It is possible to fill in 19a without difficulty using our PDFinity® online PDF tool. To retain our tool on the cutting edge of practicality, we aim to put into action user-driven capabilities and enhancements on a regular basis. We're always looking for feedback - play a vital role in revampimg PDF editing. To get the process started, go through these simple steps:

Step 1: Just click the "Get Form Button" in the top section of this site to start up our pdf editing tool. Here you'll find all that is needed to fill out your file.

Step 2: The tool provides the opportunity to modify almost all PDF documents in many different ways. Improve it with any text, correct what is already in the file, and put in a signature - all readily available!

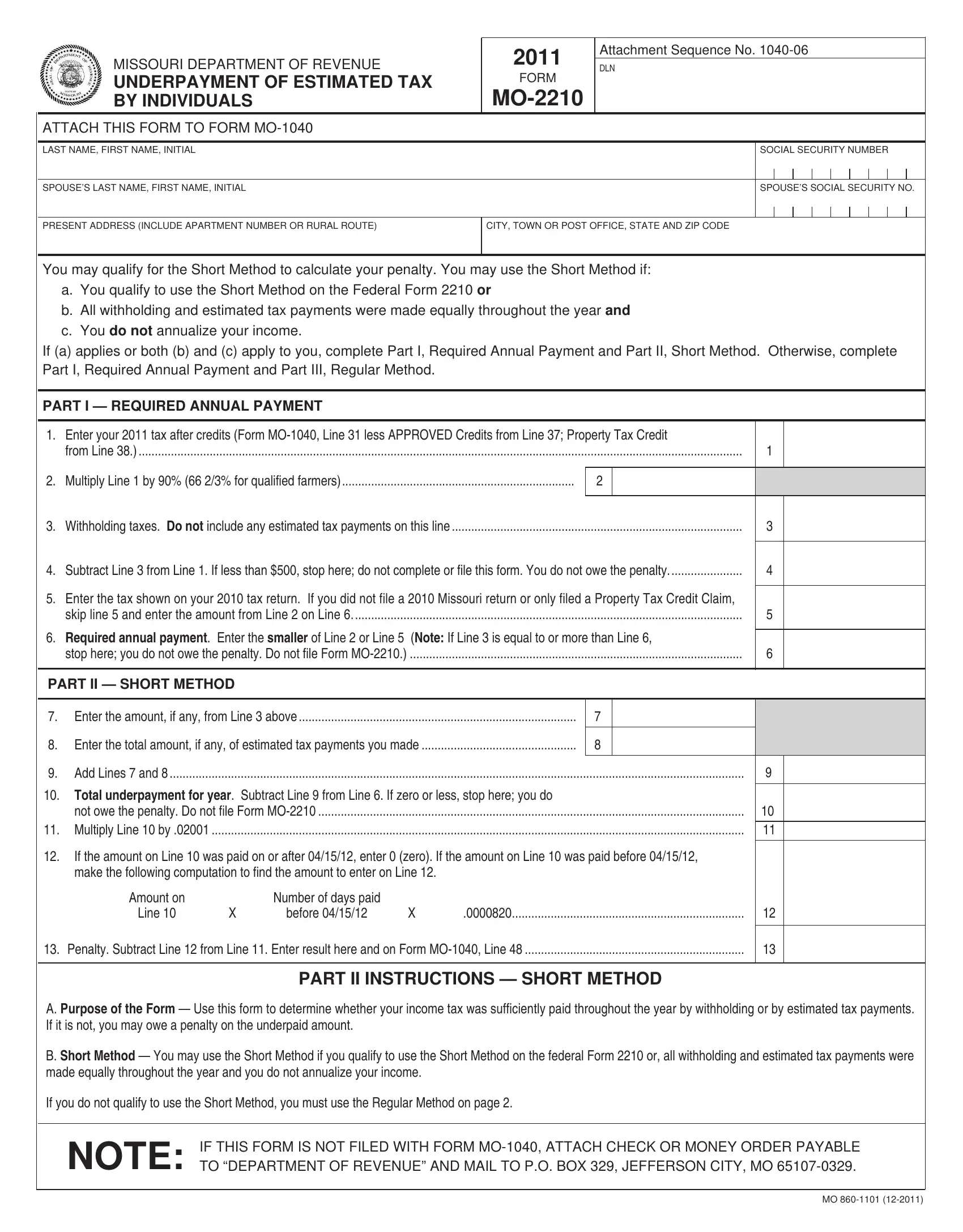

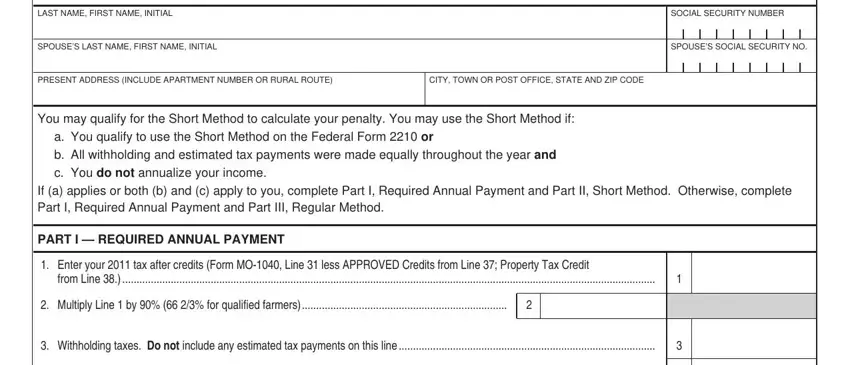

