Once you open the online editor for PDFs by FormsPal, it is easy to fill out or modify preparer right here. Our expert team is continuously endeavoring to develop the editor and ensure it is even faster for clients with its many functions. Uncover an ceaselessly revolutionary experience now - take a look at and uncover new possibilities along the way! To get the ball rolling, consider these basic steps:

Step 1: Simply hit the "Get Form Button" in the top section of this webpage to launch our form editor. There you'll find all that is necessary to work with your document.

Step 2: As soon as you access the editor, you will see the document all set to be filled out. In addition to filling in various blank fields, you may also do some other actions with the file, particularly adding your own words, changing the original textual content, inserting images, signing the PDF, and a lot more.

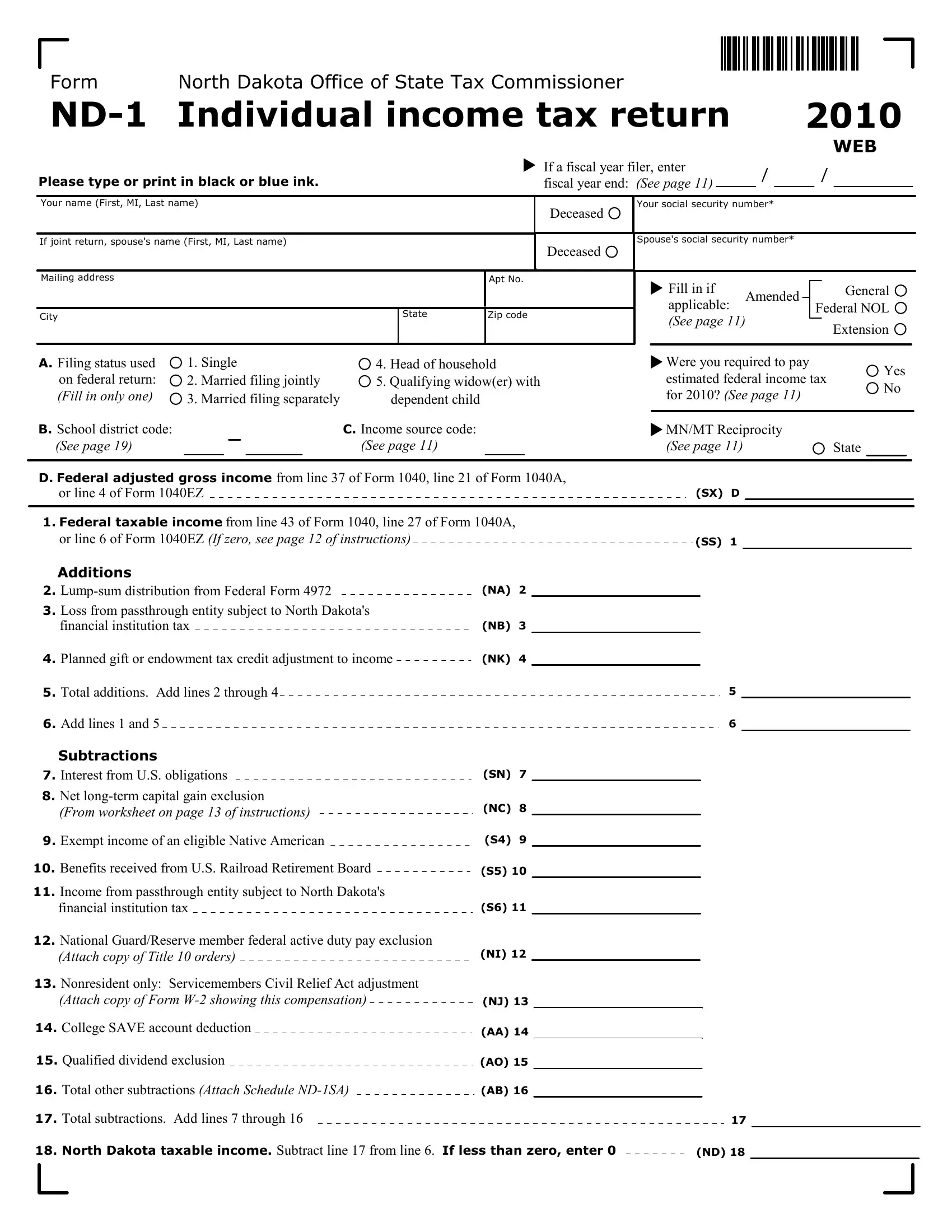

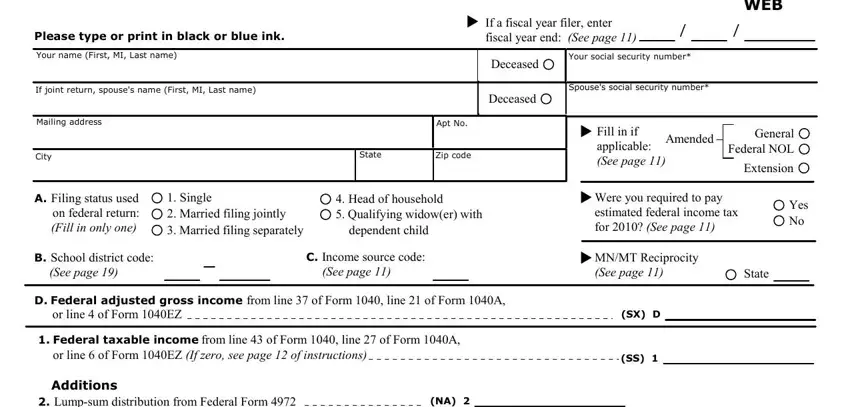

