Form MV-DF1 (Rev 12-2013)

GEORGIA DEPARTMENT OF REVENUE

DEALER REGISTRATION

Directly Financed Dealer Sales

General Instructions

•Except for the initial application, submit this application every year with your Annual Dealer Master Tag application.

•Qualifications

oUsed Motor Vehicle dealers who directly finance at least 90% of the motor vehicles sold should complete this form and return it to the address listed below.

oQualifying applicants are entitled to sell directly financed used motor vehicles at a reduced rate of state and local Title Ad Valorem Tax (TAVT). The reduced rate is equal to 2.5% less than the ordinary rate in effect on the date of purchase.

oOnly those vehicles financed by the selling dealer or a Related Finance Company (RFC) may qualify for the reduced rate.

oIf financing is provided by a Related Finance Company, common ownership of 90% must exist between the selling dealer and the Related Finance Company.

oOnly those sales financed pursuant to an installment note providing for a 24 month term or longer qualify for the reduced rate.

oQualifying dealers must retain (i.e., cannot assign) at least 90% of all such installment notes.

oAll liens and/or security interests must be recorded electronically and the ELT Customer Number must be shown on the title application in the appropriate field.

oThe “Directly Financed” block must be checked on the title application at the time of submission.

•Attach a copy of all dealer licenses which may apply to this application.

•Attach a copy of the dealer registration issued by the Georgia Department of Revenue.

•The registration fee is $100.00. Please make your check or money order payable to the Georgia Department of Revenue.

•The completed and signed application, should be mailed to:

Georgia Department of Revenue

Motor Vehicle Division – Attn: Special Tags

PO Box 740381

Atlanta Georgia 30374-0381

1

Form MV-DF1 (Rev 12-2013)

GEORGIA DEPARTMENT OF REVENUE

DEALER REGISTRATION

Directly Financed Dealer Sales

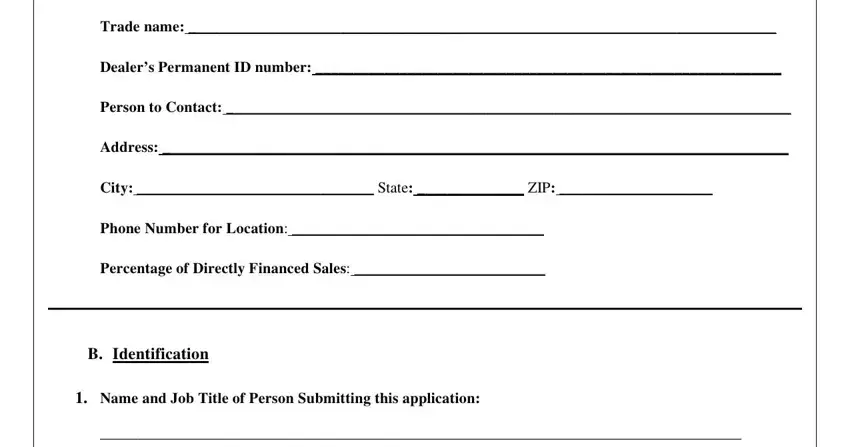

A.Established Place of Business List the dealership through which you will sell directly financed motor vehicles. Please provide the Trade name, Person to contact/Job Title, Physical address/established place of business, Permanent ID number, Phone number for location, percentage of directly financed sales.

Trade name: _____________________________________________________________________________

Dealer’s Permanent ID number: _____________________________________________________________

Person to Contact: __________________________________________________________________________

Address: __________________________________________________________________________________

City: _______________________________ State: ______________ ZIP: ____________________

Phone Number for Location: _________________________________

Percentage of Directly Financed Sales: _________________________

B.Identification

1.Name and Job Title of Person Submitting this application:

____________________________________________________________________________________

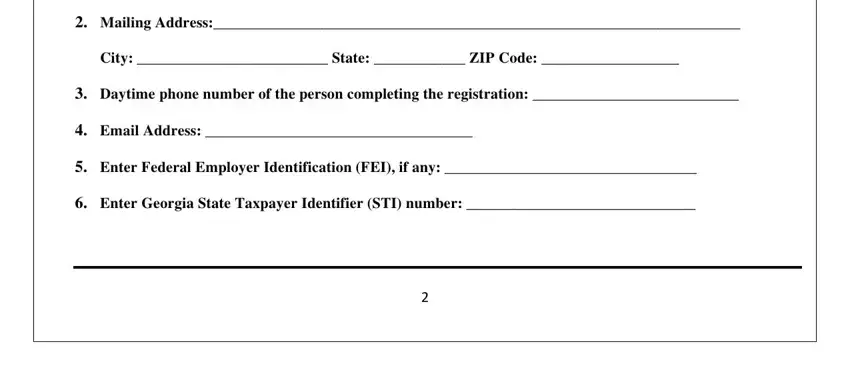

2.Mailing Address:_____________________________________________________________________

