Dealing with PDF files online can be quite easy using our PDF editor. Anyone can fill out Form N 848 here with no trouble. The tool is continually maintained by our team, acquiring powerful functions and turning out to be greater. Starting is easy! All you need to do is follow the following simple steps directly below:

Step 1: Hit the orange "Get Form" button above. It'll open our tool so that you could start completing your form.

Step 2: With this handy PDF editor, you can accomplish more than merely fill in blank fields. Edit away and make your forms look high-quality with customized textual content incorporated, or optimize the file's original content to excellence - all supported by an ability to incorporate stunning pictures and sign the PDF off.

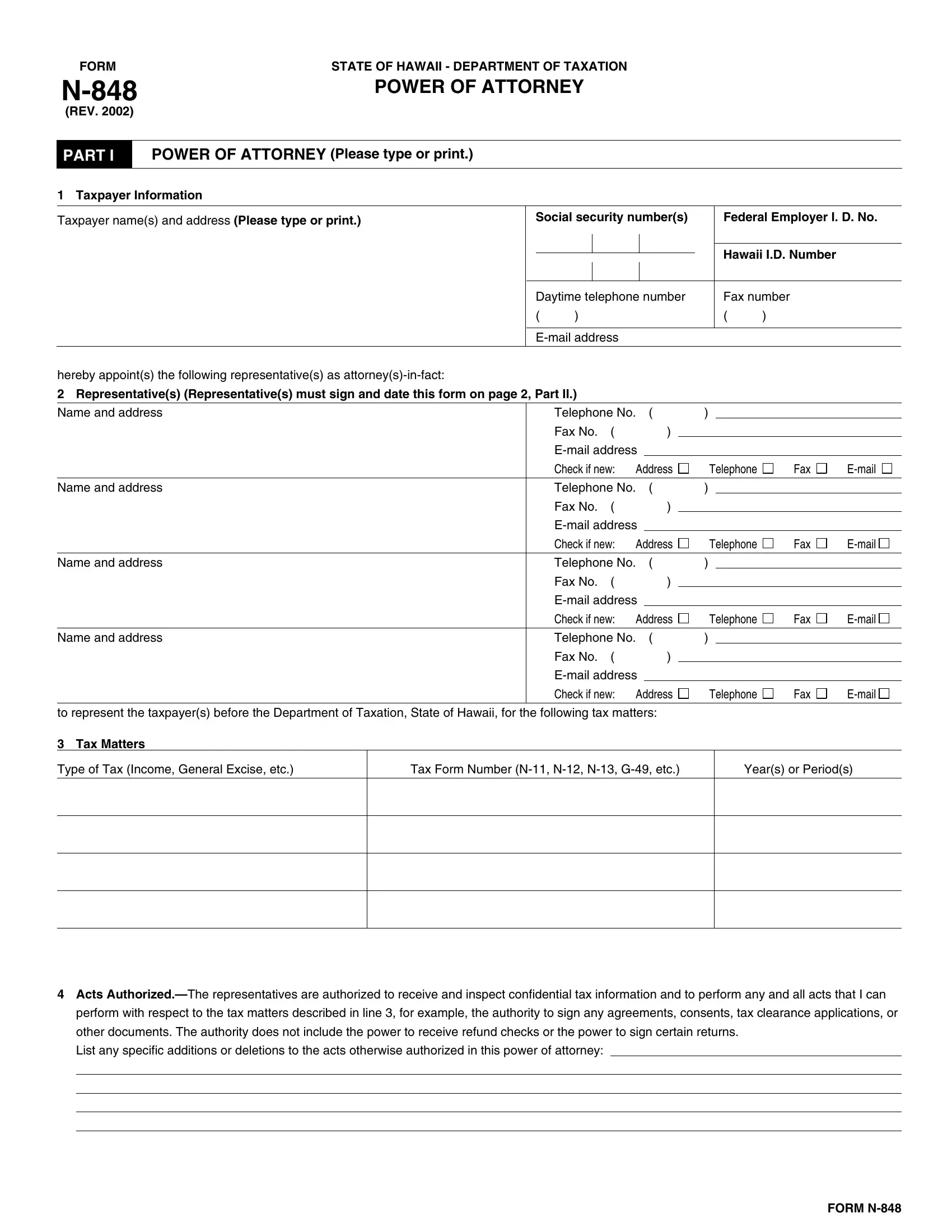

As a way to fill out this document, make sure you type in the required information in every single blank:

1. When submitting the Form N 848, be sure to complete all important blanks within the associated area. It will help to facilitate the process, enabling your information to be processed efficiently and properly.

