Working with PDF forms online is certainly a piece of cake with this PDF editor. Anyone can fill out Form Np100 here effortlessly. Our editor is consistently developing to give the best user experience attainable, and that's thanks to our resolve for constant improvement and listening closely to feedback from users. To get the ball rolling, take these basic steps:

Step 1: Press the "Get Form" button above. It's going to open up our pdf editor so that you could start filling in your form.

Step 2: Once you launch the editor, you will find the document all set to be filled out. Besides filling in different blanks, it's also possible to perform many other things with the Document, that is writing custom words, editing the initial textual content, adding graphics, affixing your signature to the form, and a lot more.

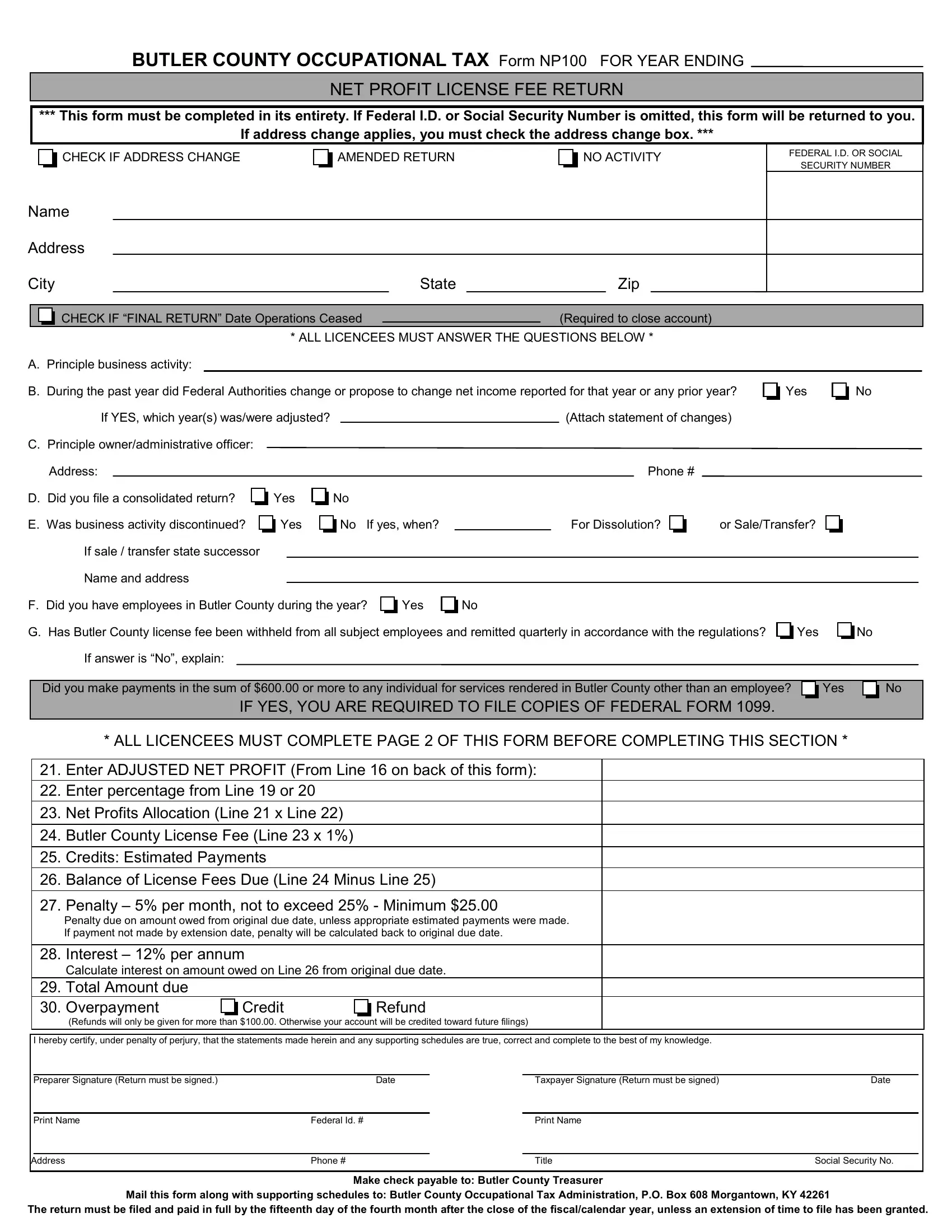

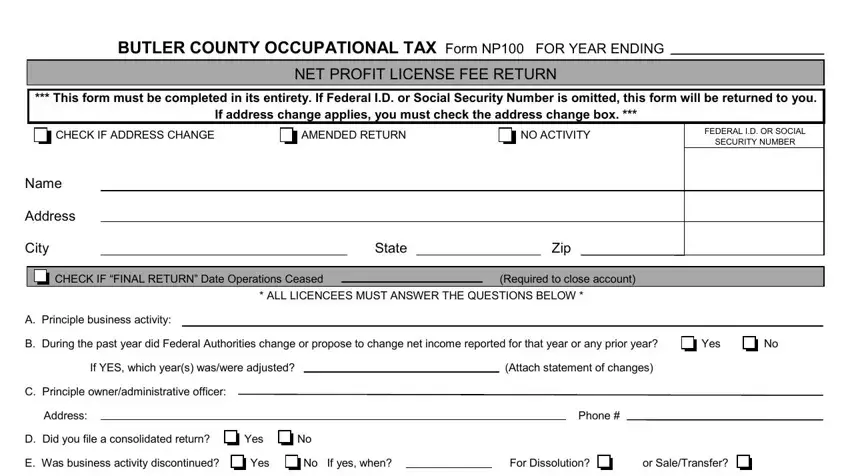

If you want to finalize this form, make sure that you provide the information you need in each field:

