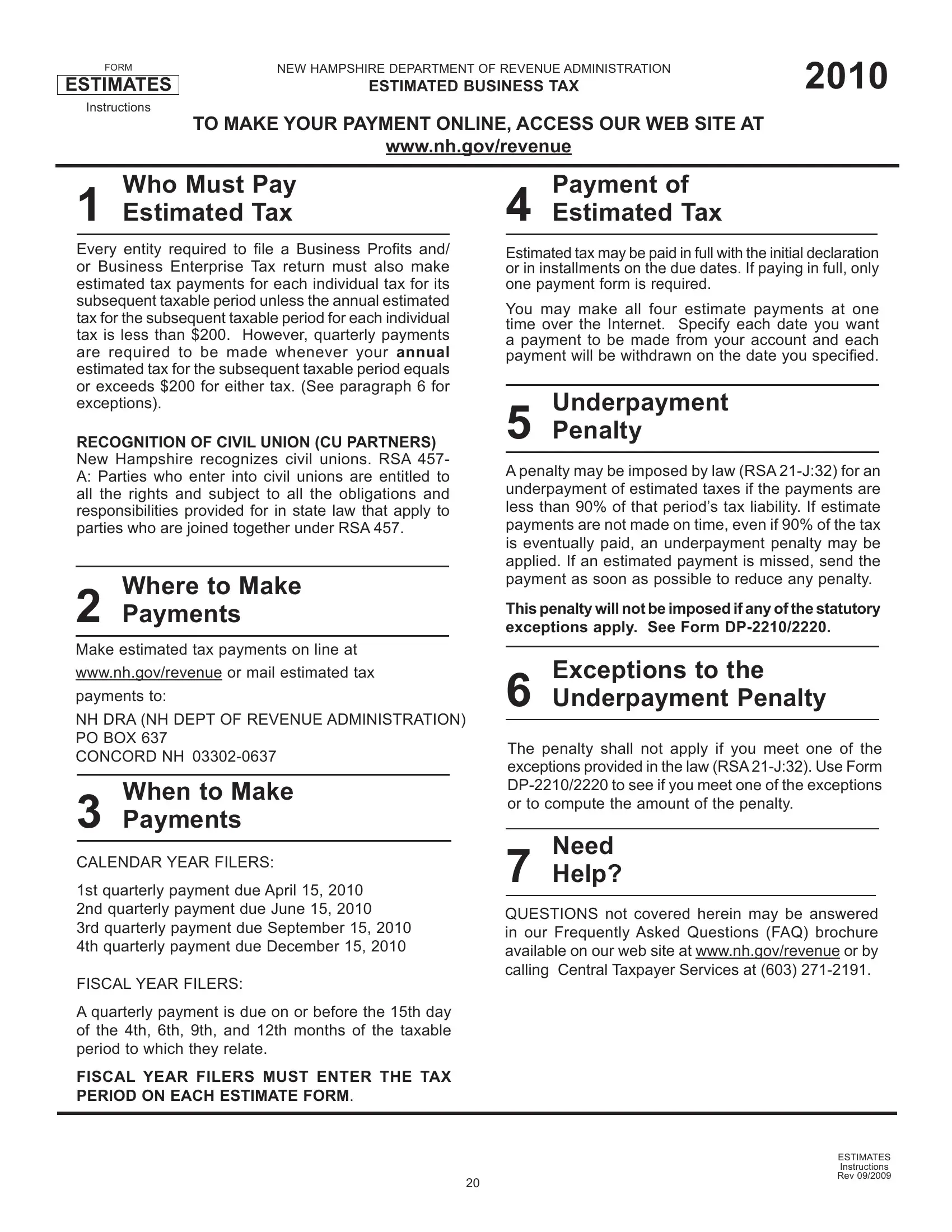

If you intend to fill out 162-N, you don't need to install any kind of applications - simply use our online PDF editor. FormsPal team is aimed at providing you the absolute best experience with our tool by consistently introducing new functions and improvements. With all of these updates, using our tool gets better than ever before! Here's what you would want to do to start:

Step 1: Click on the "Get Form" button at the top of this webpage to open our tool.

