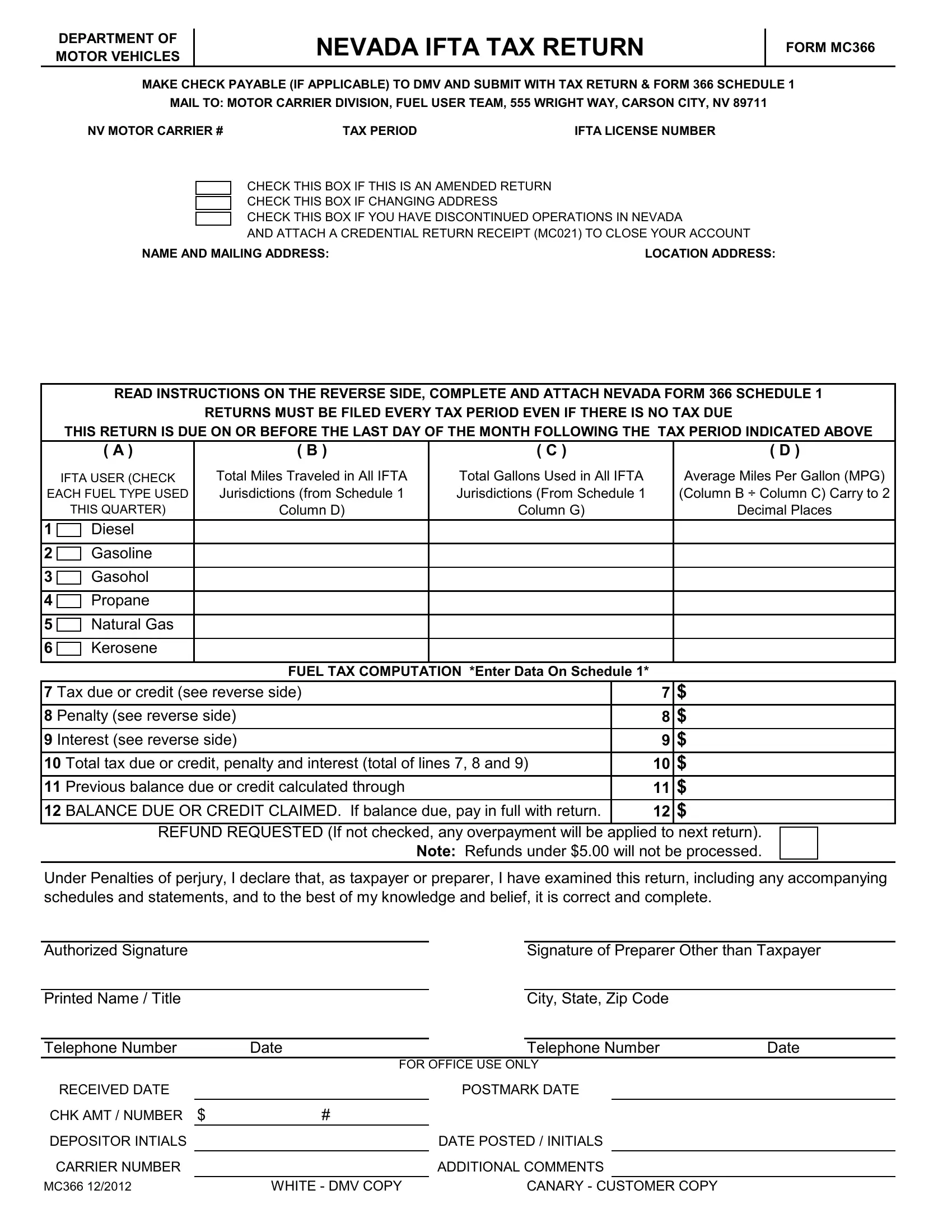

DEPARTMENT OF MOTOR VEHICLES

MAKE CHECK PAYABLE (IF APPLICABLE) TO DMV AND SUBMIT WITH TAX RETURN & FORM 366 SCHEDULE 1

MAIL TO: MOTOR CARRIER DIVISION, FUEL USER TEAM, 555 WRIGHT WAY, CARSON CITY, NV 89711

NV MOTOR CARRIER # |

TAX PERIOD |

IFTA LICENSE NUMBER |

CHECK THIS BOX IF THIS IS AN AMENDED RETURN

CHECK THIS BOX IF CHANGING ADDRESS

CHECK THIS BOX IF YOU HAVE DISCONTINUED OPERATIONS IN NEVADA

AND ATTACH A CREDENTIAL RETURN RECEIPT (MC021) TO CLOSE YOUR ACCOUNT

NAME AND MAILING ADDRESS: |

LOCATION ADDRESS: |

READ INSTRUCTIONS ON THE REVERSE SIDE, COMPLETE AND ATTACH NEVADA FORM 366 SCHEDULE 1

RETURNS MUST BE FILED EVERY TAX PERIOD EVEN IF THERE IS NO TAX DUE

THIS RETURN IS DUE ON OR BEFORE THE LAST DAY OF THE MONTH FOLLOWING THE TAX PERIOD INDICATED ABOVE

|

|

( A ) |

( B ) |

( C ) |

( D ) |

|

IFTA USER (CHECK |

Total Miles Traveled in All IFTA |

Total Gallons Used in All IFTA |

Average Miles Per Gallon (MPG) |

EACH FUEL TYPE USED |

Jurisdictions (from Schedule 1 |

Jurisdictions (From Schedule 1 |

(Column B ÷ Column C) Carry to 2 |

|

THIS QUARTER) |

Column D) |

Column G) |

Decimal Places |

1 |

|

Diesel |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

Gasoline |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

Gasohol |

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

Propane |

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

Natural Gas |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

Kerosene |

|

|

|

|

|

|

|

|

|

|

|

|

|

FUEL TAX COMPUTATION *Enter Data On Schedule 1*

7 Tax due or credit (see reverse side) |

7 |

$ |

8 Penalty (see reverse side) |

8 |

$ |

|

|

|

9 Interest (see reverse side) |

9 |

$ |

10 Total tax due or credit, penalty and interest (total of lines 7, 8 and 9) |

10 |

$ |

11 Previous balance due or credit calculated through |

