By using the online PDF editor by FormsPal, it is easy to complete or edit state right here. FormsPal development team is ceaselessly working to expand the editor and make it much easier for users with its extensive functions. Enjoy an ever-improving experience now! Getting underway is simple! All that you should do is adhere to these easy steps directly below:

Step 1: First, access the pdf tool by pressing the "Get Form Button" above on this webpage.

Step 2: As you access the PDF editor, there'll be the form made ready to be completed. Apart from filling out different blanks, you can also perform many other things with the file, that is adding any textual content, changing the initial text, inserting graphics, placing your signature to the form, and a lot more.

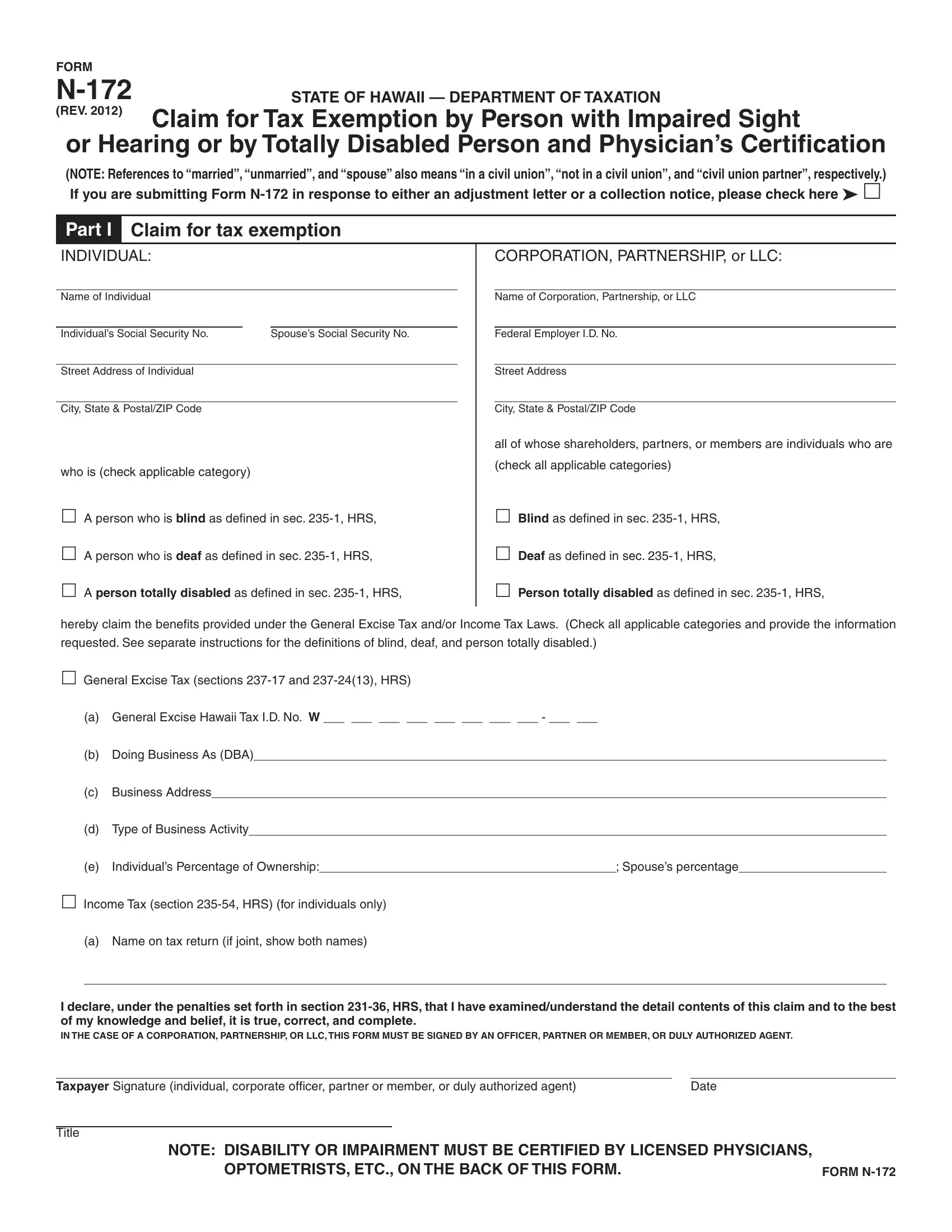

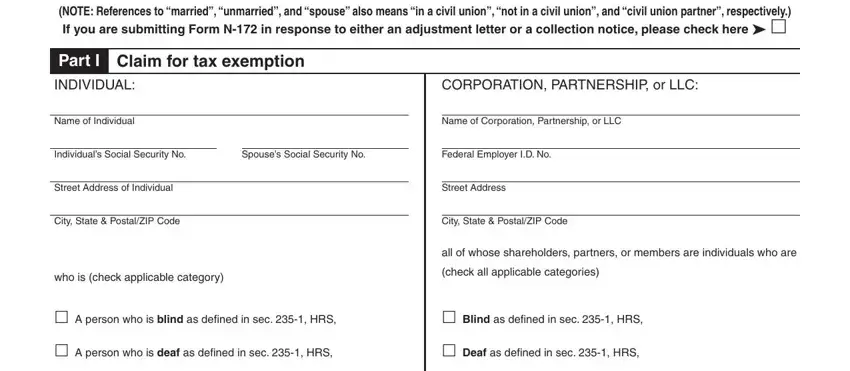

This document requires particular info to be typed in, therefore be sure you take whatever time to type in exactly what is asked:

