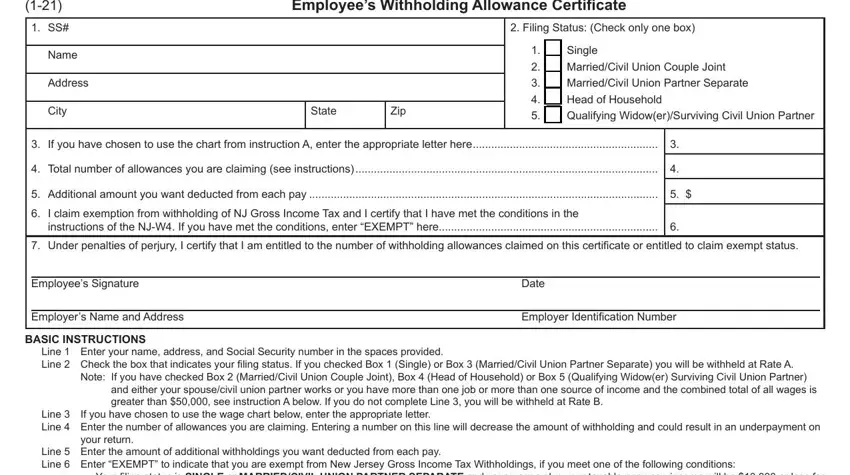

Form NJ-W4 |

|

State of New Jersey – Division of Taxation |

(1-21) |

Employee’s Withholding Allowance Certificate |

1. |

SS# |

|

|

|

2. Filing Status: (Check only one box) |

|

|

|

|

|

|

1. |

|

Single |

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

2. |

|

Married/Civil Union Couple Joint |

|

|

|

|

|

|

|

|

|

Address |

|

|

|

3. |

|

Married/Civil Union Partner Separate |

|

|

|

|

|

|

4. |

|

Head of Household |

|

|

City |

|

State |

Zip |

5. |

|

Qualifying Widow(er)/Surviving Civil Union Partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

If you have chosen to use the chart from instruction A, enter the appropriate letter here |

|

|

3. |

|

|

|

|

|

|

|

|

|

|

4. |

Total number of allowances you are claiming (see instructions) |

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

5. |

Additional amount you want deducted from each pay |

|

|

|

|

5. $ |

|

6. |

I claim exemption from withholding of NJ Gross Income Tax and I certify that I have met the conditions in the |

|

|

|

|

|

|

instructions of the NJ-W4. If you have met the conditions, enter “EXEMPT” here |

|

|

6. |

|

|

|

|

|

|

|

|

7. |

Under penalties of perjury, I certify that I am entitled to the number of withholding allowances claimed on this certificate or entitled to claim exempt status. |