With regards to the blank fields of this specific PDF, this is what you need to do:

1. While filling in the preparer, be sure to complete all essential fields in its relevant area. It will help facilitate the process, which allows your details to be handled quickly and correctly.

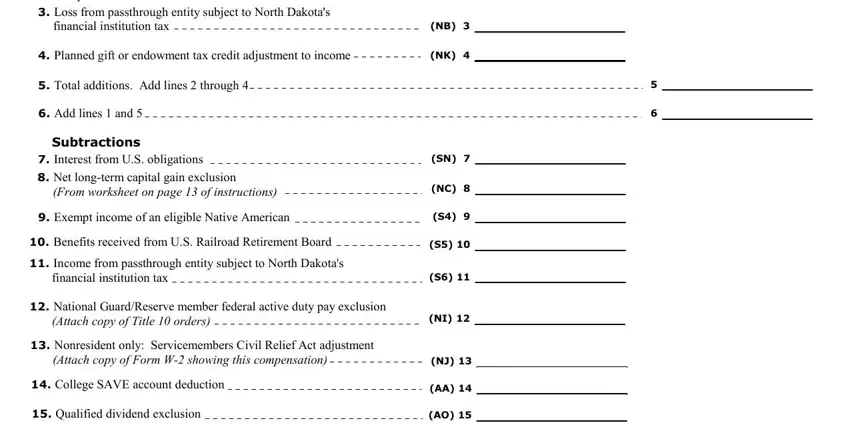

2. After finishing the previous section, go to the next part and fill in the necessary details in all these blank fields - Lumpsum distribution from Federal, Planned gift or endowment tax, Total additions Add lines, Add lines and, Subtractions, Interest from US obligations, Net longterm capital gain, Exempt income of an eligible, Benefits received from US, Income from passthrough entity, National GuardReserve member, Nonresident only Servicemembers, College SAVE account deduction, and Qualified dividend exclusion.

3. In this stage, check out Total other subtractions Attach, Total subtractions Add lines, and North Dakota taxable income. Each one of these are required to be filled in with highest accuracy.

