If you would like to fill out Form Mi 1040X, there's no need to download and install any sort of programs - just use our PDF tool. Our editor is continually developing to deliver the very best user experience attainable, and that's due to our commitment to continual improvement and listening closely to user opinions. Should you be looking to begin, this is what it will require:

Step 1: Hit the "Get Form" button in the top area of this webpage to access our tool.

Step 2: As you launch the online editor, you will get the document all set to be completed. In addition to filling in different blanks, you might also do various other things with the PDF, such as adding any text, modifying the original textual content, adding illustrations or photos, placing your signature to the form, and a lot more.

Be attentive when filling out this document. Ensure that all necessary fields are filled out accurately.

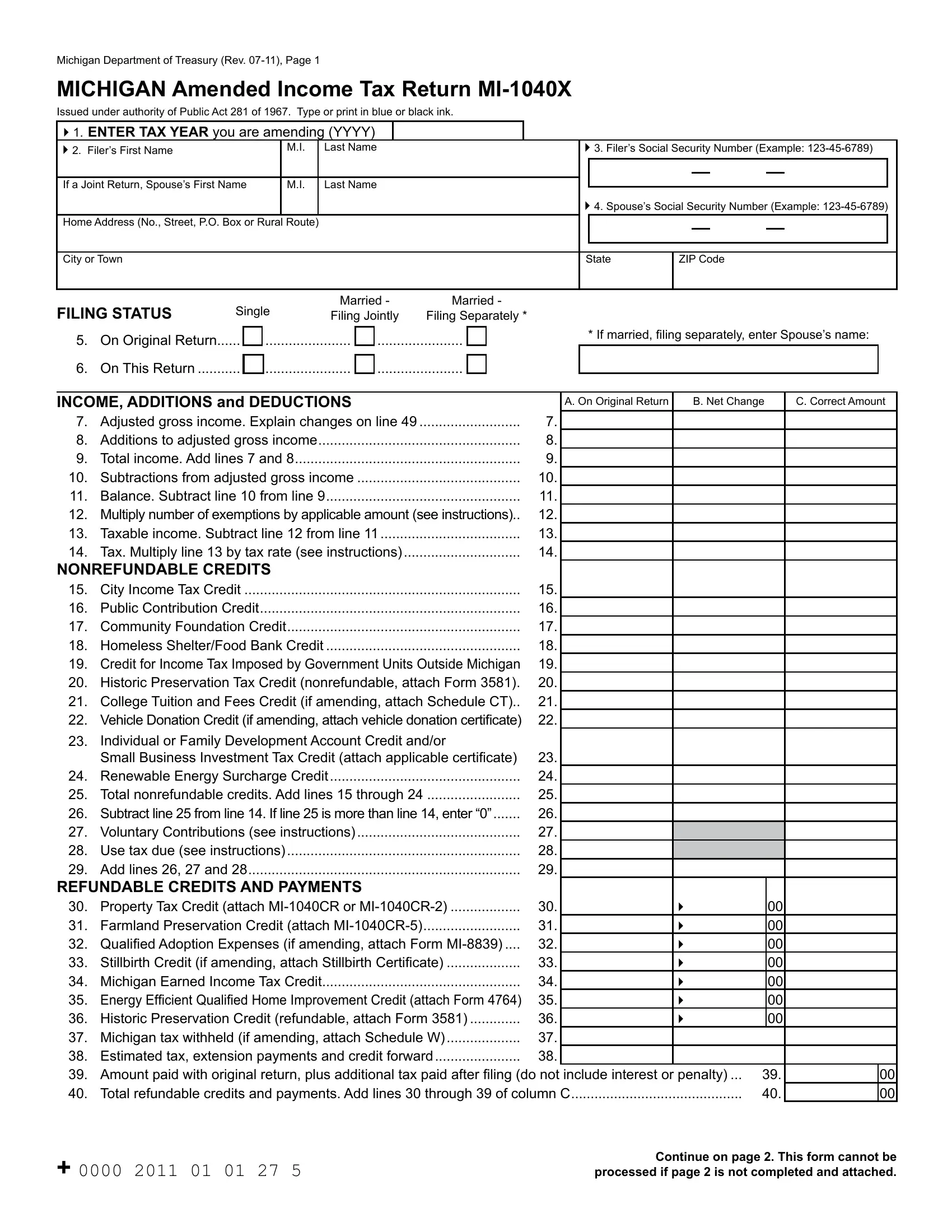

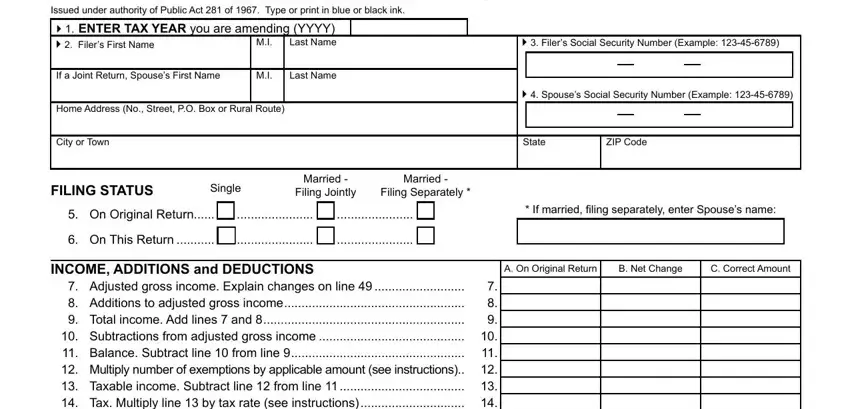

1. It's very important to complete the Form Mi 1040X accurately, hence take care while working with the sections that contain these blank fields:

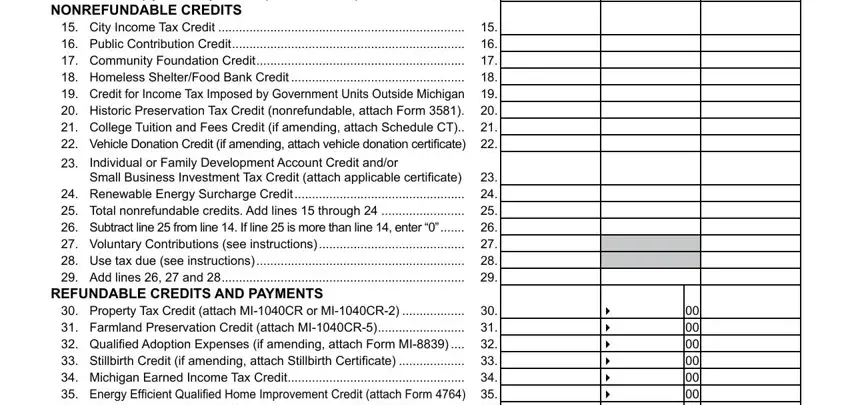

2. Once the first part is done, go to enter the applicable information in these: Adjusted gross income Explain, NONREFUNDABLE CREDITS, City Income Tax Credit Public, Individual or Family Development, REFUNDABLE CREDITS AND PAYMENTS, and Property Tax Credit attach MICR.

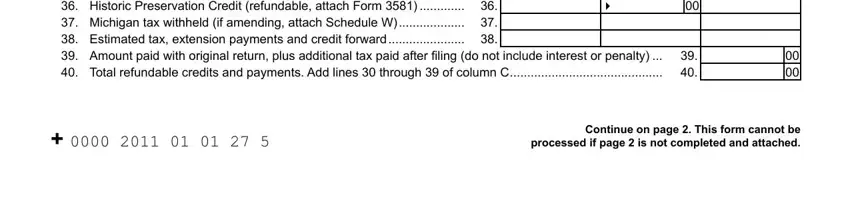

3. This next step will be focused on Property Tax Credit attach MICR, and Continue on page This form cannot - complete these fields.

