You may fill in Form Nhjb 2125 P effectively with our PDFinity® PDF editor. The tool is constantly maintained by us, acquiring useful features and growing to be greater. To get the process started, go through these simple steps:

Step 1: Just hit the "Get Form Button" above on this webpage to access our pdf form editing tool. There you will find all that is required to fill out your file.

Step 2: Once you start the editor, there'll be the form all set to be completed. In addition to filling in various blank fields, you may also do several other things with the Document, particularly adding your own text, editing the initial textual content, inserting images, signing the form, and a lot more.

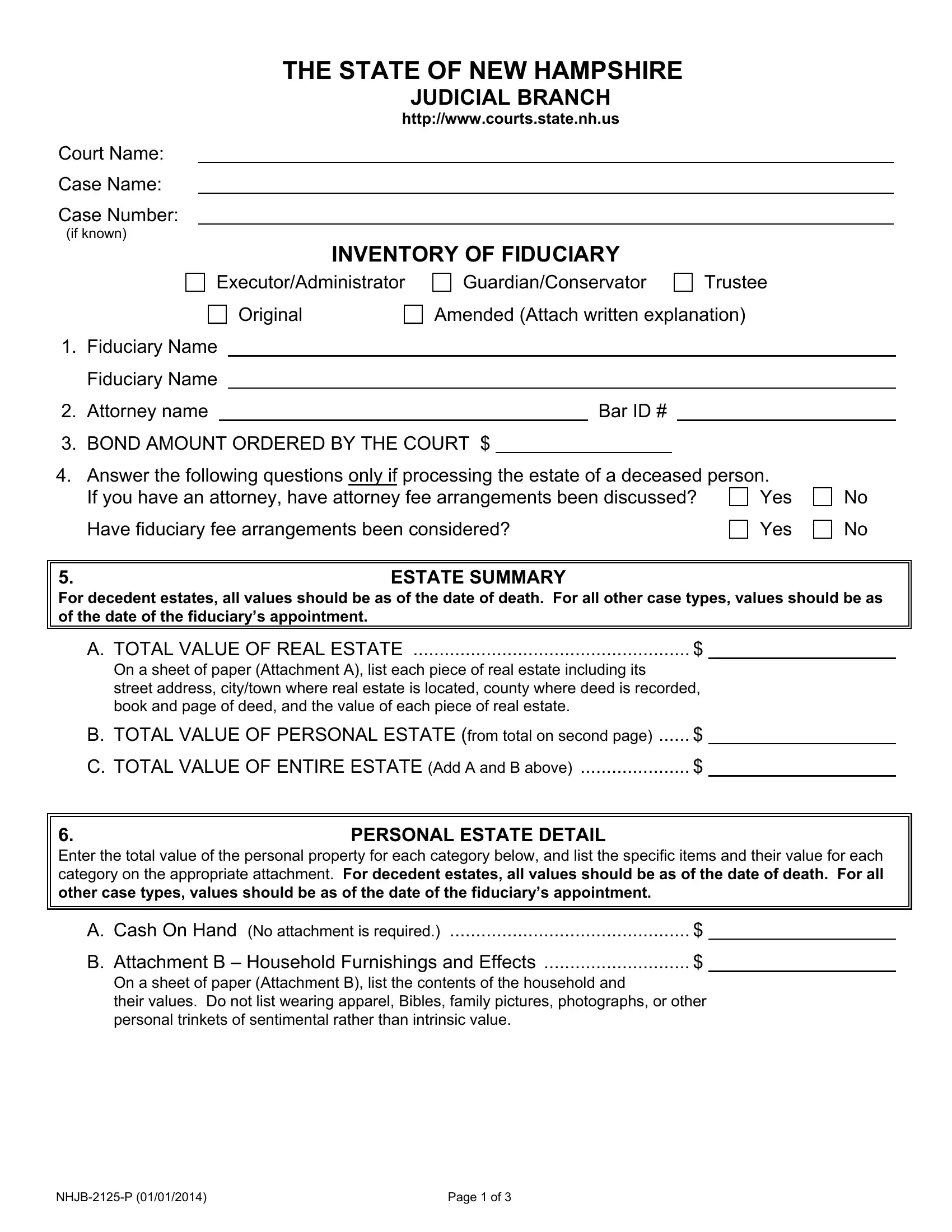

As for the fields of this specific form, here's what you need to do:

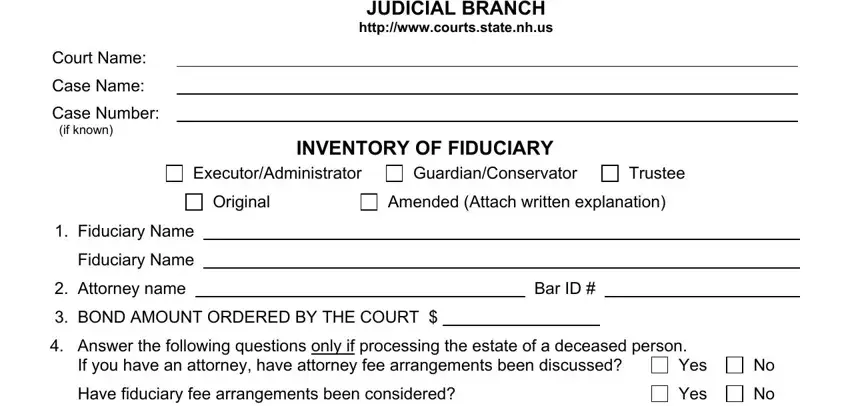

1. Fill out your Form Nhjb 2125 P with a selection of necessary blanks. Gather all of the necessary information and be sure there's nothing forgotten!

Step 3: You should make sure the information is correct and then just click "Done" to progress further. Try a 7-day free trial option with us and acquire direct access to Form Nhjb 2125 P - downloadable, emailable, and editable inside your FormsPal account. FormsPal offers secure document editor with no personal data recording or sharing. Rest assured that your data is safe here!