This document requires specific information to be filled out, so you must take some time to provide what is required:

1. It's very important to complete the 19a properly, so take care while working with the segments containing all of these blank fields:

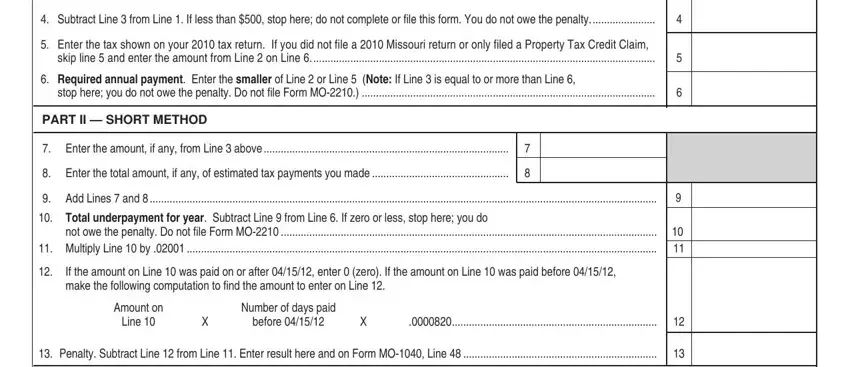

2. Right after performing the previous step, head on to the subsequent part and fill in the necessary particulars in all these blanks - Subtract Line from Line If less, Enter the tax shown on your tax, Required annual payment Enter the, stop here you do not owe the, PART II SHORT METHOD, Enter the amount if any from Line, Enter the total amount if any of, Add Lines and, Total underpayment for year, If the amount on Line was paid on, make the following computation to, Amount on, Line, Number of days paid, and before.