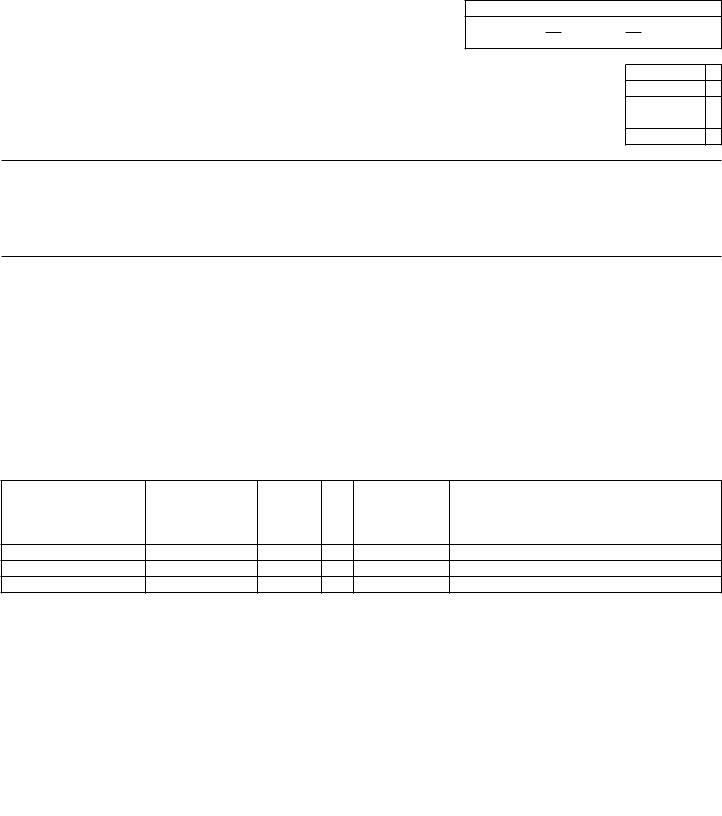

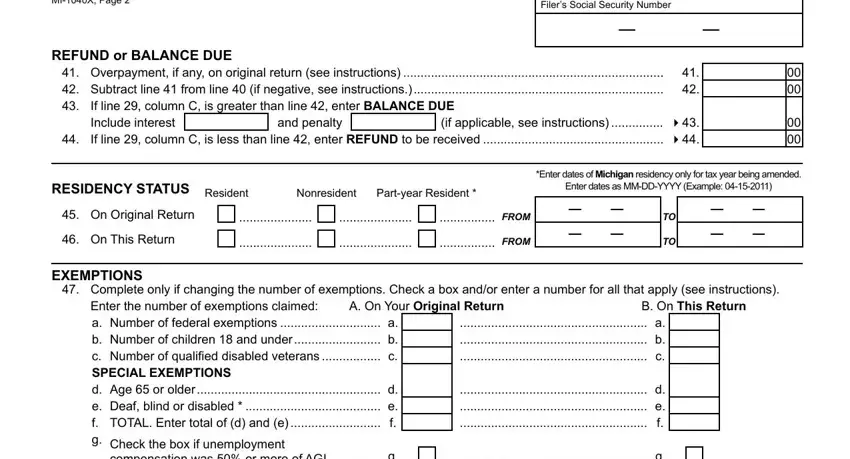

4. This section comes next with the following blanks to fill out: MIX Page, Filers Social Security Number, REFUND or BALANCE DUE, Overpayment if any on original, If line column C is greater than, if applicable see instructions, and penalty, RESIDENCY STATUS Resident, Nonresident, Partyear Resident, Enter dates of Michigan residency, Enter dates as MMDDYYYY Example, On Original Return, FROM, and On This Return.

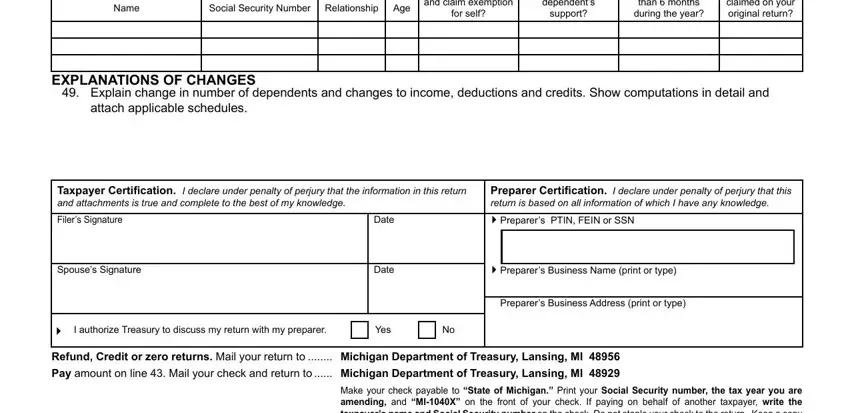

5. To conclude your form, the last section has a couple of extra fields. Filling in Name, Social Security Number, Relationship, Age, Did the dependent ile a federal, for self, dependents, support, than months during the year, claimed on your original return, EXPLANATIONS OF CHANGES, Explain change in number of, attach applicable schedules, Taxpayer Certiication I declare, and Filers Signature is going to conclude everything and you can be done in no time at all!

It is possible to make an error while completing your Age, and so make sure you take another look before you decide to submit it.

Step 3: Revise everything you have entered into the blanks and click the "Done" button. Try a 7-day free trial account with us and get immediate access to Form Mi 1040X - download, email, or edit inside your FormsPal account. FormsPal is devoted to the confidentiality of our users; we ensure that all personal information put into our system is protected.