When using the online PDF editor by FormsPal, you are able to fill in or alter Form Mo Nri here and now. To make our editor better and simpler to utilize, we continuously work on new features, taking into consideration suggestions coming from our users. Getting underway is easy! Everything you need to do is stick to the next simple steps below:

Step 1: Hit the orange "Get Form" button above. It's going to open up our pdf editor so that you can start filling in your form.

Step 2: As soon as you launch the online editor, you will notice the form made ready to be completed. Other than filling out different fields, you may as well do other actions with the Document, such as adding your own words, changing the initial text, adding graphics, affixing your signature to the document, and much more.

As for the blanks of this precise document, here's what you should do:

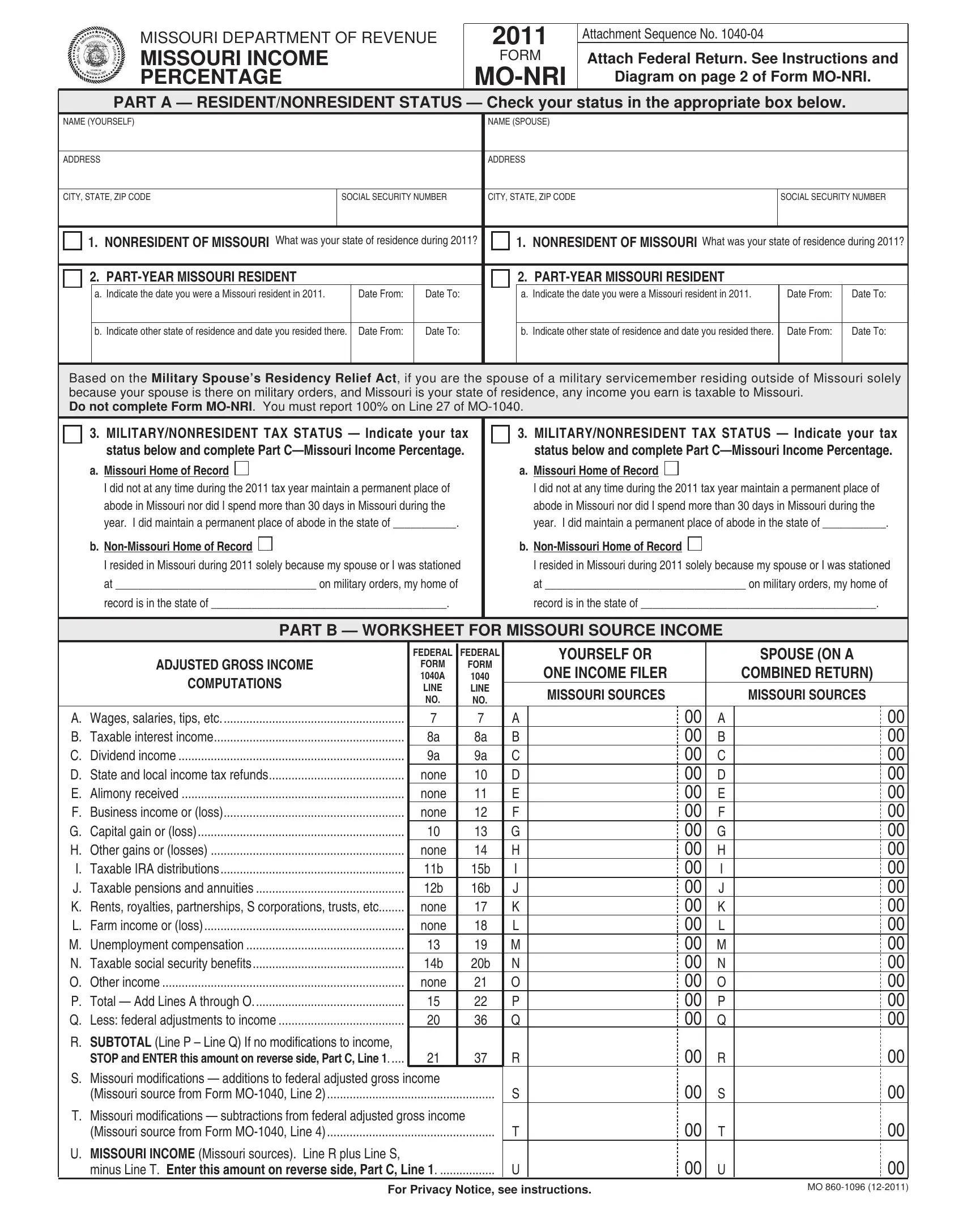

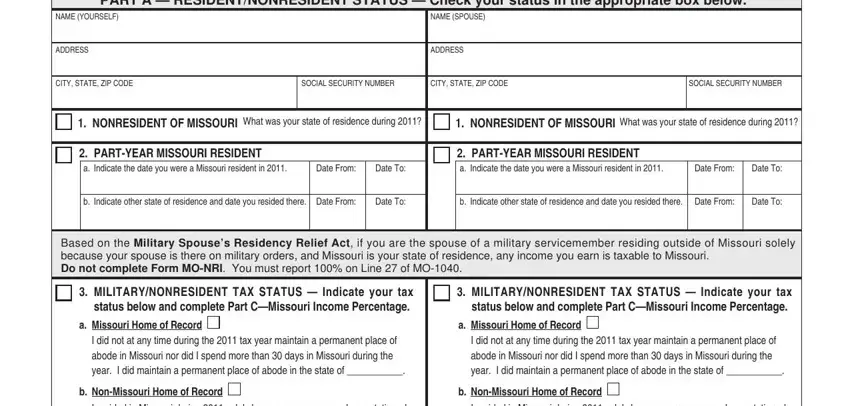

1. It's very important to fill out the Form Mo Nri properly, therefore be attentive while working with the sections including these fields:

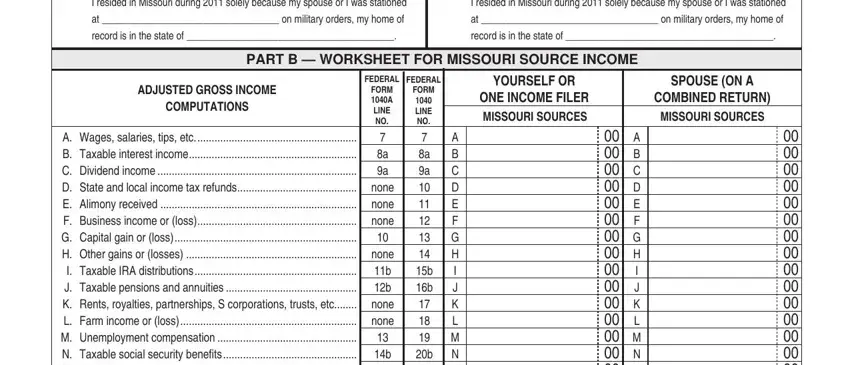

2. The third step is to fill in these fields: I resided in Missouri during, I resided in Missouri during, at on military orders my home of, at on military orders my home of, record is in the state of, record is in the state of, PART B WORKSHEET FOR MISSOURI, FEDERAL, FEDERAL, COMPUTATIONS, ADJUSTED GROSS INCOME, FORM A LINE NO A Wages salaries, FORM LINE NO a a b b b, A B C D E F G H I J K L M N O P Q, and YOURSELF OR.

