So, her Traditional IRA deduction limit is:

$10,000 - $4,619 x $3,000 = $1,614 (rounded to $1,610) $10,000

Example 2 - Married Participants, Filing Joint Tax Return: Mr. and Mrs. Young file a joint tax return. Each spouse earns more than $3,000 and each is an active participant. They are both under age 50. They have a combined AGI of $56,255 in 2002. They may each contribute to an IRA and calculate their tax-deductible contributions to each IRA as follows:

Their AGI is $56,255

Their Threshold Level is $54,000

Their Excess AGI is (AGI - Threshold Level) = $2,255

So, each spouse would determine their Traditional IRA deduction limit as follows:

$10,000 - $2,255 x $3,000 = $2,324 (rounded to $2,320) $10,000

The deduction limit is $2,320 for Mr. Young’s Traditional IRA and $2,320 for Mrs. Young’s Traditional IRA. This gives the Youngs a max- imum deduction of $4,640 on their joint return.

Example 3 - Married Participant, Filing Separate Tax Return: Mr. Jones, a married person over 50 (and eligible to make “Catch-up” Contributions), is an active participant. He files a separate tax return. He has $1,500 of compensation in 2002 and wishes to make a tax- deductible contribution to a Traditional IRA.

His AGI is $1,500

His Threshold Level is $0

His Excess AGI is (AGI - Threshold Level) = $1,500 So, his Traditional IRA deduction limit is:

$10,000 - $1,500 x $3,500 = $2,975 (rounded to $2,970) $10,000

Even though his IRA deduction limit under the formula is $2,970, Mr. Jones may not deduct an amount in excess of his compensation, so his actual deduction is limited to $1,500.

Example 4 - Spouse of Active Participant, Filing Joint Tax Return:

Mr. and Mrs. Wilson file a joint tax return. Each spouse earns more than $3,000 and are under 50. Mr. Wilson is an active participant, but Mrs. Wilson is not. Mrs. Wilson calculates her tax-deductible contri- butions as follows:

Their AGI is $155,000.

Her threshold level is $150,000.

Her Excess AGI is (AGI - threshold level) is $5,000. Therefore her Traditional IRA deduction limit is:

$10,000 - $5,000 x $3,000 = $1,500

$10,000

Mrs. Wilson’s deduction limit is $1,500. However, because the Wilsons’ AGI is above the phase-out range for married participants fil- ing joint tax returns, Mr. Wilson will not be able to make any tax- deductible contributions to his Traditional IRA for the year.

4(g) Non-Deductible Contributions.

If your tax-deductible contributions are limited due to the phase-out rules described above, you may make non-deductible contributions.

(See item 3.) In addition, you may also elect to treat a Traditional IRA contribution as non-deductible, even if you could have deducted part or all of the contribution. You designate a contribution as non- deductible at the time you file your tax return.

Investment earnings on your non-deductible Traditional IRA contri- butions (like the earnings on your deductible contributions) are not taxed until withdrawn from your Traditional IRA.

If you make a non-deductible contribution to an IRA (or designate a con- tribution as such), you must report the amount to the IRS on Form 8606 as a part of your tax return for the year. (You must file the Form 8606 even if you do not otherwise have to file a tax return for the year.)

Note: A penalty of $50 is imposed for each failure to properly file the Form 8606. In addition, a $100 penalty is imposed for any overstatement of the amount of des- ignated non-deductible contributions. A penalty will not be imposed if the tax- payer can show reasonable cause for failure to report the required information.

4(h) Corrective Withdrawals.

You may make a tax-free withdrawal of any contribution you make to your Traditional IRA for a year if you withdraw the contribution, together with any earnings on it, by the due date (including extensions) for filing your income tax return.

The withdrawal amount cannot be deducted on your tax return or reported as a non-deductible contribution. The contribution you withdraw is not included in your income as an IRA distribution, but you must include any earnings on the contribution as ordinary income for the year you made the contribution. The earnings also are subject to a 10% penalty tax on premature distribution if you are under age 591/2 (certain exceptions apply).

4(i) Tax Credit for Making IRA Contributions.

You may qualify for a new nonrefundable tax credit for contributing to your IRA. The credit is effective for the tax years beginning in 2002 through 2006. Generally, the credit for a tax year will be equal to your “applicable percentage” times the amount of “qualified retirement sav- ings contributions” as reduced by certain distributions received from retirement plans. The credit is in addition to any deduction from gross income that is otherwise allowed for the contribution.