|

|

|

|

|

|

|

|

|

|

|

Employee’s Signature |

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer’s Name and Address |

|

|

|

Employer Identification Number |

|

|

|

|

|

|

|

|

|

|

|

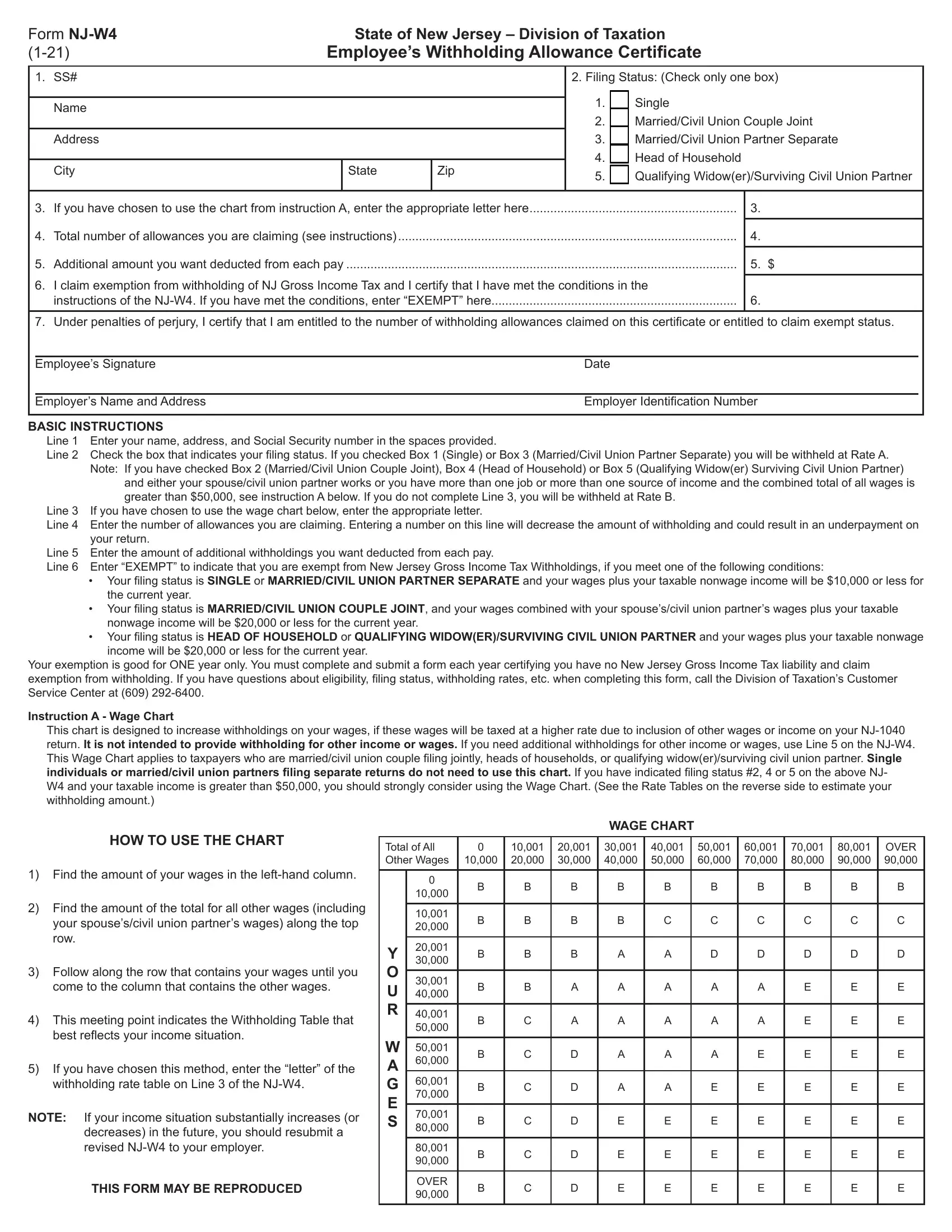

BASIC INSTRUCTIONS

Line 1 Enter your name, address, and Social Security number in the spaces provided.

Line 2 Check the box that indicates your filing status. If you checked Box 1 (Single) or Box 3 (Married/Civil Union Partner Separate) you will be withheld at Rate A. Note: If you have checked Box 2 (Married/Civil Union Couple Joint), Box 4 (Head of Household) or Box 5 (Qualifying Widow(er) Surviving Civil Union Partner)

and either your spouse/civil union partner works or you have more than one job or more than one source of income and the combined total of all wages is greater than $50,000, see instruction A below. If you do not complete Line 3, you will be withheld at Rate B.

Line 3 If you have chosen to use the wage chart below, enter the appropriate letter.

Line 4 Enter the number of allowances you are claiming. Entering a number on this line will decrease the amount of withholding and could result in an underpayment on your return.

Line 5 Enter the amount of additional withholdings you want deducted from each pay.

Line 6 Enter “EXEMPT” to indicate that you are exempt from New Jersey Gross Income Tax Withholdings, if you meet one of the following conditions:

•Your filing status is SINGLE or MARRIED/CIVIL UNION PARTNER SEPARATE and your wages plus your taxable nonwage income will be $10,000 or less for the current year.

•Your filing status is MARRIED/CIVIL UNION COUPLE JOINT, and your wages combined with your spouse’s/civil union partner’s wages plus your taxable nonwage income will be $20,000 or less for the current year.

•Your filing status is HEAD OF HOUSEHOLD or QUALIFYING WIDOW(ER)/SURVIVING CIVIL UNION PARTNER and your wages plus your taxable nonwage income will be $20,000 or less for the current year.

Your exemption is good for ONE year only. You must complete and submit a form each year certifying you have no New Jersey Gross Income Tax liability and claim exemption from withholding. If you have questions about eligibility, filing status, withholding rates, etc. when completing this form, call the Division of Taxation’s Customer

Service Center at (609) 292-6400.

Instruction A - Wage Chart

This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages or income on your NJ-1040 return. It is not intended to provide withholding for other income or wages. If you need additional withholdings for other income or wages, use Line 5 on the NJ-W4.

This Wage Chart applies to taxpayers who are married/civil union couple filing jointly, heads of households, or qualifying widow(er)/surviving civil union partner. Single individuals or married/civil union partners filing separate returns do not need to use this chart. If you have indicated filing status #2, 4 or 5 on the above NJ- W4 and your taxable income is greater than $50,000, you should strongly consider using the Wage Chart. (See the Rate Tables on the reverse side to estimate your

withholding amount.)