In the complex landscape of manufacturing and production, understanding the nuances of operational reporting is essential for compliance and strategic planning. The MC-3011 form serves as a crucial tool in this domain, capturing detailed information about the consumption of selected materials during a specified period, in this case, 1997. This comprehensive document not only facilitates a granular examination of the materials, parts, and supplies commonly utilized in the fabrication, processing, or assembly of diverse products but also extends to describe the valuation methods for the materials consumed, including adjustments for inventory changes. Beyond merely tracking material consumption, the form intricately details the valuation of products and services provided by the establishment, emphasizing the importance of reporting the net selling value, f.o.b. (free on board) plant, thereby excluding freight charges and excise taxes. Moreover, it addresses the intricacies of contract work, resales, and miscellaneous receipts, thereby painting a holistic picture of the establishment's operational landscape. With spaces reserved for both quantitative and qualitative descriptions, the form ensures that every facet of material consumption and product valuation is meticulously recorded, offering insights essential for regulatory compliance and business insight. The inclusion of certification at the conclusion underscores the commitment to accuracy and accountability in reporting.

| Question | Answer |

|---|---|

| Form Name | Form Mc 3011 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | felts, resins, 11-digit, Plasticizers |

Form |

Page 5 |

If not shown, please enter your

Census File Number

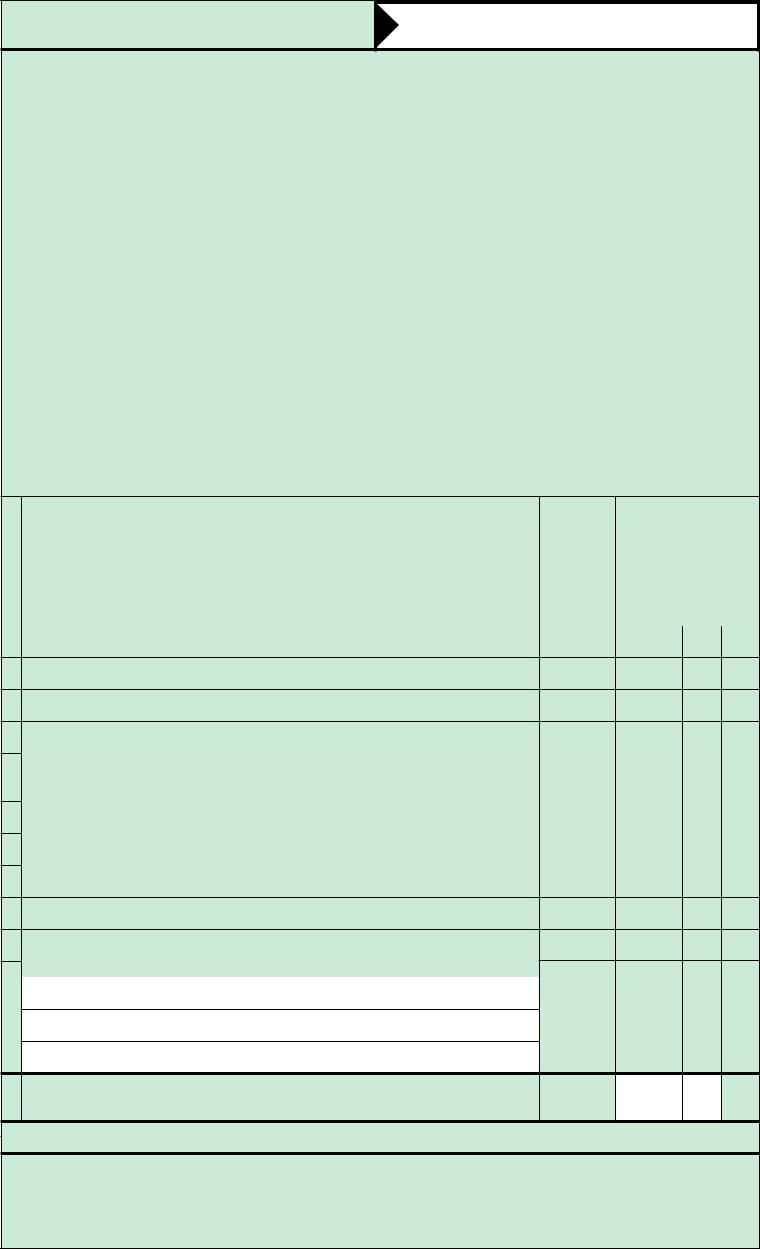

Item 17. CONSUMPTION OF SELECTED MATERIALS DURING 1997

INSTRUCTIONS

1.General – The materials, parts, and supplies listed below are those commonly consumed in the manufacture, processing, or assembly of the products listed in item 18B. Please review the entire list and report separately each item consumed. Leave blank if you do not consume the item. If you use materials, parts, and supplies which are not listed, describe and report them in the "Cost of all other materials . . . " line at the end of this section. If you consumed less than $25,000 of a listed material, include the value with "Cost of all other materials . . . ," Census material code 970099 8.

Report materials, parts, and supplies purchased, transferred from other plants of your company, or withdrawn from inventory.

If quantities are requested, please use the unit of measure specified.

If the information as requested cannot be taken directly from your book records, REASONABLE ESTIMATES ARE ACCEPTABLE.

2.Valuation of Materials Consumed – The value of the materials, etc., consumed should be based on the delivered cost; i.e., the amount paid or payable after discounts and including freight and other direct charges incurred in acquiring the materials.

Materials received from other plants within your company should be reported at their full economic value (the value assigned by the shipping plant, plus the cost of freight and other handling charges).