Step 2: The tool helps you customize PDF forms in a range of ways. Transform it by writing customized text, adjust what's already in the PDF, and add a signature - all close at hand!

This PDF form will involve some specific details; in order to guarantee correctness, please be sure to take heed of the recommendations down below:

1. You should complete the 162-N accurately, thus pay close attention while filling out the parts including all of these fields:

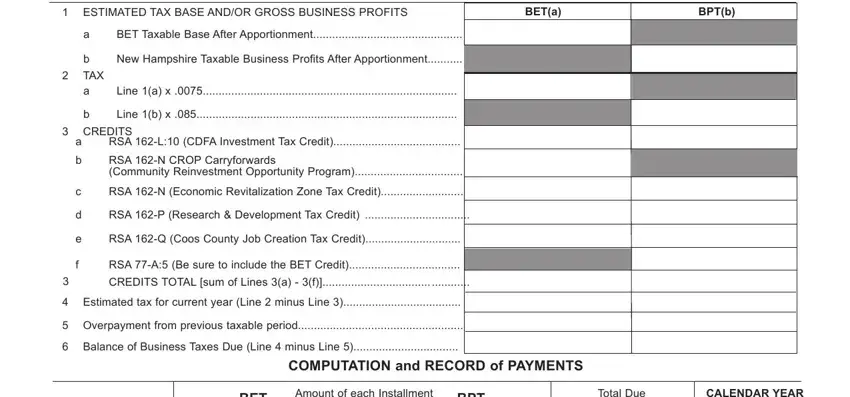

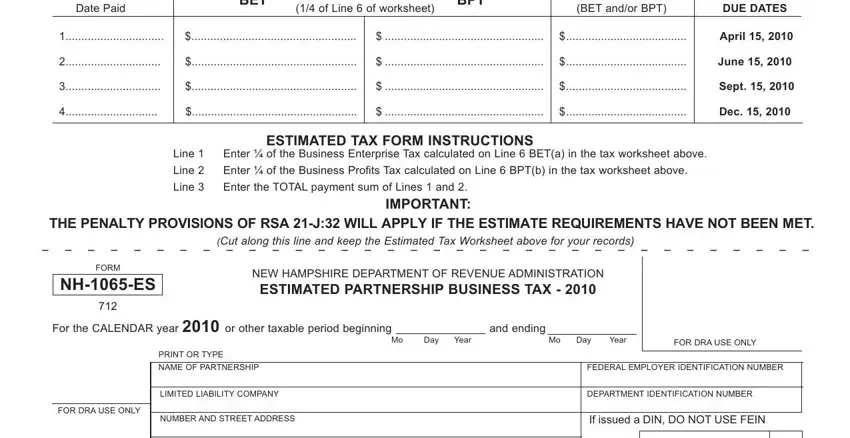

2. Soon after completing this part, go to the next part and fill out all required details in these fields - Date Paid, Amount of each Installment of, BPT, BET, Total Due, CALENDAR YEAR, BET andor BPT, DUE DATES, April, June, Sept, Dec, ESTIMATED TAX FORM INSTRUCTIONS, Line, and Enter of the Business Enterprise.

A lot of people generally make errors when filling in BET in this area. Ensure you re-examine what you enter right here.

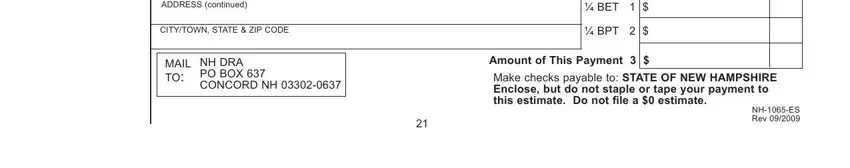

3. Completing ADDRESS continued, CITYTOWN STATE ZIP CODE, MAIL TO, NH DRA PO BOX CONCORD NH, BET, BPT, Amount of This Payment, Make checks payable to STATE OF, and NHES Rev is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

