Form Mo 7004 can be completed online without any problem. Just try FormsPal PDF editor to accomplish the job in a timely fashion. We are dedicated to giving you the perfect experience with our editor by regularly releasing new capabilities and upgrades. With all of these updates, working with our tool gets better than ever! Getting underway is easy! What you need to do is follow the following basic steps below:

Step 1: Hit the orange "Get Form" button above. It's going to open up our editor so that you could start completing your form.

Step 2: As you access the tool, you will see the form all set to be filled out. Aside from filling out different blank fields, you can also perform many other things with the file, including adding any words, changing the initial textual content, adding illustrations or photos, affixing your signature to the PDF, and more.

Completing this document requires attentiveness. Ensure that all mandatory areas are filled out accurately.

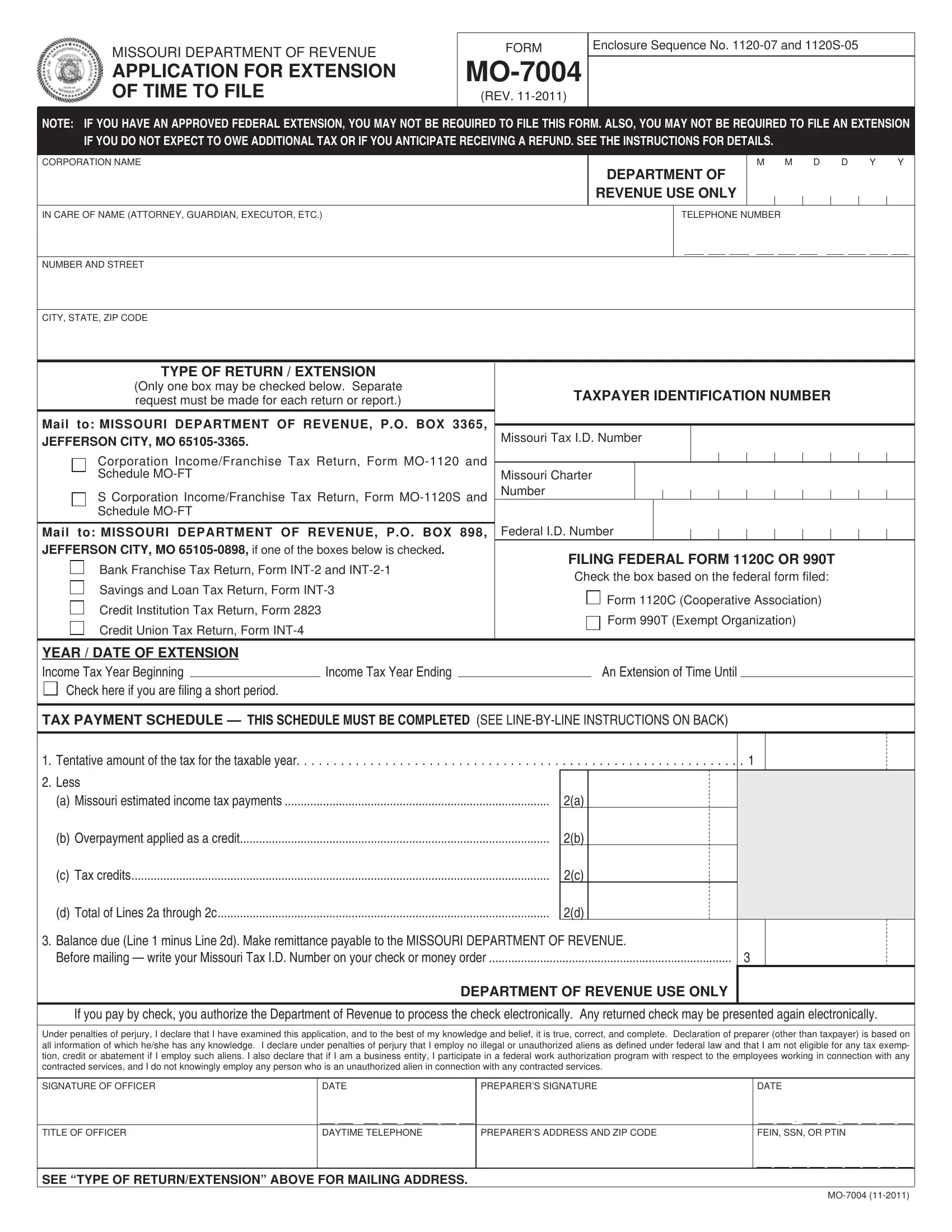

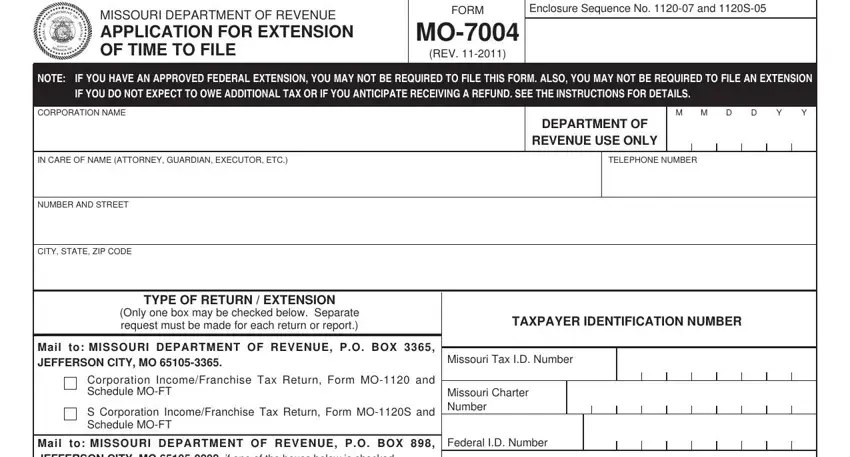

1. First of all, while completing the Form Mo 7004, begin with the part that features the next blank fields:

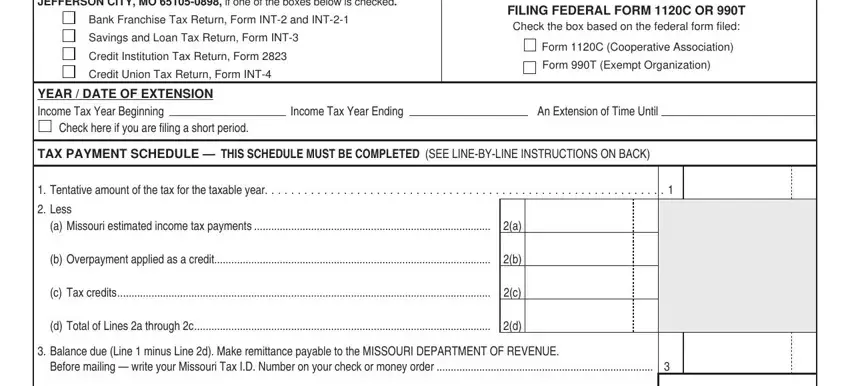

