Making use of the online PDF editor by FormsPal, you may fill in or edit NJ right here. The tool is consistently maintained by our staff, getting new features and turning out to be even more versatile. In case you are seeking to start, here is what it's going to take:

Step 1: Just hit the "Get Form Button" above on this page to launch our pdf form editing tool. There you'll find all that is necessary to work with your file.

Step 2: With this handy PDF editing tool, you're able to do more than merely complete blank form fields. Edit away and make your forms look faultless with custom textual content added, or adjust the original input to excellence - all supported by an ability to add any type of photos and sign the PDF off.

It is actually straightforward to fill out the form using this helpful guide! Here is what you should do:

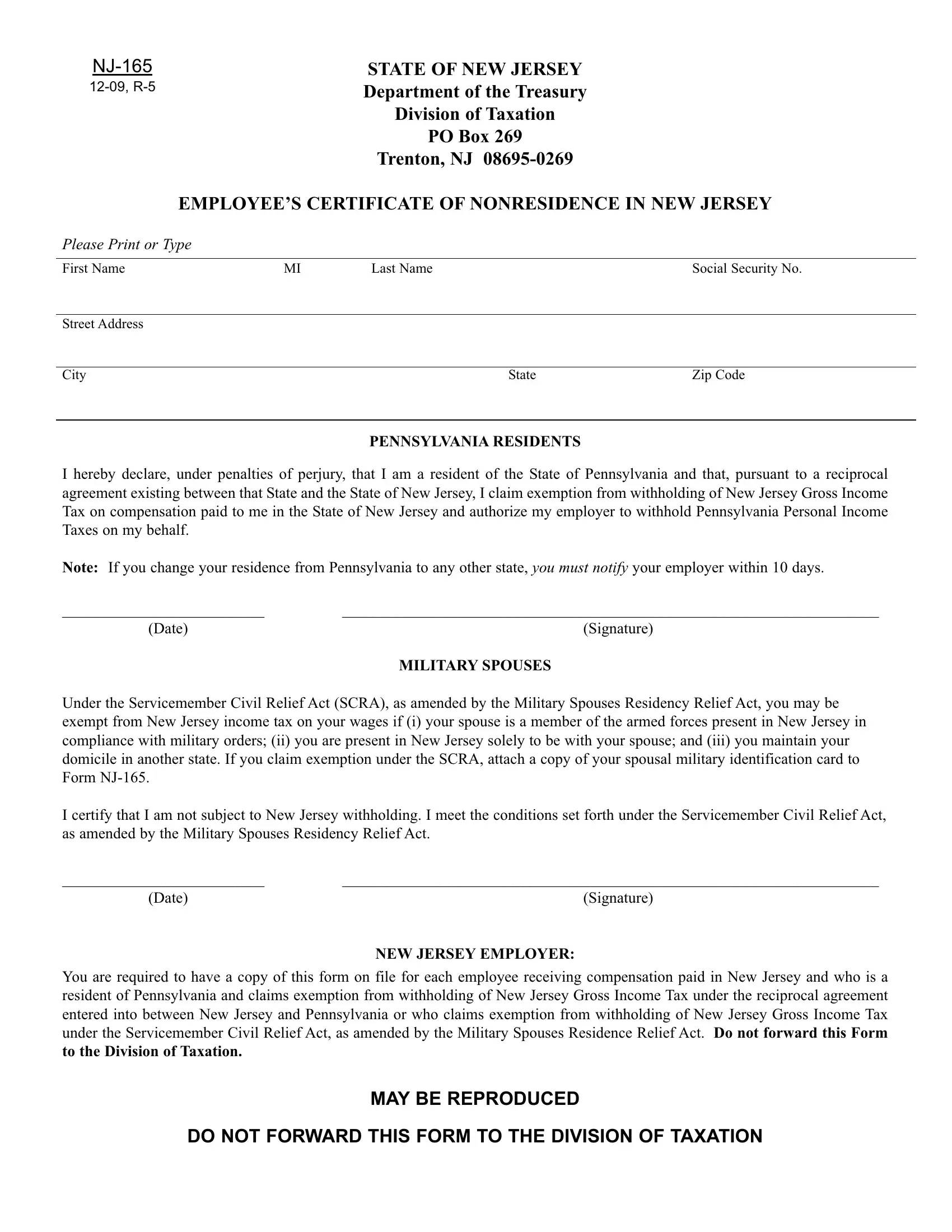

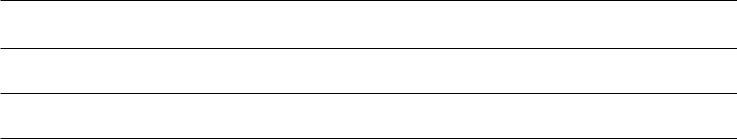

1. First of all, while completing the NJ, start with the form section with the next fields:

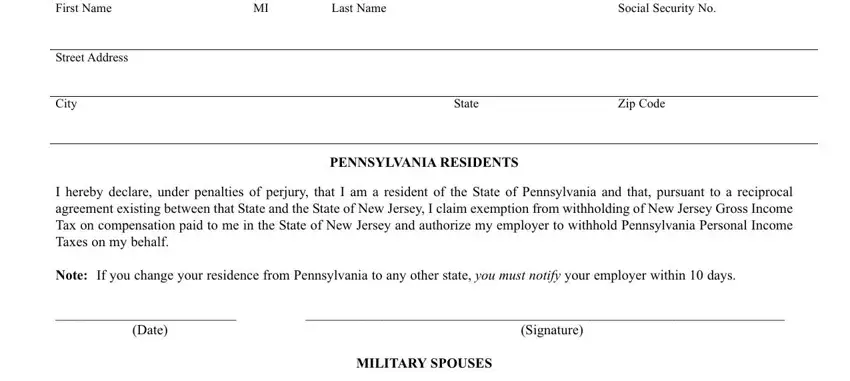

2. When this selection of fields is done, go to type in the applicable details in these - I certify that I am not subject to, Date, Signature, NEW JERSEY EMPLOYER, You are required to have a copy of, MAY BE REPRODUCED, and DO NOT FORWARD THIS FORM TO THE.

As for You are required to have a copy of and Date, be sure that you do everything right in this section. These two are definitely the most significant ones in this page.

Step 3: Always make sure that your information is right and then click "Done" to conclude the process. Sign up with us right now and easily access NJ, all set for downloading. All modifications made by you are saved , enabling you to modify the file at a later stage if required. FormsPal is focused on the personal privacy of our users; we make sure all personal data used in our editor is secure.