Understanding the complexities of tax forms is crucial for Michigan residents desirous of maximizing their returns or minimizing liabilities, and the MI-1040CR form is a substantial part of this process for those who qualify. Officially known as the Michigan Homestead Property Tax Credit Claim, this form, issued under Public Act 281 of 1967, offers a voluntary filing option for taxpayers seeking credit against their property taxes. It accommodates various categories of filers, including homeowners, renters, and occupants of nursing or adult foster care homes, by allowing them to claim a credit based on the taxes levied on their home or rent paid within the state. It specifically addresses the taxpayers' residency status, household income limits for eligibility, and detailed instructions for paraplegics, quadriplegics, hemiplegic individuals, and seniors, with meticulous calculations and prerequisites for different types of claimants. In essence, the MI-1040CR form embodies the state’s initiative to alleviate the financial burden of property taxes on its residents, ensuring those eligible can navigate their obligations with the state treasury more affordably.

| Question | Answer |

|---|---|

| Form Name | Form Mi 1040Cr |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 98_1040CR_FORM_ 340079_7 2015 1040cr forms |

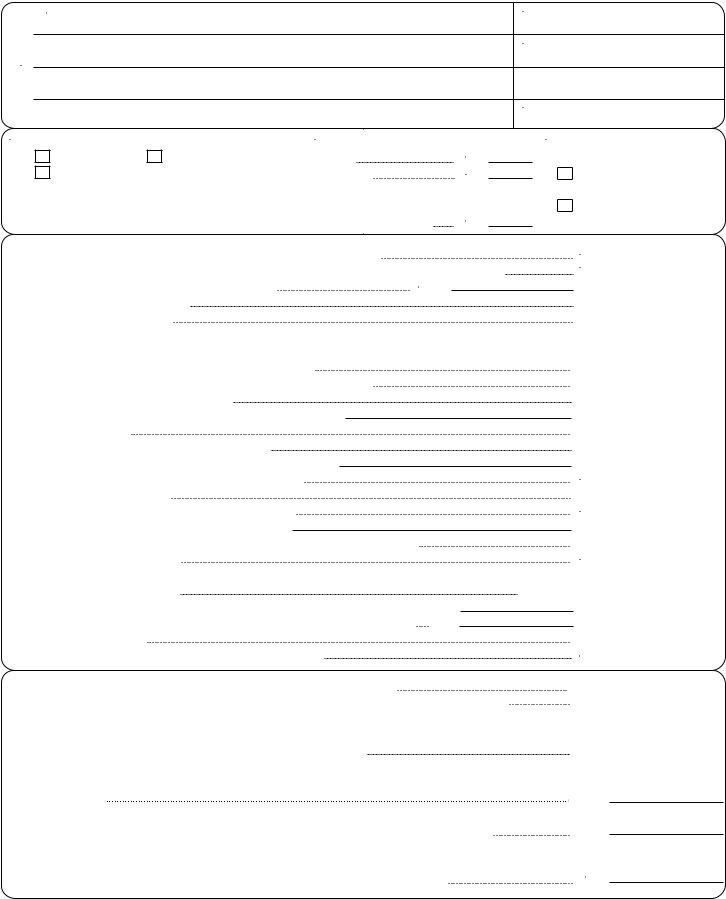

Homestead Property Tax Credit Claim

Issued under P.A. 281 of 1967. Filing is voluntary.

HERE |

▼ |

1 Filer's First Name, Middle Initial and Last Name |

|

|

|

|

|

|

|

|||||||||

If a Joint Return, Spouse's First Name, Middle Initial and Last Name |

|

|

|

|

||||||||||||||

LABEL |

|

|

|

|

|

|||||||||||||

|

Home Address (No., Street, P.O. Box or Rural Route) |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLACE |

|

City or Town |

|

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▼ 5 |

Residency Status in 1998 |

|

▼ 6 Age on Dec. 31, 1998 |

|

|

|||||||||||||

a. |

|

Resident |

b. |

|

Nonresident |

|

a. YOU |

|

|

▼ |

a. |

|||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|||||||||||||

c. |

|

|

b. SPOUSE |

|

|

▼ b. |

||||||||||||

|

|

|

|

|||||||||||||||

|

|

|

||||||||||||||||

|

You |

|

|

|

|

|

|

|

|

|

|

c. If you are an unremarried |

|

|

||||

|

FROM: Mo. Day |

Yr. TO: Mo. Day Yr. |

|

surviving spouse, enter |

|

|

||||||||||||

|

Spouse |

|

|

|

|

|

|

|

|

|

|

spouse's age at death |

▼ c. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.Homeowners: Enter the 1998 taxable value of your homestead

9.Property taxes levied on your home in 1998 (see p. 34) or amount from line 43, 48 or 50

10. Renters: Enter rent paid in 1998 from line 45 |

▼ |

10. |

11.Multiply line 10 by 20% (.20)

12.Total. Add lines 9 and 11

Household Income. Be sure to include income from both spouses.

If your household income is more than $82,650, you are not eligible for a credit.

13.Wages, salaries, tips, sick, strike and SUB pay, etc.