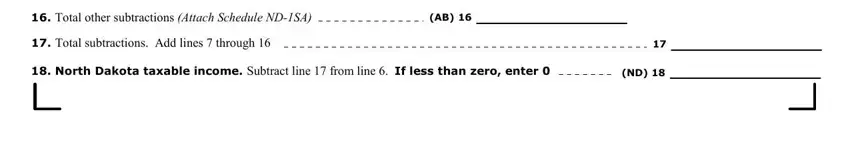

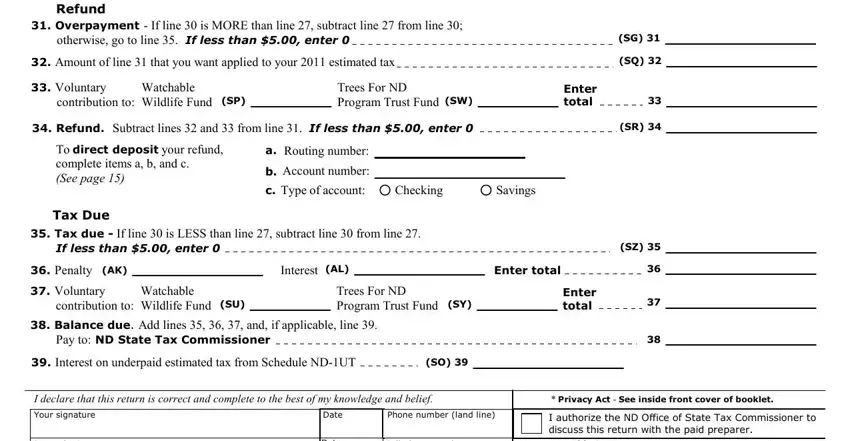

4. This next section requires some additional information. Ensure you complete all the necessary fields - North Dakota Office of State Tax, Enter your North Dakota taxable, Tax calculation, Tax If a fullyear resident enter, If a fullyear nonresident or, Credits, Credit for income tax paid to, Marriage penalty credit for joint, Carryover of unused or, Total other credits Attach, Total credits Add lines through, Net tax liability Subtract line, Tax paid, North Dakota withholding Attach, and Estimated tax paid on Forms NDES - to proceed further in your process!

People generally get some points incorrect while completing Tax paid in this part. You should reread everything you type in here.

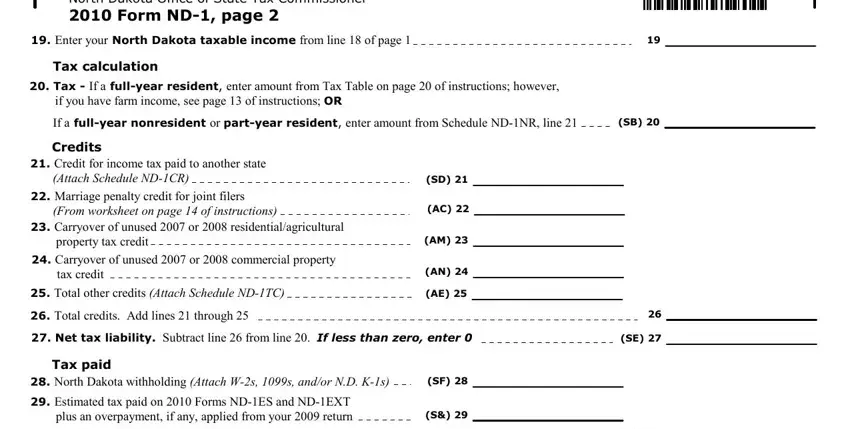

5. While you come close to the completion of your file, there are several more requirements that need to be fulfilled. In particular, Refund, Overpayment If line is MORE, Amount of line that you want, Voluntary contribution to, Watchable Wildlife Fund SP, Trees For ND Program Trust Fund SW, Enter total, Refund Subtract lines and from, To direct deposit your refund, Routing number, b Account number, Type of account, Checking, Savings, and Tax Due should all be done.

Step 3: Check that the information is correct and click on "Done" to progress further. After registering afree trial account with us, you will be able to download preparer or email it at once. The PDF file will also be accessible in your personal cabinet with your each edit. When using FormsPal, you're able to fill out documents without having to worry about personal data breaches or data entries being shared. Our protected system ensures that your personal details are stored safely.