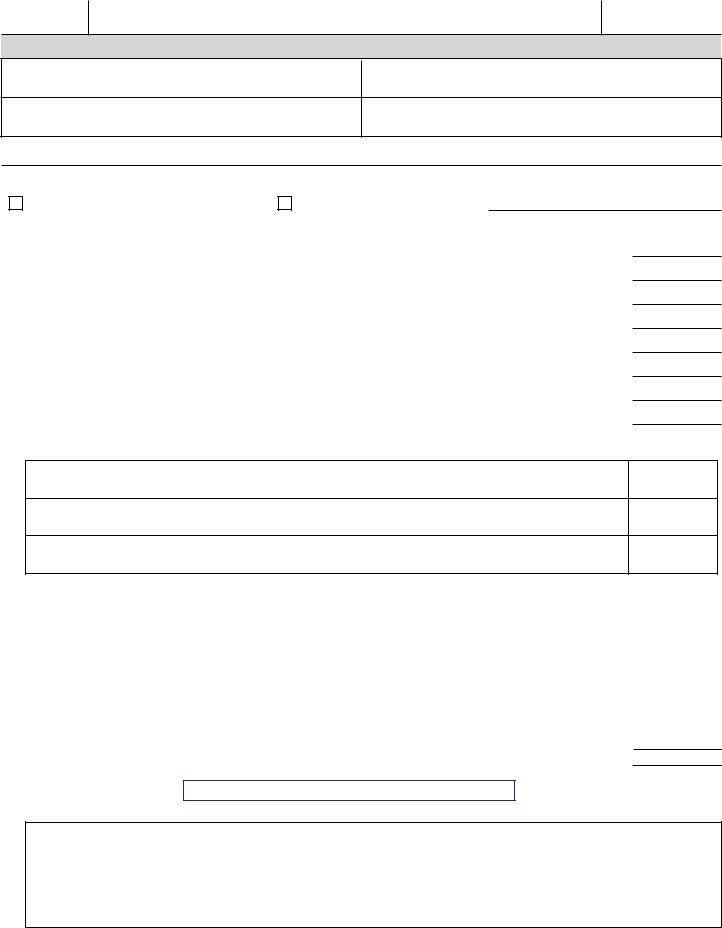

12. |

. . . . . . . . . . . . . . . . . . . . . . . . . . .Percent complete on January 1, 2021 (use cost incurred, not cost paid, to calculate) |

|

|

|

13. |

. . . . . . . . . . . . . . . . . . . . . . . . . . .Total building cost incurred before January 1, 2021 (excluding Ex M&E) (multiply line 11 by line 12) |

|

|

|

14. |

Important - deduct cost of construction reported last year |

( |

) |

|

|

|

|

|

15.Net amount to be reported this year. Enter here and on Sch. B, Line 1, "Cost" column and make appropriate entries on Sch. YR,Part 1, Col. 3 (Additions), Line 3-7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.Your estimate of market value of construction as of January 1, 2021. Enter here and Sch. B, Line 1, "Value" column . . . . . . . . .

Each R-1 Form filed must have a separate attachment!

Explain your opinion of the effective increase in value here or attach supporting documentation.