14.All interest and dividend income (including nontaxable interest)

15.Net rent, business or royalty income

16.Retirement pension and annuity benefits. Name of payer:

17.Net farm income

18.Capital gains less capital losses (see page 43)

19.Alimony and other taxable income (see page 43). Describe:

20.Social Security, SSI or railroad retirement benefits

21.Child support (see page 43)

22.Unemployment compensation and TRA benefits

23.Other nontaxable income (see page 43). Describe:

24.Workers' comp. , veterans' disability compensation and pension benefits

25.FIP and other FIA benefits

26.Subtotal. Add lines

27. |

Other adjustments (see page 44). Describe: |

|

27. |

|

|||

28. |

Medical insurance or HMO premiums you paid for you and your family |

28. |

|

29.Add lines 27 and 28

30.HOUSEHOLD INCOME. Subtract line 29 from line 26

31.Multiply line 30 by 3.5% (.035) or by the percent in Table 3 (see p. 44)

32.Subtract the amount on line 31 from line 12. If line 31 is more than line 12, enter zero (0)

|

|

1998 |

CR |

|||||

|

Attachment Sequence No. 05 |

|||||||

▼ 2 Filer's Social Security Number |

||||||||

▼ 3 Spouse's Social Security Number |

||||||||

|

Office Use |

|

|

|

|

|||

▼ 4 School District Code (see p. 46) |

||||||||

|

▼ |

7 If you qualify for either of |

||||||

|

||||||||

|

|

|

the following, check the box. |

|||||

|

a. |

|

|

Paraplegic, Quadriplegic, |

||||

|

|

|

||||||

|

|

|

|

or Hemiplegic |

|

|||

|

b. |

|

|

Totally and Permanently |

||||

|

|

|

||||||

|

|

|

|

Disabled (see p. 43) |

||||

|

|

|

|

▼ |

8. |

|

|

.00 |

|

|

|

|

|

|

|||

|

|

|

|

▼ |

9. |

|

|

.00 |

.00 |

|

|

|

|

|

|||

|

|

|

|

|

11. |

|

|

.00 |

|

|

|

|

|

12. |

|

|

.00 |

|

|

|

|

|

13. |

|

|

.00 |

|

|

|

|

|

14. |

|

|

.00 |

|

|

|

|

|

15. |

|

|

.00 |

|

|

|

|

|

16. |

|

|

.00 |

|

|

|

|

|

17. |

|

|

.00 |

|

|

|

|

|

18. |

|

|

.00 |

|

|

|

|

|

19. |

|

|

.00 |

|

|

|

|

▼ |

20. |

|

|

.00 |

|

|

|

|

|

|

.00 |

||

|

|

|

|

|

21. |

|

|

|

|

|

|

|

▼ |

22. |

|

|

.00 |

|

|

|

|

|

|

.00 |

||

|

|

|

|

|

23. |

|

|

|

|

|

|

|

|

24. |

|

|

.00 |

|

|

|

|

▼ |

25. |

|

|

.00 |

|

|

|

|

|

|

.00 |

||

Subtotal |

26. |

|

|

|||||

|

|

.00 |

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

29. |

|

|

.00 |

|

|

|

|

▼ |

30. |

|

|

.00 |

|

|

|

|

|

31. |

|

|

.00 |

|

|

|

|

|

32. |

|

|

.00 |

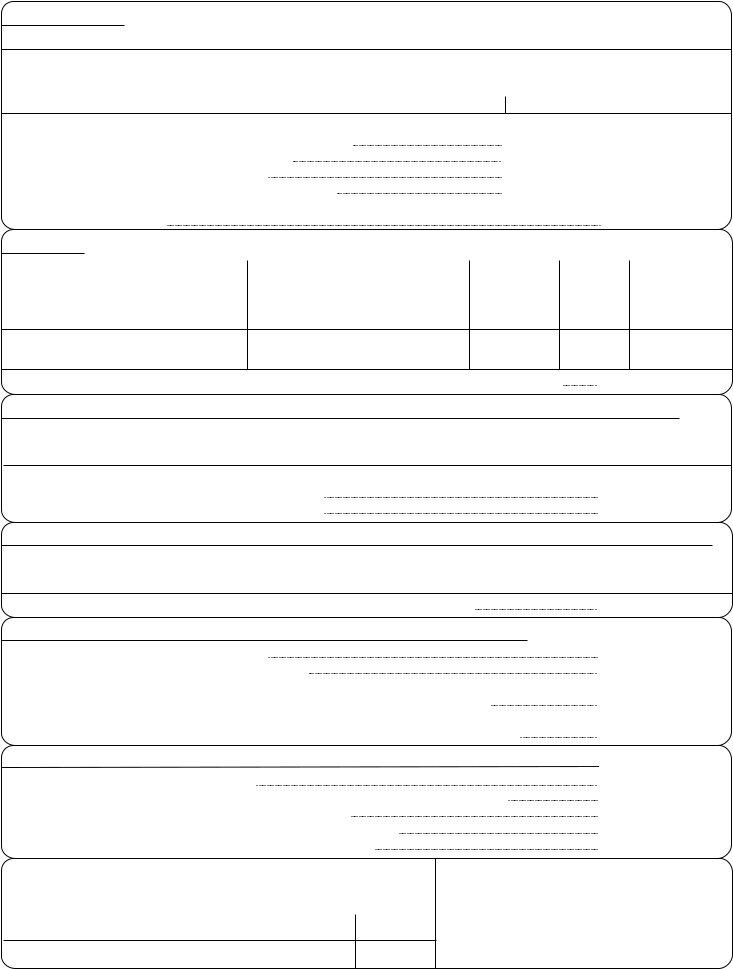

Seniors (you wrote "65" or older anywhere in box 6), go to lines 34 or 35. FIP/FIA recipients and people who checked box 7a, go to lines 34 or 35. All others (including people who checked box 7b) must complete line 33.

33. Multiply line 32 by 60% (.60) (maximum $1,200). Go to line 36 |

33. |

.00 |

34.Everyone who received FIP/FIA payments, complete lines

Go to line 36

35.Senior homeowners or people who are paraplegic, quadriplegic or hemiplegic (if you completed line 34, skip this line), enter the amount from line 32 (maximum $1,200). Go to line 36

36.CREDIT. If your household income (line 30) is less than $73,650, enter the amount that applies to you from line 33, 34 or 35 here. If it is more than $73,650, you must reduce your credit (see instructions on page 44). If you file an