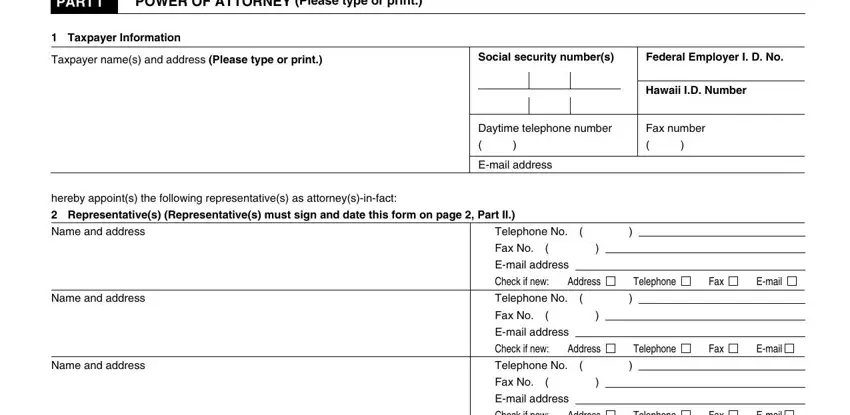

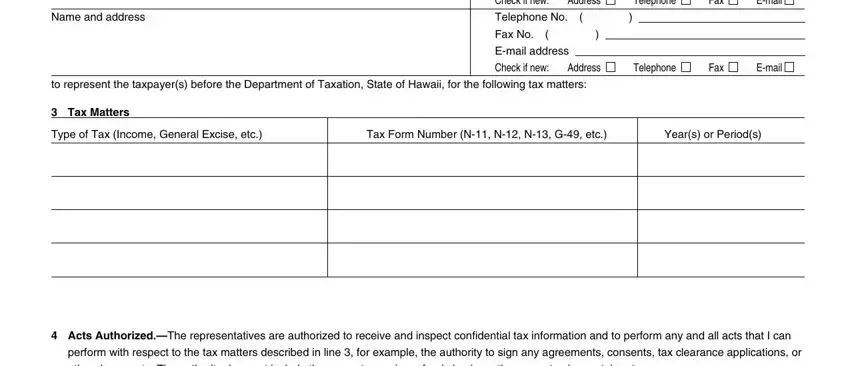

2. Once your current task is complete, take the next step – fill out all of these fields - Name and address, Check if new, Address, Telephone, Fax, Email, Telephone No, Fax No, Email address, Check if new, Address, Telephone, Fax, Email, and to represent the taxpayers before with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

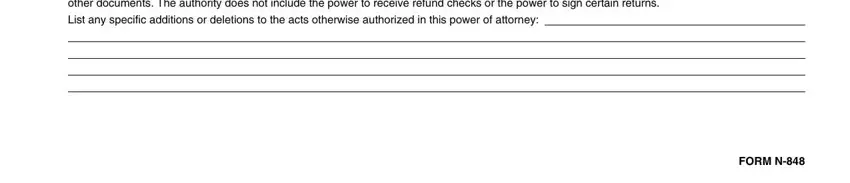

3. Completing other documents The authority does, List any specific additions or, and FORM N is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

