It is possible to complete ps05 form election 2019 pdf effectively with our PDFinity® editor. Our editor is constantly evolving to give the best user experience attainable, and that's due to our resolve for constant development and listening closely to feedback from users. Here's what you'd have to do to begin:

Step 1: First, open the pdf tool by clicking the "Get Form Button" in the top section of this page.

Step 2: As you access the online editor, you will get the document all set to be filled in. Other than filling in different blanks, you can also do many other things with the file, such as putting on your own text, editing the initial textual content, adding graphics, putting your signature on the form, and more.

With regards to the blanks of this specific document, here's what you should consider:

1. For starters, while filling out the ps05 form election 2019 pdf, start with the area that contains the following blanks:

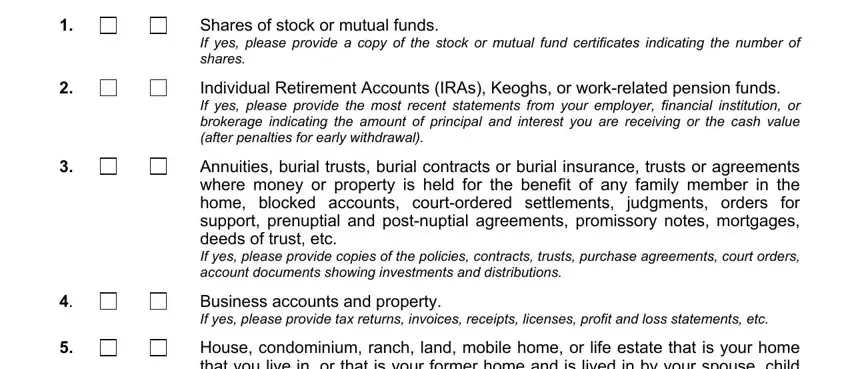

2. The third part would be to fill in these blank fields: Shares of stock or mutual funds If, Individual Retirement Accounts, Annuities burial trusts burial, Business accounts and property If, and House condominium ranch land.

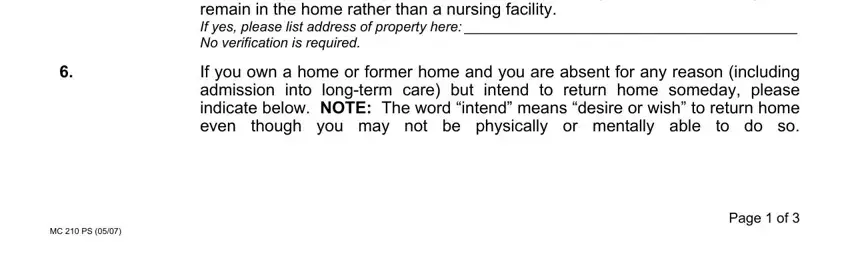

3. The following portion will be about House condominium ranch land, If you own a home or former home, though you may not be physically, MC PS, and Page of - fill in each one of these blank fields.

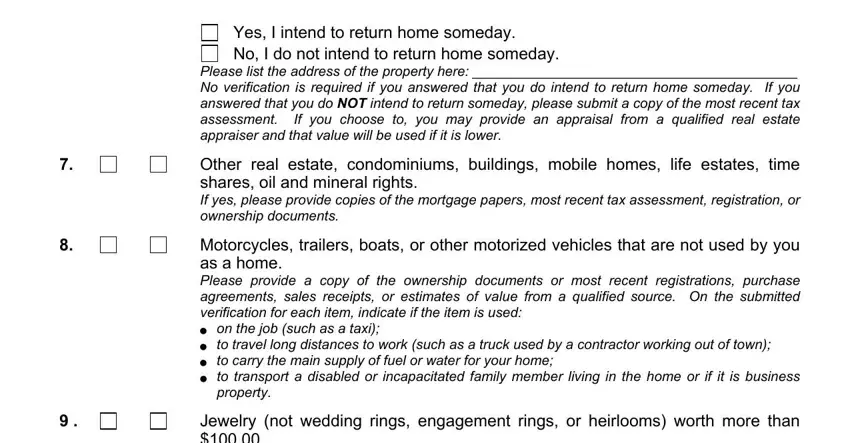

4. To move forward, this fourth part will require filling in a couple of form blanks. Examples of these are Yes I intend to return home, Please list the address of the, Other real estate condominiums, Motorcycles trailers boats or, to travel long distances to work, and Jewelry not wedding rings, which you'll find integral to going forward with this particular document.

Many people generally make some errors while completing to travel long distances to work in this part. You should double-check what you enter right here.

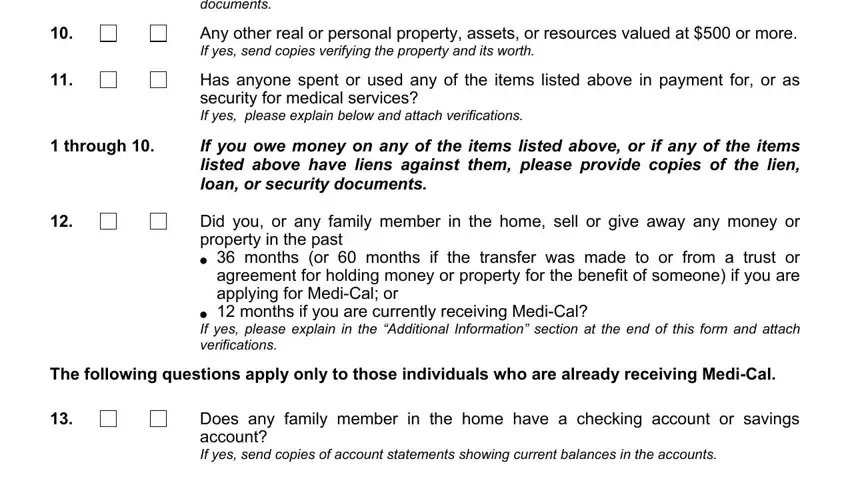

5. This last notch to conclude this document is pivotal. Make sure that you fill in the appropriate form fields, including through, Jewelry not wedding rings, Any other real or personal, Has anyone spent or used any of, If you owe money on any of the, Did you or any family member in, o months if you are currently, The following questions apply only, and Does any family member in the home, prior to submitting. Failing to do this may result in a flawed and potentially invalid document!

Step 3: Ensure the information is accurate and just click "Done" to continue further. Sign up with FormsPal right now and easily get access to ps05 form election 2019 pdf, prepared for downloading. Every change you make is conveniently preserved , enabling you to customize the pdf at a later stage as required. FormsPal ensures your information confidentiality by having a protected system that never records or shares any sort of personal data provided. You can relax knowing your docs are kept safe whenever you work with our service!