34.

35.

▼ 36.

.00

.00

.00

www.treasury.state.mi.us

HOMEOWNERS

Report on lines 37 and 38 the addresses of the homesteads you are claiming credit on. If you need more space, attach a list.

37. |

Address where you lived on Dec. 31, 1998, if different than reported on line 1. |

Taxable Value |

|

|

|

38. |

Address of homestead sold during 1998 (No., street and city). |

Taxable Value |

If you bought or sold your home in 1998, complete lines 39 - 43.

39.Number of days occupied. (Total cannot be more than 365)

40.Divide line 39 by 365 and enter percentage here

41.Property taxes levied in calendar year 1998

42.Prorated taxes. Multiply line 41 by percentage on line 40

43.Taxes eligible for credit. Add line 42, columns A and B. Enter here and on line 9

Homestead |

A. Bought |

B. Sold |

||

39. |

|

|

|

|

40. |

% |

% |

|

|

41. |

|

|

|

|

42. |

|

|

|

|

|

43. |

|

.00 |

|

RENTERS

44. |

Address of homestead you rented |

|

Number of |

Monthly |

|

|

(No., street, apt. no. and city) |

Landowner's Name and Address |

Months Rented |

Rent |

Total Rent Paid |

A. |

|

|

|

|

A. |

B.

B.

45. Total rent paid (not more than 12 months). Add total rent for each period. Enter here and on line 10 |

45. |

.00 |

OCCUPANTS OF HOUSING ON WHICH SERVICE FEES ARE PAID INSTEAD OF TAXES

46.Name and address of housing project or landowner.

47.Enter the total amount of rent you paid in 1998. Do not include

amounts paid on your behalf by a government agency |

47. |

.00 |

48. Multiply line 47 by 10% (.10). Enter here and on line 9 |

48. |

.00 |

OCCUPANTS OF NURSING OR ADULT FOSTER CARE HOMES OR HOMES FOR THE AGED

49. Name and address of care facility.

50. Your share of taxes paid by the landowner (see page 41). Enter here and on line 9 |

50. |

.00 |

CREDIT PRORATION

51. |

Subtract line 25 from line 30 and enter here |

51. |

.00 |

52. |

Divide line 51 by line 30 and enter percentage here |

52. |

% |

53. |

If you entered 65 or older anywhere in box 6, or checked box 7a, enter the amount from line 32. |

|

|

|

All others multiply amount on line 32 by 60% (.60) and enter here (maximum $1,200) |

53. |

.00 |

54. |

Multiply line 53 by percentage on line 52. If you are age 65 or older and you rent your home, |

|

|

|

enter here and on line 55 and complete lines |

54. |

.00 |

ALTERNATE PROPERTY TAX CREDIT FOR RENTERS AGE 65 AND OLDER

55. |

Enter amount from line 32 or from line 54 |

55. |

.00 |

56. |

Enter rent paid from line 45 or 47. (If you moved during 1998, see instructions, page 45.) |

56. |

.00 |

57. |

Multiply the amount on line 30 by 40% (.40) and enter here |

57. |

.00 |

58. |

Subtract line 57 from line 56. If line 57 is more than line 56, enter "0" |

58. |

.00 |

59. |

Enter the larger of line 55 or 58 and carry this amount to line 34 |

59. |

.00 |

I declare, under penalty of perjury, that the information in this claim and attachments is true and complete to the best of my knowledge.

|

|

I authorize Treasury to discuss my claim |

|

Do not discuss my claim |

|

|

and attachments with my preparer. |

|

with my preparer. |

|

|

|

||

Filer's Signature |

|

Date |

||

I declare, under penalty of perjury, that this claim is based on all information of which I have knowledge.

Preparer's Signature, Address, Phone and ID No.

Spouse's Signature

Date