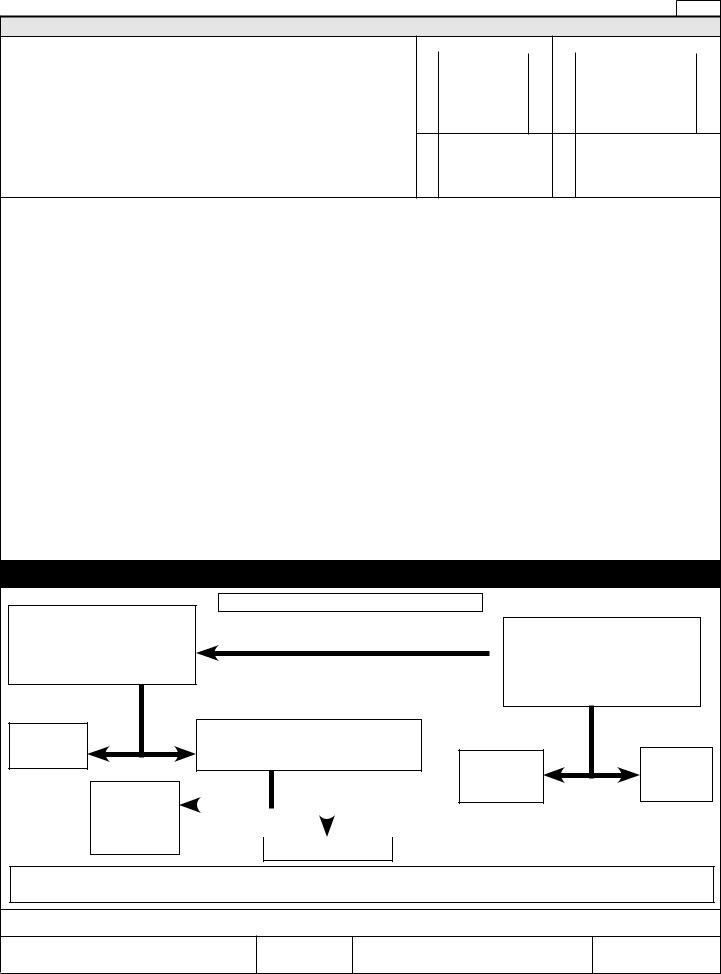

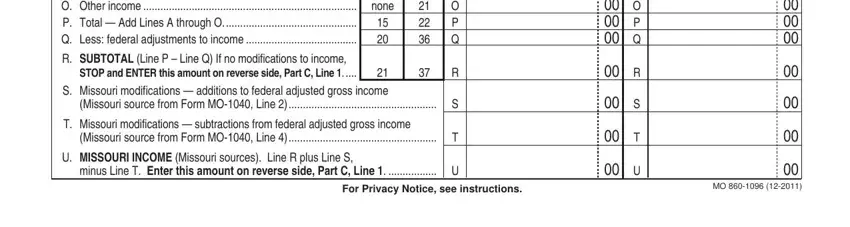

3. This step will be simple - fill out all the fields in FORM A LINE NO A Wages salaries, STOP and ENTER this amount on, R SUBTOTAL Line P Line Q If no, Missouri source from Form MO Line, T Missouri modifications, Missouri source from Form MO Line, U MISSOURI INCOME Missouri sources, minus Line T Enter this amount on, FORM LINE NO a a b b b, A B C D E F G H I J K L M N O P Q, A B C D E F G H I J K, and For Privacy Notice see instructions to conclude the current step.

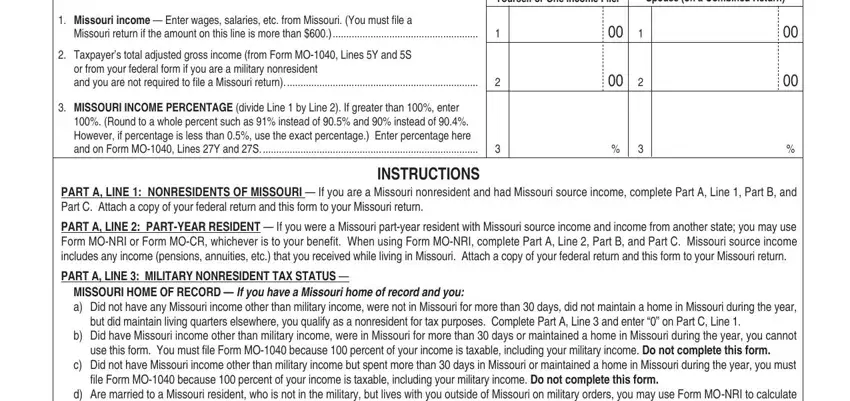

4. Now begin working on this fourth form section! Here you have all these Yourself or One Income Filer, Spouse on a Combined Return, Missouri income Enter wages, Taxpayers total adjusted gross, or from your federal form if you, MISSOURI INCOME PERCENTAGE divide, and on Form MO Lines Y and S, INSTRUCTIONS, PART A LINE NONRESIDENTS OF, PART A LINE PARTYEAR RESIDENT If, PART A LINE MILITARY NONRESIDENT, but did maintain living quarters, b Did have Missouri income other, use this form You must file Form, and c Did not have Missouri income empty form fields to fill out.

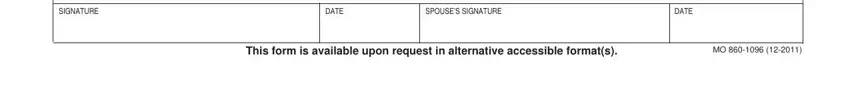

5. As you draw near to the last sections of this document, there are actually a few extra points to do. Mainly, Under penalties of perjury I, SIGNATURE, DATE, SPOUSES SIGNATURE, DATE, and This form is available upon must be done.

It is easy to make an error when completing your DATE, consequently make sure that you take another look before you send it in.

Step 3: Check the information you have inserted in the form fields and press the "Done" button. Create a 7-day free trial plan with us and obtain direct access to Form Mo Nri - downloadable, emailable, and editable inside your FormsPal account page. FormsPal guarantees your data confidentiality via a secure method that in no way saves or distributes any kind of private data provided. Be assured knowing your docs are kept confidential every time you work with our services!