2. Just after filling in this section, go on to the subsequent step and enter the essential details in all these blanks - Mail to MISSOURI DEPARTMENT OF, Bank Franchise Tax Return Form INT, Savings and Loan Tax Return Form, Credit Institution Tax Return Form, Credit Union Tax Return Form INT, FILING FEDERAL FORM C OR T Check, Form C Cooperative Association, Form T Exempt Organization, YEAR DATE OF EXTENSION Income Tax, Check here if you are filing a, Income Tax Year Ending, An Extension of Time Until, TAX PAYMENT SCHEDULE THIS, Tentative amount of the tax for, and Less.

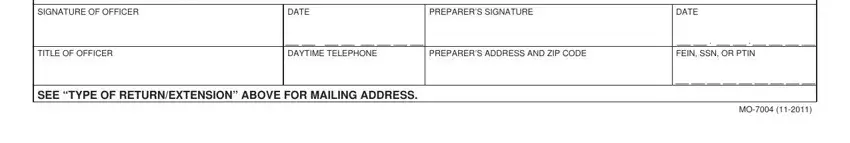

3. The following segment will be about Under penalties of perjury I, SIGNATURE OF OFFICER, DATE, PREPARERS SIGNATURE, DATE, TITLE OF OFFICER, DAYTIME TELEPHONE, PREPARERS ADDRESS AND ZIP CODE, SEE TYPE OF RETURNEXTENSION ABOVE, and FEIN SSN OR PTIN - complete each one of these blanks.

It is possible to make a mistake while filling in your TITLE OF OFFICER, hence be sure to take a second look before you finalize the form.

Step 3: After you've looked once again at the details provided, press "Done" to complete your document generation. Find the Form Mo 7004 after you register online for a free trial. Instantly access the pdf from your FormsPal account, together with any edits and adjustments being conveniently saved! At FormsPal.com, we do our utmost to make sure your details are kept private.