1. The Form Np100 requires specific information to be inserted. Be sure the next blanks are complete:

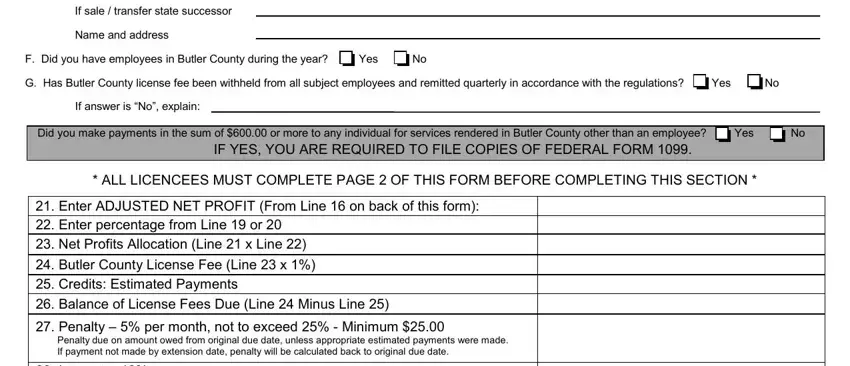

2. Once your current task is complete, take the next step – fill out all of these fields - If sale transfer state successor, Name and address, F Did you have employees in Butler, G Has Butler County license fee, If answer is No explain, Did you make payments in the sum, ALL LICENCEES MUST COMPLETE PAGE, Enter ADJUSTED NET PROFIT From, Penalty per month not to exceed, and Interest per annum Calculate with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

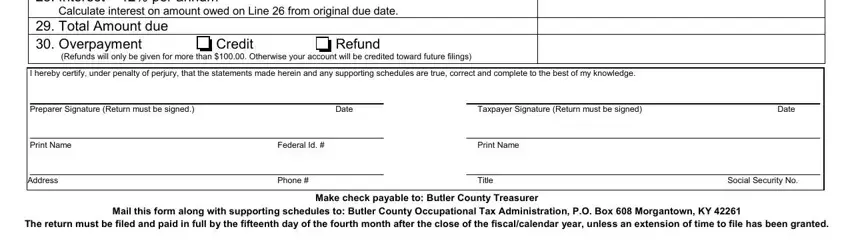

3. This third part is usually straightforward - fill out all of the empty fields in Interest per annum Calculate, Credit, Refund, I hereby certify under penalty of, Preparer Signature Return must be, Print Name Address, Federal Id, Phone, Taxpayer Signature Return must be, Print Name, Title, Date, Social Security No, The return must be filed and paid, and Mail this form along with in order to finish the current step.