11 |

$ |

|

|

|

12 BALANCE DUE OR CREDIT CLAIMED. If balance due, pay in full with return. |

12 |

$ |

REFUND REQUESTED (If not checked, any overpayment will be applied to next return).

Note: Refunds under $5.00 will not be processed.

Under Penalties of perjury, I declare that, as taxpayer or preparer, I have examined this return, including any accompanying schedules and statements, and to the best of my knowledge and belief, it is correct and complete.

Authorized Signature

Printed Name / Title

Signature of Preparer Other than Taxpayer

City, State, Zip Code

Telephone Number |

Date |

|

Telephone Number |

Date |

|

|

FOR OFFICE USE ONLY |

|

RECEIVED DATE |

|

|

|

POSTMARK DATE |

|

|

CHK AMT / NUMBER $ |

# |

|

|

|

|

|

DEPOSITOR INTIALS |

|

|

|

DATE POSTED / INITIALS |

|

|

CARRIER NUMBER |

|

|

|

ADDITIONAL COMMENTS |

|

|

MC366 12/2012 |

WHITE - DMV COPY |

|

|

CANARY - |

CUSTOMER COPY |

|

For assistance please call (775) 684-4711 option #2 then option #1, FAX (775) 684-4619 or visit our website at

www.dmvnv.com/mcforms.htm

WHO MUST FILE: All carriers licensed as Nevada based IFTA carriers.

WHEN AND WHERE TO FILE: This return, properly signed and accompanied by a check or money order made payable to the Nevada Dept. of Motor Vehicles, if applicable, will be considered timely filed if postmarked and paid in full on or before the last day of the month following the quarter covered by the return. A return is required for each quarter even if no miles were traveled. Please submit a brief explanation for any quarter where no miles were traveled. If you have any questions, contact the Fuel User Team at (775) 684-4711 ext. 2 or FAX (775)684-4619.

VERIFICATION AND AUDIT: The records required to substantiate this return must be retained and be available for at least four years from the due date of the return or the date filed, whichever is later.