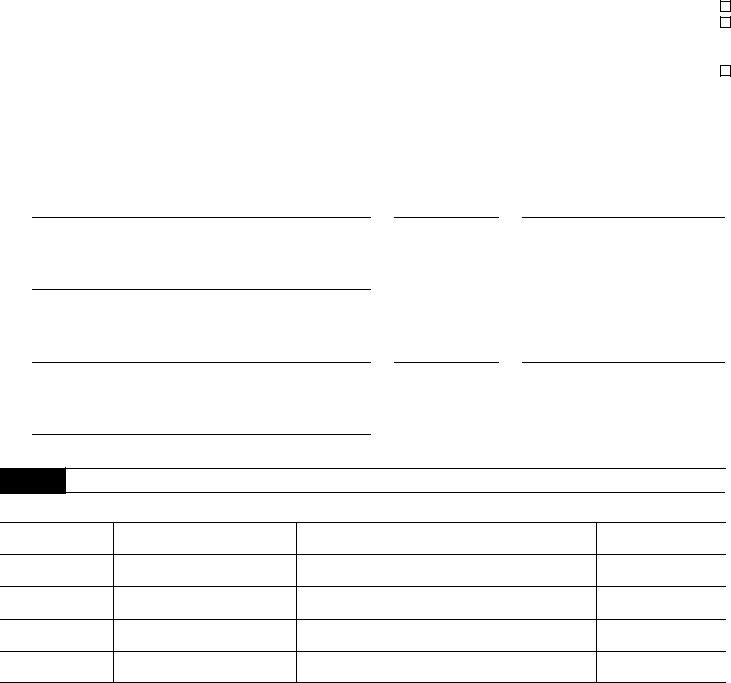

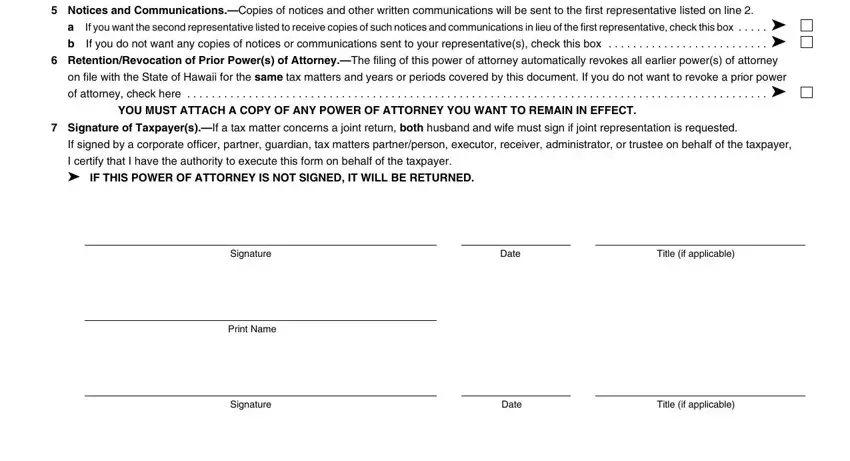

4. It's time to start working on the next section! In this case you will have all these Notices and CommunicationsCopies, If you want the second, If you do not want any copies of, RetentionRevocation of Prior, on file with the State of Hawaii, of attorney check here, YOU MUST ATTACH A COPY OF ANY, Signature of TaxpayersIf a tax, If signed by a corporate officer, I certify that I have the, IF THIS POWER OF ATTORNEY IS NOT, Signature, Date, Title if applicable, and Print Name blank fields to complete.

As to I certify that I have the and If you want the second, be sure you get them right in this current part. Both of these could be the most significant fields in the document.

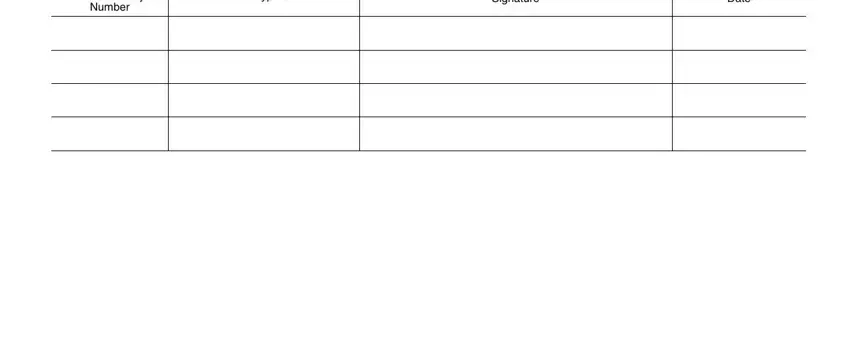

5. This form needs to be concluded by dealing with this section. Further you have a full set of blanks that require correct details in order for your document usage to be complete: Social Security, Number, Print or Type Name, Signature, and Date.

Step 3: After you have looked once more at the information in the fields, press "Done" to complete your document creation. Sign up with us now and instantly get access to Form N 848, prepared for download. Every last edit you make is handily preserved , making it possible to edit the file further if required. If you use FormsPal, it is simple to fill out documents without worrying about information breaches or data entries getting distributed. Our protected system helps to ensure that your private information is stored safe.