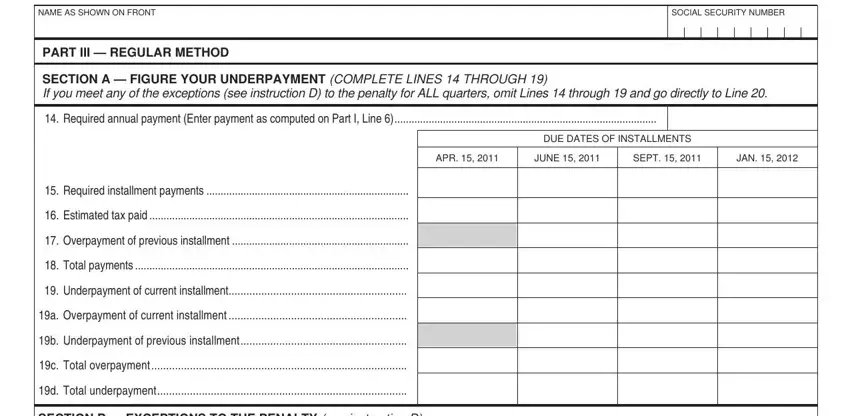

3. In this stage, have a look at NAME AS SHOWN ON FRONT, PART III REGULAR METHOD, Page, SOCIAL SECURITY NUMBER, SECTION A FIGURE YOUR, Required annual payment Enter, APR, JUNE, SEPT, JAN, DUE DATES OF INSTALLMENTS, Required installment payments, Estimated tax paid, Overpayment of previous, and Total payments. These have to be filled in with greatest awareness of detail.

In terms of NAME AS SHOWN ON FRONT and PART III REGULAR METHOD, be certain you double-check them in this section. Those two are viewed as the key ones in the PDF.

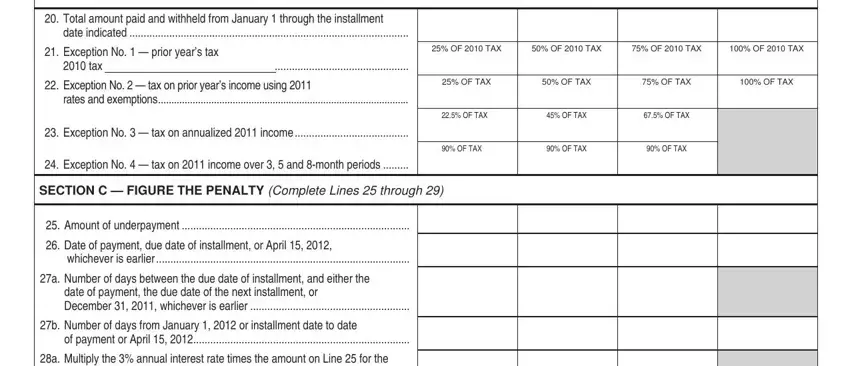

4. To go forward, this fourth section involves typing in a couple of blank fields. These include SECTION B EXCEPTIONS TO THE, Total amount paid and withheld, date indicated, Exception No prior years tax, tax, Exception No tax on prior years, rates and exemptions, Exception No tax on annualized, OF TAX, OF TAX, OF TAX, OF TAX, OF TAX, OF TAX, and OF TAX, which are key to moving forward with this PDF.

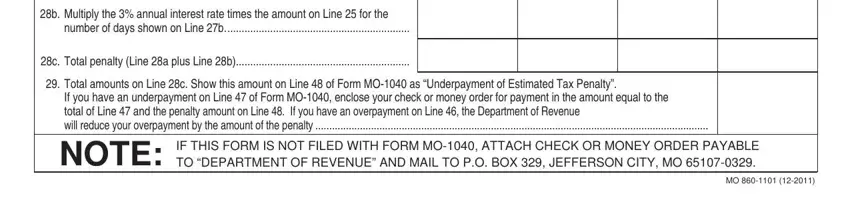

5. And finally, the following final subsection is precisely what you will need to wrap up prior to closing the document. The fields under consideration include the following: b Multiply the annual interest, number of days shown on Line b, c Total penalty Line a plus Line b, Total amounts on Line c Show this, If you have an underpayment on, NOTE, and IF THIS FORM IS NOT FILED WITH.

Step 3: Always make sure that your information is accurate and click "Done" to conclude the process. After registering a7-day free trial account at FormsPal, you will be able to download 19a or email it right off. The PDF form will also be readily available from your personal cabinet with all your adjustments. FormsPal guarantees your information confidentiality by using a protected method that in no way saves or distributes any type of personal information used. Be confident knowing your paperwork are kept protected any time you use our services!