If purchases or transfers do not differ significantly from the amounts actually put into production, you may report the cost of purchases or transfers. However, if consumption differs significantly from the amounts purchased or transferred, these amounts should be adjusted for changes in the materials and supplies inventories by adding the beginning inventory to the amount purchased or transferred and subtracting ending inventory.

3.Contract Work – Include as materials consumed those you purchased for use by others making products for you under contract. Amounts paid to the companies doing the contract work should be reported in item 10, line e, and should include freight in and out. On the other hand, materials owned by others but used at this establishment in making products for others under contract or on commission should be excluded.

4.Resales – Cost for products bought and sold or transferred from other establishments of your company and sold without further manufacture, processing, or assembly should be reported in item 10, line b, not in item 17 below. The value of these products shipped by this establishment should be reported in item 18B under Census product code 99989 00 6, "Resales."

Line No.

1

2

3

4

5

6

7

8

9

|

|

|

|

|

|

|

Consumption of |

||

|

|

|

|

|

|

purchased materials |

|||

|

|

|

|

|

|

|

and of materials |

||

|

|

|

|

|

|

received from other |

|||

|

|

|

Census |

establishments of your |

|||||

|

|

Materials, parts, and supplies |

material |

|

|

company |

|||

|

|

|

|

|

|

||||

|

|

|

|

code |

Cost, including delivery |

||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

cost |

||

|

|

|

|

|

|

|

|

(E) |

|

|

|

|

571 |

|

|

574 |

|

Thou- |

|

|

|

|

|

|

|

|

|

||

|

|

(A) |

|

(B) |

|

|

|||

|

|

|

Millions |

sands Dollars |

|||||

Asbestos, crude (including fiber) |

149971 4 |

|

$ |

|

|

|

|||

Floor covering felts |

2621B2 5 |

|

|

|

|

||||

CHEMICALS |

|

Pigment, organic and inorganic |

280023 3 |

|

|

|

|

|

|

|

|

|

|

|

|

||||

AND |

|

|

|

|

|

|

|||

ALLIED |

|

Plastics resins consumed in the form of granules, pellets, |

|

|

|

|

|

|

|

PRODUCTS |

|

|

|

|

|

|

|

|

|

|

|

powders, liquids, etc., but excluding sheets, |

|

|

|

|

|

|

|

|

|

rods, tubes, and shapes |

282104 9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Synthetic rubber |

282202 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plasticizers |

286935 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other chemicals and allied products |

280060 5 |

|

|

|

|

|

|

Paperboard containers, boxes, and corrugated paperboard |

265001 8 |

|

|

|

|

|

|||

Cost of all other materials and components, parts, containers |

|

|

|

|

|

|

|

||

and supplies consumed |

970099 8 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Describe the three principal materials, etc., included in this value.