1. It is very important complete the state properly, so take care when filling out the sections that contain all of these blank fields:

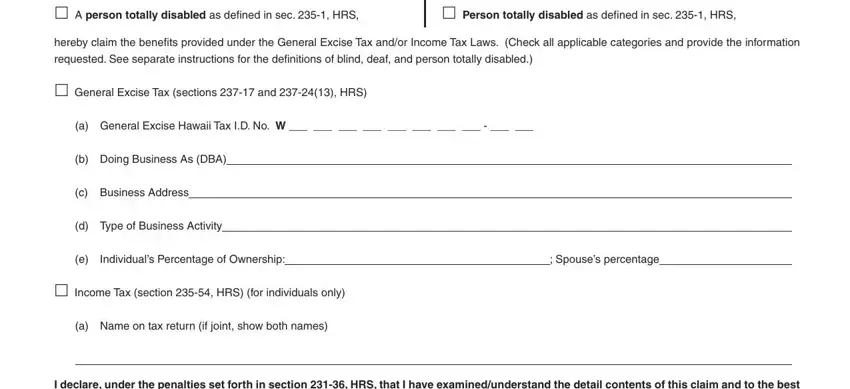

2. Once your current task is complete, take the next step – fill out all of these fields - A person totally disabled as, Person totally disabled as defined, hereby claim the benefits provided, requested See separate, General Excise Tax sections and, a General Excise Hawaii Tax ID No, b Doing Business As DBA, c Business Address, d Type of Business Activity, Individuals Percentage of Ownership, Spouses percentage, Income Tax section HRS for, a Name on tax return if joint show, and I declare under the penalties set with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

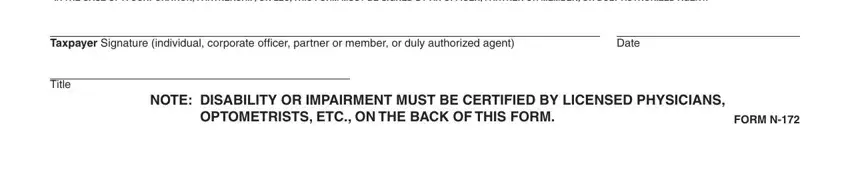

3. Within this step, examine I declare under the penalties set, Taxpayer Signature individual, Date, Title, NOTE DISABILITY OR IMPAIRMENT MUST, OPTOMETRISTS ETC ON THE BACK OF, and FORM N. Each one of these need to be filled out with highest accuracy.