City: _________________________ State: ____________ ZIP Code: __________________

3.Daytime phone number of the person completing the registration: ___________________________

4.Email Address: ___________________________________

5.Enter Federal Employer Identification (FEI), if any: _________________________________

6.Enter Georgia State Taxpayer Identifier (STI) number: ______________________________

2

Form MV-DF1 (Rev 12-2013)

GEORGIA DEPARTMENT OF REVENUE

DEALER REGISTRATION

Directly Financed Dealer Sales

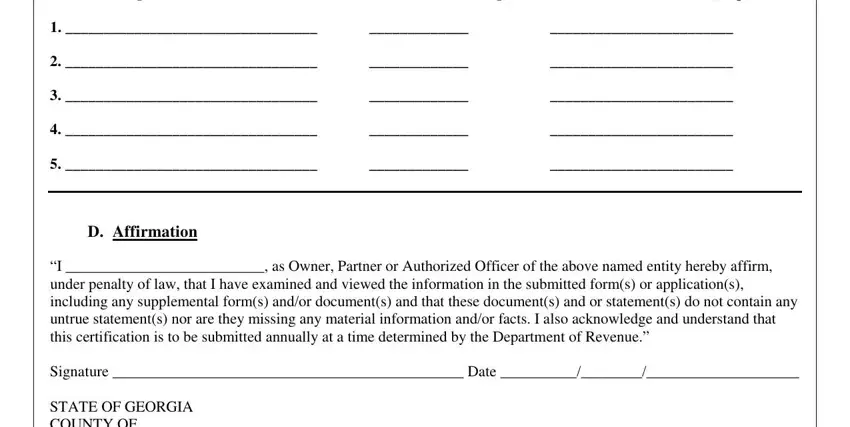

C.Directly Financed Dealer or Related Finance Companies (RFC):

Identify the Direct Finance Dealer or any Related Finance Company which will be shown as the lien or security interest holder on the title application. There must be at least a 90% common ownership to the applicant. (Attach additional sheets, if necessary).

Dealership Trade Name or RFC |

% Common Ownership |

ELT Customer Number (Required) |

1. _________________________________ |

_____________ |

________________________ |

2. _________________________________ |

_____________ |

________________________ |

3. _________________________________ |

_____________ |

________________________ |

4. _________________________________ |

_____________ |

________________________ |

5. _________________________________ |

_____________ |

________________________ |

|

|

|

D.Affirmation

“I __________________________, as Owner, Partner or Authorized Officer of the above named entity hereby affirm,

under penalty of law, that I have examined and viewed the information in the submitted form(s) or application(s), including any supplemental form(s) and/or document(s) and that these document(s) and or statement(s) do not contain any untrue statement(s) nor are they missing any material information and/or facts. I also acknowledge and understand that this certification is to be submitted annually at a time determined by the Department of Revenue.”

Signature ______________________________________________ Date __________/________/____________________

STATE OF GEORGIA

COUNTY OF __________________________

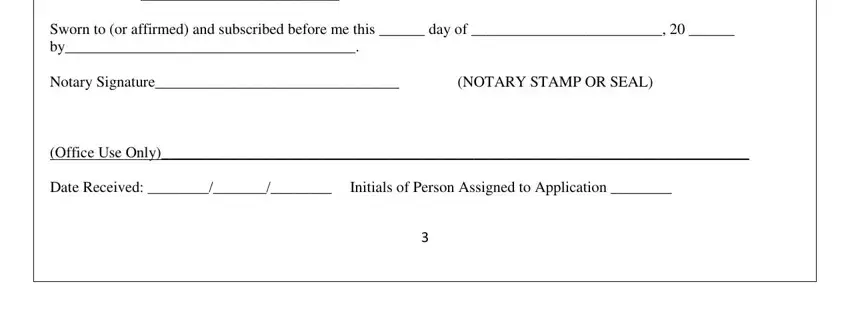

Sworn to (or affirmed) and subscribed before me this ______ day of _________________________, 20 ______

by______________________________________.

Notary Signature________________________________ |

(NOTARY STAMP OR SEAL) |

(Office Use Only)_____________________________________________________________________________

Date Received: ________/_______/________ Initials of Person Assigned to Application ________

3