TOTAL

10Sum of lines

Item 18A – Not applicable to this report

$

CONTINUE WITH ITEM 18B ON PAGE 6

Form |

Page 6 |

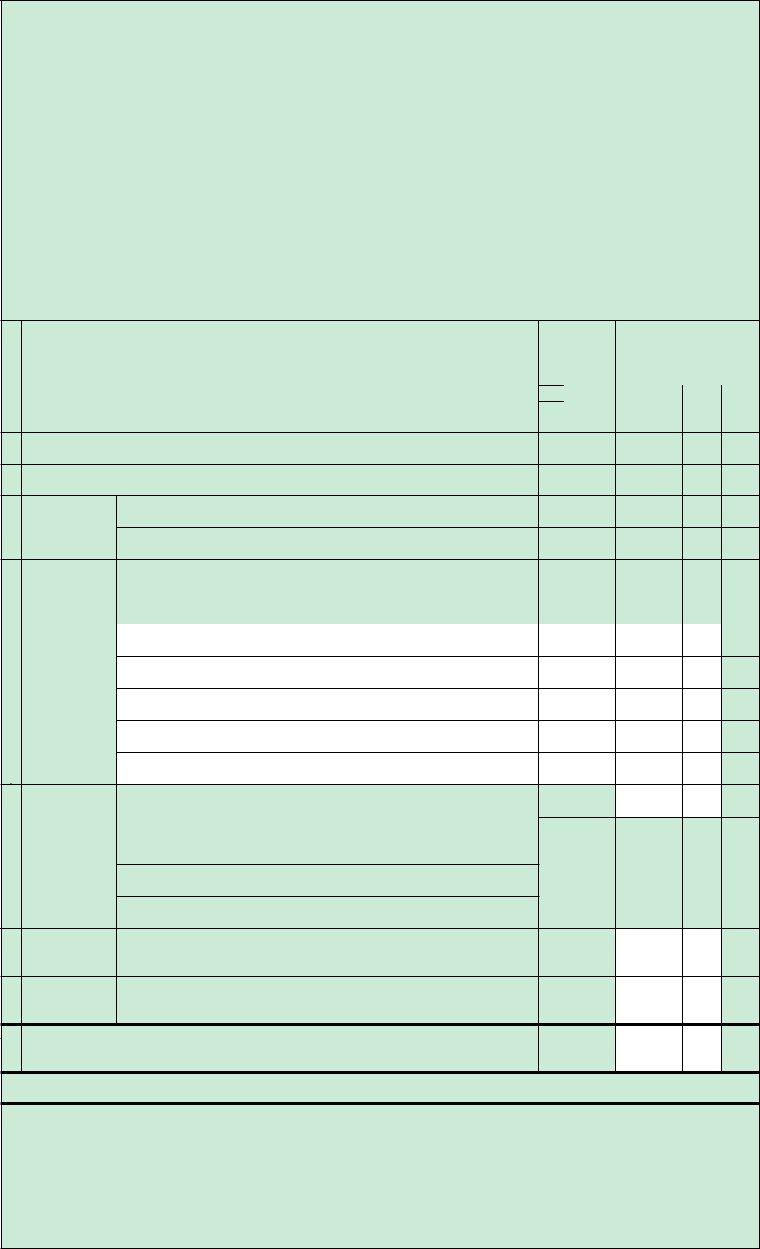

Item 18B. PRODUCTS AND SERVICES OF THIS ESTABLISHMENT DURING 1997

INSTRUCTIONS

1.General – The manufactured products and services listed below are generally made in your industry. If you make products that are not listed, describe and report them in the "All other products made in this establishment" section at the end of item 18B. PLEASE DO NOT COMBINE PRODUCT LINES.

If quantities are requested, please use the unit of measure specified.

If the information as requested cannot be taken directly from your book records, REASONABLE ESTIMATES ARE ACCEPTABLE.

2.Valuation of Products – Report the value of the products shipped and services performed at the net selling value, f.o.b. plant to the customer; i.e., after discounts and allowances, and exclusive of freight charges and excise taxes.