LINES 1 THROUGH 6, IFTA CARRIERS: In Column (A) indicate the types of fuel used. In Column (B) indicate the total miles (in whole numbers) traveled in Nevada and all jurisdictions for each fuel type. In Column (C) indicate the total fuel (in whole numbers) purchased at pump or fuel pumped from bulk tank in Nevada and all jurisdictions. Divide Column (B) by Column (C) to compute the average miles per gallon (MPG) and enter MPG in Column (D). Note: This calculation must be carried to three decimal places and then rounded back to two decimal places. For example, 5.255 should be shown as 5.26, and 5.254 should be shown as 5.25.

Form 366 Schedule 1 must be completed. Use additional sheets if necessary.

LINE 7. Take the TOTAL from Column I on Form 366 Schedule 1 and enter the total amount. If a credit, enclose in parenthesis ().

LINE 8. If this return is filed late, enter $50.00 and 10 percent of the amount owed.

LINE 9. Enter the Total from column J on schedule 1.

LINE 10. Total lines 7, 8 and 9.

LINE 11. A balance due or credit resulting from a partial payment, mathematical or clerical error, penalty, or interest relating to prior returns will be entered in this space by the Department.

LINE 12. If the amount on line 12 is a balance due, attach a check made payable to the Dept of Motor Vehicles. If the amount on line 12 is a credit balance, you may check the "REFUND REQUESTED" box, and a refund will be issued to you. If the box is not checked, the credit will be applied to your next return.

SIGNATURES: The owner, partner, or corporate officer must sign this return. If the taxpayer authorizes another person to sign this return, there must be a current notarized power of attorney on file annually. Any person who is paid for preparing a taxpayer's return must also sign the return as preparer.

MC366I Form MC366 Instructions (12/2012)

SCHEDULE 1 INSTRUCTIONS

Schedule 1 must be completed. Use additional sheets if necessary.

For assistance please call (775) 684-4711 option #2 then option #1, FAX (775) 684-4619 or visit our website at www.dmvnv.com/mcforms.htm.

COLUMN A. Nevada based IFTA carriers complete the line for Nevada and enter any other IFTA jurisdictions they travel in using separate lines for each fuel type. COLUMN B. Enter fuel type code; BD = bio-diesel, DI = diesel, GA = gasoline, GH = gasohol, KR = kerosene, LP = propane, and NG = CNG.

COLUMN C. Enter the tax rate for the fuel type. For Tax Rate table for applicable quarter, and Conversion rates for miles and gallons refer to www.iftach.org. COLUMN D. Enter total miles in whole numbers traveled in each jurisdiction. The total of Column D should match your total for Column B of the MC366

COLUMN E. Enter the taxable miles traveled in whole numbers. Effective January 1 2008, off-highway miles in Nevada must not be claimed on the IFTA return.

A separate refund request (MC45) must be submitted to claim the credit for off-highway mileage in Nevada. This form is located on the DMV- Motor Carrier Website www.dmvnv.com/mcforms.htm. Non Nevada off-road miles for registered vehicles or miles traveled during the valid period of a Fuel / Trip Permit are not entered in this column. Subtract non Nevada off-road or Fuel / Trip-permit miles from total miles in Column E. Records must be maintained to substantiate non Nevada off-road miles and trip-permits for audit purposes. All carriers must submit a copy of fuel / trip permits with tax return.

Note: Only subtract off road or exempt miles after confirming with that jurisdiction that they honor these exemptions. Your tax return will be processed without them, which will change credits due or owed.

COLUMN F. Divide Column E by the MPG on Line 1 thru 6 from Column D on Form MC366 and enter the gallons in whole numbers.

COLUMN G. Enter all tax paid gallons purchased in each state in whole numbers for the quarter and include any tax paid fuel pumped from a bulk tank.

The total of Column G should match your total for Column C of the MC366

Note: Exclude gallons purchased at any stations that do not collect the state tax. All invoices and bulk tank logs to support tax paid gallons must be retained by the fuel user for audit purposes.

COLUMN H. Subtract Column G from Column F; if credit, enclose in parenthesis () (example F – G = H).

COLUMN I. Multiply Column H by the tax rate in Column C; if credit, enclose in parenthesis ().

Note: If you have traveled in jurisdictions that also require surcharges you will also need to compute the surcharges due for those jurisdictions in addition to the tax due. The surcharge information must be listed on a separate line. The surcharge is calculated by taking the gallons listed in the Taxable Gallons Column F and multiplying by the surcharge rate listed in Column C for that state to determine the surcharge due. List this amount on the appropriate line in Column I. Remember, the surcharge is always a tax due, never a tax credit.