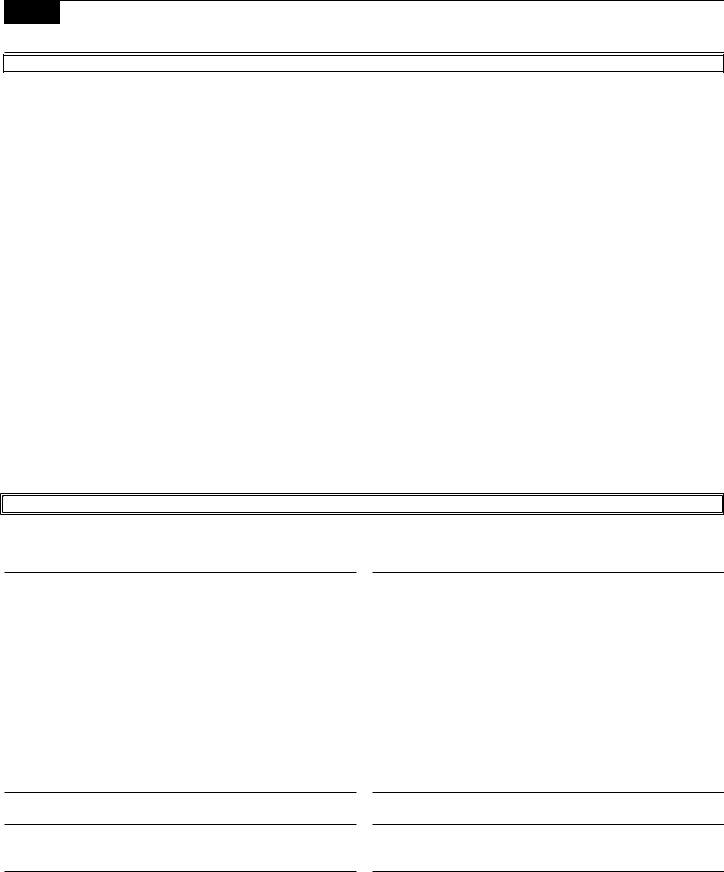

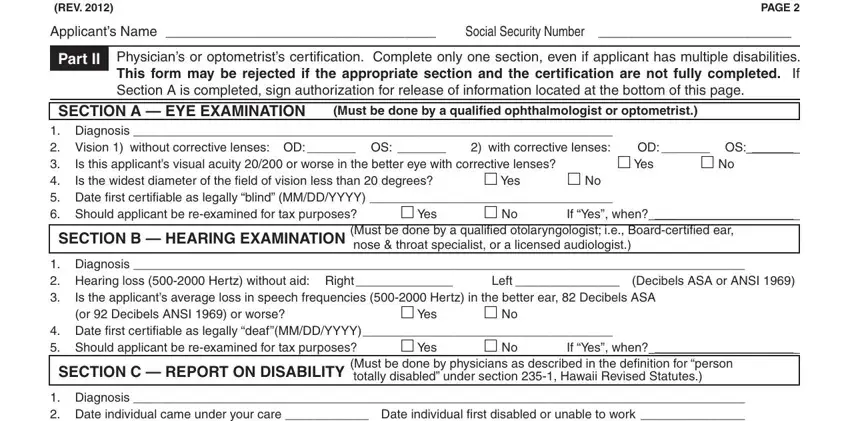

4. Filling in FORM N REV, PAGE, Applicants Name Social Security, Part II, Physicians or optometrists, SECTION A EYE EXAMINATION, Must be done by a qualified, Diagnosis Vision without, Is this applicants visual acuity, Yes, Yes, OD OS, Yes, If Yes when, and SECTION B HEARING EXAMINATION is key in the next step - you should definitely don't rush and be attentive with each and every field!

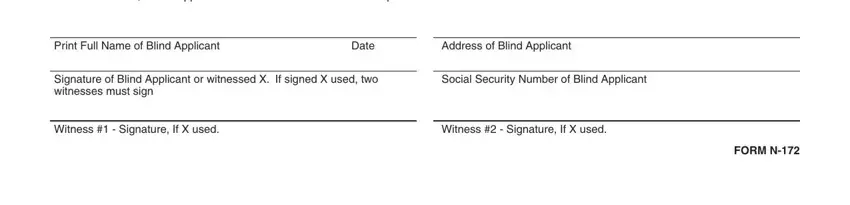

5. As you come near to the completion of this document, there are just a few more points to do. Notably, Revised Statutes and to apprise me, Print Full Name of Blind Applicant, Date, Address of Blind Applicant, Signature of Blind Applicant or, Social Security Number of Blind, Witness Signature If X used, Witness Signature If X used, and FORM N should be done.

A lot of people generally make mistakes while filling out Print Full Name of Blind Applicant in this section. Remember to revise everything you type in here.

Step 3: Before obtaining the next step, ensure that all blank fields were filled out as intended. Once you are satisfied with it, click on “Done." Sign up with FormsPal today and immediately gain access to state, available for downloading. Every single edit you make is conveniently kept , making it possible to edit the pdf later if required. We don't share any information that you enter when completing forms at our website.