If you transfer products to other establishments within your company, you should assign the full economic value

to the transferred products; i.e., include all direct costs of production and a reasonable proportion of all other costs and profits.

3.Contract Work – Report PRODUCTS MADE BY OTHERS FOR YOU FROM YOUR MATERIALS on the specific lines as if they were made in this establishment. On the other hand, do not report on the specific product lines

PRODUCTS THAT YOU MADE FROM MATERIALS OWNED BY OTHERS. Report only the amount that you received for "commission or contract receipts" under Census product code 93000 00 8.

4.Resales – Do not report on the specific product lines those PRODUCTS BOUGHT AND SOLD OR TRANSFERRED FROM OTHER ESTABLISHMENTS OF YOUR COMPANY AND SOLD WITHOUT FURTHER MANUFACTURE. Report only a value under Census product code 99989 00 6, "Resales."

Line No. |

Products and services |

|

|

|

(A) |

1Asbestos friction materials

2Other asbestos products

|

RESILIENT |

|

|

3 |

FLOOR |

Sheet flooring, including vinyl and rubber |

|

|

COVERING |

Tile, including vinyl, vinyl composition, plain and adhesive backed, |

|

4 |

|||

|

|||

|

|||

|

ALL OTHER |

Describe and report separately each product with a sales value of |

|

|

PRODUCTS |

$50,000 or more which cannot be assigned to one of the lines |

|

|

MADE IN THIS above. Specify unit of measure for quantity. For all remaining |

||

|

ESTABLISH- |

products, write "Other" and report a single total value. |

|

|

MENT |

|

|

5 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

9 |

|

|

|

|

CONTRACT |

Receipts for work done for others on their own materials |

|

10 |

WORK |

||

|

|

Describe below products worked on and kind of work. |

|

|

|

||

|

|

|

|

|

|

|

|

|

MISCELLA- |

|

|

NEOUS |

Miscellaneous receipts (including receipts for repair |

11 |

RECEIPTS |

work, scrap, refuse, etc.) |

|

RESALES |

Sales of products bought and sold without further manufacture, |

|

|

|

|

|

processing, or assembly in this establishment. The cost of such |

12 |

|

items should be reported in item 10, line b. |

|

TOTAL value of shipments and other receipts |

|

13 |

Sum of lines |

|

|

|

Products shipped |

||||

|

|

and other receipts |

||||

Census |

|

|

|

|

||

Value, f.o.b. plant |

||||||

product |

||||||

|

|

(E) |

||||

|

code |

|

|

|||

581 |

|

584 |

|

|

|

|

|

|

|

|

Thou- |

||

|

|

|

|

|||

|

(B) |

Millions |

sands Dollars |

|||

|

|

|

|

|

||

|

|

|

|

|

|

|

32922 00 7 |

$ |

|

|

|

||

32927 00 6 |

|

|

|

|

||

39960 01 8 |

|

|

|

|

||

39960 04 2 |

|

|

|

|

||

|

|

|

|

|

|

|

18

26

34

42

59

93000 00 8

99980 00 5

99989 00 6

77000 00 8 |

$ |

Items

CONTINUE WITH ITEM 22 ON PAGE 7

Form |

Page 7 |

If not shown, please enter your

Census File Number

REMARKS – Please use this space for any explanations that may be essential in understanding your reported data.

Item 22. CERTIFICATION – This report is substantially accurate and has been prepared in accordance with instructions.

Name of person to contact regarding this report (Print or type) |

|

|

|

|

Area code |

Number |

|

Extension |

|||||||||

667 |

1 |

|

|

|

|

|

|

|

Telephone |

2 |

|

|

|

|

|

||

Name of company |

|

|

Address (Number and street, city, State, ZIP Code) |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FROM: Month |

Day |

Year |

|

TO: Month |

Day |

Year |

||||||||

Period covered |

666 |

1 |

|

|

|

|

|

2 |

|

|

|

|

|

|

|

||

Signature of authorized person |

|

Title |

|

|

|

|

|

|

|

Date |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please photocopy this form for your records