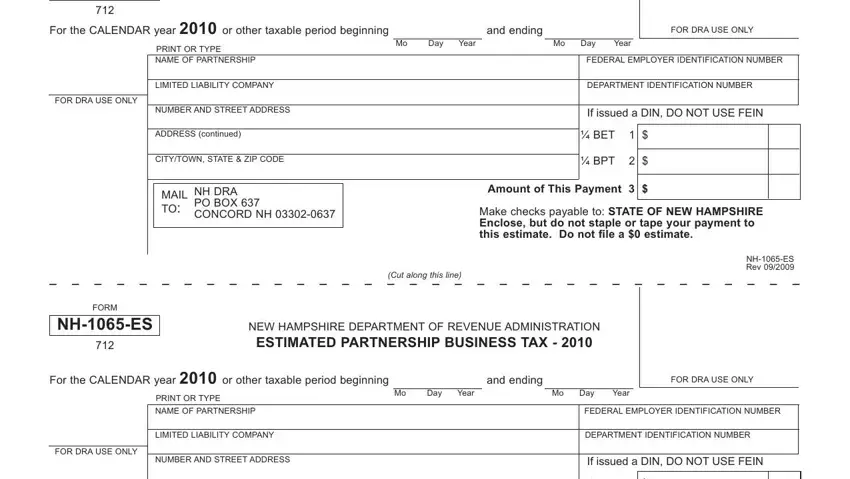

4. It's time to fill in this next part! Here you have all of these For the CALENDAR year or other, FOR DRA USE ONLY, PRINT OR TYPE NAME OF PARTNERSHIP, LIMITED LIABILITY COMPANY, FOR DRA USE ONLY, NUMBER AND STREET ADDRESS, ADDRESS continued, CITYTOWN STATE ZIP CODE, MAIL TO, NH DRA PO BOX CONCORD NH, Mo Day Year, Mo Day Year, FEDERAL EMPLOYER IDENTIFICATION, DEPARTMENT IDENTIFICATION NUMBER, and If issued a DIN DO NOT USE FEIN blank fields to fill in.

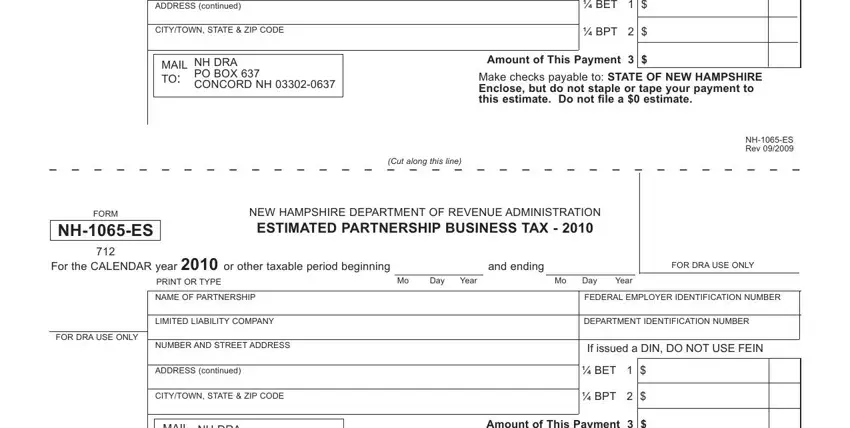

5. Last of all, the following final subsection is precisely what you'll want to wrap up prior to submitting the document. The fields in question are the next: ADDRESS continued, CITYTOWN STATE ZIP CODE, MAIL TO, NH DRA PO BOX CONCORD NH, BET, BPT, Amount of This Payment, Make checks payable to STATE OF, NHES Rev, Cut along this line, FORM, NHES, NEW HAMPSHIRE DEPARTMENT OF, ESTIMATED PARTNERSHIP BUSINESS TAX, and For the CALENDAR year or other.

Step 3: Make sure that your details are correct and press "Done" to continue further. After starting afree trial account at FormsPal, you will be able to download 162-N or email it right off. The PDF will also be at your disposal through your personal cabinet with all your adjustments. We do not share or sell the details that you enter whenever dealing with documents at our website.