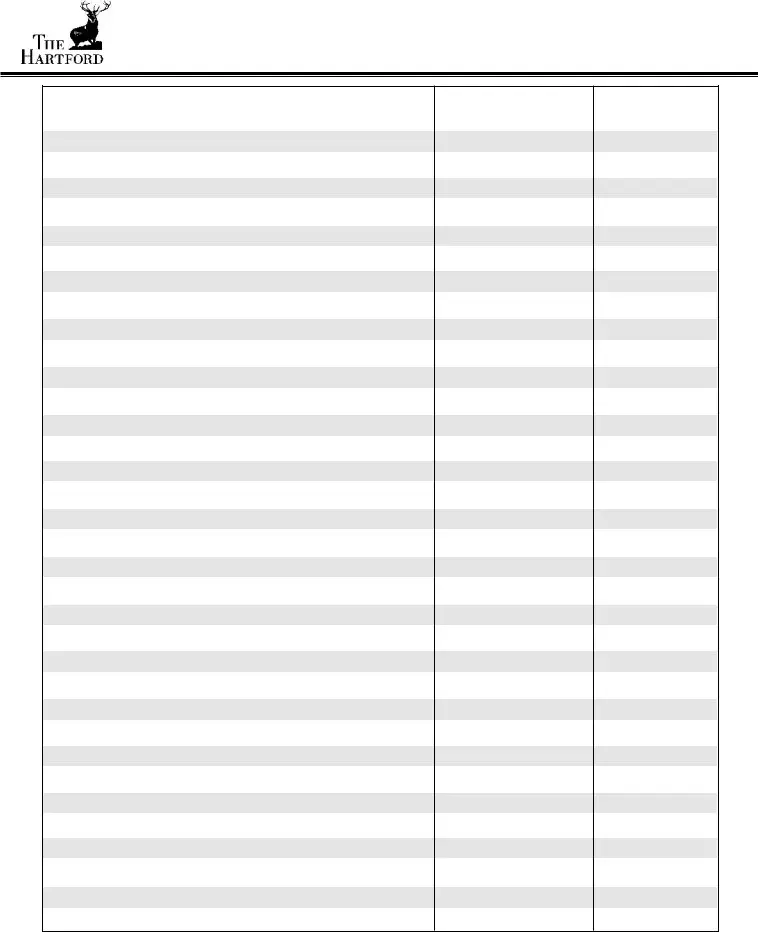

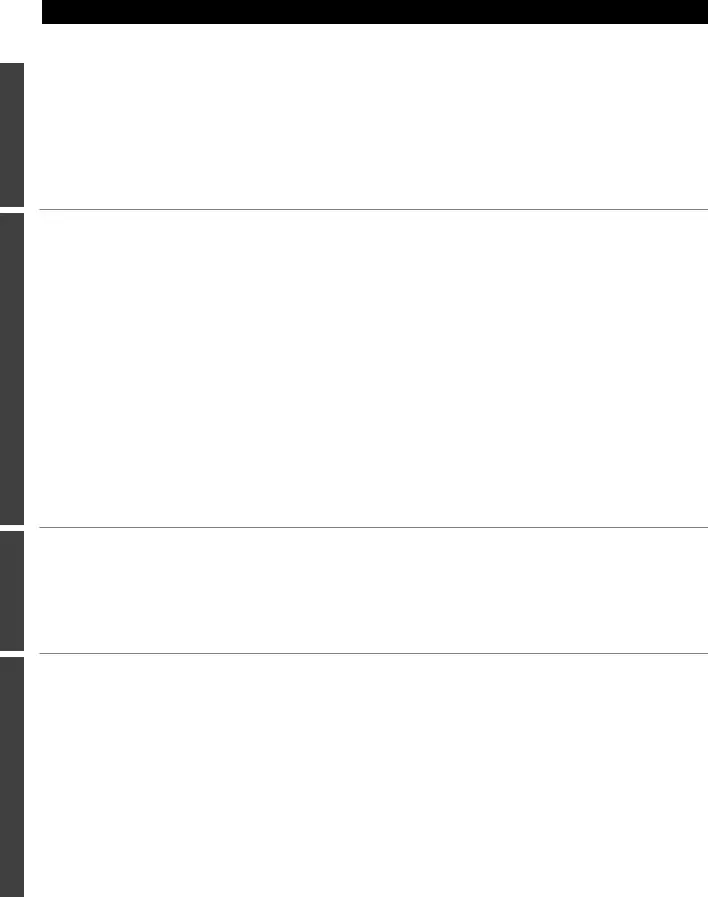

Applicable Percentage. Your applicable percentage is determined by your filing status and your federal adjusted gross income. The maxi- mum credit rate is 50% and is subject to a phase-out, as detailed below:

Joint |

Head of |

All other |

Applicable |

Return |

Household |

Cases |

|

Percentage |

Over |

Not Over |

Over |

Not Over |

Over Not Over |

|

$ 0 |

$30,000 |

$ 0 |

$22,500 |

$ 0 |

$15,000 |

50% |

30,000 |

32,500 |

22,500 |

24,375 |

15,000 |

|

16,250 |

20% |

32,500 |

50,000 |

24,375 |

37,500 |

16,250 |

|

25,000 |

10% |

50,000 |

--- |

37,500 |

--- |

25,000 |

|

--- |

0% |

For example, if you and your spouse file a joint return with a federal adjusted gross income of $36,000, your applicable percentage is 10%.

Qualified Retirement Savings Contributions. Qualified retirement savings contributions include IRA contributions, as well as contribu- tions to certain other plans. The total contribution amount is reduced by any distributions to you from:

(1) a qualified retirement plan or eligible deferred compensation plan