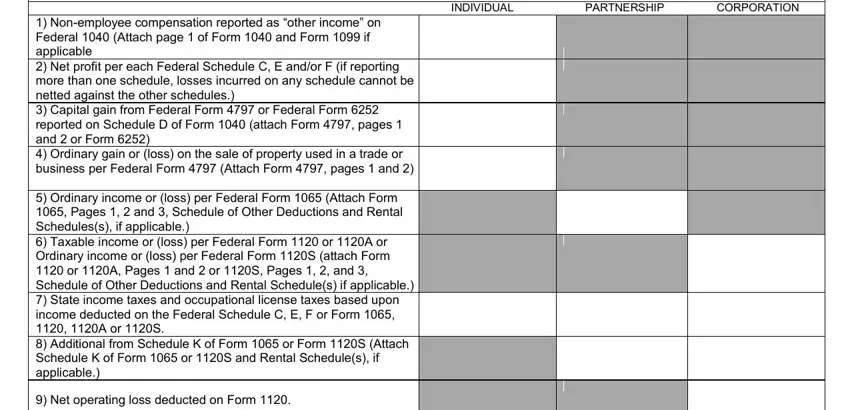

4. The subsequent paragraph requires your details in the following areas: COMPLETE THE APPLICABLE COLUMN AND, PARTNERSHIP, INDIVIDUAL, CORPORATION, Nonemployee compensation reported, and Net operating loss deducted on. Just remember to fill out all of the required information to move forward.

Always be extremely careful when completing INDIVIDUAL and COMPLETE THE APPLICABLE COLUMN AND, since this is the part where a lot of people make mistakes.

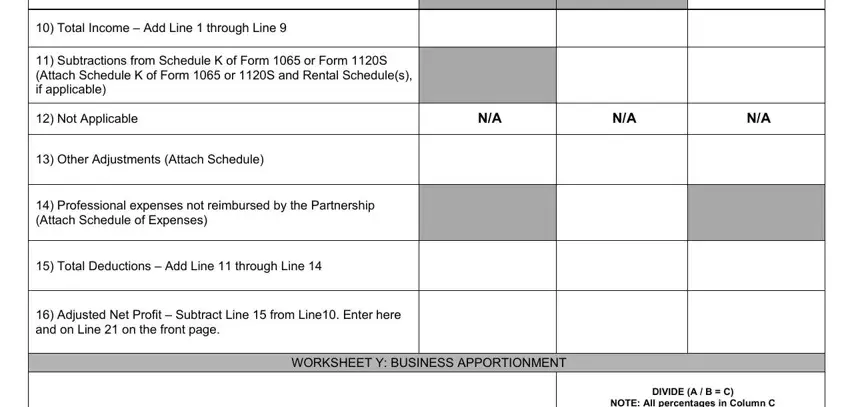

5. This final notch to submit this PDF form is critical. Make certain you fill in the mandatory form fields, like Total Income Add Line through, Subtractions from Schedule K of, Not Applicable, Other Adjustments Attach Schedule, Professional expenses not, Total Deductions Add Line, Adjusted Net Profit Subtract, WORKSHEET Y BUSINESS APPORTIONMENT, DIVIDE A B C, and NOTE All percentages in Column C, before using the pdf. In any other case, it could contribute to an unfinished and probably incorrect form!

Step 3: Make sure the information is correct and click on "Done" to proceed further. Obtain the Form Np100 once you join for a 7-day free trial. Easily access the pdf within your FormsPal account page, together with any modifications and adjustments being all saved! FormsPal ensures your information confidentiality via a protected method that in no way records or shares any private data involved in the process. Rest assured knowing your docs are kept protected each time you use our editor!