Dealing with PDF documents online is surprisingly easy using our PDF tool. Anyone can fill in Form Nj 1040 here painlessly. To make our editor better and easier to use, we continuously implement new features, taking into account feedback coming from our users. Starting is simple! What you need to do is follow the following easy steps below:

Step 1: First of all, access the pdf tool by pressing the "Get Form Button" above on this page.

Step 2: The tool will give you the ability to work with PDF documents in a range of ways. Change it by adding any text, adjust what's originally in the PDF, and place in a signature - all when you need it!

This PDF form will require specific information; to guarantee consistency, you should heed the next tips:

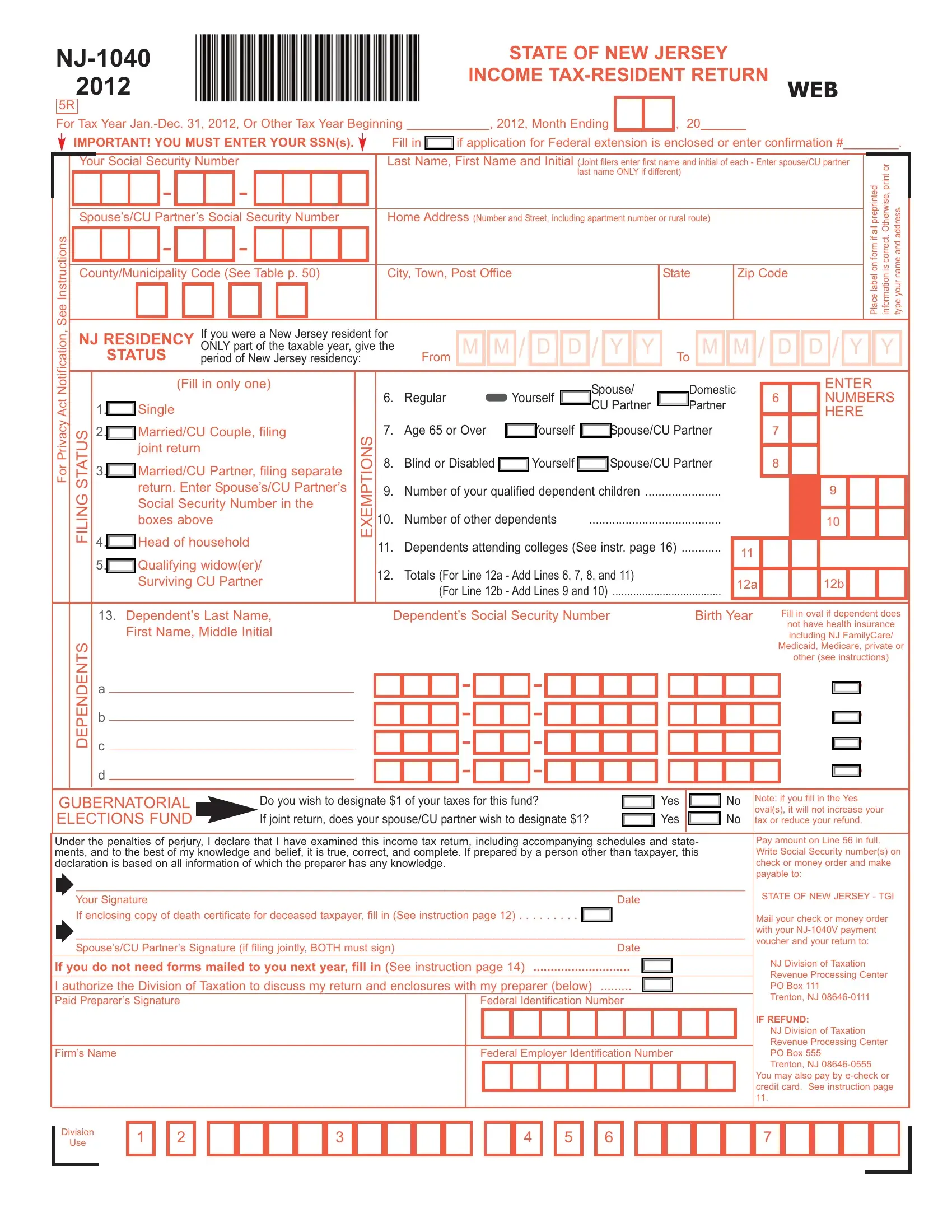

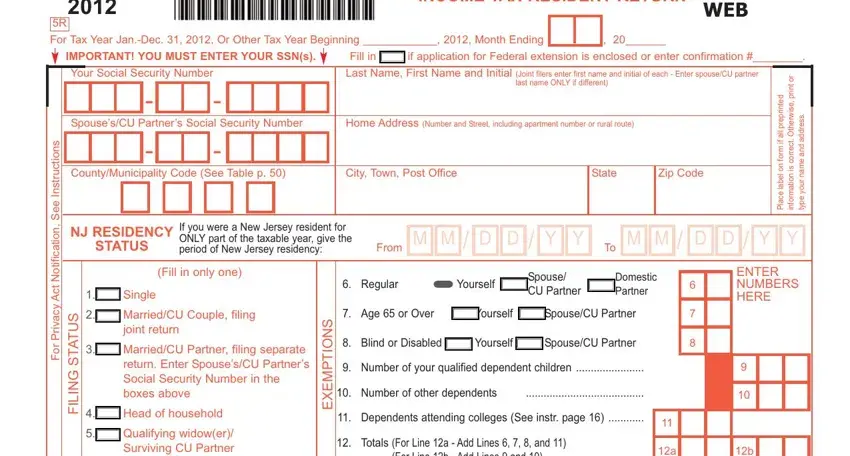

1. Firstly, while filling in the Form Nj 1040, start with the form section that features the following fields:

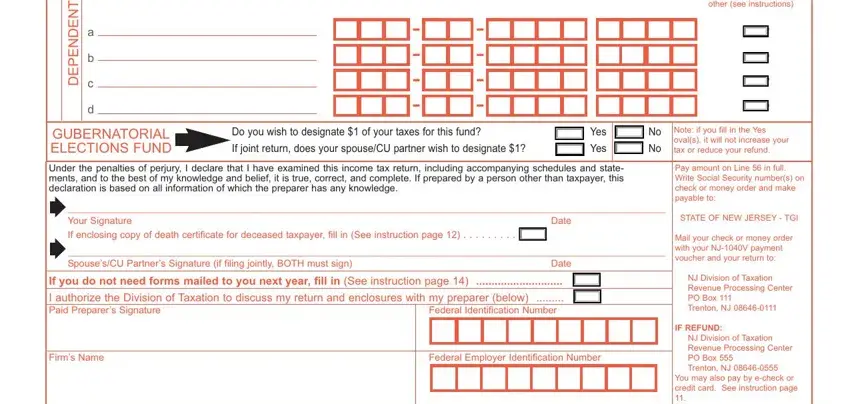

2. The next part would be to submit these particular fields: S T N E D N E P E D, other see instructions, GUBERNATORIAL ELECTIONS FUND, Do you wish to designate of your, If joint return does your spouseCU, Yes, Yes, Note if you fill in the Yes ovals, Under the penalties of perjury I, Your Signature If enclosing copy, Date, SpousesCU Partners Signature if, Date, If you do not need forms mailed to, and I authorize the Division of.