COLUMN J. If Column I is greater than zero and the report is being filed late, calculate interest due by multiplying Column I by one percent (1%) times the number of months the report is late. Any portion of a month is charged interest for a full month.

COLUMN K. Add Column I to Column J; if credit, enclose in parenthesis ().

TOTALS: Total Columns D through K down for each fleet type and enter on the corresponding totals line. Add Columns I & J and transfer the totals to Form MC366 line 7 and line 9.

MC366A Schedule 1 Instructions (2/2009)

FORM 366 SCHEDULE 1

TAX COMPUTATION

REFER TO INSTRUCTIONS ON REVERSE SIDE

Nevada Motor Carrier Number: |

|

|

Account Name: |

|

|

|

|

|

|

Tax Period: |

|

|

|

|

|

|

|

|

|

|

|

Total Miles Traveled |

in all IFTA Jurisdictions (MC366 Column B) |

|

|

|

|

|

|

|

Total Gallons Used in all IFTA Jurisdictions (MC366 Column C) |

|

|

|

|

|

|

|

Average Miles Per Gallon (MPG) (Total miles ÷ Total Gallons = MPG) |

carry to 2 decimal places |

|

|

|

|

|

|

|

|

|

ROUND TO NEAREST WHOLE MILE AND GALLON |

|

|

|

|

A |

B |

C |

D |

E |

F |

G |

H |

I |

J |

|

K |

|

FUEL |

|

|

|

|

|

|

|

|

|

|

IFTA |

TYPE |

|

TOTAL MILES |

TAXABLE |

TAXABLE |

|

NET TAXABLE |

|

|

|

|

(BD, DI, |

TAX |

TAX PAID |

TAX DUE |

INTEREST |

|

TOTAL DUE |

IN IFTA |

MILES IN IFTA |

GALLONS (E |

GALLONS |

|

JURISDICTION |

GA, GH, |

RATE |

JURISDICTION |

JURISDICTION |

÷ MPG) |

GALLONS |

(F - G) |

(H x C) |

DUE |

|

(I + J) |

|

LP, NG, |

|

|

|

|

|

|

|

KR) |

|

|

|

|

|

|

|

|

|

|

NEVADA |

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

$ |

$ |

$ |

WHITE - DMV COPY |

CANARY - CUSTOMER COPY |

FORM 366 SCHEDULE 1

TAX COMPUTATION

REFER TO INSTRUCTIONS ON REVERSE SIDE

|

Nevada Motor Carrier Number: |

|

|

Account Name: |

|

|

|

|

|

|

Tax Period: |

|

|

|

|

|

|

|

|

|

|

|

Total Miles Traveled |

in all IFTA Jurisdictions (MC366 Column B) |

|

|

|

|

|

|

|

Total Gallons Used in all IFTA Jurisdictions (MC366 Column C) |

|

|

|

|

|

|

|

Average Miles Per Gallon (MPG) (Total miles ÷ Total Gallons = MPG) |

carry to 2 decimal places |

|

|

|

|

|

|

|

|

|

ROUND TO NEAREST WHOLE MILE AND GALLON |

|

|

|

|

A |

B |

C |

D |

E |

F |

G |

H |

I |

J |

K |

|

|

FUEL |

|

|

|

|

|

|

|

|

|

|

IFTA |

TYPE |

|

TOTAL MILES |

TAXABLE |

TAXABLE |

|

NET TAXABLE |

|

|

|

|

(BD, DI, |

TAX |

TAX PAID |

TAX DUE |

INTEREST |

TOTAL DUE |

|

IN IFTA |

MILES IN IFTA |

GALLONS (E |

GALLONS |

|

JURISDICTION |

GA, GH, |

RATE |

JURISDICTION |

JURISDICTION |

÷ MPG) |

GALLONS |

(F - G) |

(H x C) |

DUE |

(I + J) |

|

|

LP, NG, |

|

|

|

|

|

|

|

KR) |

|

|

|

|

|

|

|

|

|

|

Total Page 1 |

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

$ |

$ |

$ |

WHITE - DMV COPY |

CANARY - CUSTOMER COPY |