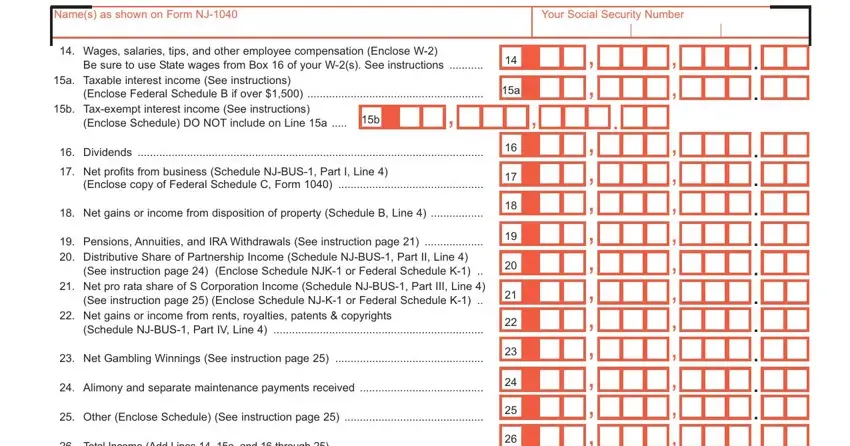

3. The third part is going to be simple - complete every one of the blanks in Names as shown on Form NJ, Your Social Security Number, Wages salaries tips and other, Be sure to use State wages from, a Taxable interest income See, Enclose Federal Schedule B if over, b Taxexempt interest income See, Enclose Schedule DO NOT include on, Dividends, Net profits from business, Enclose copy of Federal Schedule C, Net gains or income from, Pensions Annuities and IRA, See instruction page Enclose, and Net gains or income from rents in order to complete this segment.

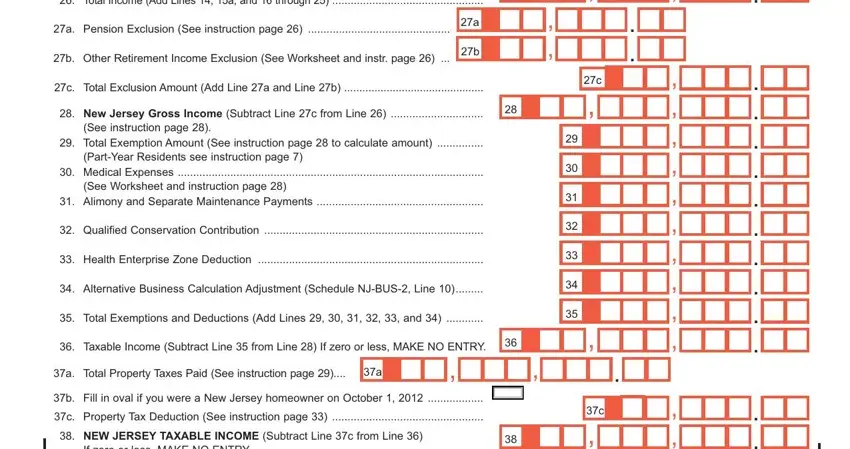

4. Completing Total Income Add Lines a and, a Pension Exclusion See, b Other Retirement Income, c Total Exclusion Amount Add Line, New Jersey Gross Income Subtract, See instruction page, Total Exemption Amount See, PartYear Residents see instruction, Medical Expenses, See Worksheet and instruction page, Alimony and Separate Maintenance, Qualified Conservation, Health Enterprise Zone Deduction, Alternative Business Calculation, and Total Exemptions and Deductions is essential in this fourth part - be sure to spend some time and be mindful with each and every blank area!

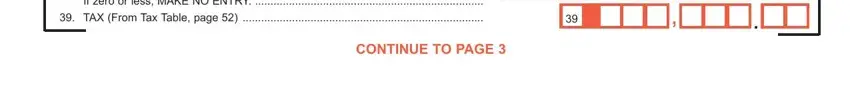

5. Because you come near to the last parts of the file, you will find a couple more points to undertake. Particularly, If zero or less MAKE NO ENTRY, TAX From Tax Table page, and CONTINUE TO PAGE should be filled out.

Always be really attentive while filling in CONTINUE TO PAGE and TAX From Tax Table page, as this is where a lot of people make some mistakes.

Step 3: Make certain the information is correct and then click on "Done" to continue further. Sign up with us today and immediately access Form Nj 1040, set for download. Each and every edit you make is handily saved , so that you can customize the pdf at a later point as required. When you use FormsPal, it is simple to complete forms without worrying about database incidents or records being shared. Our secure platform ensures that your personal details are maintained safe.